Timothy Lopes, Executive, Vinod Kothari Consultants

finserv@vinodkothari.com

– with updates as on 30-07-2022

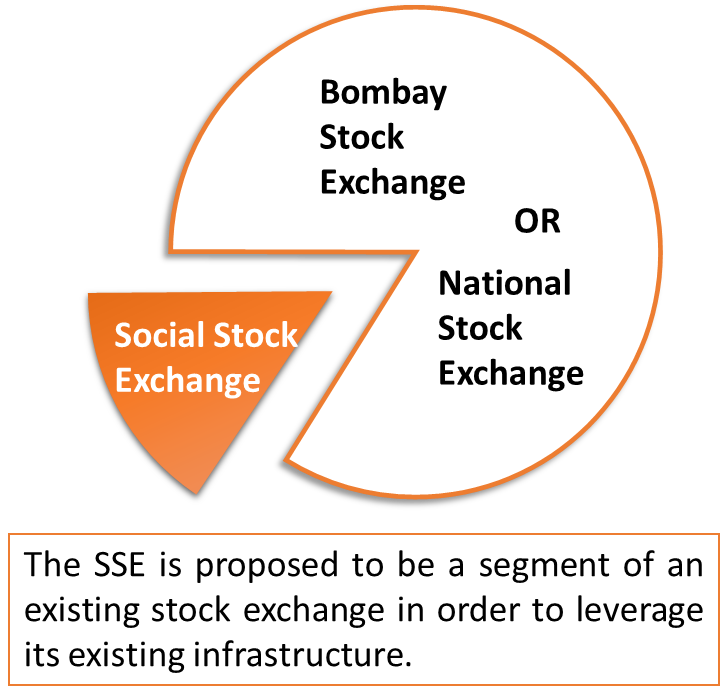

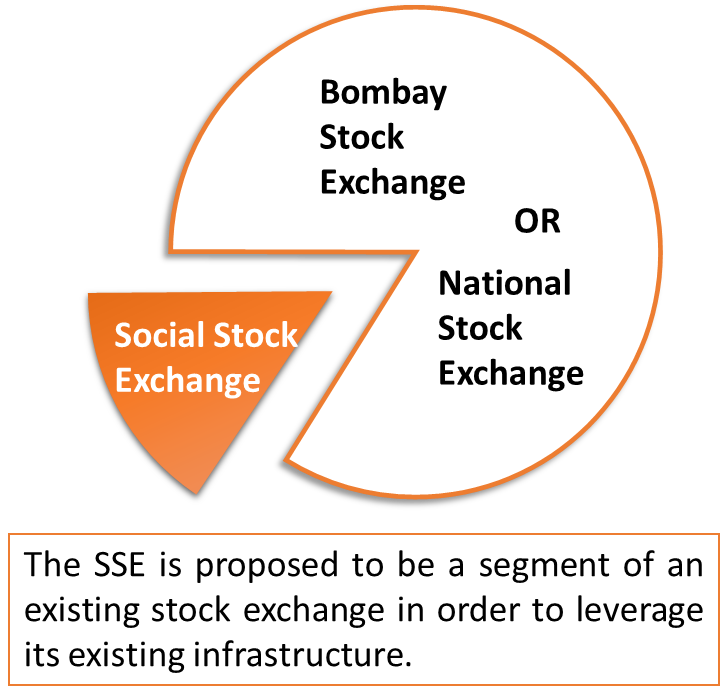

In the Union Budget of 2019-2020 the Hon’ble Finance Minister proposed “to initiate steps towards creating an electronic fund raising platform – a Social Stock Exchange (‘SSE’) – under the regulatory ambit of Securities and Exchange Board of India (‘SEBI’) for listing social enterprises and voluntary organizations working for the realization of a social welfare objective so that they can raise capital as equity, debt or as units like a mutual fund.”

A Working Group was subsequently formed on 19th September, 2019 to recommend possible structures and mechanisms for the SSE. We have tried to analyse and examine what the framework would look like based on global SSEs already prevalent in a separate write up.

On 1st June, 2020, the Working Group on Social Stock Exchange published its report for public comments. In this write up we intend to analyse the recommendations made by the working group along with its impact.

