– Decoding Regulation 24 of Listing Regulations

By Payal Agarwal and Himanshu Dubey | corplaw@vinodkothari.com

Updated as on 27th October, 2021

The seamless flow of information between a holding company and its subsidiaries is imperative for effective governance on the level of a group. Since listed companies in India often function with complex structures having a lot of subsidiaries, it is not feasible for the holding company to deliberate upon all the matters of its subsidiary. Therefore, if not all, at least the significant transaction of the subsidiaries shall be placed on the board of the holding company. Regulation 24 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’) provide for the same. The same though sounds commendable but is also surrounded by various practical difficulties while its implementation. Sometimes the compliance with the aforesaid provision becomes merely perfunctory. If too much is reported to the holding company, the relevance is lost while if too less is reported then the materiality is lost.

Need of fostering corporate governance requirements with respect to subsidiaries

In the normal course of business, it is very common for companies to have subsidiaries. However, the significance of such subsidiaries on the overall performance of the holding company varies. In case of listed companies, since the interest of the public at large is at stake, it becomes imperative that such stakeholders shall not only be informed about the listed company but also its subsidiaries. Ofcourse, the level and depth of information shall vary depending upon the significance of the subsidiaries as well as the significance of transactions being undertaken by such subsidiaries. Considering the aforesaid, Regulation 24 of the Listing Regulations requires the listed holding company to ensure corporate governance in its unlisted subsidiaries in certain ways. One of such ways is provided under sub-regulation (4) of Regulation 24 (Regulation) which says that the management of the unlisted subsidiary shall periodically bring to the notice of the board of directors of the listed entity, a statement of all significant transactions and arrangements entered into by the unlisted subsidiary.

The above-mentioned requirement was earlier applicable only to material unlisted subsidiaries but pursuant to amendment applicable w.e.f. April 1, 2019, the requirement has now been made applicable to all the unlisted subsidiaries of the listed holding company. However, the requirement though seems unequivocal, it comes with certain anomalies and practical difficulties. The author tries to present an analysis of the Regulation so as to answer the anomalies coming in the way of its practical implementation.

