RBI means to halt second wave of borrower defaults: Announces ResFra 2.0

The RBI Governor on May 05, 2021[1] announced a series of measures for improving credit delivery, ensuring that there is sufficient liquidity with the masses, and State Governments have sufficient resources in their effort to deal with the pandemic. The measures include an upto Rs 50000 crore “Covid Loan Book” which qualifies for repo at the rate of 4%, and priority sector tag, additional liquidity for small finance banks, overdrafts to state governments, and, version 2.0 of the Resolution Frameworks originally announced on 6th August, 2020[2]. Subsequently, on the same day, the RBI came out with two separate notifications, Notification no 31 dealing with individuals and small businesses, and Notification no 32 dealing with MSMEs.

An injury is particularly hurting when the body is already weak and rejuvenating. The second wave of the Pandemic, besides the ferocity it carries, comes at a time when the economy had just started inching towards normalcy. The second wave has particularly been seen over the last 2 months, and therefore, financial institutions are just beginning to see the aftermath.

In this scenario, the announcement by the RBI governor was a much needed surprise relief. The measures under the aforesaid notifications shall be contingent on the lenders satisfying themselves that the same is necessitated on account of the economic fallout from Covid-19.

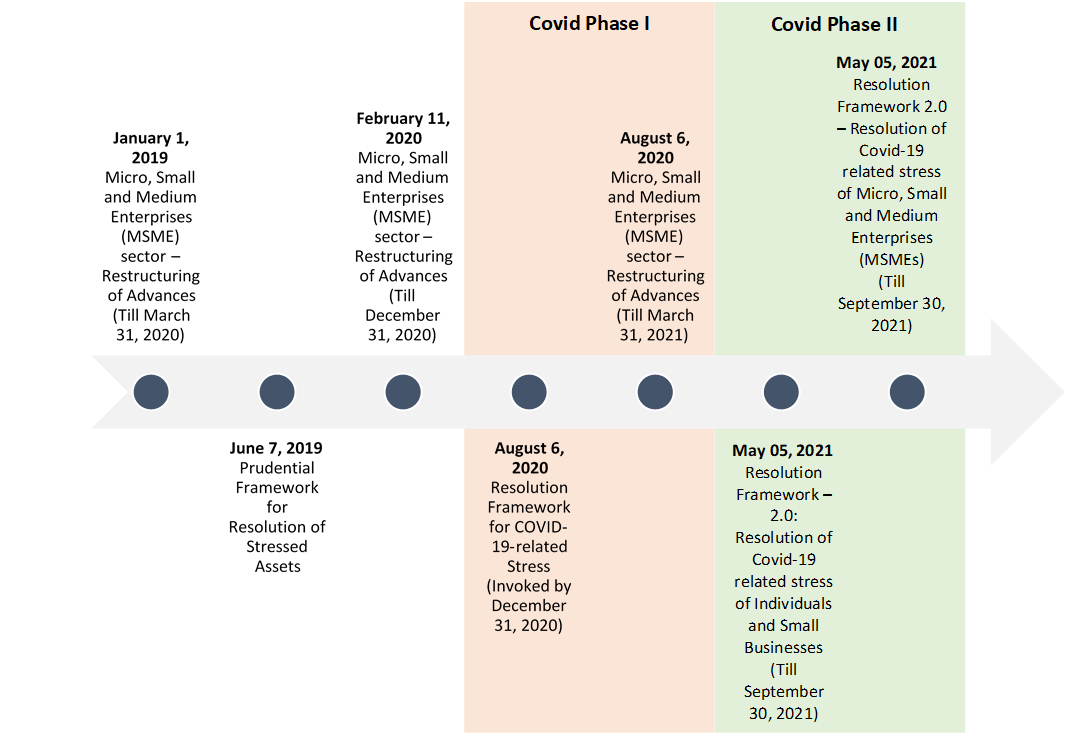

The following timelines depicts the relevant circulars issued by RBI, from time to time in this context:

In this write up we are focusing on the Resolution Framework 2.0, which is permitting a restructuring of loans to individuals, small businesses and MSMEs.

Restructuring for individuals, small businesses and MSMEs

ResFra 2.0 consists of two separate notifications, one dealing with MSMEs, and one dealing with individuals and small businesses which are not registered as MSMEs. While every MSME is, by definition, a small business, the rationale for having a separate framework altogether for MSMEs could not be clear – in fact, in several respects, it seems that the one for MSMEs is more restrictive than the one for “small businesses”. It seems that the RBI has kept to the tradition of having a separate framework for MSMEs, though the present framework does not seem to be resulting into an advantage for either the lender or the borrower, over the framework applicable to small businesses. Further, if one compares the earlier frameworks for MSME restructuring, ResFra 2.0 does not rank at par.