The idea of a Social Stock Exchange

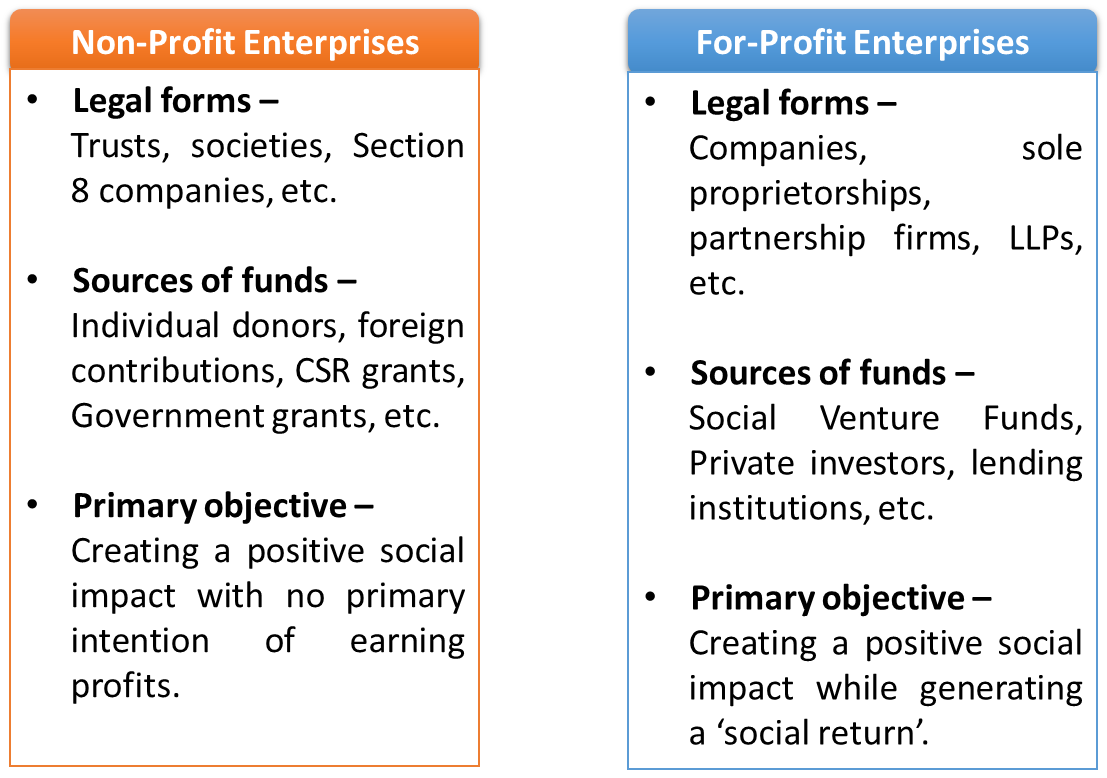

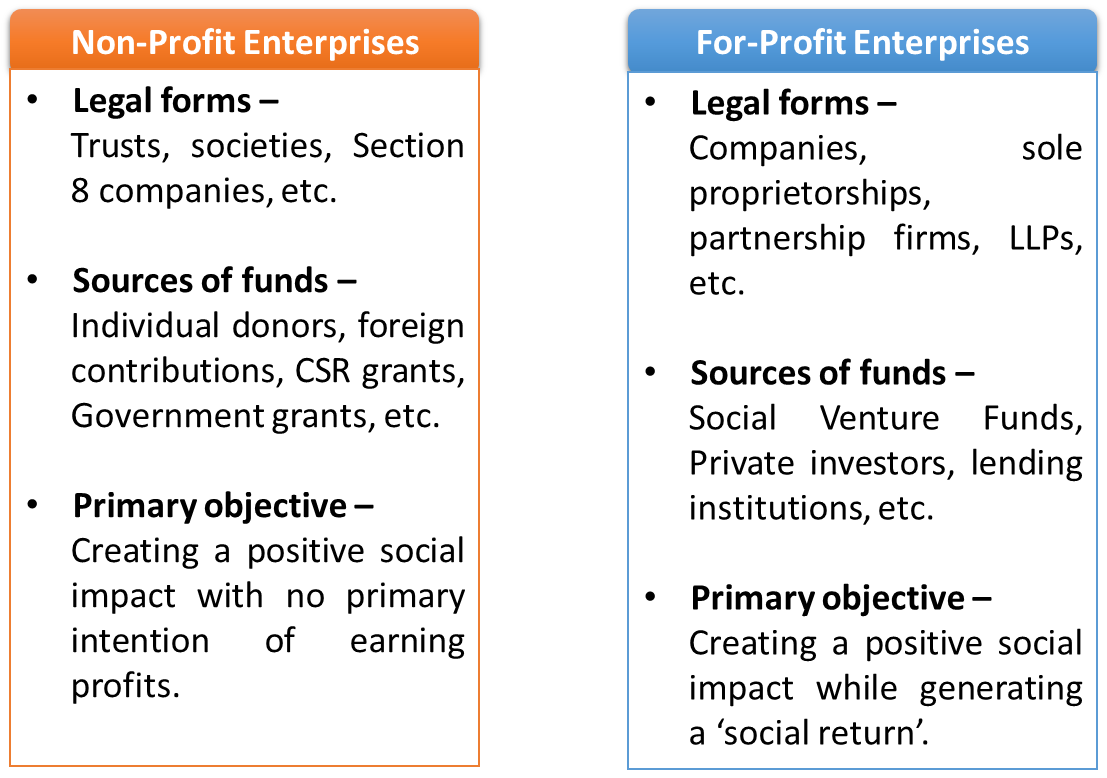

Social enterprises in India exist in large numbers and in several legal forms, for e.g. trusts, societies, section 8 companies, companies, partnership firms, sole proprietorships, etc. Further, a social enterprise can be either a For-Profit Enterprise (‘FPE’) or a Non-Profit Enterprise (‘NPO’). The ultimate objective of these enterprises is to create a social impact by carrying out philanthropic or sustainable development activities.

