Posts

General meetings by Video Conferencing: Recognising the inevitable

/1 Comment/in Companies Act 2013, Corporate Laws - Covid-19, MCA /by Vinod Kothari ConsultantsTeam Vinod Kothari & Company

corplaw@vinodkothari.com | updated as on 14th April, 2020

“If necessity is the mother of invention, then adversity must be the father of re-invention”, says Johnny Flora. It is a pity that an urgency of such colossal scale should have been needed for the lawmakers for companies to realise that in an age where all businesses are working day and night with meetings and conferences on the internet, and even courts are hearing matters using VC, the ability of a company to conduct general meetings by using VC should have come as a concession, or a limited period dispensation. The MCA Circular of 8th April, 2020[1] (‘MCA Circular’), if it is a precursor to a larger rethinking, is certainly welcome.

Timelines for holding board meetings amid the pandemic COVID 19

/19 Comments/in Corporate Laws - Covid-19 /by Vinod Kothari ConsultantsNitu Poddar and Ambika Mehrotra

As one maybe aware that during this period of disruptions caused by COVID 19, several relaxations have ben provided by the Ministry of Corporate Affairs (MCA) vide its Notifications dated 19th March, 2020[1] and March 24, 2020[2] and the Securities and Exchange Board of India (SEBI) vide its Circular dated March 19, 2020[3]. Further the Institute of Company Secretaries of India has also issued its Guidance dated April 4, 2020[4] on the applicability of Secretarial Standards on board and general meetings.

A snapshot of the relaxations granted by the above authorities wrt board meetings are:-

| S. No | MCA for Companies Act, 2013 | SEBI for LODR |

| 1. | Time gap for conducting board meetings relaxed to 180 days from present 120 days – for the first two quarters of FY 2020-2021

i.e BM from 24th March 2020 till 30th September 2020 can be conducted with a larger gap of 180 days

|

Time gap for conducting board and audit committee meeting has been relaxed without any upper limit – for meetings held / proposed to be held between December 1, 2019 and June 30, 2020.

However, it is to be ensured that there are 4 meeting of board and audit committee held during the FY.

|

| 2. | Board meetings can be held through video conferencing or other audio visual means for all matters including the otherwise restricted matters mentioned in Rule 4 of the MBP Rules.

|

The time limit for submitting the annual financial results with the stock exchange has also been extended to June 30 from May 15 (for unaudited results) and May 30 (for audited results) |

| 3. | For the FY 2019-20, a ID meeting per se as per Schedule VI has been relaxed. If the IDs so deem necessary, the views may be shared through telephone / email or any other mode of communication

|

On close perusal of the relaxations granted by MCA and SEBI, it is understood that the relaxations are different for a listed and an unlisted company and the quarter for which the meeting pertains to. The major points to be kept in mind with respect to board meetings are:

- There has to be minimum 4 meetings in the FY;

- The maximum gap between two board meeting cannot be more than 180 days (stricter of the provisions to be applicable – MCA allows maximum time gap of 180 days and SEBI does not prescribes any maximum time gap.

Mostly, listed companies might have had their last board meeting held in the month of Feb, 2020. In that case, the next meeting can be held within 180 days but before 30th June, 2020 since that is the last date of filing financial results for Q4 of FY 2019-20 for both equity and debt[5] listed companies.

It is to be noted that the debt listed companies are required to make half-yearly intimation of financial result u/r 52 of LODR. However, where a debt-listed company is a subsidiary / joint venture or associate of an equity listed company, it needs to prepare and gets its results approved quarterly for the purpose of consolidation.

For unlisted company, the maximum time gap of 180 days is extended till all board meeting to be held before September 30, 2020.

- The relaxation is only with respect to the approval of financial results of Q4 of FY 19-20 which is till June 30, 2020. There is no relaxation w.r.t the approval of financial results for Q1 of FY 20-21. Accordingly, the same will have to be held within 45 days of the end of the quarter; i.e by 14th August, 2020.