We accordingly discuss the two separately:

ResFra 2.0 for individuals and small businesses:

Notably, this Framework, coming from Notification no 31, is applicable only for individuals and “small businesses”. The expression “small business” would exclude MSMEs as defined in Gazette Notification S.O. 2119 (E) dated June 26, 2020.[3]

For both the categories, there are 3 types of restructuring – we call them First time restructuring, Convergence Restructuring, and Working Capital reassessment.

(a) First time restructuring

Eligible borrowers:

There are 3 categories of eligible facilities, given in Para 5 of the Notification:

- Individuals, who have availed personal loans. See below for the meaning of “personal loans”. Conspicuously, the limit on the exposure size of Rs 25 crores is not visible here. This means, in case of personal loans, as long as fits into the definition, there is no limit to the aggregate exposure.

- Individuals who have availed loans and advances for business purposes, and in respect of whom the aggregate exposure of lending institutions is not more than Rs 25 crores as on 31st March, 2021. The very same individual may have availed personal loans as well, and a question may arise whether the aggregate exposure will include that by way of personal loans. Our answer is in affirmative.

- Small businesses, including those engaged in wholesale or retail trade, not classified as MSMEs as on 31st March, 2021, and on whom the aggregate exposure of lending institutions is within Rs 25 crores.

Note: In case of Individuals who have availed loans and advances for business purposes and loans to small business the above-specified limit on aggregate exposure to lending institutions has been enhanced from Rs 25 crores to Rs 50 crores via RBI notification dated June 04, 2021.

What are Personal Loans to Individuals

Under the ResFra 2.0 reference of personal loans to individuals is to be taken from XBRL Returns – Harmonization of Banking Statistics- dated Jan 04, 2018.

Personal loans would include the following:

- Consumer Credit- Consumer credit refers to the loans given to individuals; (i) loans for consumer durables, (ii) credit card receivables, (iii) auto loans (other than loans for commercial use), (iv) personal loans secured by gold, gold jewellery, immovable property, fixed deposits (including FCNR(B)), shares and bonds, etc., (other than for business / commercial purposes), (v) personal loans to professionals (excluding loans for business purposes), and (vi) loans given for other consumptions purposes (e.g., social ceremonies, etc.).

- Education Loan

- Loans for creation/ enhancement of immovable assets (e.g., housing, etc.), and

- Loans for investment in financial assets (shares, debentures, etc.).

For further discussion on meaning of “personal loans”, see FAQ 5A in our write up on the earlier resolution framework

Additional eligibility conditions:

1. The ineligible businesses as were listed in clauses (a) to (e) of Para 2 of Annexure to ResFra 1.0 will remain ineligible here too. These are as follows:

- MSME borrowers whose aggregate exposure to lending institutions collectively, is Rs

25 crore50 crores or less as on March 1, 2020. - Farm credit as listed in Paragraph 6.1 of Master Direction FIDD.CO.Plan.1/04.09.01/2016-17 dated July 7, 2016 (as updated) or other relevant instructions as applicable to specific category of lending institutions.

- Loans to Primary Agricultural Credit Societies (PACS), Farmers’ Service Societies (FSS) and Large-sized Adivasi Multi-Purpose Societies (LAMPS) for on-lending to agriculture.

- Exposures of lending institutions to financial service providers.

- Exposures of lending institutions to Central and State Governments; Local Government bodies (eg. Municipal Corporations); and, body corporates established by an Act of Parliament or State Legislature.

2. The borrower should not have availed of restructuring as per ResFra 1.0

3. The credit exposure to the borrower should be standard as on 31st March, 2021. The standard classification, obviously, is lender-specific. That is, while the credit exposure by different lending institutions is being aggregated, the standard classification is as per the books of the specific lender considering restructuring.

“Small business” or MSME: Dilemma whether Borrowers will fall under Notification No 31 or Notification No 32

There would be certain categories of borrower, who may be satisfying the definition of being classified as MSME, but have neither obtained the Udyam Registration nor do they intend to obtain such registration. These borrowers may not have GST registration or exemption from GST registration.

The RBI has come with two separate notifications – one applicable to individuals and small businesses, and the other specifically applicable to MSMEs, with conditions as above. We have discussed above that this demarcation between “small businesses” and MSMEs will only breed confusion, and was unwarranted. However, the predicament for a lender will be – can a lender choose either of the two Notifications?