Certain gaps exist for social enterprises in terms of funding, having a common repository able to track these entities and their performance. The sources of funding for social enterprises have been philanthropic funding, CSR, impact investing, government agencies, etc.

and their performance. The sources of funding for social enterprises have been philanthropic funding, CSR, impact investing, government agencies, etc.

Funding is important in terms of the effectiveness of NPOs in creating an impact. The funding, however, is contingent upon demonstration of impact or outcomes.

Here comes the idea and role of a social stock exchange. An SSE proposed to be set up is intended to fill the gaps not only in terms of funding, but also to put in place a comprehensive framework that creates standards for measuring and reporting social impact.

Who is eligible to be listed on the SSE?

The SSE is intended for listing of social enterprises, whether for-profit or non-profit. Listing would unlock the funds from donors, philanthropists, CSR spenders and other foundations into social enterprises.

There is no new legal form recommended by the working group which a social enterprise will have to establish in order to get listed. Rather, the existing legal forms (trusts, societies, section 8 companies, etc.) will enable a NPO or FPE to get listed through more than one mode.

Is there any minimum criteria for listing on the SSE?

In case of NPOs, the minimum reporting standards recommended to be implemented, require the NPO to report that it has received donations/contributions of at least INR 10,00,000 in the last financial year.

Further, in case of FPEs, it must have received funding from any one or more of the impact investors who are members of the Impact Investors Council. Certain eligibility conditions for equity listings would also apply in case of FPEs, as per the SEBI’s Issue of Capital, Disclosure Requirements (ICDR).

The working group has requested SEBI to look into the following aspects of eligibility and recalibrate the existing thresholds in the ICDR:

- Minimum Net Worth;

- Average Operating Profit;

- Prior Holding by QIBs, and;

- Criteria for Accredited Investor (if a role for such investors is envisaged).

Listing, compliance and penalty provisions must be aptly stringent to prevent any misuse of SSE platform by FPEs.

What is a social enterprise? Is the term defined?

Social enterprises broadly fall under two forms – A For-Profit Enterprise and a Non-Profit Enterprise.

For-Profit Enterprise – A FPE generally has a business model made to earn profits but does so with the intent of creating a social impact. An example would be creating innovative and environmental friendly products. FPEs are generally in the form of Companies.

Non-Profit Enterprise – NPOs have the intention of creating a social impact for the better good without expecting any return on investment. These are generally in the form of trusts, societies and Section 8 companies. These entities cannot issue equity. The exception to this is a section 8 company which can issue equity shares, however, there can be no dividend payment.

The working group defines a social enterprise as a class or category of enterprises that are engaging in the business of “creating positive social impact”. However, the group does not recommend a legal/regulatory definition but recommends a minimum reporting standard that brings out this aspect clearly, by requiring all social enterprises, whether they are FPEs or NPOs, to state an intent to create positive social impact, to describe the nature of the impact they wish to create, and to report the impact that they have created. There will be an additional requirement for FPEs to conform to the assessment mechanism to be developed by SEBI.

Therefore, an enterprise is “social” not by virtue of satisfying a legal definition but by virtue of committing to the minimum reporting standard.

Since there would be no legal definition to classify as a social enterprise, a careful screening process would be required in order to enable only genuine social enterprises to list on the exchange.

Who are the possible participants of the SSE?

What are the instruments that can be listed? What are the other funding structures? What is the criteria for listing?

In case of Section 8 companies, there is no restriction on issue of shares or debt. However, there is no dividend payment allowed on equity shares. Further, there is no real regulatory hurdle in listing shares or debt instruments of Section 8 companies. However, so far listing of Section 8 companies is a non-existent concept, as these avenues have not been utilized by Section 8 companies apparently due to their inherent inability to provide financial return on investments.