In view of the same, we have put together the timelines wrt listed and unlisted companies in the table below:-

| BMs to be held/held during the quarter | MCA Relaxation | SEBI Relaxation | Equity Listed | Debt Listed | Unlisted |

| FY 2019-20 – Q4

|

Maximum time gap between two meetings can be 180 days | Results of Q4 to be approved latest by June 30, 2020

|

BM to be held within June 30, 2020 | BM to be held within June 30, 2020 | Maximum time gap between two meetings can be 180 days |

| FY 2020-21 – Q1

|

Maximum time gap between two meetings can be 180 days | No relaxation currently for approving results of Q1

|

BM to be held within August 14, 2020 | If the financial results are consolidated with an equity listed company – BM to be held within August 14, 2020

If the financial results are not consolidated with an equity listed company – will have to ensure that the gap between two board meeting is not more than 180 days |

|

| FY 2020-21 – Q2

|

Maximum time gap between two meetings can be 180 days | No relaxation currently for approving results of Q2

|

BM to be held within November 14, 2020 |

[1] http://www.mca.gov.in/Ministry/pdf/Rules_19032020.pdf

[2] http://www.mca.gov.in/Ministry/pdf/Circular_25032020.pdf

[3] https://www.sebi.gov.in/legal/circulars/mar-2020/relaxation-from-compliance-with-certain-provisions-of-the-sebi-listing-obligations-and-disclosure-requirements-regulations-2015-due-to-the-covid-19-virus-pandemic_46360.html

[4] https://www.icsi.edu/media/webmodules/Guidance_on_applicability_of_Secretarial_Standards.pdf

[5] https://www.sebi.gov.in/legal/circulars/mar-2020/relaxation-from-compliance-with-certain-provisions-of-the-sebi-listing-obligations-and-disclosure-requirements-regulations-2015-and-certain-sebi-circulars-due-to-the-covid-19-virus-pandemic-cont-_46395.html

FAQs on Companies Fresh Start Scheme, 2020

/6 Comments/in Answering some nagging questions - Covid-19, Companies Act 2013, Corporate Laws - Covid-19, Covid-19, MCA, UPDATES /by Vinod Kothari ConsultantsA quick analysis of the Scheme is available at- https://youtu.be/lXUb4l8srM8

Global Securitisation – Are we heading into a coronavirus credit crisis?

/0 Comments/in Financial Services, Financial services/ NBFCs/Fin-tech - Covid-19, Securitisation /by Vinod Kothari ConsultantsTimothy Lopes, Executive, Vinod Kothari Consultants

The global financial credit crisis of 2007-08 was a result of severe financial distress arising out of high level of sub-prime mortgage lending. Top Credit Rating Agencies (CRA) downgraded majority securitization transactions, slashing ‘AAA’ ratings to ‘Junk’.

Sub-prime borrowers could not repay, lenders were weary of lending further, investors investments in Mortgage Backed Securities (MBS) were stagnant and not reaping any return.

All these factors led to one of the worst financial crisis that affected global economies and not just the US alone. Recovering from such a crisis takes ample amount of time and efforts in the form of policy measures and financial stimulus / bail out packages of the government.

The rapid spread and depth of Coronavirus (COVID-19) outbreak has had severe impact across the globe in a matter of months. Stock markets are witnessing a global sell off. Countries have imposed complete lockdowns countrywide in order to mitigate the impact of this pandemic. Securitisation volumes are likely to witness a drop in light of the pandemic.

Daily, the situation only seems to be getting worse due to the unprecedented outbreak of COVID-19 and its rapid spread. There is absolutely no doubt that the impact on the financial sector and on economies worldwide is / will be a negative one.

As stated by the RBI Governor, in his nationwide address on 27th March, 2020 –

“The outlook is now heavily contingent upon the intensity, spread and duration of the pandemic. There is a rising probability that large parts of the global economy will slip into recession”

The question here is, “Are we headed for another global financial crisis?” We try to analyse this question in this write up, in light of the present scenario.

