Compound financial instruments- A paradigm shift in accounting concepts

By Rahul Maharshi (rahul@vinodkothari.com, ifrs@vinodkothari.com)

Introduction

Financial instruments accounting has been one of the highlighting issues in implementation of Ind AS in India. Several new concepts have been introduced and compound financial instrument (CFI) is one of them.

Explained in para 28 of Ind AS 32, a CFI is a financial instrument which is a non-derivative financial instrument that, from the issuer’s perspective, contains both liability and equity component. Therefore, when characteristics of both, liability and equity are fused into one instrument, it gives rise to a CFI.

It is usually observed, as a way of raising funds, many companies go for issuing debt instruments with a conversion feature in it. A bond which is convertible into fixed number of shares of the issuer would generally be preferred over a plain vanilla bond, since there lies a convertibility feature which would be an incentive for the investor over and above the interest income on such a bond. Additionally, if the issuer company is one which is positively growing, the investor would reap out fair amount of benefits with the help of a convertibility option.

Therefore, this makes CFI an interesting topic to discuss. In this article, we intend to discuss the manner of treatment, recognition, classification and various other intricacies associated with CFIs.

Compound financial instrument from investors perspective

The accounting treatment with respect with CFI prescribed in Ind AS 32 deals with the issuer’s books of accounts only, there is no special treatment required in the books of the investor. A CFI is nothing but a financial asset in the books of an investor.

A CFI is required to be accounted for in the books of an investor as a financial asset till redemption, however, at the time of redemption, if the instrument is converted into equity, the same will require reclassification for subsequent measurement of the financial asset as a whole by the investor.

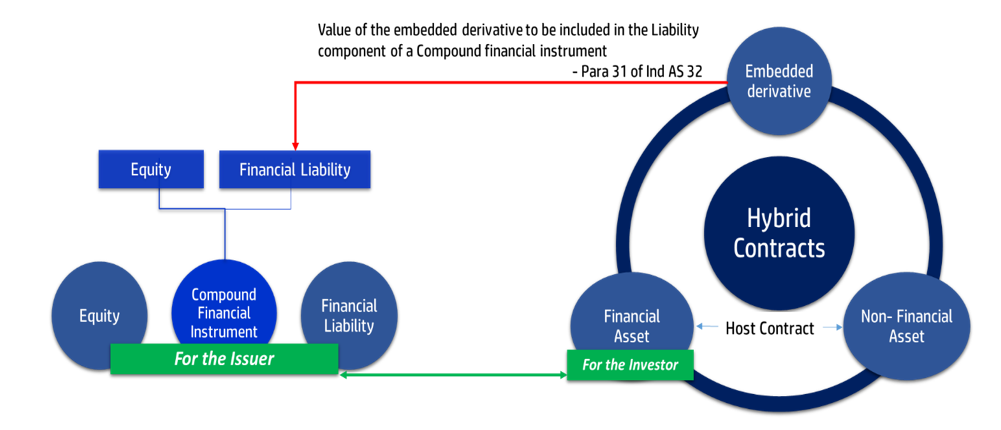

Compound financial instrument vs. Hybrid financial instrument

Yet another new concept in the Ind AS is that of hybrid financial instrument. Differentiating the same with CFI; a hybrid financial instrument, or a hybrid contract is one which has an embedded derivative sitting on a host contract. From an investor’s point of view, a host contract can be of any kind, such as a financial asset or a non-financial asset.

If the host contract is a non-financial asset, the embedded derivative will be required to be separated from the host contract subject to the requirements given in para 4.3.3 of Ind AS 109. After separation, the host contract shall be required to be accounted for in accordance with the appropriate Ind AS(s).

For example, a lease agreement with variable lease payments adjusted to the change in a benchmark interest rate such as LIBOR would result in a hybrid instrument with the host contract being the lease agreement i.e. a non-financial asset and an embedded derivative being the variability feature of the lease payments being leveraged. The lease agreement should be accounted for as per Ind AS 17- Leases and the derivative feature may be required to be accounted for as per Ind AS 109 subject to para 4.3.3.

A host contract being a financial instrument (viz. being a financial asset) is required to be accounted for by the investor as explained in the earlier section.

However, for the purpose of this article, emphasis is required to be given on the treatment of a CFI being a host contract with an embedded derivative (such as a call option) from an issuer’s point of view. Ind AS 32 provides that the value of the derivative embedded on CFI is required to be included in the liability component of the CFI.

It is to be noted that the equity conversion option in a CFI, on a standalone basis, is not a derivative. The derivative that is required to be included in the liability component are those which qualify to be a derivative as defined under Ind AS 109.

