Siddhart Goel

finserv@vinodkothari.com

Introduction

On September 03, 2020 the Hon’ble Supreme Court (the “court”) while dealing with several petitions on account of Covid related stress from various stakeholders, passed an interim order that that the accounts which have not declared NPA till August 31, 2020 shall not be declared NPA till further orders of the court.[1] Further in its September 10, 2020 order the court asked the government and RBI to file affidavit within two weeks to the court, on issues raised and relief granted thereto.[2]

The primary contention raised before the court for consideration was that the moratorium postpones the burden and does not eases the plight. It would be a double whammy on borrowers since Banks are charging compounded interest, and banks have benefitted during moratorium by charging compounded interest from customers. The court in its order dated September 10, 2020 observed that individuals are more adversely affected during this period of pandemic. Therefore, the court from the government and RBI, with regard to charging of compound interest and credit rating/downgrading during moratorium period, has sought specific instructions.

Though the matter is sub judice, this write-up aims to provide a legal analyses to the contentions raised in front of the court on the above counts, since any action or direction on the above issues will have an impact on the wider financial system including all, i.e. borrowers, government, banks and other financial institutions as a whole.

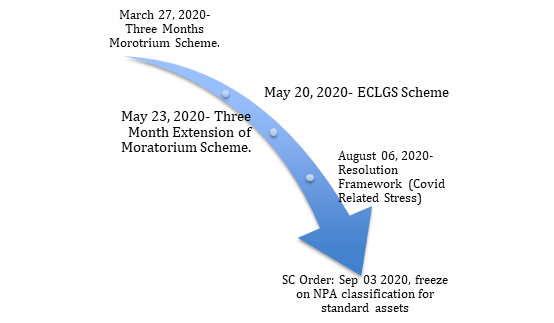

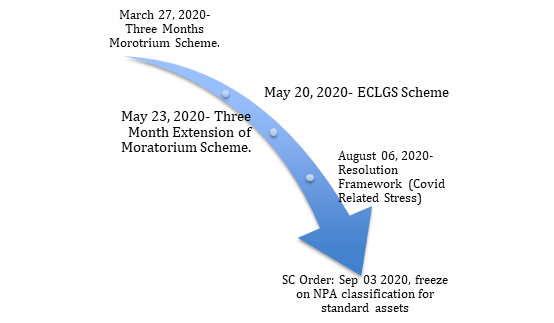

Before directly getting into the analyses, it is important to consider material reliefs and incentives announced by RBI and Government of India in respect to COVID19 related regulatory package. A brief history of timelines on series of regulatory reforms to cope with the disruptions caused due to COVID19 is provided below:

Waiver of Interest on Interest during moratorium and Systemic Implications

The moratorium scheme deferred the repayment schedule for loans, and the residual tenor, was to be shifted across the board. This essentially meant that all the liabilities of customers towards their repayments (principal plus interests) were to be rescheduled and shifted across the board by the Banks and NBFCs. However, the scheme clearly stipulated that the interest should continue to accrue on the outstanding portion of the term loans during the moratorium period. Moratorium granted to the customers of banks and NBFCs was to reprieve borrowers from any immediate liability to pay. However, charging of interest on outstanding accrued amount is the center of concern in the matter.

The money has time value, which is often expressed as interest in banking parlance. This is one of the most fundamental principles in finance. Rupee 1 today is more valuable from a year today. If interest is not paid, when it accrues, this in effect means, right to receive interest, which is a predictable stream of cash flow, is not available for reinvestment. Therefore, interest earned but not paid, should earn interest until paid. In debt markets, an obligation towards debt is valued in reference to yield to maturity or present value, all these rest on the compounding interest. These are generally in form of obligations on Banks and NBFCs on the liability side of their balance sheet. Bank deposits and interest thereon also attracts interest, which is adjusted towards total deposit amount of the customer. Therefore, interest on interest is a rule in finance and not a selective event.

Banking is no different to any other commercial business, besides it involves liquidity and maturity transformation and hence is highly leveraged. The short-term demand deposits from customers are converted into long-term loans to borrowers (‘maturity transformation’). Similarly, the customer deposits (liabilities of banks) are payable on demand, while on asset side receivables (repayment of principal and interest) are fixed on due dates (‘liquidity transformation’). It would be wrong to presume that NBFCs are any different from commercial banks. NBFCs largely rely on borrowings from Banks and other financial institutions by way of issuing debt instruments (CP, bonds, etc.), which is reflected on the asset side of the investing commercial banks and other financial institutions. Though obligation of payment on these debt instruments is not payable on demand, but they carry a substantial roll over and default risk. Hence, these institutions are highly leveraged and inherently fragile by nature of their business. Needless to state that receivables on asset side of banks and NBFC also carry certain risk of default and therefore are inherently risky in nature.

Financial institutions and other investors in market, (like Money Market Funds, Pension funds and etc.) invest in debt of Banks and NBFCs on the basis of strength of assets held by them. These assets are in form of receivables from pool of loans or by way advances to underlying borrowers. Thus, participants in financial markets are highly interlinked and are adversely affected by asset deterioration as a rule. Banks and financial institutions bear credit risk (default risk) of the underlying borrowers on their balance sheet. This credit risk has already increased substantially and would be unfolding further due the impact of pandemic on wider economy.

