Can companies donate out all their assets?

– Is sarvasva samarpan by companies valid?

- Pammy Jaiswal, Partner and Payal Agarwal, Senior Executive (corplaw@vinodkothari.com)

Companies are creatures of their shareholders. If the company is a private company, the business and wealth of the company is the property of its shareholders. Technically, shareholders own the shares of the company, and certainly, a shareholder may donate his shares out. There are several iconic examples of such demonstrations of charitable intent, such as Mark Zuckerberg giving away 99% of his holdings in Facebook and Bill Gates donating 95% of his wealth to their charitable foundation and ultimately utilizing the same for charitable purposes.

However, can the shareholders resolve that the business and assets of the company that they own be donated out? Conceptually, there should be no difference between emptying out the assets of the company to the same charitable cause to which shareholders would have considered donating the shares. There are various judicial precedents[1] to refer to when it comes to checking the admissibility of a shareholder to transfer his shares by way of gift. However, in case of donation of shares, the company would remain up and running, and the charity will become simply the owner of the shares. However, if the business or assets of the company are donated out, that amounts to a mode of winding up, because the charity will not obviously run the business. So, can such donation be used as a mode of emptying the company out, so as to spend all its substratum, and once the company that empties out itself, it may just become a dud company, good for a strike off action u/s 248 (2) of the Companies Act, 2013 (‘Act’).

Surely enough, it will be unusual for the Memorandum of Association (‘MoA’) of the company to have the power to donate all its assets out. Normally, MoA will have charity as one of the incidental powers, but incidental powers can only be used in furtherance of the business or in conjunction thereof. There is no question of using incidental powers to donate the business out itself. So, can a corporate entity take such a drastic action, as to donate out all assets? And if yes, what will be the modality of doing the same? Also, what happens to the donee?

We have started with the donee being a charity. By way of argument, if one could donate all assets out to a charity, one can do it even to another entity. However, there may be taxation implications in that case, also discussed in this article.

Permissibility for a corporate person to make gifts

A doubt may arise as to whether a company, being a corporate person, can make a gift. Before answering that question, let us first understand the legality of making gifts. As per Section 25 of the Indian Contract Act, 1972, a contract without consideration is void. The same is also contemplated through the latin maxim ex nudo pacto nor oritur action meaning ‘a contract without consideration is void’. Here the adequacy of the consideration is not necessary and only the presence of the same suffice the requirement for constituting a valid contract.

However, Section 25 provides certain exceptions under which a contract is valid even if the same is not backed by consideration, which are –

- A written and registered document made on account of natural love and affection between the parties, i.e., a gift

- Compensation for voluntary services given by the recipient in the past

- Time barred debt

Explanation 1. —Nothing in this section shall affect the validity, as between the donor and donee, of any gift actually made.

Now given the fact that one can make gifts to the other, however, in the context of of a corporate person, the component of natural love and affection cannot be said to be present. The same was a question raised for determination before the ITAT – Mumbai bench in the matter of KDA Enterprises Pvt. Ltd., Mumbai vs Department Of Income Tax, ITA No.2662/M/2013, where both the donor as well as the donee were companies. In the matter of KDA Enterprises (supra), the AO was of the view that gifts can be given only by natural persons and therefore, a gift by a company is not tenable[2], against which, an appeal was preferred by the Company. However, the ITAT shifted the attention of the contended AO to the explanation u/s 25 of the Contract Act which states that the section does not have any effect on the validity of the gifts between donor and donee.

The AO, in the instant case, had further submitted that no gift deed has been executed, which is again, not a prerequisite for a valid gift. Here, one may refer to the definition of gift given under Section 122 of the Transfer of Property Act, 1822, which defines gift as –

“Gift is the transfer of certain existing moveable or immoveable property made voluntarily and without consideration, by one person, called the donor, to another, called the donee, and accepted by or on behalf of the donee.”

From the above definition, the three essential components of gift can be noted –

- Transfer or delivery of property

- Voluntary, i.e., with a donative intent

- Acceptance by donee

The aforementioned components of a gift may be present in case of a company as a donee and therefore, the contention of the AO that the transfer is not a gift on the basis of either of the grounds does not survive merit consideration.

