Strengthening Corporate Governance Norms in Banks – An after dose to a wounded governance system

Aanchal kaur Nagpal | finserv@vinodkothari.com

Introduction

A witness of serious lapses, over the past, in the banking system of India has brought the adequacy of the entire governance framework of banks into question. Banks have a huge fiduciary responsibility thereby casting a higher need of accountability. Failure or weakness in governance of a bank severely affects its risk profile, financial stability and depositors’ interest resulting in systemic and systematic risks in the entire financial sector as well as the economy as a whole.

In response to the aftermath created by bank failures like PNB and Yes bank, RBI released a Discussion Paper on ‘Governance in Commercial Banks in India’ on 11th June, 2020 (‘Discussion Paper’)[1]. The objective of the Discussion Paper was to align the current regulatory framework with global best practices while being mindful of the context of domestic financial system. Various proposals were made to fill in the cracks of the age-old and derelict governance regime of the banking sector.

Based on the feedback received from market participants, RBI has reviewed and released a Circular on ‘Corporate Governance in Banks – Appointment of Directors and Constitution of Committees of the Board’ on 26th April, 2021[2] (‘Circular’). The Circular consists of instructions by RBI on certain aspects covered in the Discussion Paper viz. chair and meetings of the board, composition of certain committees of the board, age, tenure and remuneration of directors, and appointment of the whole-time directors (‘WTDs’). A Master Direction on Governance will be issued in due course.

Effective Date

These guidelines will be effective from the date of issue of this circular i.e. 26th April, 2021. However, in order to enable smooth transition to these requirements, RBI has permitted banks to comply with the same latest by 1st October, 2021. Further, there are certain specific transitioning relaxations, as discussed later in this article.

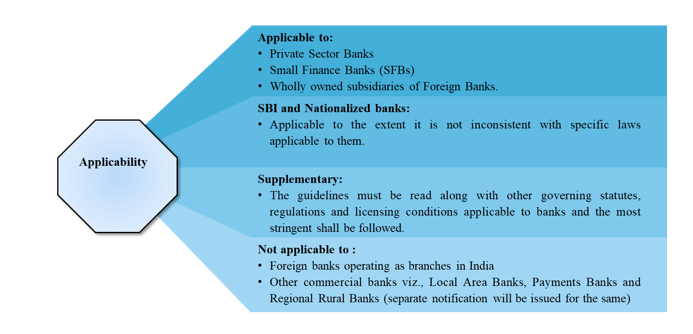

Applicability of the Circular

Supplementary nature of the Circular

The Circular does not have an overriding effect and will be read along with other governing statutes. It shall supplement the existing law in place and not withstand anything contrary contained in the any notifications, directions, regulations, guidelines, instructions, etc., issued by RBI before the Circular. Therefore, the most stringent provision will prevail.

The following guidelines have been brought by the Circular –

Chairperson and Meetings of the Board

Chairperson –

As per the Circular, the Chairperson of the Board shall be an independent director. Section 10B of the Banking Regulation Act, 1949 gives banks, an option to either appoint a whole time or a part-time chairman subject provided that in case of a part-time chairman, the following conditions are satisfied –

- A managing director (‘MD’) is appointed for management of the affairs of the bank

- Prior approval of RBI is obtained

The Circular provides a transitioning relaxation if the Chairperson of the Board is not an independent director as on the date of issue of the Circular, such Chairperson will be allowed to complete the current term as already approved by RBI.

As per market practice, most of the banks have independent directors as Chairpersons. However, in case of non-independent Chairpersons, Banks will be required to appoint an independent director to the office of the Chairperson while also complying with conditions under section 10B of the BR Act (since the Circular is only supplemental to existing provisions).

Further, in the absence of the Chairperson, the meetings of the board shall be chaired by an independent director.

Meetings of the Board

The quorum for the board meetings shall be:

- 1/3rd of the total strength of the board or

- three directors, whichever is higher

Further, at least half of the directors attending the meetings of the board shall be independent directors.

While the intent is to pose independence in Board deliberations, this also implies that banks will be required to have a majority of independent directors on their Board as well, at all times, considering if Board Meetings have full attendance. The Circular therefore is nudging banks towards a Board with an independent majority.