Consensual restructuring of debt obligations, due to COVID disruption, not to be taken as default, clarifies SEBI

/1 Comment/in Covid-19, Financial Services, Financial services/ NBFCs/Fin-tech - Covid-19, SEBI /by Vinod Kothari ConsultantsVinod Kothari

The global economy, as also that of India, is passing through a systemic disruption due to the COVID crisis. The Reserve Bank of India in its Seventh Bi-monthly Monetary Policy Statement 2019-20 dated March 27, 2020[1] has permitted banks and non-banking financial institutions to provide a moratorium to borrowers for a period of 3 months.

As a result, cashflows of banks and financial institutions from underlying loans will be disrupted, at least for the period of the moratorium. It is a different thing that the disruption may actually prolong, but 3 months as of now is what is explicitly regarded by the RBI has COVID-driven.

COVID- 19 AND THE SHUT DOWN: THE IMPACT OF FORCE MAJEURE

/0 Comments/in Financial Services, Financial services/ NBFCs/Fin-tech - Covid-19 /by Vinod Kothari Consultants-Richa Saraf (richa@vinodkothari.com)

COVID- 19 has been declared as a pandemic by the World Heath Organisation[1], and the Ministry of Health and Family Welfare has issued an advisory on social distancing[2], w.r.t. mass gathering and has put travel restrictions to prevent spreading of COVID-19. On 19th February, 2020, vide an office memorandum O.M. No. 18/4/2020-PPD[3], the Government of India has clarified that the disruption of the supply chains due to spread of coronavirus in China or any other country should be considered as a case of natural calamity and “force majeure clause” may be invoked, wherever considered appropriate, following the due procedure.

In view of the current situation where COVID- 19 has a global impact, and is resulting in a continuous sharp decline in the market, it is important to understand the relevance of force majeure clauses, and the effect thereof.

Meaning Of Force Majeure:

The term has its origin from French, meaning “greater force”. Collins Dictionary[4] defines “force majeure” as “irresistible force or compulsion such as will excuse a party from performing his or her part of a contract”

The term has been defined in Cambridge Dictionary[5] as follows:

“an unexpected event such as a war, crime, or an earthquake which prevents someone from doing something that is written in a legal agreement”.

In Merriam Webster Dictionary[6], the term has been defined as “superior or irresistible force” and “an event or effect that cannot be reasonably anticipated or controlled”.

In light of COVID- 19, a pertinent question that may arise here is whether COVID- 19 shut down will be regarded as a force majeure event for all the agreements, providing a leeway to the parties claiming impossibility of performance? Further, whether such non-compliance of the terms of the agreement will neither be regarded as a “default committed by any party” nor a “breach of contract”? The general principle is that an event will be regarded as a force majeure event on fulfilment of the following conditions:

- An unexpected intervening event occurred: The event should be one which is beyond the control of either of the parties to the agreement, similar to an Act of God;

- The parties to the agreement assumed such an event would not occur: A party’s non-performance will not be excused where the event preventing performance was expected or was a foreseeable risk at the time of the execution of the agreement; and

- The unexpected event made contractual performance impossible or impracticable: For instance, can the issuer of debentures say that there is no default if the issuer is unable to redeem the debentures? Whether an event has made contractual performance impossible or impracticable has to be determined on a case-to-case basis. It is to be analysed whether the problem is so severe so as to deeply affect the party, and thereby creating an impossibility of performance. This has to be, however, relative to the counterparty so as to create an impossibility of performance.

- The parties have taken all such measures to perform the obligations under the agreement or atleast to mitigate the damage: It is required that a party seeking to invoke force majeure clause should follow the requirements set forth the agreement, i.e. to provide notice to the other party as soon as it became aware of the force majeure event, and should concretely demonstrate how the said situation has directly impacted the performance of obligations under the agreement.