It seems clear that Notification no 31 specifically excludes borrowers with MSME registration (as was the case of 6th August 2020 notification). It is also clear that the precondition for falling under Notification no 32 is that the borrower must have MSME registration, or must have Udyam registration before implementation. If the borrower, otherwise eligible to be classified as MSME, does not avail of Udyam registration, can it be the idea of the RBI to deny him the benefit of restructuring?

In our view, the intent of the Governor’s 5th May dispensation was to allow more money to flow or stay with smaller borrowers, because that is where the brunt of the pandemic is the maximum. MSMEs are admittedly conferred several benefits by scheme of various enactments and policy measures. The idea cannot be to deny the benefit of restructuring to MSMEs not strictly falling within the terms of Notification no 32, even as small businesses are specifically eligible for restructuring under Notification no 31, without any such conditions.

That brings us to a question – can a lender allow the borrower the option of coming under Notification no 31 or 32? We have tabulated below the differences between Notification 31 restructuring and Notification 32 restructuring. However, given the mutually exclusive nature of the two, it does not seem logical that the borrower is to be allowed the option. However, the borrower may, of course, choose not to have Udyam registration, and therefore, come under Notification 31.

Resulting questions are – if the lender has treated the borrowers as MSMEs for the purpose of priority sector lending guidelines, or CGTMSE scheme, or for other benefits, is the lender precluded from putting the borrower under Notification 31? In our view, Notification 32 comes with its own set of clear conditions. An MSME is also a small business. If the MSME does not meet all the conditions of Notification 32, but meets those of Notification 31, it would be contrary to the intent of the Governor’s pronouncement to deny such an entity the benefit of either of the Notifications.

Qualitative considerations in restructuring:

The restructuring under the Framework is intended to be a redressal of the difficulties faced by the borrower by the Pandemic, more specifically, the second wave. Thus, an en masse restructuring, or restructuring without any due diligence on the impact of the pandemic on the cashflows of the borrower is not warranted. Appropriately, the restructuring policy [see below] should set out the basis for identification of borrowers to whom the restructuring facility will be granted. There is a reference in Para 8 to standardised product-level templates; however, it should be clear that the decision to restructure is neither agnostic to the borrower’s income, assets and cashflows, nor is it mechanical. The reference to templates may be standardisation of the parameters, so as to arrive at fast decision-making on restructuring.

Where there are various lenders, it is quite likely that some lenders approve the borrower for restructuring while other lender(s) do not. This is perfectly acceptable – see para 9 of the Notification.

Procedure and Time limit for invocation:

Invocation of restructuring happens when a request made by either the borrower or the lender, for the purpose of restructuring, is accepted by the other. Para 8 provides: “The resolution process under this window shall be treated as invoked when the lending institution and the borrower agree to proceed with the efforts towards finalising a resolution plan to be implemented in respect of such borrower”. In essence, it is mutual agreement between the lender and the borrower to proceed for a resolution plan. Invocation does not imply that the contours of the resolution plan itself are finalised.

Thus, if the borrower proposes restructuring, and the lender agrees to consider the proposal, or vice versa, the invocation would have been triggered. If the request comes from the borrower, obviously, it is not a mere non-speaking intent of restructuring; the borrower provides some justification as to why his case should be considered for restructuring.

If the borrower puts up an application for restructuring, the lender should consider the same within 30 days. Invocation shall be deemed done only when the lender, on consideration of the application, agrees to approach for restructuring.

Given the prevailing situation, where most of the states are under lockdown, it may not be practically possible to ensure physical meeting with the borrowers or obtain their physical signatures on the restructured terms. In our view, the invocation atleast could be done electronically, via text message or email, provided a proper written trail is maintained. Further since there is sufficient time for implementation, proper execution of the relevant supplementary agreements and revised repayment schedules can be ensured.

The invocation must have been done by Sept., 30, 2021.

Process and Time limit for implementation:

Since restructuring is modification of the loan facility, it will require either a supplementary agreement or a fresh set of documentation. There may be modifications as to security etc – depending thereon, the same also shall be documented.

Implementation shall be deemed complete when all the following conditions are satisfied:

-

- all related documentation, including execution of necessary agreements between lending institutions and borrower and collaterals provided, if any, are completed by the lenders concerned in consonance with the resolution plan being implemented;

- the changes in the terms of conditions of the loans get duly reflected in the books of the lending institutions; and,

- borrower is not in default with the lending institution as per the revised terms.

Further, implementation must be done within 90 days from the date of invocation. The lenders will have an incentive for early implementation, as the asset classification may be treated as standard only upon implementation.

Is it possible to do a retrospective restructuring, that is, restructure the payment obligations from the 1st of April, even if the invocation is done, say in later part of May?

In our view, restructuring takes effect only upon implementation. There is no question of restructuring dating back to the date of implementation.