The waiver of interest charged on interest accrued but not paid during the moratorium, would not only be a loss for the banks and NBFCs, but would also substantially dilute the value of assets held by them. This could lead to an asset liability mismatch on balance sheets of banks. Such waiver of interest on accrued amount could exacerbate the risk of banks and NBFCs defaulting on other financial institutions (‘systemic risk’). The foregoing of charging of interest on interest accrued during moratorium would mean banks and financial institutions partially baling out borrowers either from their own limited funds or from the borrowed funds of other financial institutions. Such a move could entail systemic risk and wider financial catastrophe. As risk of default from comparatively large diversified group of borrowers will be shifted and get concentrated in the balance sheets of banks and financial institutions.

Credit Rating Downgrades and Stressed Assets Resolution

The RBI moratorium notification dated March 27, 2020, freezes the delinquency status of the loan accounts, which have availed moratorium benefit under the scheme. This essentially meant that asset classification standstill will be imposed for accounts where the benefit of moratorium have been extended.[3] As it stands, the RBI, March 27, 2020 circular clearly stipulated that moratorium/deferment/recalculation of loans is provided to borrowers to tide over economic fallout due to COVID and same shall not be treated as concession or change in terms and conditions due to financial difficulty of the borrower. In essence the rescheduling of payments and interest is not a default and should not be reported to Credit Information Companies (CICs). A counter obligation on CIC was also imposed to ensure credit history of the borrowers is not impacted negatively, which are availing benefits under the scheme. The relevant excerpt from the notification stipulates as follows:

“7. The rescheduling of payments, including interest, will not qualify as a default for the purposes of supervisory reporting and reporting to Credit Information Companies (CICs) by the lending institutions. CICs shall ensure that the actions taken by lending institutions pursuant to the above announcements do not adversely impact the credit history of the beneficiaries.”

Further through notifications dated August 06, 2020 RBI introduced a special window scheme for Resolution of stress on account of COVID 19 (“Special Window”). Banks and financial institutions could restructure the eligible accounts under the Special Window without any asset classification downgrade of borrowers. The Special Window scheme included personal loans to individuals and other corporate exposures. It is relevant to realize that the resolution of stressed assets is highly subjective to borrower’s leverage, sector specific risks, and other financial parameters. Banks and Financial institutions are better placed to implement the resolution or restructuring of the assets (loan accounts) at bank level.

The moratorium scheme and the Special Window resolution framework dated August 06, 2020 (the “Schemes”) were highlights of discussions during the court proceedings extensively. The primary contentions were in respect to limited applicability of these schemes. The schemes and their benefits were available to borrowers whose accounts were standard and not more than 30 DPD as on March 01, 2020 with their respective banks and financial institutions. Though the legal validity of the schemes were questioned directly in front of the court, but selective nature of schemes conferring benefit on to standard accounts (which are not more than 30 DPDs) only. The exclusion of other borrower accounts was criticised extensively. But this could form as a part of separate issue, the primary concern here being asset down gradation and credit rating scores.

The Special Window restructuring scheme notification under its disclosures and credit reporting section made an onus on lending institutions to make disclosures on such re-structured assets in their annual financial statements along with other disclosures. However where accounts have been restructured under special facility, and involve ‘renegotiations’, it shall qualify as restructuring and the same shall be governed under credit information polices as applicable. The relevant clause is produced as is herein below:

“54. The credit reporting by the lending institutions in respect of borrowers where the resolution plan is implemented under this facility shall reflect the “restructured” status of the account if the resolution plan involves renegotiations that would be classified as restructuring under the Prudential Framework. The credit history of the borrowers shall consequently be governed by the respective policies of the credit information companies as applicable to accounts that are restructured.”

It is argued that the area of application and scope of both the schemes are entirely exclusive and independent remedies available to respective eligible borrowers. Under moratorium scheme the borrower gets benefit of liquidity since all the payments due during the period are deferred. While in the latter, i.e. restructuring scheme the borrower under stress can get their accounts restructured by way of implementing resolution plan without facing any asset classification downgrade upfront. In the latter case, only such restructurings involving ‘renegotiations’ will affect the credit history of the borrowers.

Conclusion

The intention of the RBI and the government was to provide relief to the borrowers, who were gasping for relief after the disruptions caused due to COVID 19. There is no doubt that the COVID-19 outbreak and subsequent lockdown has impacted all level of borrowers, ranging from small to large borrowers, including, individuals to corporates. It would be wrong to presume that those accounts, which were NPA or otherwise ineligible under the schemes, are not affected by the pandemic. Therefore it is always open for the government and RBI to introduce or implement any other scheme or some sort of reprieving mechanism for the ineligible borrowers. However, it is important to consider that even banks and financial institutions are no exception like any other businesses that have been affected by the pandemic; moreover they have been exposed to severe liquidity crunch and on the flip side are witnessing asset quality problems on their balance sheets. Any attempts to tamper or distort with the fundamental principle of finance (‘interest on interest’) or shifting the burden of it on banks and other financial institutions could have a much wider systemic ramifications than the current economic stress.

[1] https://main.sci.gov.in/supremecourt/2020/11127/11127_2020_34_16_23763_Order_03-Sep-2020.pdf

[2] https://main.sci.gov.in/supremecourt/2020/11127/11127_2020_36_1_23895_Order_10-Sep-2020.pdf

[3] Our detailed write up asset classification standstill is available at < http://vinodkothari.com/2020/04/the-great-lockdown-standstill-on-asset-classification/>