To understand this further, let us discuss the precedents laid down in several cases.

Principles in Other Jurisdictions:

Prior to the decision in Taylor vs. Caldwell, (1861-73) All ER Rep 24, the law in England was extremely rigid. A contract had to be performed after its execution, notwithstanding the fact that owing to an unforeseen event, the contract becomes impossible of performance, which was not at the fault of either of the parties to the contract. This rigidity of the common law was loosened somewhat by the decision in Taylor (supra), wherein it was held that if some unforeseen event occurs during the performance of a contract which makes it impossible of performance, in the sense that the fundamental basis of the contract goes, it need not be further performed, as insisting upon such performance would be unjust.

In Gulf Oil Corp. v. FERC 706 F.2d 444 (1983)[7], the U.S. Court of Appeals for the Third Circuit considered litigation stemming from the failure of the oil company to deliver contracted daily quantities of natural gas. The court held that Gulf- as the non- performing party- needed to demonstrate not only that the force majeure event was unforeseeable but also that the availability and delivery of the gas were affected by the occurrence of a force majeure event.

Illustrations: When Is An Event Not Considered As Force Majeure?

Inability to sell at a profit is not the contemplation of the law of a force majeure event excusing performance and a party is not entitled to declare a force majeure because the costs of contract compliance are higher than it would have liked or anticipated. In this regard, the following cases are relevant:

- In the case of Dorn v. Stanhope Steel, Inc., 534 A.2d 798, 586 (Pa. Super. Ct. 1987)[8], it was observed as follows:

“Performance may be impracticable because extreme and unreasonable difficulty, expense, injury, or loss to one of the parties will be involved. A severe shortage of raw materials or of supplies due to war, embargo, local crop failure, unforeseen shutdown of major sources of supply, or the like, which either causes a marked increase in cost or prevents performance altogether may bring the case within the rule stated in this Section. Performance may also be impracticable because it will involve a risk of injury to person or to property, of one of the parties or of others, that is disproportionate to the ends to be attained by performance. However, “impracticability” means more than “impracticality.” A mere change in the degree of difficulty or expense due to such causes as increased wages, prices of raw materials, or costs of construction, unless well beyond the normal range, does not amount to impracticability since it is this sort of risk that a fixed-price contract is intended to cover.”

- In Aquila, Inc. v. C.W. Mining 545 F.3d 1258 (2008)[9], Justice Neil Gorsuch authored an opinion for the U.S. Court of Appeals for the 10th Circuit, which excused a coal mining company’s deficient performance under a coal supply contract with a public utility only to the extent that partial force majeure, namely labor dispute, caused deficiency.

- In OWBR LLC v. Clear Channel Communications, Inc., 266 F. Supp. 2d 1214[10], it was observed- “To excuse a party’s performance under a force majeure clause ad infinitum when an act of terrorism affects the American populace would render contracts meaningless in the present age, where terrorism could conceivably threaten our nation for the foreseeable future”.

- In Transatlantic Financing Corp. v. U.S. 363 F.2d 312[11], the D.C. Circuit Court of Appeals affirmed a finding that there was no commercial impracticability where one party sought to recover damages because its wheat shipment was forced to be re-routed due to the closing of the Suez Canal. The Court of Appeals held that because the contract was not rendered legally impossible and it could be presumed that the shipping party accepted “some degree of abnormal risk,” there was no basis for relief.

Some Landmark Rulings in India:

Deliberating on what is to be considered as a force majeure, in the seminal decision of Satyabrata Ghose v. Mugneeram Bangur & Co., 1954 SCR 310[12], the Hon’ble Apex Court had adverted to Section 56 of the Indian Contract Act. The Supreme Court held that the word “impossible” has not been used in the Section in the sense of physical or literal impossibility. To determine whether a force majeure event has occurred, it is not necessary that the performance of an act should literally become impossible, a mere impracticality of performance, from the point of view of the parties, and considering the object of the agreement, will also be covered. Where an untoward event or unanticipated change of circumstance upsets the very foundation upon which the parties entered their agreement, the same may be considered as “impossibility” to do as agreed.