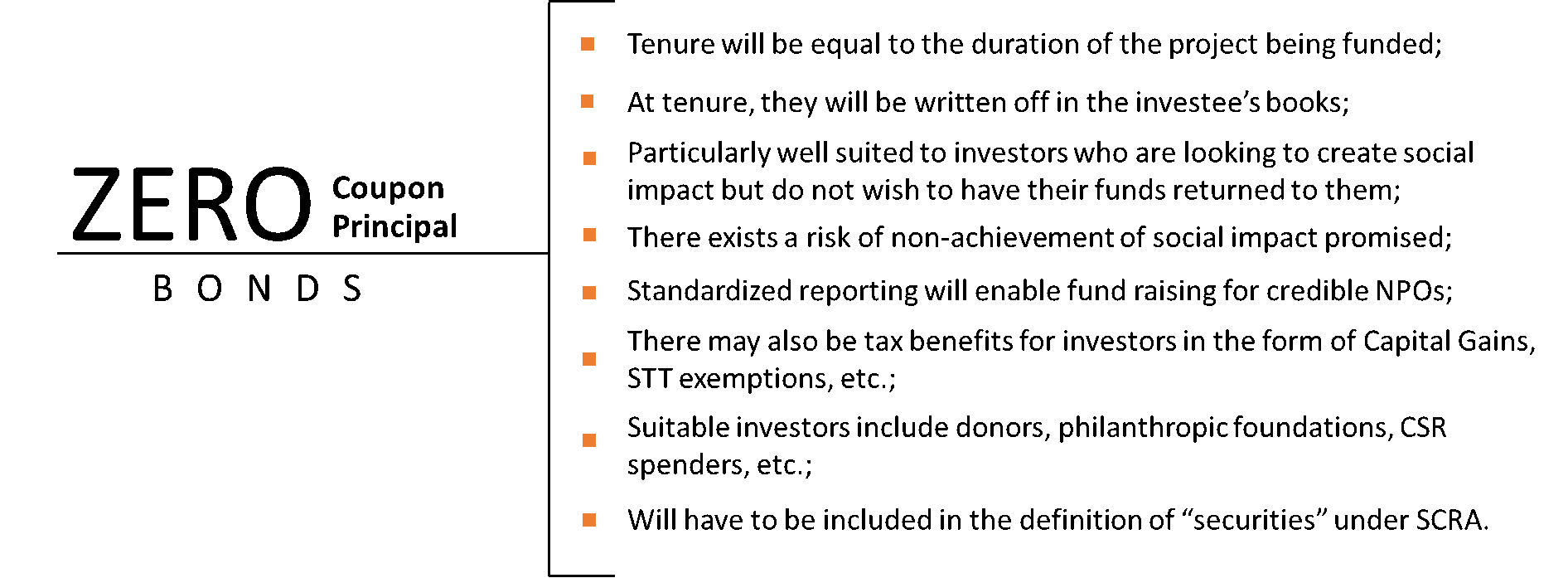

The working group recognises that trusts and societies are not body corporates under the Companies Act, and hence, in the present legal framework, any bonds or debentures issued by them cannot qualify as securities under the Securities Contracts (Regulation) Act 1956 (SCRA).