Applicability to subsidiaries

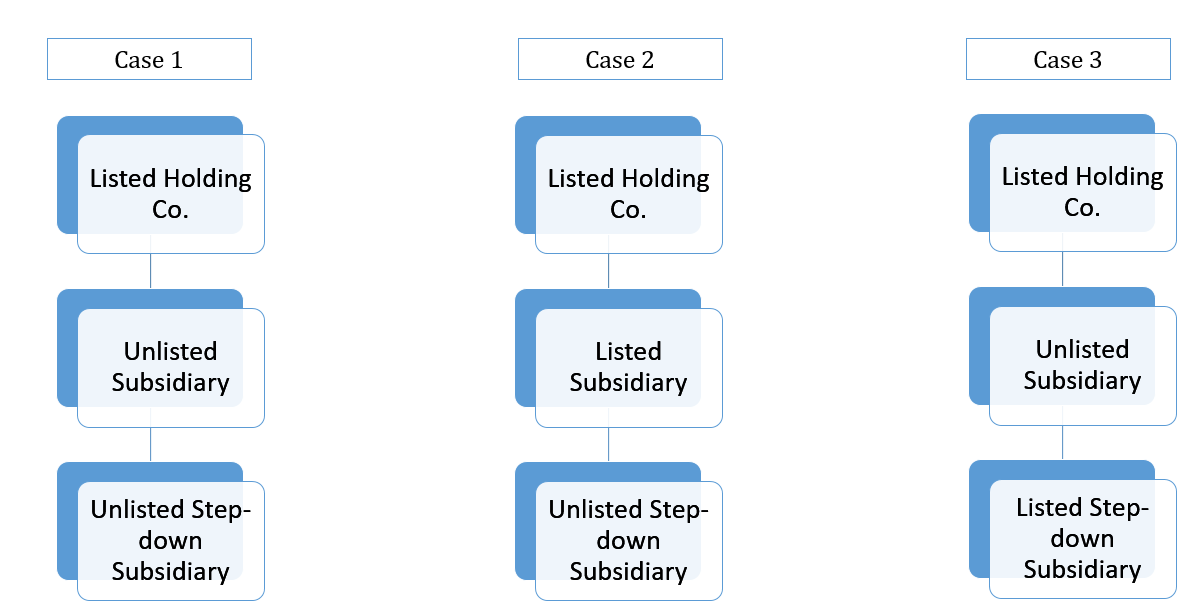

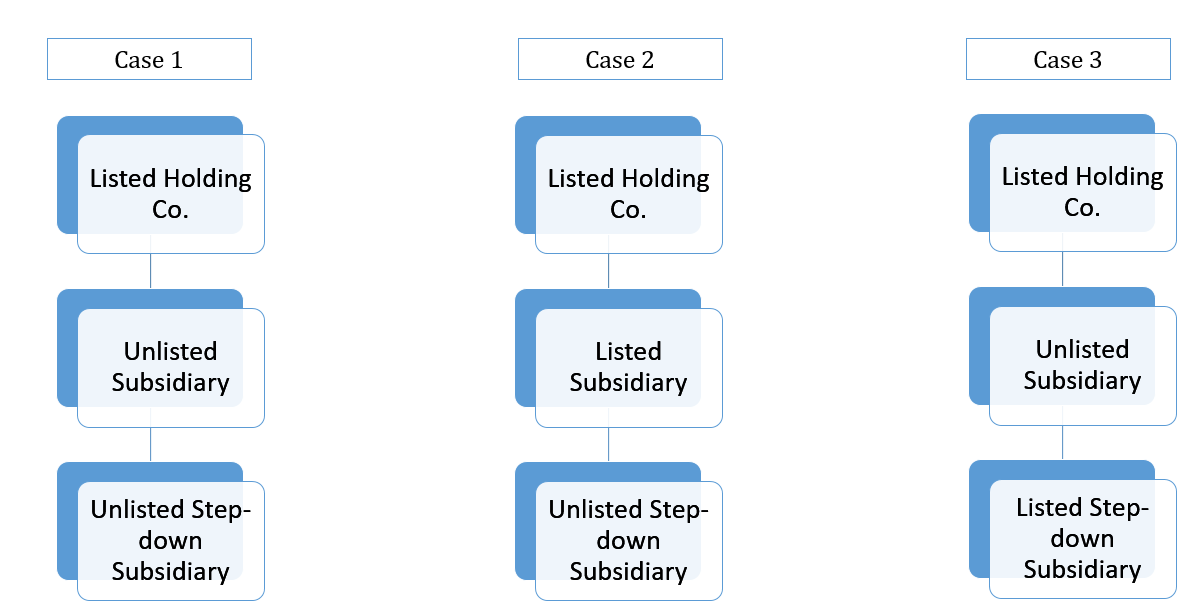

It is very common for a large corporate group to have various subsidiaries which in turn have various subsidiaries under them i.e. step down subsidiaries, from the angle of the ultimate holding company. The possibility of the holding company being listed and the subsidiaries including step down subsidiaries being unlisted is very high. This kind of a structure is very common and can be seen in most of the major corporate groups in India. Since the Regulation talks about subsidiaries, a question might pop up whether it only includes the immediate subsidiaries or the step down subsidiaries as well.

Given the purpose of the Regulation of enhancing corporate governance in the subsidiaries and also the fact that the shareholders interested in the listed company shall be aware of the business being undertaken by the subsidiaries as well. The principle behind this is that on the consolidated level, the performance of the holding company gets affected by the performance of its subsidiaries including its step down subsidiaries. Therefore it is pertinent to have some degree of supervision over them in terms of corporate governance though they are unlisted. Considering this rationale, there seems to be no purpose of excluding the step down subsidiaries from the purview of this Regulation. Hence, the Regulation will be applicable to both immediate and step down unlisted subsidiaries. Let us understand the applicability of the Regulation under different cases enunciated below:

Case 1: since both the immediate subsidiary and the step down subsidiary are unlisted, the Regulation will apply to both of them and significant arrangements or transactions entered into by them will be reported to the ultimate holding company.

Case 2: since the subsidiary itself is a listed company and the Regulation clearly states that it applies to unlisted subsidiary. Therefore, the Regulation will not apply to the subsidiary. Going further, the step down subsidiary is unlisted, but the holding company just one level above is listed. Therefore, the Regulation will apply to unlisted step down subsidiary in relation to its immediate holding company. The ultimate holding company at the top will not be required to note or review the significant transactions or arrangements of the step down subsidiary under the Regulation.