Restructuring is done, say, on May 31, 2021. However, as on this date, there were payments due by the borrower. Can these payments, already due, also be restructured? Is that a case of retrospective restructuring?

Any restructuring, in its very essence, has to include payments already fallen due as well. It is quite common for these overdue payments to be added to the principal outstanding, and then the instalment/payment structure being revised to recover the overdue amounts too. This is not a case of retrospective restructuring. It is counter-intuitive to think of a restructuring leaving overdue payments as is, and merely tweak the future payment obligations. However, in case of Notification no 31, the account should not have slipped to a substandard category as a result of the overdues.

The RBI has, however, vide an email communication to the FIDC on June 7, 2021 clarified that the loan accounts that may have slipped into NPA between April 1, 2021 and the date of implementation, on the same lines as mentioned in Notification 32 for MSMEs, can be upgraded as standard assets on implementation of the resolution plan.

What all may restructuring include?

Restructuring may include rescheduling of payments, conversion of any interest accrued or to be accrued into another credit facility, revisions in working capital sanctions, granting of moratorium etc. based on an assessment of income streams of the borrower. Para 11 says that restructuring shall not include “compromise settlement”. A question may be, whether a reduction of rate of interest, grant of a rebate, or a partial waiver, will also be a case of “compromise settlement” not permitted under restructuring framework? In our view, compromise settlement should be agreeing to a substantial sacrifice by the lender, mostly resulting into waiver of outstanding principal.

Restructuring should not result into moratorium beyond 2 years or extension of the residual tenure of the loan by more than 2 years.

Will the 2 year moratorium limit under ResFra 2.0 take into account the six months moratorium period extended pursuant to Covid moratorium relief?

The extension of 6 months moratorium cannot be said to be the restructuring by the Lender, since the same was extended as a regulatory relief. Therefore, 24 months moratorium period allowed under ResFra 2.0 shall exclude six months moratorium extended (if any) pursuant to the Covid moratorium relief. In essence, any elongation of tenure that happened due to Covid moratorium will not be regarded as “restructuring” for this purpose. Hence, the limit of 24 months will compare the loan tenure, as modified due to the Covid moratorium, versus the elongated tenure post restructuring.

What if the restructuring is not compliant with the conditions of the Notification?

Such restructuring will be deemed to be restructuring within the meaning of 7th June, 2019 framework, and will be treated as such.

Asset classification, Provisioning and write back of the provision:

The Eligible Borrower accounts restructured under ResFra 2.0, the standard classification of the assets can be retained. However, whereby the Eligible Borrower account has slipped into NPA classification between the date of invocation and implementation of resolution plan, such account can be upgraded to standard classification as on date of implementation of resolution plan.

There is no relaxation provided to borrowers who have slipped into NPA between the period from March 31, 2021 to the date of invocation. Hence, such loan accounts, which have become NPA from 1st April to the invocation date, irrespective of being restructured in compliance with the provisions of the Notifications will continue to be classified as NPA. Note that this position is different in case of MSMEs coming under Notification 32, wherein the borrowers who have slipped into NPA between the period from March 31, 2021, till the date of invocation shall be upgraded to standard.

The RBI has, however, vide an email communication to the FIDC on June 7, 2021 clarified that the loan accounts that may have slipped into NPA between April 1, 2021 and the date of implementation, on the same lines as mentioned in Notification 32 for MSMEs, can be upgraded as standard assets on implementation of the resolution plan.

Provisioning- The provisions to be maintained on such restructured account by lending institutions shall be higher of the two below:

- Provisions maintained with respect to such Eligible Borrower prior to implementation of resolution plan as per the applicable IRAC norms

- 10 % of the renegotiated debt exposure after implementation of resolution plan (‘Residual Debt’)

Write back of provisions- 50% of the provision may be written back upon the borrower paying at least 20% of the Residual Debt without slipping into NPA and remaining half may be reversed upon payment of additional 10% of Residual Debt.

However, in cases (other than personal loans) the provisions shall not be written back before one year from date of commencement of first payment of interest or principal (whichever is later) on credit facility with the longest period of moratorium.

Disclosure

The RBI has required quarterly disclosure of resolution plans approved under this Framework in a format, viz. Format X, annexed to the Notification. It appears that this will have to be part of the quarterly disclosures to the public for those lending institutions which prepare and publish quarterly financial statements.

Additionally, the credit reporting, to credit information companies, of borrowers whose accounts are restructuring under this facility shall carry a specific mention – “restructured due to COVID19” status. The intent seems that the restructuring shall not tarnish the credit history of the borrower.