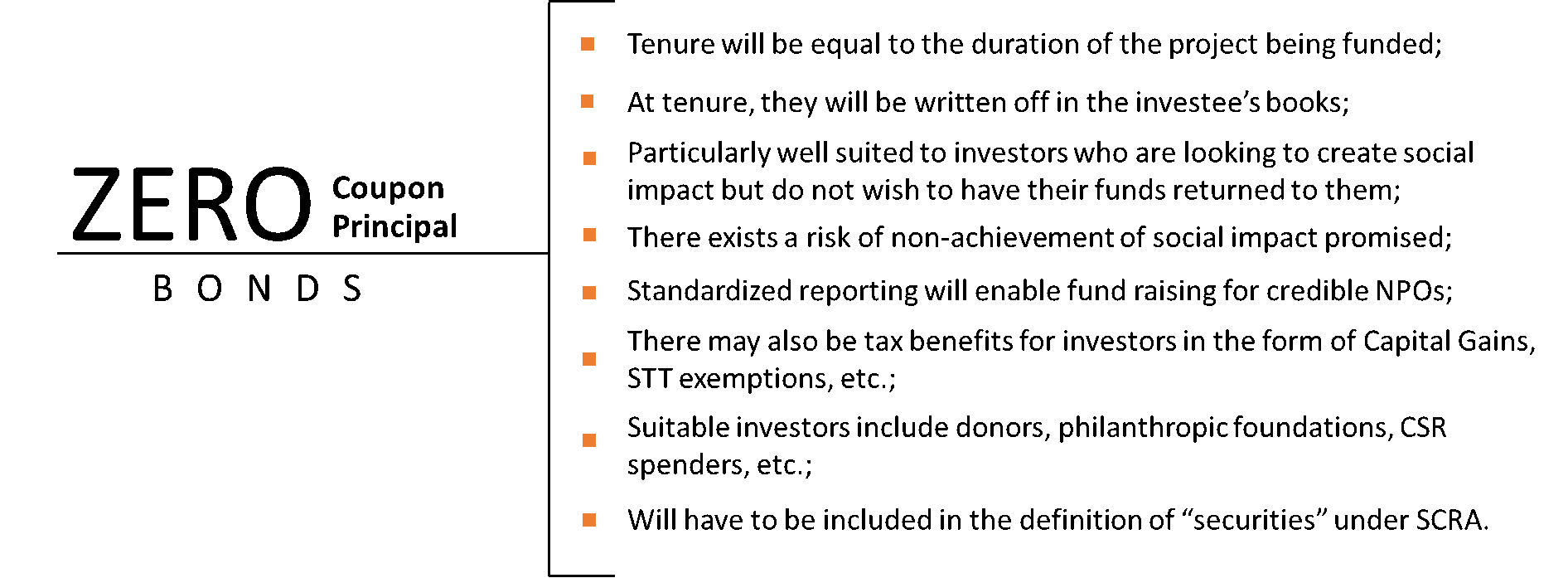

In this regard the working group suggests introducing a new “Zero Coupon Zero Principal” Bond to be issued by these entities. The features and other specifics of these bonds are discussed further on in this write up.

Further, it is recommended that FPEs can list their equity on the SSE subject to certain eligibility conditions for equity listings as per the SEBI’s Issue of Capital, Disclosure Requirements (ICDR) and social impact reporting.

Funding structures and other instruments are discussed further on in the write up.

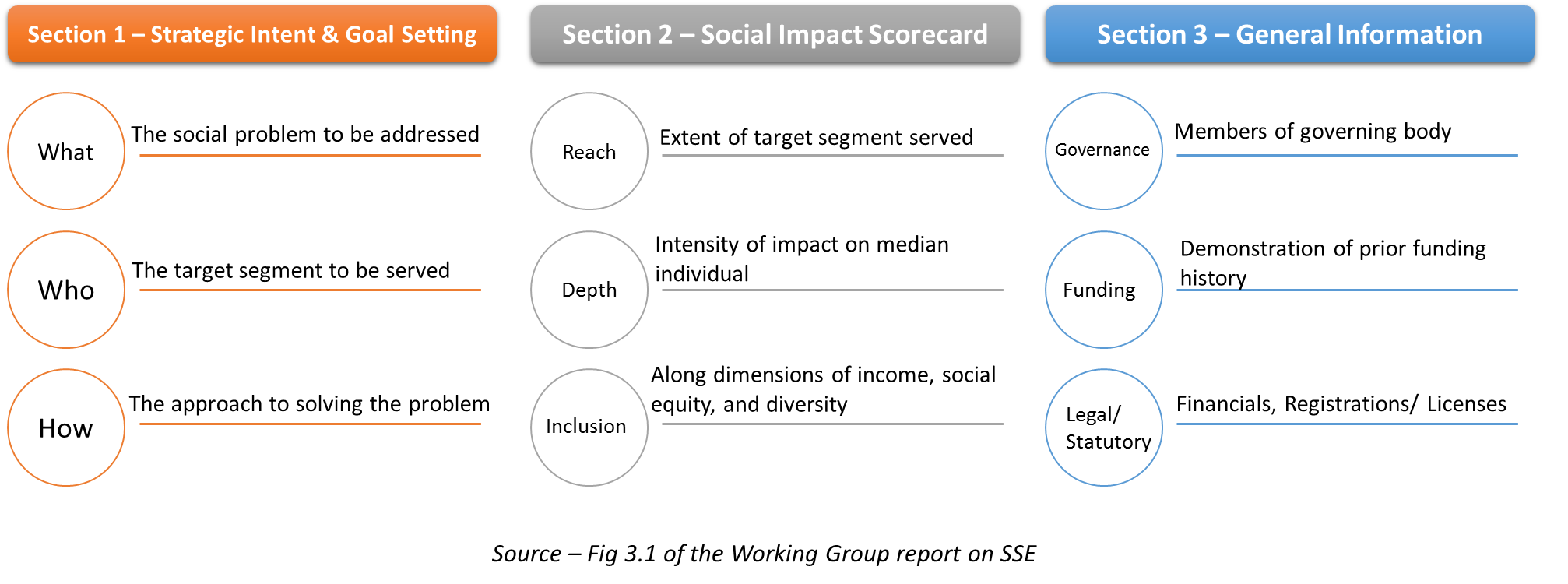

What are the minimum reporting standards?