The concept of CFI and a Hybrid contract is diagrammatically explained below:

The above diagram can be seen as an example of deriving concepts from application of two Ind AS(s) viz. Ind AS 109 and Ind AS 32. By interpretation, it exhibits the notion that a CFI is in fact, a type of a hybrid contract, but a hybrid contract is not a type of a CFI. Nevertheless, this notion can be questioned on the ground that both the instruments are required to be looked at from different perspectives.

The distinctions between a hybrid contract and a CFI can be tabulated as below:

| Basis of distinction | Hybrid contract/ Hybrid financial instrument | Compound financial instrument |

| Governing Ind AS for accounting | Ind AS 109 Financial Instruments | Ind AS 32 Financial Instruments- Presentation |

| Nature | Derivative | Derivative /Non- derivative |

| Split accounting | Based on conditions given in para 4.3.3 of Ind AS 109 | Mandatory in all cases |

| Resultant instruments after splitting | Financial assets, non-financial assets, financial liability, non-financial liability and/or equity | Equity and financial liability |

Split Accounting in case of a CFI

The incidence or event of testing a financial instrument to be a CFI or not is not only to be done at the issuance or on a periodic basis, rather whenever the terms of the contract of a financial instrument reveal a dual character i.e. of equity as well as liability, the same should be classified and accounted for.

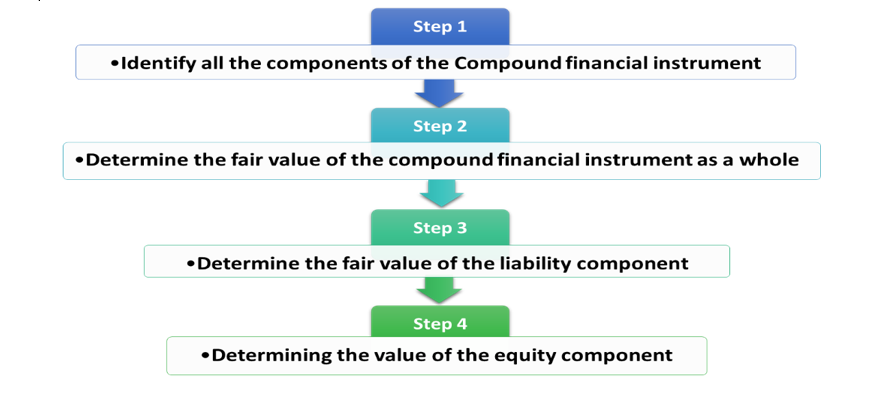

The steps involved in accounting for a CFI from the perspective of an issuer is diagrammatically represented below:

Step 1: Identification of the components of the CFI:

Identifying the components of CFI into equity and liability from the issuer’s perspective is done by checking the terms and conditions provided in the contract of the financial instrument.

For example, an issuer issues 7% Optionally Convertible Debentures, convertible into a fixed number of shares. This would mean that the obligation towards debenture holder can be discharged either by payment of cash or by issuing a fixed number of the equity shares of the issuer. The liability component here being the issuer’s obligation to pay 7% interest and the potential redemption of the debenture in cash at maturity. The equity component here being the holder’s call option for the issuer’s shares.

Step 2: Determination of fair value of CFI as a whole

The fair value of the CFI as a whole would normally be the transaction price as provided in para B5.1.2A of Ind AS 109. In case the transaction has not taken place under market conditions, then the principles of Ind AS 113 would be applied to derive at the fair value of the financial instrument as a whole.

Step 3: Determination of the fair value of the liability component:

Fair value of the liability component is the present value of the contractually determined stream of future cash flows discounted at the rate of interest applied at that time by the market to instruments of comparable credit status and providing substantially the same cash flows, on the same terms but without the convertibility option.

The act of discounting the cash flows of the instrument as a whole with the discounting rate being the rate of interest prevailing in the market on a debenture without the conversion option is done to derive the value of the liability component.

Now if the instrument as a whole has an embedded derivative, like a call option on the equity shares, the liability component is inclusive of the value of the derivative embedded in the CFI.

Step 4: Determine value of the equity component:

The equity component of a CFI is nothing but the residual amount left after subtracting the liability component as computed in step 3 from the fair value of the CFI as a whole (step 2).

This is fairly evident from the definition of equity as provided in para 11 of Ind AS as below:

“An equity instrument is any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities.”

Also, once the value of the equity component of a CFI is determined, being the residual amount, it is not re-measured or reclassified till final settlement. In cases of conversion, there can merely be a change within equity. Any kind of cost associated with the issue of the CFI shall be proportionately allocated to the liability and equity components.

Since the liability component of a CFI satisfies the definition of a financial liability as per Ind AS 32, the same is required to be subsequently accounted for in accordance with the principles of subsequent measurement of financial liabilities as provided in para 4.2 of Ind AS 109 viz. at Fair value through profit or loss (FVTPL) or at amortised cost method.