Case 3: since the subsidiary is unlisted, the Regulation will have to be complied in relation to it. However, going forward to the listed step down subsidiary, since it is itself listed with the stock exchange, the Regulation will not apply as it is applicable only to unlisted subsidiaries.

Issues to address

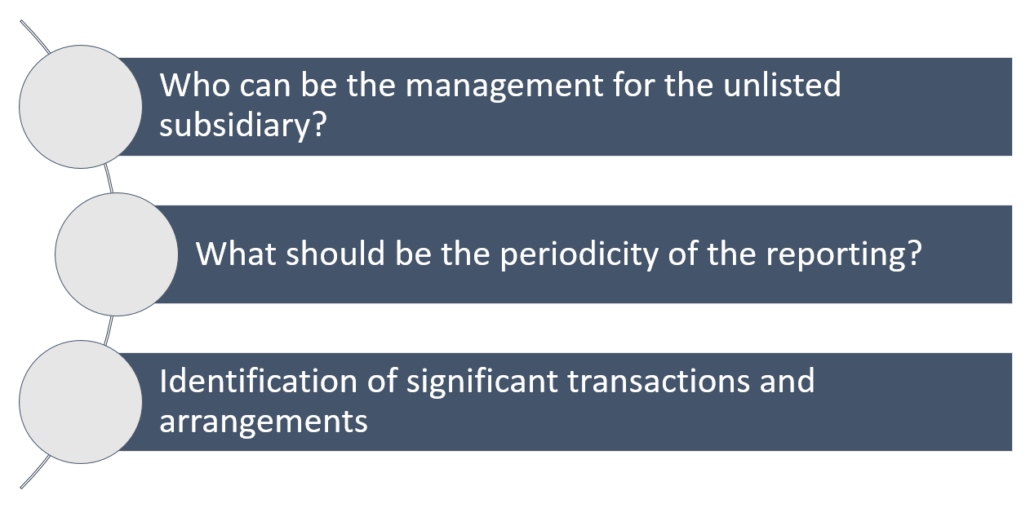

Regulation 24(4) of the Listing Regulations reads as below –

“The management of the unlisted subsidiary shall periodically bring to the notice of the board of directors of the listed entity, a statement of all significant transactions and arrangements entered into by the unlisted subsidiary.”

The following may be require to be identified –

While a plain reading entails the aforesaid questions, a deep analysis of the provisions and on consideration of the practical implications, further issues/questions may arise which have been dealt with at relevant places in this write-up.