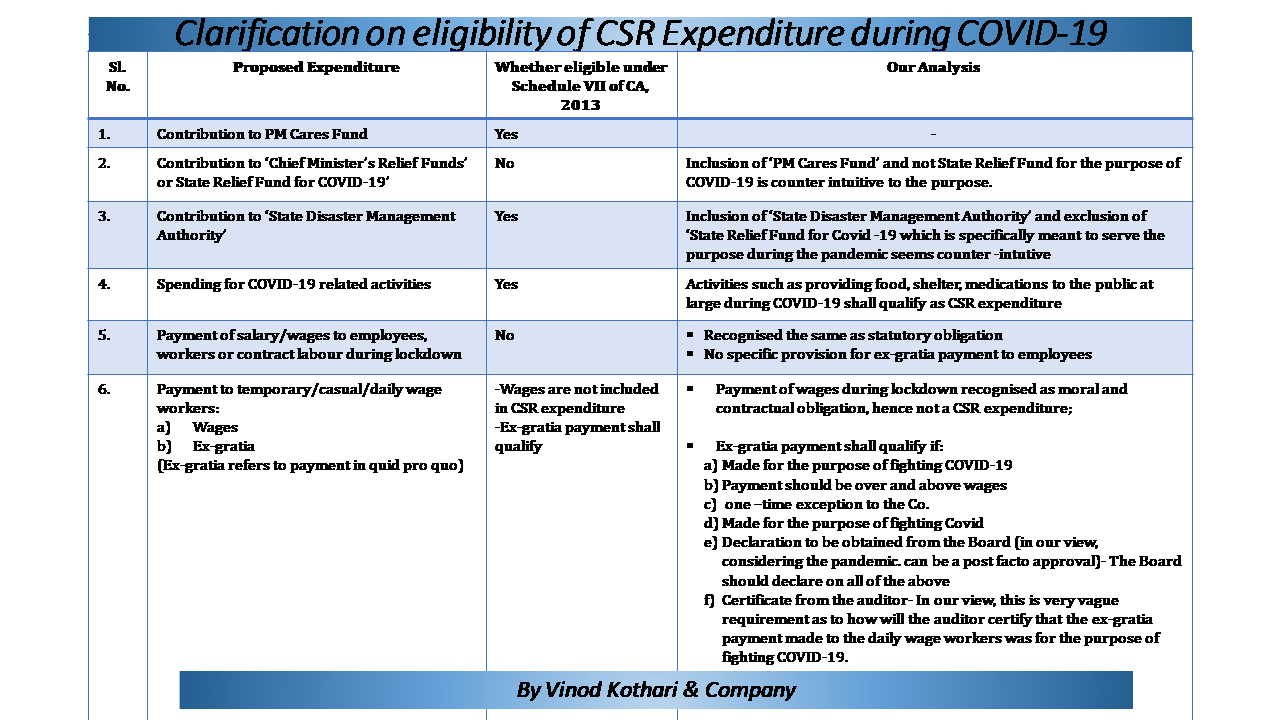

One of the important pre-requisites to listing on the SSE is to commit to the minimum reporting standards prescribed. The working group has laid down minimum reporting standards for the immediate term to be implemented as soon as the SSE goes live. The minimum reporting standards broadly cover the areas shown in the figure below –

The details of the minimum reporting standard are stated in Annexure 2 to the working group report. The working group states in its report that over time, the reporting requirements can begin to incorporate more rigour in a graded and deliberate manner.

Overall, it seems as though the reporting framework at the present stage is sufficient to measure performance and identify truly genuine social enterprises. The framework sets a benchmark for reporting by NPOs and FPEs and will provide the requisite comfort to investors.

Innovative bonds and funding structures

The SSE’s role is clearly not limited to only listing of securities and trading therein. The working group has recommended several innovative funding mechanisms for NPOs that may or even may not end up in creation of a listable security. Following are the highlights of the proposed structures –

1. Zero coupon zero principal bonds –

The exact modalities of this instrument are yet to be worked out by SEBI.

2. Mutual Fund Structure –

- Under this structure, a conventional closed-ended fund structure is proposed wherein the Mutual Fund acts as the intermediary and aggregates capital from various individual and institutional investors to invest in market-based instruments;

- The returns generated out of such fund is will be channelled to the NPOs who in turn will utilise the funds for its stated project;

- The principal component will be repaid back to the investors, while the returns would be considered as donations made by them;

- There could also be a specific tax benefit arising out of this structure;

- The other benefit of this structure is that the role of the intermediary can be played by existing AMCs.

3. The Social/ Development Impact Bond/ Lending Partner Structure –

These bonds are unique in a way that they returns on the bonds are linked to the success of the project being funded. This is similar to a structured finance framework involving the following –

- Risk Investors/ Lenders (Banks/ NBFCs) – Provide the initial capital investment for the project;

- Intermediary – Acts as the intermediating body between all parties. The intermediary will pass on the funds to the NPO;

- NPO (Implementing Agency) – will use the funds for achieving the social outcomes promised;

- 3rd party evaluator – An independent evaluator who will measure and validate the outcomes of the project;

- Outcome Funder – Based on the third party evaluation the outcome funders will pay the Principal and Interest to the risk investors/ lending partners in case the outcome of the project is successful. In case the outcome is not successful the outcome funders have the option to not pay the risk investors/ lending partners.