Examples

Example 1: 9% Preference shares with partial conversion and partial redemption

Company M has issued 10,000 9% Preference shares having face value Rs. 100 each with mandatory dividends and mandatory conversion of 50% preference shares into equity and balance 50% redemption at the end of 3 years from the date of issue. Market rate for Preference shares with similar credit status and other features except the conversion feature is 12%p.a.

The preference share has two components – (1) Contractual obligation for payment of mandatory dividend and mandatory redemption of 50% Preference shares. (2) Mandatory conversion of 50% Preference shares into equity.

The first component is a financial liability because the same consist of contractual obligation to pay cash and the entity does not have an unconditional right to avoid delivering cash.

The second component is equity since there is mandatory conversion into equity shares, which, in substance, signifies that the amount for the equity is already prepended even before receiving the shares in reality.

The values of equity and liability components are calculated as follows:

Present value of Principal payable at the end of the 3 years (Rs. 5,00,000 discounted at 12% for 3 years)= Rs.3,55,890.

Present value of contractual obligation to pay dividends in arrears for 3 years (Rs. 90,000 discounted at 12% for 3 years) = Rs. 2,16,165

Total financial liability= Rs.5, 72, 055.

Therefore, equity component= fair value of CFI, say Rs. 10,00,000 less financial liability component i.e. Rs. 5,72,055=Rs. 4,27,945.

Subsequent year’s profit and loss account is charged with interest amortisation at 12% on the financial liability component and dividend expense of Rs. 90,000 each.

Example 2: 6% optionally convertible debentures (OCDs)

X ltd (issuer) has issued 6% p.a. debentures to Y Ltd. (holder) for a consideration of Rs. 30 lakhs. The holder has an option to convert these debentures to a fixed number of equity instrument of the issuer anytime up to a period of 3 years. If the option is not exercised by the holder, the debentures are redeemed at the end of 3 years. The prevailing market rate for similar debentures without the conversion feature is 9% p.a.

The instrument has two components – (1) Contractual obligation that is conditional on holder exercising his right to redeem, and (2) conversion option with the holder.

The first component is a financial liability because the entity does not have an unconditional right to avoid delivering cash. The other component, conversion option with the holder, is an equity feature.

The values of liability and equity component are calculated as follows:

Present value of principal payable at the end of 3 years (Rs. 30 Lakhs discounted at 9% for 3 years)= Rs. 23,16,550.

Present value of interest payable in arrears for 3 years (Rs. 1,80,000 discounted at 9% for each of 3 years) = Rs. 4,55,632

Total financial liability= Rs. 27,72,182.

Therefore, equity component= fair value of CFI, say Rs. 30 Lakhs less financial liability component i.e. Rs. 27, 72,182=Rs. 2, 27,818.

In subsequent years the profit is charged with interest of 9% on the debt instrument.

Example 3: Accounting for Compound financial instrument on date of transition

On 1st April, 2015, X Ltd. issued 50,000, 7% convertible debentures of face value of Rs. 100 per debenture at par. The debentures are redeemable on 31st March 2020 or these may be converted into ordinary shares at the option of the holder. The interest rate for equivalent debentures without the conversion rights would have been 10%. The date of transition to Ind AS is 1st April, 2017.

As per previous Indian GAAP, the given instrument has been accounted for as a non-current liability and corresponding interest expense of Rs. 3,50,000 each for 2 years should have been charged directly to profit and loss account.

On the date of transition to Ind AS, i.e. 1st April, 2017, the Company has to account for the instrument as a compound financial instrument as per para 28 of Ind AS 32. Subsequently, the value of debt component and equity component has to be calculated (viz. split accounting).

Therefore, for the remaining 3 years, there will be an interest expense at Rs. 3,50,000 each and at the end of 3rd year the instrument either gets redeemed or gets converted into ordinary shares of the Company.

On 1st April, 2017

Value of Debt:

Present value of interest payable for 17-18, 18-19 & 19-20 = (Rs. 3,50,000 discounted at 10% for each of the 3 years)= Rs. 8,70,398

Present value of Principal at the end of 3rd year i.e. as on 31st March, 2020 = (Rs. 50,00,000 discounted at 10% for 3 years) = Rs. 37,56,574

Value of Debt component= Rs. 37,56,574 + 8, 70,398 =Rs.46,26,972

Value of equity component= Rs. 50,00,000-46,26,972=3,73,028

Therefore, on the date of transition i.e. 1/4/2017 amount of Rs. 50,00,000 being the Fair value of CFI will be split into debt & equity as given above.