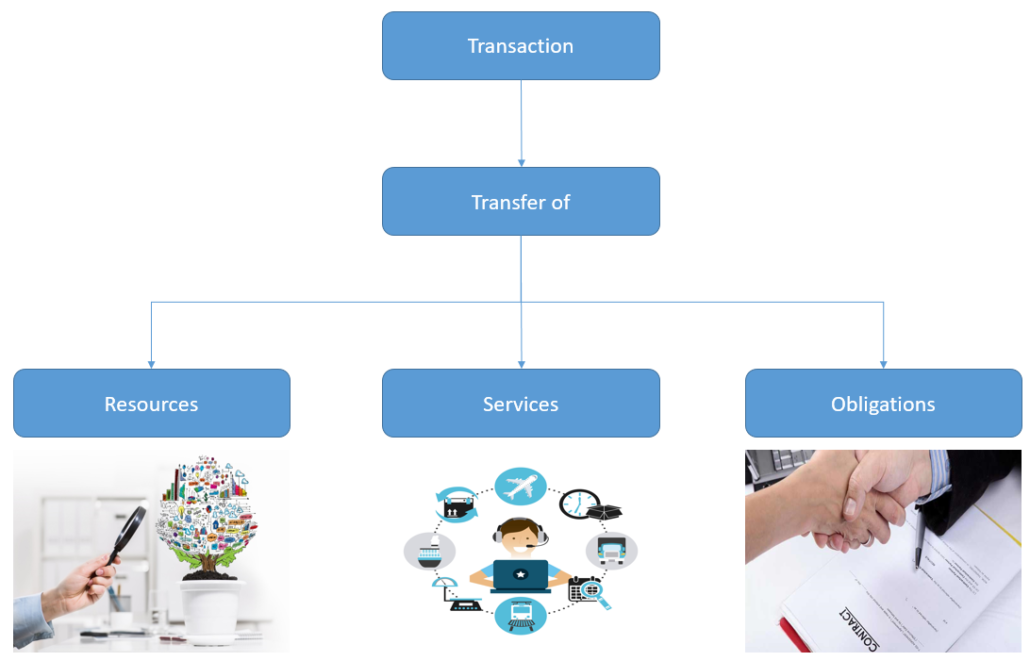

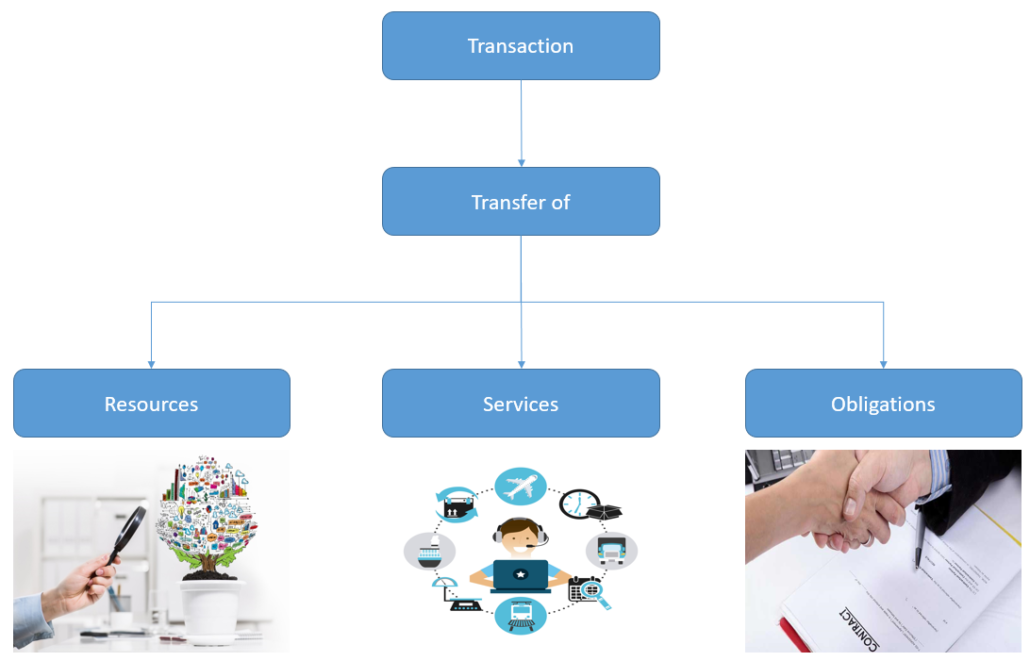

Meaning of Transactions or Arrangements

The first question that arises while complying with the requirements of Regulation 24(4) is the identification as to what constitutes transaction or arrangement. While the term ‘transaction’ is not defined, the meaning of the same may be construed from Regulation 2(1)(zc) of the Listing Regulations and Indian Accounting Standard (Ind-AS) 24, defining the term “related party transaction” (RPT) .

The term has been defined as –

A related party transaction is a transfer of resources, services or obligations between a reporting entity and a related party, regardless of whether a price is charged.

Accordingly, the term transaction may be understood to be “a transfer of resources, services or obligations between two parties”. Similarly, arrangements shall mean a plan or programme for undertaking or understanding to undertake such transactions in future.

Items not considered as transaction/ arrangement

There are various line items in the financial statements which does not arise out of any transaction or arrangement but as a result of accounting entries. Such line items such as deferred tax expenditure, provisions for future liabilities, unrealised gains or losses, etc do not involve any contract, result into any transfer and does not involve two or more parties. Therefore, these fail to contain the basic features of transaction and should not require reporting.