In view of the above, the ITAT in the matter of KDA Enterprises (supra), has allowed the admissibility of gift by a company to a company and held that –

“… the companies are competent to receive and make gifts. All the three requirements of a valid gift, viz. identity of the donor, capacity/source and the genuineness stands proved in the case of the assessee. All the donor companies and the assessee are authorized by their Memorandum and Articles of Association for giving and receiving gifts. Proper resolutions in the Board Meeting have been passed by all the four companies for making the gift to the assessee and assessee has also accepted the said gifts by way of adopting a resolution in the meeting of Board of Directors.” [Emphasis supplied]

In another similar case of D.P. World Pvt. Ltd. vs. DCIT, ITA No. 3627, which related to the gift of shares made by a company to another, the view was upheld that a company can make a gift. The relevant extract is reproduced below –

“It would not be out of place to mention that a combined reading of Sec. 82 of the Companies Act, Section 5 and Section 122 of the TPA suggest that a company can validly transfer the shares by way of gift, provided where Articles of Association of the donor company permits the same. In case of donor is a foreign company, the relevant corporate/commercial law of the jurisdiction where the donor is based needs to be considered. In the light of the above discussion, we have no hesitation to hold that a company can gift shares and such transaction may appear as ‘strange’ transaction but cannot be treated as “non – genuine” transaction.” [Emphasis supplied]

Power of shareholders regarding disposal of all assets of a company

While the Act does permit the disposal of assets of a significant value in the company after obtaining shareholders’ approval, however, the shareholders’ authority cannot extend beyond the MoA of the company. Where the disposal of assets has the effect of impacting the going concern status of the company, the same cannot be done without express authorization for the same in the MoA of the company. This is evident from the rulings cited above as well, since in each of the said rulings, the company(ies) had express authority for making/ receiving gifts/donations through its/their MoA.

Points for consideration in case of disposal of entire assets of a company as a gift/donation

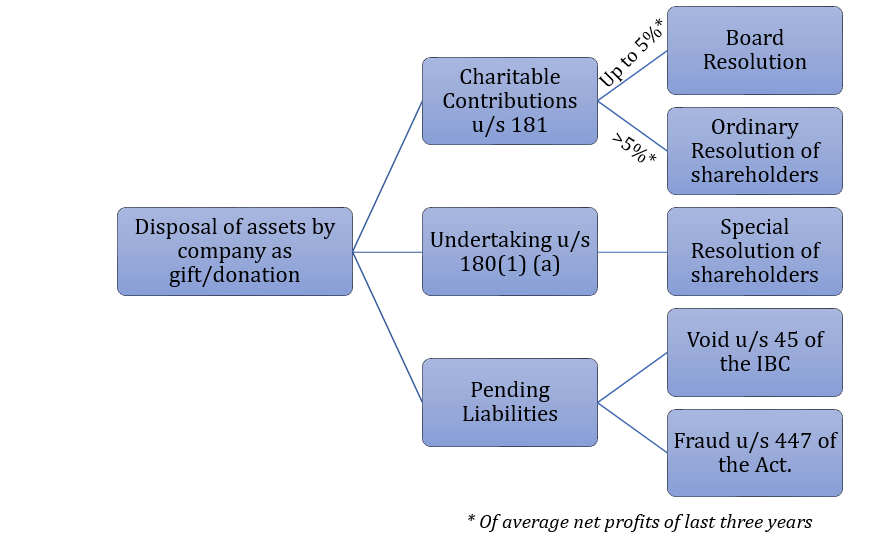

The above discussions clearly entail that a company is competent enough to make and/or receive gifts and/or donations. Having said that, consider the case of a company which wants to dispose off all its assets by way of donations/ gifts. The following points are significant to be considered while making the gift / donation:

- Board’s / shareholder’s power to make charitable contributions u/s 181 of the Companies Act (‘Act’)

The Act recognizes the power of directors to make contributions to bona fide charitable and other funds u/s 181 of the Act, subject to the shareholders’ approval if the same exceeds 5% of the preceding three years’ average net profits.

- Disposal of undertaking u/s 180(1) (a) of the Act

Section 180(1)(a) of the Act restricts the powers of the board with respect to disposal of substantial undertaking(s) of a company. It requires shareholders’ consent by way of a special resolution in order to dispose of the whole or substantially the whole of undertakings of the company.

For the purposes of the said sub-section, undertaking would mean an undertaking in which the company’s investments exceed 20% of its net worth or which generates income equal to 20% or more of the total income of the company. ‘Substantial’ part of undertaking would mean 20% or more of the undertaking of the company.

Further, undertaking has not been defined under the Act and its meaning can be taken from the provisions of the Income Tax Act, 1961 (‘IT Act’). The explanation to Section 2(19AA) of the IT Act, defines undertaking as –

“undertaking shall include any part of an undertaking, or a unit or division of an undertaking or a business activity taken as a whole, but does not include individual assets or liabilities or any combination thereof not constituting a business activity.”