Granting of new facilities pending implementation

The Eligible Borrowers in respect to whom the Resolution Plan has been invoked, the lending institutions can grant interim finance by way of additional credit facility to such borrowers. The additional credit facility shall be classified as standard, irrespective of the underlying actual performance by the borrower with regard to such additional credit facility.

However, where the resolution plan is not implemented within 90 days from the date of invocation, the additional credit facility shall be classified worse of the two below:

- Actual performance of the borrower under interim additional credit facility

- Performance of the borrower under the original loan account

Immediate actionables for lenders

Lending institutions to frame board approval policies not later than 4 weeks from the date of ResFra 2.0 circular date, i.e. latest by 04 June 2021.

The policy should have following broad coverage:

- Eligible Borrowers to whom resolution under ResFra 2.0 is to be extended

- Due diligence and considerations to be followed for resolution of stress accounts

- Policies with respect to viable resolution plans of Eligible Borrowers

- Resolution under ResFra 2.0 is provided to borrowers having stress on account of COVID-19

- Grievance redressal mechanism for borrowers requesting resolution or undergoing resolution under ResFra 2.0

- The policy should be published on the lending institutions’ website

Board-approved policy

- Why when?

The framework requires formulation of a Board-approved policy pertaining to implementation of viable resolution plans for eligible borrowers under this framework, ensuring that the resolution under this facility is provided only to the borrowers having stress on account of Covid-19. The policy has to be adopted at the earliest, but not later than four weeks from the date of the Notification, that is, by 4th June, 2021.

The policy shall be published on the website of the Company.

- Contents of the Policy

The major contents of the policy should include the following:

- Eligible borrowers

- Manner of determining that the total exposure is within the permissible limits

- Manner of determining whether the borrower is eligible for restructuring, manner of assessing the impact of the pandemic on the borrower’s cashflows, nature of evidence to be provided by the borrower, etc.

- Invocation of the RP

- Procedure of initiation of the RP

- Applications for RP

- Conditions precedent for invocation of RP

- Time limit for sanctioning the RP- To be confirmed within 30 days from the date of receipt of application

- Invocation to be done before 30th September, 2021

- To be implemented with 90 days from the date of invocation

- Manner of restructuring – This should deal with the variety of modifications which can be explored between the parties, including but not limited to rescheduling of payments, conversion of any interest accrued or to be accrued into another credit facility, revisions in working capital sanctions, granting of moratorium etc. The policy should have requisite flexibility. The authority matrix for permitting/rejecting restructuring applications should be laid down.

- Asset Classification of the restructured accounts

- Provisioning norms

- Provisioning at the rate of 10% of the residual debt

- Circumstances of reversal of provisions

- For personal loans

- For small business loans

- Likely impact on the ECL of the entity, where applicable

- Grievance redressal: This should include the hierarchy of at least 2 levels of complaint redressal. The complaint may, for example, relate to refusal to restructure, or a restructuring which is burdensome.

- Disclosure requirements: This should broadly follow the regulations.

(b) Convergence restructuring:

This covers those borrowers who have availed restructuring under ResFra 1.0. Such borrowers will be eligible if the original restructuring either did not grant a moratorium, or the moratorium granted was less than 2 years, or the elongation of the residual term, was less than 2 years.

Eligible borrowers

Who have already availed the restructuring benefit under ResFra 1.0. Therefore, by presumption, the borrower should have been eligible under ResFra 1.0. Additionally, the eligibility criteria in Para 5 of the Notifications, discussed above in case of Frist time Restructuring, shall also apply.

Conditions of eligibility:

Apart from the moratorium/term extension being within 2 years, there does not seem to be any other conditions. For example, a condition that the borrower should have been paying as per restructured terms is not specified.

In such cases, what sort of restructuring can be offered? Restructuring to borrowers affected by a systemic stress is typically moratorium or extension of term. That is why the RBI makes reference to the same. However, so far it is unclear whether restructuring by way of reduction of rate of interest, waiver of any extras such as penalty or overdue interest, or a waiver of any amounts payable, can be granted. One will have to wait for the fineprint of the regulations to comment on that.

Incoation of Resolution Process

The borrower shall by way of application request the lending institution for invocation of resolution process under ResFra 2.0. The decision on application of such borrower shall be communicated in writing within 30 days of receipt of application.

For meaning of invocation and implementation, please see discussion above, under the First time restructuring.

(c) Restructuring by review of working capital facilities

In respect of individuals who have availed advances for business, or small businesses (other than MSMEs), lending institutions are also being permitted as a one-time measure, to review the working capital sanctioned limits, based on a reassessment of the working capital cycle, margins, etc.

It appears that this facility is available only in case of working capital facilities, as lenders have been permitted to “review” working capital sanctioned limits. Possibly, lenders will enhance working capital sanctioned limits, such that irregularities may be corrected, and the increased time for accounts receivables and inventory build-up may be granted to borrowers.