Subsequently, in Naihati Jute Mills Ltd. v. Hyaliram Jagannath, 1968 (1) SCR 821[13], the Supreme Court also referred to the English law on frustration, and concluded that a contract is not frustrated merely because the circumstances in which it was made are altered. In general, the courts have no power to absolve a party from the performance of its part of the contract merely because its performance has become onerous on account of an unforeseen turn of events. Further, in Energy Watchdog v. CERC (2017) 14 SCC 80[14], it was observed as follows:

“37. It has also been held that applying the doctrine of frustration must always be within narrow limits. In an instructive English judgment namely, Tsakiroglou & Co. Ltd. v. Noblee Thorl GmbH, 1961 (2) All ER 179, despite the closure of the Suez canal, and despite the fact that the customary route for shipping the goods was only through the Suez canal, it was held that the contract of sale of groundnuts in that case was not frustrated, even though it would have to be performed by an alternative mode of performance which was much more expensive, namely, that the ship would now have to go around the Cape of Good Hope, which is three times the distance from Hamburg to Port Sudan. The freight for such journey was also double. Despite this, the House of Lords held that even though the contract had become more onerous to perform, it was not fundamentally altered. Where performance is otherwise possible, it is clear that a mere rise in freight price would not allow one of the parties to say that the contract was discharged by impossibility of performance.

38. This view of the law has been echoed in ‘Chitty on Contracts’, 31st edition. In paragraph 14-151 a rise in cost or expense has been stated not to frustrate a contract. Similarly, in ‘Treitel on Frustration and Force Majeure’, 3rd edition, the learned author has opined, at paragraph 12-034, that the cases provide many illustrations of the principle that a force majeure clause will not normally be construed to apply where the contract provides for an alternative mode of performance. It is clear that a more onerous method of performance by itself would not amount to a frustrating event. The same learned author also states that a mere rise in price rendering the contract more expensive to perform does not constitute frustration. (See paragraph 15-158)”

General Force Majeure Clauses in Agreements and the Impact Thereof:

While some of the agreements do have a force majeure clause, one question that may arise is whether the excuse of force majeure event be taken only if there is a specific clause in the agreement or event otherwise? Typically, in all the agreements, whether the promisor is under the obligation to promptly inform the promisee in case of occurrence of any event or incidence, any force majeure event or act of God such as earthquake, flood, tempest or typhoon, etc or other similar happenings, of which the promisor become aware, which is reasonably expected to adversely affect the promisor, or its ability to perform obligations under the agreement.

The terms of the agreement and the intent has to be understood to determine the effect of force majeure clause. In Phillips P.R. Core, Inc. v. Tradax Petroleum Ltd., 782 F.2d 314, 319 (2d Cir. 1985)[15], it was observed that the basic purpose of force majeure clauses is in general to relieve a party from its contractual duties when its performance has been prevented by a force beyond its control or when the purpose of the contract has been frustrated.

The next question that may arise is whether every force majeure leads to frustration of the contract? For instance, if the agreement was hiring of a car on 24th March, the occurrence of COVID- 19 may just have the impact of altering the timing of performance. In some other cases, the event may only affect one part of the transaction. Therefore, the impact of the force majeure event cannot be generalised and shall vary depending on the nature of transaction.

Usually, occurrence of a force majeure event provides the promisee with a right to terminate the agreement, and take all necessary actions as it may deem fit. For instance, in case of lease, if the lessor considers that there is a risk to the equipment, the lessor may seek for repossession of the leased equipment.

