Vinod Kothari ( finserv@vinodkothari.com)

Sale and leaseback (SLB) transactions are one of the most innovative, and in the past history of lease transactions, one of the most maligned transaction types. All over the world, there have been hundreds of rulings where SLB transactions have been challenged; in many cases, there were upheld and their sanctity was preserved, in many other cases, they have been treated either as no valid lease transactions, or pure financing transactions.

Motivations

There may be various motivations for a lessee to get into an SLB:

- Liquidity – while normal lease transactions do not lead to cash in the hands of the lessee, SLBs do, SLBs extend leasing to a device of unlocking of investment. The money raised by SLBs is like general purpose corporate funding – it may be used for any purpose as the lessee may choose.

- Putting assets off the books – A selling lessee may put the asset being sold off the books, if the SLB is properly structured as a sale and operating leaseback.

- Financial restructuring – if the money raised by an SLB is used to pay off on-balance sheet liability, the SLB may have twin effects on the balance sheet. By putting fixed assets off the books, it reduces operating leverage, and by reducing liabilities, it reduces financial leverage.

- Capturing revaluation gains – assume there are assets where the carrying values as per books are significantly lower as compared to the fair market value. In such cases, if the SLB is properly structured as operating leaseback (other conditions also need to be satisfied), the gain on the sale of the asset may be booked as realized gain (not just a revaluation surplus), and may be taken to shareholders’ equity.

- Tax benefits – many SLBs, such as those of cars, furniture, etc., may be designed to accelerate the tax write off of the lessee by moving from depreciation to rental write off.

- Acceleration of VAT set off – an entity having substantial amount of carry forward of input tax credit may accelerate the set off by making a sale of capital assets.

Why SLBs walk on Achilles’ heels:

An SLB transaction has the apparent looks of a financial transaction. There is only a transfer of legal title over the asset. The asset stays with the lessee. In practice, parties may take quite callous approach evaluating the asset, and may take a purely lessee exposure, in which case, most often lessor may not bother about valuation of the asset. In many cases in the past, assets have been found not even to be existing.

Besides, in many cases, lessees in SLBs have been motivated either by a funding motive, or one of booking profits on the sale of the asset. Therefore, lessees may have aggressively overvalued assets.

In India, one of the ill-famed example of SLBs has been the SLB of electric meters by state electricity boards (SEBs). SEBs, starved of funding, were advised to use the innovative funding device of leasing back electric meters that were installed in consumers’ premises. Leasing companies (and in fact, many entities not in leasing business at all), starved of tax benefits, were easily attracted to this option, as it was contended that electric meters qualify for 100% depreciation. Many SLB transactions of electric meters happened around 1996-1997. Many of these cases have already traveled long routes of litigation. Some High courts have challenged them as being pure financing devices. Some have respected them, merely based on the legal nature of the contract.

In one of the recent rulings before the Madras High court, electric meters were shown to have been bought on 30th March – hence, used for just one day. In fact, meters actually bought by the selling SEB only a few months back were heavily revalued too. Despite such glaring facts, the Madras High court still went by the legal form, and upheld the lessor’s claim to depreciation.

Electric meters is not the only thing – many weird assets such as glass bottles, gas cylinders, tools, jigs, and so on have been sold and taken back on lease. In recent past, we have noticed transactions structured to give lessees a rental write off – hence, SLBs of sanitary fittings, office fitouts, office interiors, wall panels, false ceilings, etc have commonly been done.

As most of these transactions are factually very weak, SLB transactions continue to look like money lending transactions.

Types of SLBs:

First of all, the most essential distinction will be on – is it a new asset or old asset? Since it is SLB, sure enough, it is not a new asset being acquired by the lessee, but the moot question is – has the asset been subject to use for a long period? There are cases where lessees might have recently bought assets, and may now want to get them off the books. Needless to say, older the asset, more serious the concerns, as the chances of overvaluation, or sale of decrepit assets purely with financial motives, etc., go up.

From accounting viewpoint, SLBs may be sale and financial leasebacks, and sale and operating leasebacks. We discuss the implications under the caption accounting issues.

Note that the following is not a case of sale and leaseback – X has leased an asset to Y, and X now sells the leased asset to Z, such that now the lease continues between Z and Y.

Lease and leasebacks are also not sale and leasebacks. A lease and leaseback transaction may be structured from variety of viewpoints – longer lease out, and shorter leaseback, or financial lease out and operating leaseback, etc.

Legal issues

First key question is – is an SLB legally valid as a lease? US Supreme Court discussed the legal validity of SLBs in the famous ruling of Frank Lyon and Company. The questions on the legal validity of an SLB are in fact questions which are germane to the validity of any lease. By way of a quick check (each of the factors below are negatives):

- The asset being sold might have become an immovable property.

- The asset being sold may have become inseparable part of another asset.