This facility shall be available to individuals who have availed business loans, and small businesses.

A pertinent question would be – if the original facility was not a working capital facility, can a lender grant a working capital facility and treat the same as a case of restructuring of the original facility? In our view, the intent does not seem to be such.

ResFra 2.0 for MSMEs:

Conditions of eligibility for MSME Restructuring:

- Not availed of restructuring under any of the earlier restructuring frameworks. This would include the earlier issued Micro, Small and Medium Enterprises (MSME) sector – Restructuring of Advances circulars, dated August 6, 2020, February 11, 2020 and January 1, 2019 (‘MSME Restructuring Circulars’).

- The borrower should be classified as a micro, small or medium enterprise as on March 31, 2021 in terms of the Gazette Notification S.O. 2119 (E) dated June 26, 2020.

- If the borrower is not registered in the Udyam Registration portal, such registration shall be required to be completed before the date of implementation of the restructuring plan for the plan to be treated as implemented.

- The borrower should be standard as on March 31, 2021. In case of term loans or similar facilities, this would mean the account must not be more than 89 DPD. In case of working capital facilities, this would mean any of the credit facilities has not become a non-performing asset.

- The borrower should be GST-registered on the date of implementation of the restructuring. However, this condition will not apply to MSMEs that are exempt from GST-registration. This shall be determined on the basis of exemption limit obtaining as on March 31, 2021.

- The “aggregate exposure” of the borrower should be upto Rs 25 crore, including non-fund based facilities, from all lending institutions to the borrower as on March 31, 2021.

(Note: MSME borrowers aggregate exposure limit to lending institutions has been enhanced from Rs 25 crore to Rs 50 crore via RBI notification dated June 04, 2020)

Time limit for invocation:

The restructuring of the borrower account is invoked by September 30, 2021.

The restructuring shall be treated as invoked when the lending institution and the borrower agree to proceed with implementation of a restructuring plan.

Time limit for implementation:

-

- An MSME borrower intending to avail the restructuring benefit shall be required to make an application to the lender.

- The decisions on applications received by the lending institutions from their customers for invoking restructuring shall be communicated in writing to the applicant within 30 days of receipt of such applications.

- The restructuring has to be implemented within 90 days after invocation.

Does implementation necessarily have to be done by all lenders, if there are multiple lenders? The decision to invoke the restructuring under this facility shall be taken by each lending institution having exposure to a borrower independent of invocation decisions taken by other lending institutions, if any, having exposure to the same borrower.

What all may the restructuring entail?

Restructuring can be done in any of the following manners or a combination of

any of these, as may be feasible, considering the status of the borrower and the loan account:

- Rescheduling of payments;

- Conversion of any interest accrued, or to be accrued, into a separate credit facility;

- Granting moratorium (with immediate effect upon implementation of the RP), based on an assessment of income streams of the borrower, subject to a maximum of two years;

- Extension of tenure, subject to a maximum of two year and accordingly restructuring of repayment instalments;

- Granting additional credit facilities;

- Conversion of a portion of the debt into equity or other marketable, non-convertible debt securities issued by the Borrower, subject to the relevant RBI guidelines and other applicable laws;

- Any other measures or modification in the existing terms of the loan, as the lender may deem appropriate, considering the financial situation of the borrower and the feasibility of restructuring.

Any additional provision requirement?

Upon implementation of the restructuring plan, the lending institutions shall keep provision of 10 percent of the residual debt of the borrower.

This is different from the earlier MSME Restructuring Guidelines wherein the requirement was to create an additional provision of 5% over and above the provision already held.

Further, the asset shall retain its standard status and the 10% provision shall be a ‘provision specific to the asset’ created considering the risk involved in the asset after restructuring. The accounts which may have slipped into NPA category between April 1, 2021 and date of implementation may be upgraded as ‘standard asset’, as on the date of implementation of the restructuring plan.

Can restructuring be offered selectively by the lender? Does the lender have discretion to offer restructuring selectively to borrowers, or to impose any additional conditions?

In our view, restructuring is a free choice of the lender and the borrower. The regulator permits restructuring, while not treating the facility as an NPA. However, neither can the regulator nor can the borrower force the lender to agree to restructuring. The lender has to take a call on the extent to which the borrower’s cash flows are affected by the pandemic. The lender is also free to add further conditions.

Upgradation to standard status

Discuss here

Can MSME accounts already restructured under the MSME Restructuring Circulars avail any further benefit?