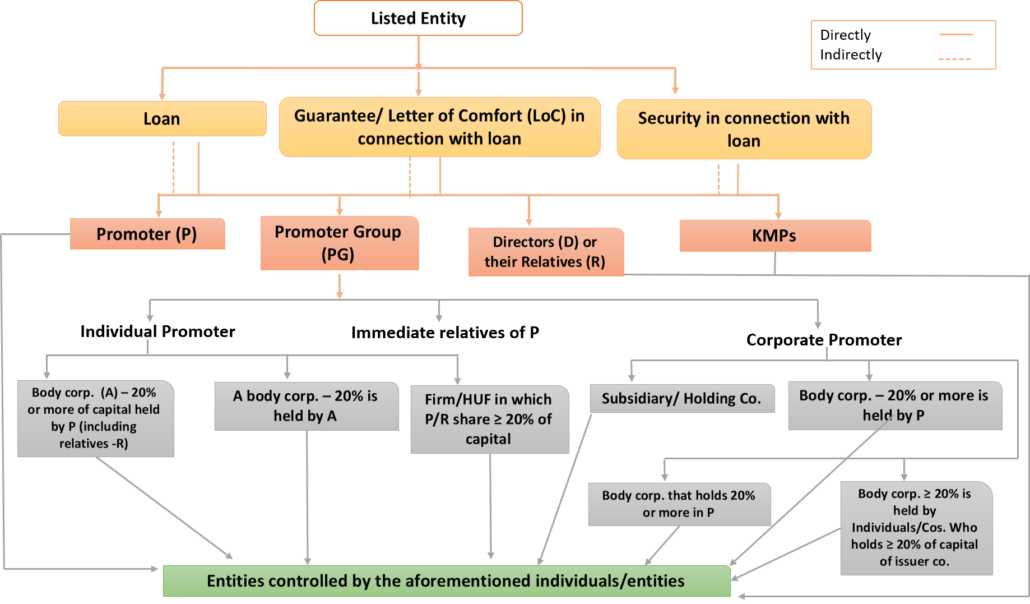

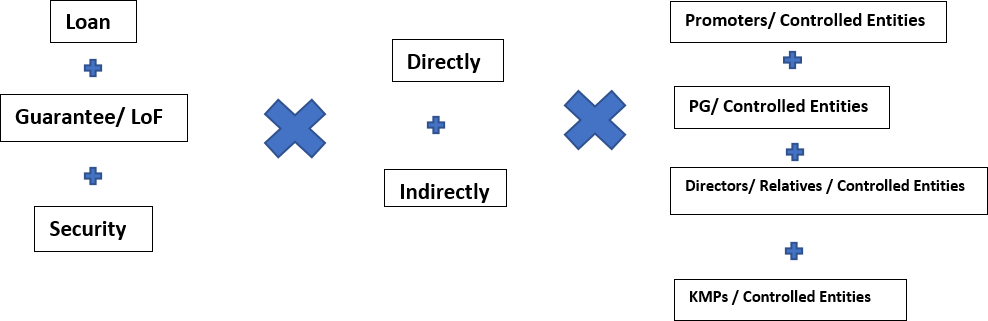

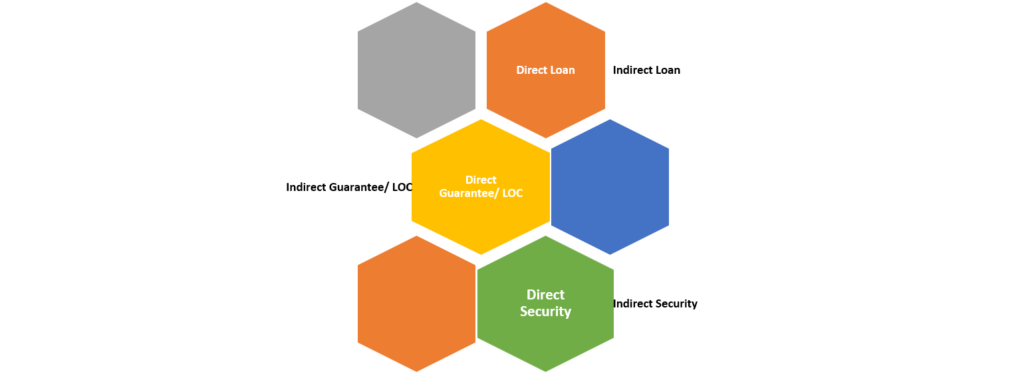

On the other hand, there are certain off-balance sheet items such as guarantee, or derivative transactions. The component of “transfer” may not be present from the early stage but may arise in due course. Moreover, these arise out of contracts and constitute transactions. Therefore, the same should be reported at the values as recognised in the books of accounts.