Although banks may not be looking into risky lending, the structure provides incentive to the bank in the form of Priority Sector Lending (PSL) qualification. In order to meet their PSL targets, banks may choose to lend under this structure.

4. Pay-for-success through grants –

This structure is where a new CSR aspect comes in. The working group recommends a structure which is similar to the pay-for-success structures stated earlier however, this required the CSR arm of a Company to select the NPO for implementation of the project. The CSR funds are then kept in an escrow account earmarked for pay-for-success, for a pre-defined time period over which the impact is expected to be created (say 3 years).

The initial capital required by the NPO to achieve the outcomes, will be provided by an interim funding partner (typically a domestic philanthropic organization, and distinct from the third-party evaluator).

If the CSR funder finds that the NPO has achieved the outcomes, then it pays out the CSR capital from the escrow account partly to the interim funding partner (similar to the earlier mentioned pay-for success structures), and partly to the NPO in the form of an accelerator grant up to 10% of the program cost in case the NPO exceeds the pre-defined outcome targets. The grant to the NPO is designed to provide additional support for non-programmatic areas such as research, capacity building, etc.

If the CSR funder finds that the NPO has not achieved the outcomes, then it either rolls over the CSR capital in the escrow account (if the pre-defined time period is not yet over), or routes the CSR capital to items provided under Schedule 7 of the Companies Act such as the PM’s Relief Fund (if the pre-defined time period is over).

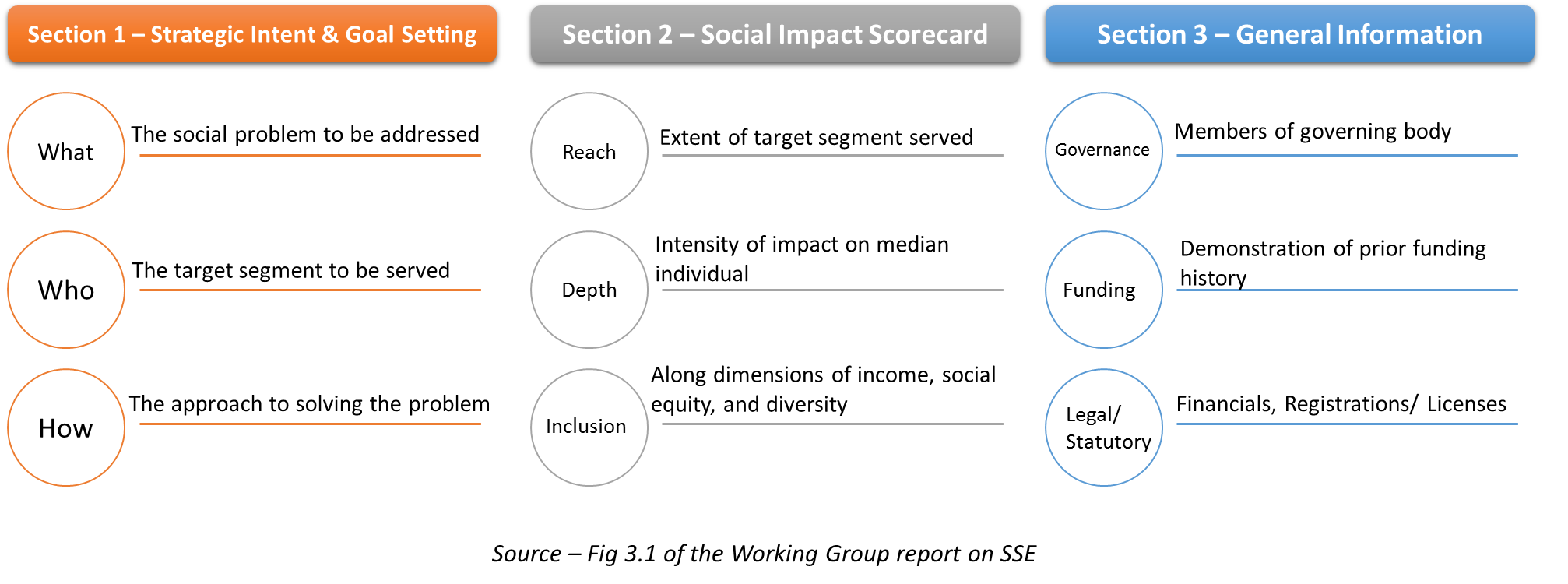

An avenue for Corporate Social Responsibility

The implementation of the SSE will provide a new platform, not just for CSR spending but also a trading platform for trading in a “CSR certificates” between corporates with excess CSR expenditure and those with a deficit in a particular year.

Investment in securities listed on the SSE are likely to qualify as CSR expenditure. However, necessary amendments in the Companies Act, 2013 will also be required to permit the same to qualify as CSR expenditure. The working group has made the necessary policy recommendations in its report.