Further, in case the force majeure event frustrates the very intent of the agreement, then the parties are under no obligation to perform the agreement. For instance, if the agreement (or performance thereof) itself becomes unlawful due to any government notification or change in law, which arises after execution of the agreement, then such agreements do not have to be performed at all. In such cases, if the agreement contains a force majeure or similar clause, Section 32 of the Indian Contract Act will be applicable. The said section stipulates that contingent contracts to do or not to do anything if an uncertain future event happens, cannot be enforced by law unless and until that event has happened; If the event becomes impossible, such contracts become void. Even if the agreement does not contain a specific provision to this effect then in such a case doctrine of frustration under Section 56 of the Indian Contract Act shall apply. The section provides that a contract to do an act which, after the contract is made, becomes impossible, or, by reason of some event which the promisor could not prevent, unlawful, becomes void when the act becomes impossible or unlawful.

Impact of COVID- 19 on Loan Transactions:

The Reserve Bank of India has, vide notification No. BP.BC.47/21.04.048/2019-20 dated 27th March, 2020[16], has announced that in respect of all term loans (including agricultural term loans, retail and crop loans), all commercial banks (including regional rural banks, small finance banks and local area banks), co-operative banks, all-India Financial Institutions, and NBFCs (including housing finance companies) are permitted to grant a moratorium of three months on payment of all instalments falling due between 1st March, 2020 and 31st May, 2020. Further, in respect of working capital facilities sanctioned in the form of cash credit/overdraft, the lending institutions have been permitted to defer the recovery of interest applied in respect of all such facilities during the period from 1st March, 2020 upto 31st May, 2020.

Detail discussion on the same has been done in our article “Moratorium on loans due to Covid-19 disruption”, which can be accessed from the link below:

http://vinodkothari.com/2020/03/moratorium-on-loans-due-to-covid-19-disruption/

Further, our article “RBI granted moratorium on term loans: Impact on securitisation and direct assignment transactions” can be accessed from the following link:

http://vinodkothari.com/2020/03/rbi-moratorium-on-term-loans-impact-on-sec-and-da-transactions/

[1] https://www.who.int/emergencies/diseases/novel-coronavirus-2019/events-as-they-happen

[2] https://www.mohfw.gov.in/pdf/SocialDistancingAdvisorybyMOHFW.pdf

[3] https://doe.gov.in/sites/default/files/Force%20Majeure%20Clause%20-FMC.pdf

[4] https://www.collinsdictionary.com/dictionary/english/force-majeure

[5] https://dictionary.cambridge.org/dictionary/english/force-majeure

[6] https://www.merriam-webster.com/dictionary/force%20majeure

[7] https://casetext.com/case/gulf-oil-corp-v-ferc

[8] https://law.justia.com/cases/pennsylvania/supreme-court/1987/368-pa-super-557-0.html

[9] https://www.courtlistener.com/opinion/171400/aquila-inc-v-cw-mining/

[10] https://law.justia.com/cases/federal/district-courts/FSupp2/266/1214/2516547/

[11] https://www.casemine.com/judgement/us/59149a86add7b0493462618f

[12] https://indiankanoon.org/doc/1214064/

[13] https://indiankanoon.org/doc/1144263/

[14] https://indiankanoon.org/doc/29719380/

[15] https://law.justia.com/cases/federal/appellate-courts/F2/782/314/300040/

[16] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11835&Mode=0

Further content related to Covid-19: http://vinodkothari.com/covid-19-incorporated-responses/