Lenders have an option to review and reassess, before September 30, 2020, the working capital sanctioned limits and / or drawing power based on a reassessment of the working capital cycle, reduction of margins, etc. without the same being treated as restructuring.

The reassessed sanctioned limit / drawing power shall be subject to review by the lending institution at least on a half yearly basis and the renewal / reassessment at least on an annual basis. The annual renewal/reassessment shall be expected to suitably modulate the limits as per the then-prevailing business conditions.

What are the immediate actionables?

There is a requirement for adopting a board approved policy within one month from the date of notification, that is by June 5, 2021. In our view, since this may be an extension of the MSME Restructuring Circulars, the existing policy may be suitably modified to include the new provisions. In other words, there is no need to proliferate policies – the existing policy may be suitably amended to permit both the types of restructuring covered by the 5th May Notifications.

What kind of disclosures are required to be made for the MSME accounts restructured?

In compliance with the earlier MSME Restructuring Circulars, Lender shall make appropriate disclosures in their financial statements, under ‘Notes on Accounts’, relating to the MSME accounts restructured under these instructions as per the following format:

| No. of accounts restructured | Amount (₹ in million) |

Comparison of the provisions in the two Notifications:

| Point of distinction | Individuals and Small Business | MSMEs |

| Eligibility | ● Individual borrowers

● Individuals who have borrowed for business purposes with an aggregate exposure, including non-fund based facilities, of all lending institutions to the borrower does not exceed ₹25 crore as on March 31, 2021. ● Small businesses, not being MSMEs, with an aggregate exposure, including non-fund based facilities, of all lending institutions to the borrower does not exceed ₹25 crore as on March 31, 2021. Note: In case of Individuals who have availed loans and advances for business purposes and loans to small business the above-specified limit on aggregate exposure to lending institutions has been enhanced from Rs 25 crores to Rs 50 crores via RBI notification dated June 04, 2021. ● Should be standard as on March 31, 2021

|

● MSMEs with an aggregate exposure, including non-fund based facilities, of all lending institutions to the borrower does not exceed ₹25 crore as on March 31, 2021.

(Note: MSME borrowers aggregate exposure limit to lending institutions has been enhanced from Rs 25 crore to Rs 50 crore via RBI notification dated June 04, 2020) ● Should be standard as on March 31, 2021 |

| Provisioning | 10% of the residual debt | 10% of the residual debt |

| Provision reversal | For other than personal loans –

50% can be reversed once 20% of the residual debt is repaid Rest 50% can be reversed once an additional 10% of the residual debt is repaid

Additional point for loans other than personal loans – the reversal cannot happen before the expiry of 1 year from date of first payment of interest or principal (whichever is later) with the longest moratorium period. |

Nothing has been mentioned in this regard. |

| Asset classification | Standard assets to be retained as standard

Accounts which have slipped into NPA category between the invocation date (this should be read as April 1, 2021- pursuant to the clarification received from the RBI) and the date of implementation shall be upgraded |

Standard assets to be retained as standard

Accounts which have slipped into NPA category between 1st April and the date of implementation shall be upgraded |

| Maximum period of moratorium | 2 years | 2 years |

| Board approved policy | Required | Required |

| Restructuring of the working capital facility | Allows review of sanctioned limits based on a reassessment of the working capital cycle, reduction of margins, etc. without the same being treated as restructuring | Allows review of sanctioned limits based on a reassessment of the working capital cycle, reduction of margins, etc. without the same being treated as restructuring |

| Restructuring of accounts, already restructured under the earlier framework | Only extension of moratorium is allowed, provided that the aggregate period of moratorium should not exceed 2 years | Not allowed |

| Disclosure | Fresh disclosure requirements have been introduced in the circular | The present circular does not provide for fresh requirements, however, the disclosure requirements under the earlier circulars shall continue |

Restructuring for Direct assignment and PTC customers

Several lenders, mostly NBFCs, would have done securitisation of their receivables, or sold the same under direct assignment transactions. Question will arise, whether such receivables may be restructured too.

We have earlier discussed restructuring in case of direct assignment and securitisation – see here. We have also discussed the implication of moratorium in case of securitisation and direct assignment.

Our earlier discussion on restructuring will be applicable in case restructuring of securitised and assigned loans too.

Accounting Aspects

How would classification be governed under Ind AS? Will restructuring of loan change asset classification from stage I to stage 2 or stage 2 to stage 3 under IND AS?

The pandemic is an external situation, merely the account has been restructured, and same cannot be considered as the deterioration in specific credit quality of the borrower. The stage 2 and stage 3 classification of the borrower is subjective, and is only to be downgraded in case there is increase in probability of default of the Borrower. Therefore, the Lender has to take into account substantial degradation in credit quality of the customer. The mere fact of a Covid-induced restructuring does not mean there is a “significant increase in credit risk” which is required for changing the staging of the loan.