Assessment of Significance

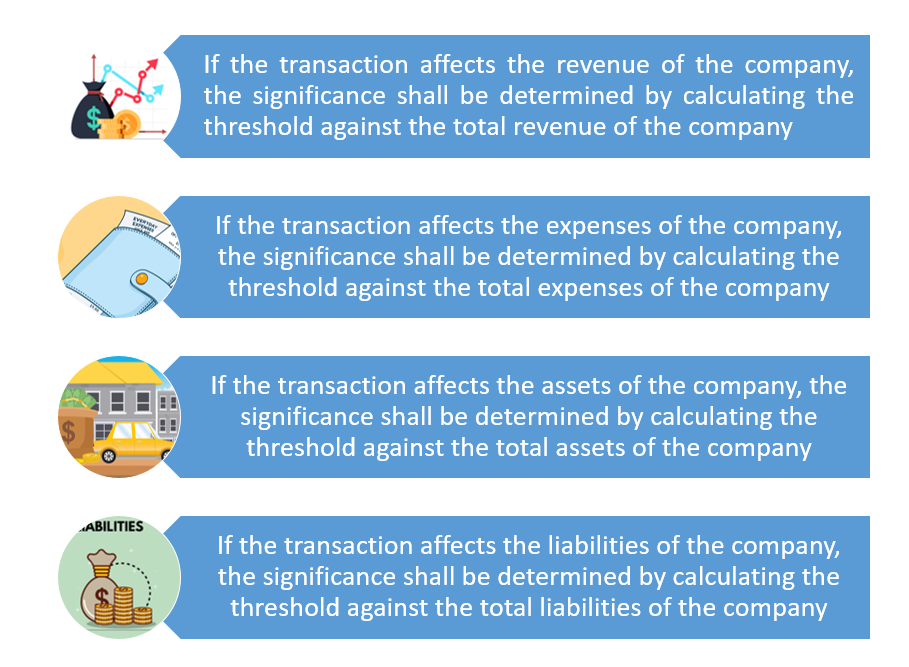

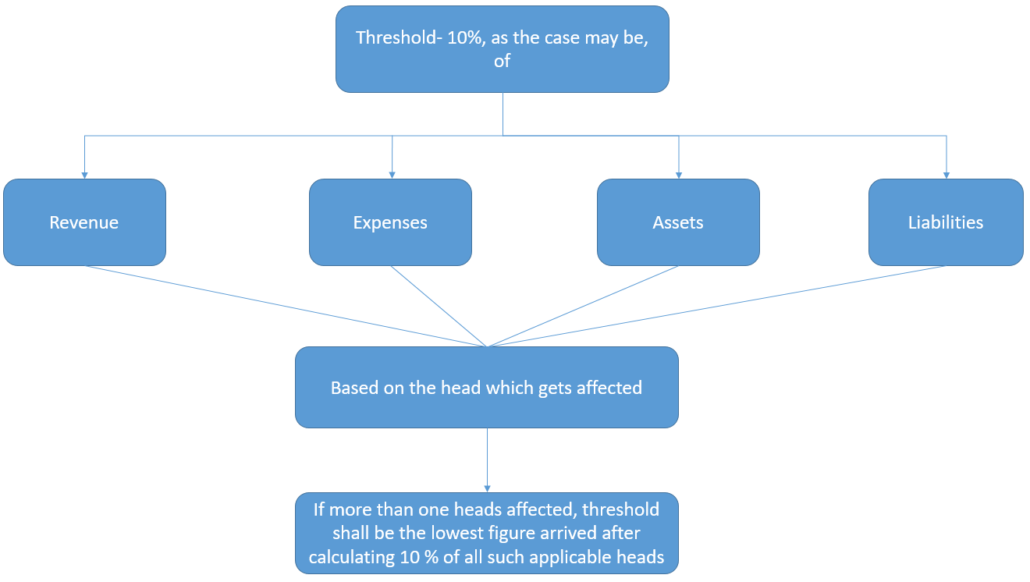

The second step that comes after identifying the transaction/arrangement is the assessment of significance. For the purpose of Regulation 24(4), a transaction or arrangement is significant if it individually exceeds or is likely to exceed ten percent of the total revenues or total expenses or total assets or total liabilities, as the case may be, of the unlisted subsidiary for the immediately preceding accounting year.