- The lessor may not have done anything to indicate that the lessor is really interested in the asset, or that the asset is a genuine purchase of an asset. Facts may indicate that the lessor merely went by the financials of the lessee.

- The asset may have been subject matter of third party rights. For example, the asset might already have been leased to a third party, in which case, it cannot be sold without the concurrence of the third party. The asset might have been encumbered, and so on.

- In not-so-extreme cases, the asset may not at all exist, or may have outlived its life.

If facts are strong, there is nothing to challenge the legal validity of an SLB, merely because it is an SLB and not a lease of a new asset. Of course, the lessor must do everything that a prudent man would do, if really buying an asset for good value.

Income Tax issues

In case of assets which have already been depreciated by the lessee prior to their sale, income-tax law has an explanation below section 43 (1) whereby the tax WDV in the hands of the lessor will be the tax WDV in the hands of the selling lessee. That is to say, the actul sale price of the asset will be ignored, and the seller’s WDV will become the WDV of the acquiring lessor. Obvious enough, if the asset has not been depreciated by the seller, the provision does not apply. If the asset has been sold in the same financial year in which it is acquired, the seller does not claim tax depreciation.

Other than the above specific SLB-directed provision, in actual practice, tax officers question eligibility of financial lease transactions to depreciation for the lessor or rental write off for the lessee. The real culprit for tax purposes is not a financial lease, but such a lease which is a disguised financial transaction, particularly transactions containing options to buy at bargain prices. SLB transactions may especially be targeted as engineered to produce an artificial tax shelter – for example, a sale of office furniture which is taken back on lease.

VAT issues

VAT is one of the least understood implications – in fact, for VAT purposes, SLBs are no different from any other sales. Where capital assets are sold by the selling lessee, the sale is a taxable sale (assuming the seller is in some business where he generates taxable sales). Presumably, when the asset was acquired, it might have been acquired either under CST, or it might have been imported, or might have been acquired under some state VAT law (that is, the asset was acquired after introduction of VAT laws in the country). If the asset had suffered VAT at the time of its purchase, such VAT might have been eligible for set off (assuming the capital asset was not one of the negative-listed capital asset). If the asset was bought under CST or was an imported asset, the question of any VAT set off at the time of acquisition would not arise at all.

In any case, the sale of the asset would certainly be a local sale. The question of an SLB being an inter-state sale does not arise at all. The local sale will be chargeable to VAT. Of course, if the selling lessee has carry forward of input tax credit, the same can be claimed against the VAT on the sale of the capital asset.

As the asset is taken back on lease, there is clearly a VAT on lease rentals. This is also off-settable by lessee.

In the hands of the lessor, the VAT paid on the purchase of the asset is off-settable in the same manner as any other VAT.

Accounting standards

Accounting standards distinguish between SLB where the leaseback is financial, and SLB where the leaseback is operating.

If the leaseback is financial, the fact of sale of the asset is completely disregarded. No profit is booked on the sale of the asset, as there is no accounting sale of the asset at all. The amount of funding raised by the sale of the asset appears as a liability on the books of the lessee.

If the leaseback is operating lease, the asset goes off the books, and the funding realized does not come as a liability, Any gain or loss on the sale of the asset is a realized gain, and is taken to profit and loss. In fact, there is something even further: if the sale price is not fair market value of the asset, profits are recognized based on the fair market value of the asset.

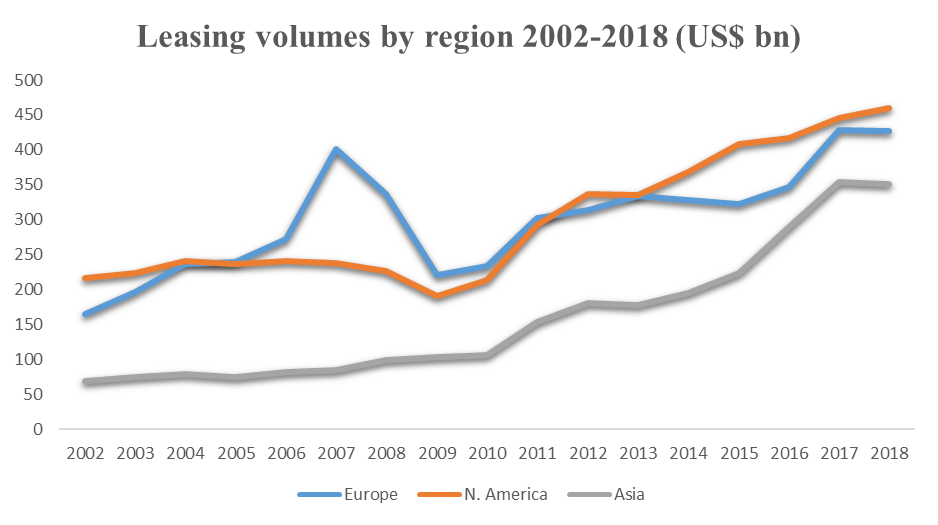

Loading…

Loading…