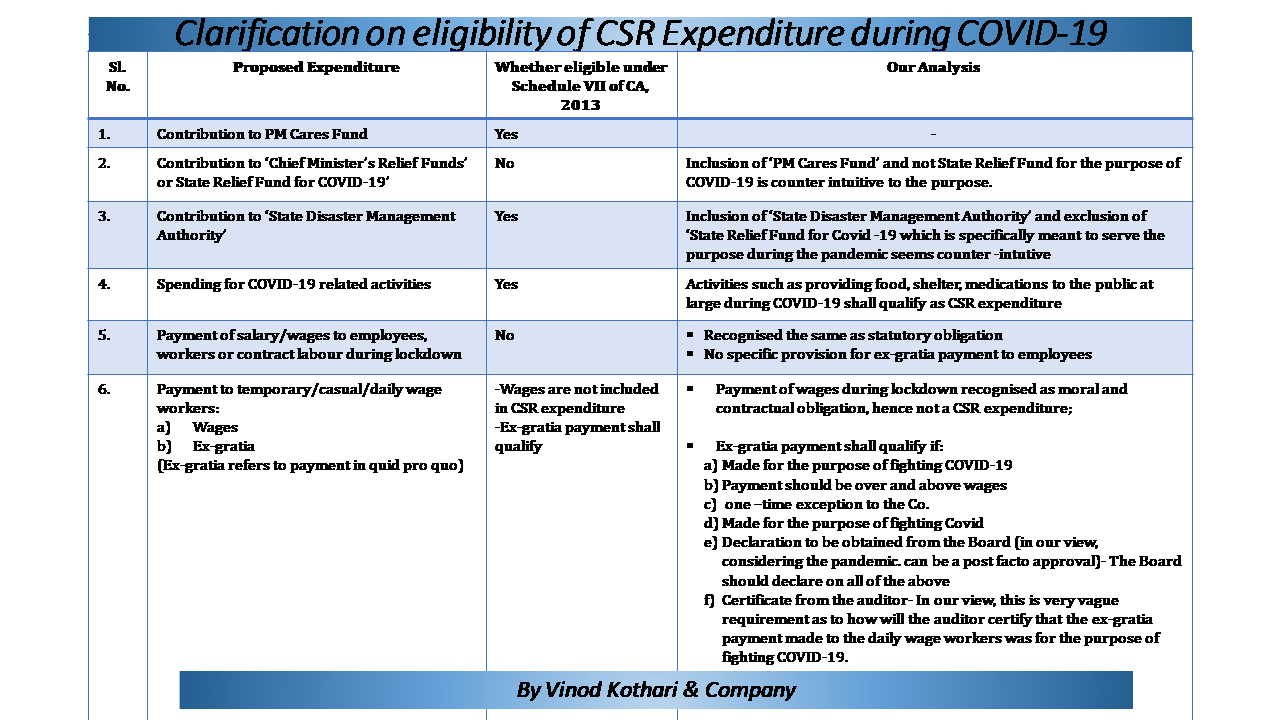

Contribution to PM CARES Fund qualifies as CSR expenditure

/0 Comments/in Companies Act 2013, Corporate Laws, Corporate Laws - Covid-19, Covid-19, UPDATES /by Vinod Kothari ConsultantsBuy-back of shares during Covid-19 Pandemic

/0 Comments/in Companies Act 2013, Corporate Laws, Corporate Laws - Covid-19, Covid-19 /by Vinod Kothari ConsultantsBy CS Vinita Nair, Senior Partner| Vinod Kothari & Company

RBI granted moratorium on term loans: Impact on securitisation and direct assignment transactions

/1 Comment/in Financial Services, Financial services/ NBFCs/Fin-tech - Covid-19, RBI, Securitisation /by Vinod Kothari ConsultantsAbhirup Ghosh

In response to the stress caused due to the pandemic COVID-19, the regulatory authorities around the world have been coming out relaxations and bailout packages. Reserve Bank of India, being the apex financial institution of the country, came out a flurry of measures as a part of its Seventh Bi-Monthly Policy[1][2], to tackle the crisis in hand.

One of the measure, which aims to pass on immediate relief to the borrowers, is extension of moratorium on term loans extended by banks and financial institutions. We have in a separate write-up[3] discussed the impact of this measure, however, in this write-up we have tried to examine its impact on the securitisation and direct assignment transactions.