Committees of the Board

The guidelines provide for a stringent framework related to the composition and functioning of the Board Committees.

| Audit committee (‘AC’) | Risk Management Committee (‘RMC’) | Nomination and Remuneration Committee (‘NRC’) | |

| Composition | Only NEDs

|

Majority NEDs | Only NEDs

|

| Minimum 2/3rd of the directors shall be IDs

|

Minimum 1/2 of the directors shall be IDs | Minimum 1/2 of the directors shall be IDs | |

| Chairperson | Independent Director

|

Independent Director | Independent Director |

| Restrictions on Chairperson | Cannot chair any other committee of the Board | Cannot chair the Board and/or any Committee of the Board

|

Cannot chair the Board |

| Qualification of Members | All members should have the ability to understand all financial statements as well as the notes/ reports attached thereto and

At least 1 member shall have requisite professional expertise/ qualification in financial accounting or financial management

|

At least 1 member shall have professional expertise/ qualification in risk management | No specific provision |

| Meetings | One meeting in every quarter | One meeting in every quarter

|

As and when required |

| Quorum | 3 members of which at least 2/3rd will be IDs | 3 members of which at least 1/2 are IDs | 3 members of which at least 1/2 are IDs of which one shall be a member of the RMC.

|

RBI has retained majority of the provisions as proposed in the Discussion Paper. However, the requirement of holding at least 6 meetings in a year and not more than 60 days to elapse between 2 meetings has been relaxed to 4 meetings for the RMC and AC, while the NRC is permitted to meet as and when required. Such modification prevents the Company from being excessively burdened and statutorily mandated to hold meetings.

Remunerations of NEDs

As per the Circular, banks may pay remuneration to NEDs by way of sitting fees, expenses related to attending meetings of the Board and Committees, and compensation in the form of a fixed remuneration. However, the existing guidelines on ‘Compensation of NEDs of Private Sector Banks’[3] dated 1st June, 2015 permit profit related commission to NEDs, except Part-time Chairman, subject to the bank making profits. The ambiguity that arises here is whether banks will be permitted to pay fixed remuneration as well as profit-based commission or only fixed compensation to its NEDs. A clarification with respect to the same is yet sought.

Payment of fixed compensation to NEDs seems like a move in similar lines to SEBI’s proposal to grant stock options to IDs instead of profit linked commission[4]. However, if banks are only allowed to pay fixed remuneration, payment in the form of ESOPs as per SEBI guidelines, would not be permitted. Further, the earlier circular permits profit-linked commission, if banks have profit. Permitting a fixed remuneration would enable banks to pay remuneration to its NEDs during losses as well, as has been recently allowed by MCA[5].

Further, the Circular sets a limit of INR 20 lakhs on the fixed compensation payable to an NED. The existing guidelines also provide for a limit of INR 10 lakhs on compensation paid as profit-linked commission to an NED. This leads to another question whether a bank is permitted to pay a maximum of INR 30 lakhs (where INR 20 lakhs shall be fixed component and INR 10 lakhs will be profit-linked) or INR 20 lakhs is an all-inclusive limit.

Since the Circular does not have any repealing effect, it creates various ambiguities as mentioned above. Clarifications are sought for the same from RBI.

Age and tenure of NEDs

The upper age limit for all NEDs, including the Chairperson, will be 75 years post which no person can continue as an NED. The total tenure of an NED, continuously or otherwise, on the board of a bank, shall not exceed 8 years and such NED will be eligible for re-appointment after a cooling period of 3 years. This means that even if an NED’s appointment is staggered and results into a total of 8 years irrespective of any gaps in the tenure, a cooling period of 3 years will be required before his/her reappointment once he/she completes 8 years as an NED.

However, such cooling period will not preclude him/her from being appointed as a director in another bank subject to meeting the requirements.

Tenure of MD & CEO and WTDs

The Circular also puts a limit to the tenure of MD&CEO and WTDs which was indicative of the need to separate ownership from management while also building a culture of sound governance and professional management in banks.

A person can act as an MD and CEO or a WTD only for a period of 15 years, subject to statutory approvals required from time to time. The person will be eligible for re-appointment as MD&CEO or WTD in the same bank, if considered necessary and desirable by the Board, after a cooling off period of 3 years, subject to meeting other conditions. During this three-year cooling period, the person will not be allowed to be appointed or associated with the bank or its group entities in any capacity, either directly or indirectly.

Further, an MD&CEO or WTD who is also a promoter/ major shareholder, cannot hold such posts for more than 12 years. However, in extraordinary circumstances, at the sole discretion of RBI such directors may be allowed to continue up to 15 years.

It is to be noted that RBI has permitted banks with MD&CEOs or WTDs who have already completed 12/15 years, on the date these instructions come to effect, to complete their current term as already approved by RBI.

Conclusion

The growing size and complexity of the Indian financial system underscores the significance of strengthening corporate governance standards in regulated entities. After the financial sector took huge blows due to failed governance systems in various banks, it was seen imperative to strengthen the governance culture in banks. However, there are certain aspects that still require clarity.

Related presentation – https://vinodkothari.com/2021/08/ensuring-board-continuity-and-balance-of-capabilities/

[1] https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=19613

[2] https://www.rbi.org.in/scripts/NotificationUser.aspx?Id=12078&Mode=0

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=9749&Mode=0

Thank you for the detailed summary. Would this circular be applicable to foreign banks operating in India like Deutsche, Citibank etc. Since these are only branches and not 100% subsidiaries how will this circular be implemented.

Apologies I missed the point that this circular is not applicable to foreign banks operating as branches.