For the coming 3 years, the following treatment shall be done by the X Ltd.

| Particulars | 2017-18 | 2018-19 | 2019-20 |

| Opening debt component | 46,26,972 | 47,33,669 | 48,57,015 |

| (+)Interest amortisation @ 10% | 4,62,697 | 4,73,365 | 4,85,702 |

| (-)Interest expense at 3.5 lakhs p.a | 3,50,000 | 3,50,000 | 3,50,000 |

| Closing balance of debt component | 47,33,669 | 48,63,635 | 50,00,000 |

Conclusion

The move towards substance over form and fair value accounting is fairly reflected with the introduction of the concept of CFI. There has been a fundamental shift in the understanding when a contract is put to test in light of Ind AS governing financial instruments. The instruments which were erstwhile treated to be debt are currently being treated as equity. This is primarily dependant on the notion that equity capital is the amount of money not repaid, accordingly an instrument convertible into equity capital should also be treated as equity. Therefore, a CCD is shown as a CFI.

However, in the midst of split accounting of a CFI, there are certain issues which are of concern to entities in doing the same. The major challenge to stakeholders lies in treatment of the equity component of the CFI from Income tax perspective, since there arises a MAT implication.

On the date of transition to Ind AS, there arises a tax implication on the already issued instruments which require reclassification as a CFI in the current Ind AS regime. The equity component of the CFI is required to be included in the “transition amount” defined in sub-section 2(C) of section 115JB of the Income Tax Act, 1961.

This results in taxing the one-fifth amount of the equity component for 5 years. The same has been further clarified by the CBDT circular dated 25th July, 2017[1] stating that the equity component of a CFI is to be included in the transition amount and further be taxed for MAT purposes over a period of five years. The same is seen as a burden on companies transitioning from erstwhile Indian GAAP to Ind AS because the equity component is not excluded from the purview of book profits as computed for MAT purposes.

Nevertheless, we feel the concept is relatively new to the Indian context and the same shall be developed over a period of time.

[1] https://www.incometaxindia.gov.in/Communications/Circular/Circular_24_%202017.pdf

Dear Team,

We have issued non-convertible redeemable preference shares which can be redeemed anytime by the Board within 20 years at 0% coupon rate. However there is no redemption price decided by the Board at the time of issuance. How shall such preference shares be valued as on date as per Ind AS?

Once the OCPS are redeemed, what can the equity component be utilized for

A CCD is issued by a company and these CCD will be converted into equity at merger into new entity. Whether the company that issued the CCD needs to account this as equity or liability.

What would be treatment of Investment in Non-cumulative redeemable preference share under below two cases :

1. Issuer – Group company

2. Issuer – Other then group company

Are we required to separate debt and equity investment component as we do in case of compound financial instrument in books of issuer ?

Dear Sir,

Treating a Financial instrument as a CFI does not depend on whether it is issued to/by a group company or not. The recognition of deferred equity will still be done by split accounting.

With the limited facts given in the above case, Non-cumulative redeemable preference shares are ordinarily treated as Financial liability and do not require split accounting.

For further clarification with detailed facts you may reach out at rahul@vinodkothari.com.

Thanks.

Dear Sir,

If this investment in preference share is below market rate (say 2% coupon rate) than what should be treatment. Whether considering CFI, equity portion (investment) and preference portion needs to be created and whether equity portion also needs to be amortised over the period of preference shares or at the time of recognition only equity portion to be taken to ‘other equity’?

Does it make any difference if the investment is in parent company or in group concern?

Respected Sir,

Need Clarification

As per Sec 55(2) of the companies act, 2013, “no such shares shall be redeemed except out of the profits of the company which would otherwise be available for dividend or out of the proceeds of a fresh issue of shares made for the purposes of such redemption”;

Initially, at the time of issuance of preference shares, company has recognised the equity component out of the preference share liability.

At the time of redemption, can company treat the equity component as free reserves for redemption of preference shares.

Dear Sir,

The classification of a financial instrument as a CFI is done for the sole purpose of accounting, as per the provisions of Ind AS. The recognition of equity component in a CFI is for the purpose of recognising the deferred equity which would later be recognised on conversion.

The term “Equity” in a company, represents something that would never be repaid back, with the only exception of the event of liquidation.

In case of a CFI, at the time of conversion, there is a change in the line item, from “Equity Component of Compound Financial Instruments” shown in “Other Equity” to “Equity share capital”.

In case of issue of non-convertible redeemable preference shares, there is no reason to treat the same as a compound financial instrument i.e. the same will be treated as a financial liability.

For a CFI, at the time of redemption, the equity component cannot be used as a free reserve for redemption of preference shares as such an amount represents deferred equity and not profit of a company that would otherwise be available for dividend purposes. The same cannot be treated as a reserve.

If there is a change in the terms of a CFI, resulting the whole instrument to be treated solely as a financial liability, the equity component would not be recognised further due to reclassification of the whole financial instrument.