Conclusion

At the time when the country is gasping for oxygen, whether RBI’s measures will ease the situation? The answer must be optimistic. These measures, besides their own tangible impact, are also symbolic – they indicate that the policy-makers’ attention is now seriously on resolving the after-effects of the pandemic.

The text in green highlights the recent amendments/updates in the guidelines or clarifications thereto.

[1] https://rbi.org.in/Scripts/BS_SpeechesView.aspx?Id=1108

[2] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11941&Mode=0 and https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11942&Mode=0

[3] We have substantially rich resources dealing with MSME financing -see here: http://vinodkothari.com/2020/05/resources-on-msme/

Hello Sir,

1) Whether Small Businessman and MSME classified as NPA as on 31st Mar 2021 be allowed to be restructured

2) Whether this provision is over and above the ECL provision created on the account to be restructured

3) Whether Small Businessman and MSME classified as Standard as on 31st Mar 2021 but substandard before invocation be allowed to be restructured

1) To qualify for restructuring under either of the notifications (31 and 32), the account should not be NPA as on March 31, 2021.

2) The provision under notification (31 and 32) will form part of regulatory provisions. Provisoning for the purpose of ECL shall be on the basis of Lender’s extant policy in this regard. Higher of the two (ECL or regulatory provision) has to maintained by the Lender.

3) Yes.

Whether Bill Discounting facility will be covered under the scope of Resolution framework 2.0.

A bill discounting facility, if is in the nature of a term loan shall be covered, however, factoring transactions or assignment of receivables are not in the nature of loans and advances by the lending institutions, hence will not be covered under ResFra2.0.

Case : Individual borrower / Small business

DPD : 100 DPD (i.e. Non standard) as on the date of invocation , (Suppose 15th of june 2021)

Question: Can we restructure such account under 2.0 ? And if yes, can we upgrade the status to standard after restructuring.

The loan account must be classified as ‘standard’ as on March 31, 2021 as well as on the Invocation date- so as to retain the classification even after the restructuring. The regulations provide that accounts which have slipped into NPA category between the invocation date and the date of implementation shall be upgraded. However, there is no relaxation provided to borrowers who have slipped into NPA between the period from March 31, 2021 to the date of invocation.

However, the framework does not explicitly says that borrower classified as NPA after March 31,2021 till date of invocation is to be retained as NPA. ( In such case the condition of borrower remaining standard as on March 31, 2021 has no relevance and it should have been borrower to be Standard as on date of invocation )

Also if such borrower is restructured, whether that would be governed by IRAC restructuring ??

This is coming clear from the language of para 16 which allows retention of the asset classification as standard- this would mean the account which was standard as on the date of implementation to be retained as standard. However, if the same has degraded to sub-standard category, the upgradation as standard is allowed only if it slipped into NPA between invocation and implementation. Hence, it could be inferred that the slippage before the invocation would not get the relief of upgradation upon restructuring.

Is tractor loan covered under the exclusion under farm credit

Tractor loans are not categorised as Farm Credit (refer RBI FAQs ) and hence covered under the ResFra2.0.

Tractor loans are not categorised a Farm Credit (refer RBI FAQs ) and hence covered under the ResFra2.0.

Hi,

Can Eligible exposure be eloberated. Again finance, non agri etc. So clarity can be established.

RBI master direction-Priority Sector Lending- Targets and Classification (RBI/FIDD/2016-17/33), defines agriculture loans and broadly classifies them into three categories; i) Farm Credit (which will include short-term crop loans and medium/long-term credit to farmers), ii) Agriculture Infrastructure, iii) Ancillary Activities. Refer to PSL master direction for indicative sub-categories covered under the above three categories.

RBI FAQs excluded Farm Credit (except loans to allied activities, viz., dairy, fishery, animal husbandry, poultry, bee-keeping, and sericulture) from the list of eligible accounts, under the August 06, 2020 restructuring framework.

Thus all agriculture loans including allied activities, except Farm Credit, are eligible for restructuring under ResFra2.0.

Hi,

Just as Quick question:

What is definition of business purposes?

If the asset (vehicle) has been sold to customer and the same is used by the customer for commercial use are they eligible for ResFre 2.0.?

The RBI has issued two separate notifications – one applicable to individuals and small businesses, and the other specifically applicable to MSMEs. In case of individuals, personal loans as well as loans for business purpose are covered under ResFra 2.0. The term ‘business purposes’ is not defined, however, going by the intent, in case the end use of a loan is to use the proceeds for commercial purpose, the same should be covered as loan for business purpose.