Securitisation and direct assignment transactions have been happening extensively since the liquidity crisis after the failure of ILFS and DHFL, as it allowed the investors to take exposure on the underlying assets, without having to take any direct exposure on the financial intermediaries (NBFCs and HFCs). However, this measure has opened up various ambiguities in the structured finance industry regarding the fate of the securitisation or direct assignment transactions in light of this measure.

Originators’ right to extend moratorium

The originators, will be expected to extend this moratorium to the borrowers, even for the cases which have been sold the under securitisation. The question is, do they have sufficient right to extend moratorium in the first place? The answer is no. The moment an originator sells off the assets, all its rights over the assets stands relinquished. However, after the sale, it assumes the role of a servicer. Legally, a servicer does not have any right to confer any relaxation of the terms to the borrowers or restructure the facility.

Therefore, if at all the originator/ servicer wishes to extend moratorium to the borrowers, it will have to first seek the consent of the investors or the trustees to the transaction, depending upon the terms of the assignment agreement.

On the other hand, in case of the direct assignment transactions, the originators retain only 10% of the cash flows. The question here is, will the originator, with 10% share, be able to grant moratorium? The answer again is no. With just 10% share in the cash flows, the originator cannot alone grant moratorium, approval of the assignee has to be obtained.

Investors’ rights

As discussed above, extension of moratorium in case of account sold under direct assignment or securitisation transactions, will be possible only with the consent of the investors. Once the approval is placed, what will happen to the transactions, as very clearly there will be a deferral of cash flows for a period of 3 months? Will this lead to a deterioration in the quality of the securitised paper, ultimately leading to a rating downgrade? Will this lead to the accounts being classified as NPAs in the books of the assignee, in case of direct assignment transactions?

Before discussing this question, it is important to understand that the intention behind this measure is to extend relief to the end borrowers from the financial stress due to this on-going pandemic. The relief is not being granted in light of any credit weakness in the accounts. In a securitisation or a direct assignment, the transaction mirrors the quality of the underlying pool. If the credit quality of the loans remain intact, then there is no question of the securitisation or the direct assignment transaction going bad. Similarly, we do not see any reason for rating downgrade as well.

The next question that arises here is: what about the loss of interest due to the deferment of cash flows? The RBI’s notification states that the financial institutions may provide a moratorium of 3 months, which basically means a payment holiday. This, however, does not mean that the interest accrual will also be suspended during this period. As per our understanding, despite the payment suspension, the lenders will still be accruing the interest on the loans during these 3 months – which will be either collected from the borrower towards the end of the transaction or by re-computing the EMIs. If the lenders adopt such practices, then it should also pass on the benefits to the investors, and the expected cash flows of the PTCs or under the direct assignment transactions should also be recomputed and rescheduled so as to compensate the investors for the losses due to deferment of cash flows.

Another question that arises is – can the investors or the trustee in a securitisation transaction, instead of agreeing to a rescheduling of cash flows, use the credit enhancement to recover the dues during this period? Here it is important to note that credit enhancements are utilised usually when there is a shortfall due to credit weakness of the underlying borrower(s). Using credit enhancements in this case, will reduce the extent of support, weaken the structure of the transaction and may lead to rating downgrade. Therefore, this is not advisable.

We were to imagine an extreme situation – can the investors force the originators to buy back the PTCs or the pool from the assignee, in case of a direct assignment transaction? In case of securitisation transactions, there are special guidelines for exercise of clean up calls on PTCs by the originators, therefore, such a situation will have to be examined in light of the applicable provisions of Securitisation Guidelines. For any other cases, including direct assignment transactions, such a situation could lead up to a larger question on whether the original transaction was itself a true sale or not, because, a buy-back of the pool, defies the basic principles of true sale. Hence, this is not advisable.

[1]https://rbidocs.rbi.org.in/rdocs/Content/PDFs/GOVERNORSTATEMENT5DDD70F6A35D4D70B49174897BE39D9F.PDF

[2] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11835&Mode=0

[3] http://vinodkothari.com/2020/03/moratorium-on-loans-due-to-covid-19-disruption/