In a case where a company wishes to donate all its assets, it definitely calls for taking approval of the shareholders and in fact considering the disposal of the entire assets, the unanimous approval from the shareholders should rule out any defiance from a third party.

- Disposal of assets without cleaning of liabilities may attract section 45 of the IBC and 447 of the Act

While there may be no bar on the disposal of all the assets of a company, thereby leading it to dissolution, the same can be done only after all the external liabilities have been paid. Where a company has disposed off all its assets for free, without settlement of the external liabilities, the same may amount as an undervalued transaction under Section 45 of the Insolvency and Bankruptcy Code, 2016 (‘IBC’), and may be rendered void and therefore, directed to be reversed.

Done with the intent to defraud the creditors, the same also attracts the provision of Section 447 of the Act and imposes mandatory imprisonment on the person guilty of such offence.

Impact of disposal of all assets of a company

The disposal of all the assets of the company leads to the loss of substratum of the company. In the matter of Mohan Lal & Anr vs Grain Chamber Ltd, 1968 SCR (2) 252, “Substratum of the Company is said to have disappeared when the object for which it was incorporated has substantially failed, or when it is impossible to carry on the business of the Company except at a loss, or the existing and possible assets are insufficient to meet the existing liabilities.” This, in turn, becomes a ‘just and equitable ground’ u/s 271 for winding up of the company.

In another matter of Rajan Naginds Doshi And Anr. vs British Burma Petroleum Co. Ltd, 1972 42 CompCas 197 Bom, the Bombay High Court held that –

“…. the company has ceased to carry on business, its substratum is gone, it has carried on ultra vires business and that the said business has been carried on by meddlers and that it will be just and equitable that the company should be wound up.”

However, as per Section 274(2) of the Act, a petition for winding up on the basis of just and equitable grounds can be dismissed by the Tribunal if it is of the opinion that a remedy other than winding up is available to the petitioners and seeking winding up of the company is unreasonable.

Tax implications on gifts/donations

Gifts and donations are not prohibited to be made by the companies, rather regulated and made taxable over and above the specified limits. The provisions of IT Act by way of certain clauses of Section 56, provides for taxability in case of transfer of shares without consideration, over and above a specified amount. Similarly, Section 80G of the IT Act also permits various donations and voluntary contributions.

- No capital gains

Any transfer of a capital asset under a gift or to an irrevocable trust is an exempted transfer under section 47(iv) of the IT Act, and therefore, not taxable as capital gains. However, reference may be made of the ruling of Madras High Court in the matter of Principal Commissioner Of Income Tax vs M/S.Redington (India) Limited, T.C.A.Nos.590 & 591 of 2019, in which, on the facts of the case it was found that the transfer of shares, camouflaged in the nature of a gift made to its subsidiary, is actually an attempt of corporate restructuring and does not include the necessary elements of a gift (para 6).

The receipt/giving of such gifts/donations cannot be said to be related to the business of an assessee and therefore, cannot be made taxable as profits and gains of business or profession (refer cases above).

- Chargeability as income from other sources

Section 56 of the IT Act admits taxability of certain gifts (both movable and immovable) without consideration beyond a specified limit. As per clause (x) of Section 56, gifts (cash/movable property/immovable property) is not taxable upto a certain threshold, being Rs. 50 lacs. Over and above the specified limit, gifts are taxable as ‘income from other sources’ except when the same qualifies as an exception under the proviso to the said clause. Here also, benefits can be availed by a trust or an organisation registered under Section 12A, 12AA or 12AB or u/s 10(23C) for charitable or religious purposes.

Concluding Remarks

Disposal of all assets of a company does not seem to be prohibited and can be sought as a good means of providing closure to the business, subject to the same being authorised through the charter documents and sanctioned through shareholders’ consent. However, the same should not be designed as a ‘tax avoidance’ exercise, since if the malicious intent becomes evident, it may attract payment of taxes along with fine and penalty and may even lead to prosecution based on the severity of the case.

[1] Manjula Finance Ltd., New Delhi vs Ito, Ward-16(2), New Delhi

Direct Media Distribution … vs Pr.Cit – Range -6, Mumbai

[2] The sin qua non of a gift is that the transaction is without any consideration and out of natural love and affection, as held in various judicial pronouncements. Since company is an artificial judicial person, so there cannot be any natural love & affection by a company or between the companies. Hence, a transaction of gift cannot be said to be valid or legally tenable between companies or where one of the parties is a company.”