Trading platform for CSR spending –

India is one of the only countries that has mandated CSR spending. In a particular year, a Company may fail to meet its required spending obligations owing to several reasons. The High Level Committee on CSR had recommended the transfer of unspent CSR funds to a separate account and the said amount should be spent within 3 years from the transfer failing which the funds would be transferred to a fund specified in Schedule VII. The necessary provisions were inserted by the Companies (Amendment) Act, 2019, however, the same is yet to be notified.

The working group has proposed a new model that could solve the issue of unspent CSR funds. It is recommended that CSR Certificates [may be negotiable instruments, somewhat similar to Priority Sector Lending Certificates (PSLCs)], be enabled to be bought and sold on a separate trading platform. This will allow Companies which have unspent CSR funds to transfer these funds to those Companies that have spent excess for CSR in a particular year. This in turn motivates Companies to spend more than the minimum required CSR amount in a particular year.

The certificates are recommended to have a validity of 3-5 years but may be used only once. In order to avoid any profit making on excess CSR spends, it is recommended that these transactions must involve only a flat transaction fee that gets charged to the platform and involves actual transfer of funds.

Further, the working group has recommended that If the platform as described above succeeds in facilitating the trading of CSR certificates, the government might then consider licensing private platforms that provide an auction mechanism for the trading of CSR certificates (similar to the RBI’s licenses for Trade Receivables Discounting Systems or TReDS). However, this would require additional clarifications on whether CSR certificates must have the status of negotiable instruments or not and on how companies are to treat any profits from the sale of such certificates.

Conclusion

The recommendations of the working group has given an expanded role to the SSE. The working group also attempted to address the role of the SSE in terms of COVID-19 by proposing the creation of a separate COVID-19 Aid Fund to activate solutions such as pay-for-success bonds which can be used to provide loan guarantees to NBFC-MFIs that wish to extend debt moratoriums to their customers.

Necessary changes in law have also been recommended, while several other tax incentives have been recommended by the working group.

The SSE framework seems to be interesting in the Indian context. Nevertheless, the implementation of the same is yet to be seen.

Developments taken place since the WG report

Subsequent to the Working Group Report published on 1st June, 2020, several developments have taken place relating to a framework for SSE. A Technical Group on SSE was constituted by SEBI on 21st September, 2020 which submitted its report on 6th May, 2021[1].

The key recommendations of the Technical Group (which built upon the recommendations of the WG) included recommendations relating to eligibility of social enterprise for SSE, on-boarding of NPOs and FPEs, various instruments available for NPOs and FPEs, offer document content for social enterprises, social venture funds, capacity building fund, social auditors, information repositories and disclosures on SSE.

Our article on the recommendations of the Technical Group can be viewed here.

Public comments were invited and received on the report of the Technical Group. Subsequent to this, SEBI in its Board meeting dated 28th September, 2021, discussed the agenda relating ‘Framework for Social Stock Exchange’[2] which was considered and approved and amendments to several regulations were proposed. Further, SEBI in its Board meeting dated 15th February, 2022, discussed the agenda relating to ‘Regulatory Framework for Social Stock Exchanges’[3] which was also considered and approved.

On 15th July, 2022[4], the Central Government in exercise of the powers conferred by sub-clause (iia) of clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 (‘SCR Act’) declared “zero coupon zero principal instruments” as “securities” for the purpose of the SCR Act.

Further, pursuant to these developments, on 25th July, 2022, SEBI has amended the following regulations to lay down a framework for SSE –

- Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015[5];

- Securities and Exchange Board of India (Alternative Investment Funds), 2012[6];

- Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018[7].

Amendments to other Acts (as proposed in the Working Group and Technical Group reports) that fall outside the purview of SEBI, such as the Companies Act, 2013, Income Tax Act, 1961, etc. are yet to be made.

[1] https://www.sebi.gov.in/reports-and-statistics/reports/may-2021/technical-group-report-on-social-stock-exchange_50071.html

[2] https://www.sebi.gov.in/sebi_data/meetingfiles/oct-2021/1633606607609_1.pdf

[3] https://www.sebi.gov.in/sebi_data/meetingfiles/feb-2022/1645691296343_1.pdf

[4] https://www.sebi.gov.in/legal/gazette-notification/jul-2022/declaration-of-zero-coupon-zero-principal-instruments-as-securities-under-the-securities-contracts-regulation-act-1956_60875.html

[5] https://www.sebi.gov.in/legal/regulations/jul-2022/securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-fifth-amendment-regulations-2022_61169.html

[6] https://www.sebi.gov.in/legal/regulations/jul-2022/securities-and-exchange-board-of-india-alternative-investment-funds-third-amendment-regulations-2022_61156.html

[7] https://www.sebi.gov.in/legal/regulations/jul-2022/securities-and-exchange-board-of-india-issue-of-capital-and-disclosure-requirements-third-amendment-regulations-2022_61171.html