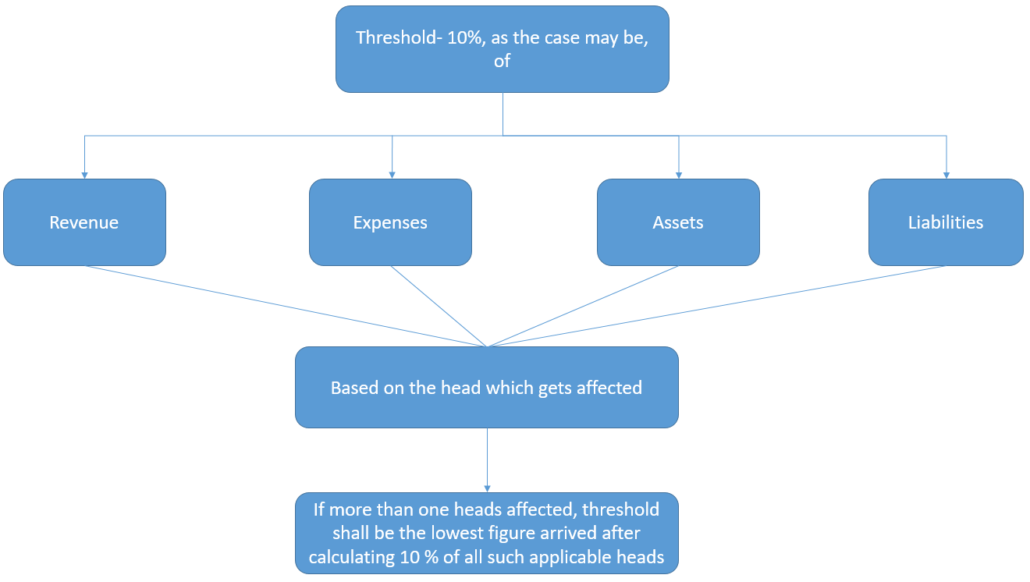

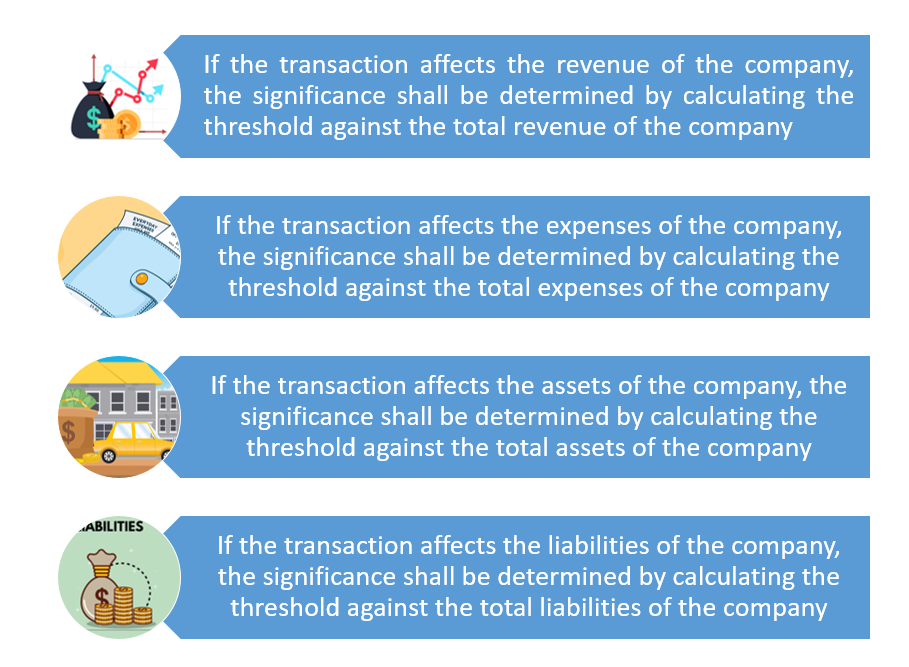

The criteria of significance as provided above requires that the threshold needs to be checked against different parameters “as the case may be”. The parameter to be checked will depend upon the nature of the transaction. Therefore, depending upon the nature of the transaction, the significance shall be assessed against the threshold determined on the basis of figures under relevant head as explained below:

There may be instances where the transaction does not affect any one parameter in isolation but two or more of the parameters i.e. revenue, expenses, assets or liabilities together. In such cases, an issue may arise as to which parameter has to be considered. In such cases, all the parameters applicable to such a transaction shall be considered. 10% threshold of all such applicable parameters shall be determined and the lowest of such threshold shall be applied for assessment of significance of such transaction.

For example, S Ltd, the subsidiary of A Ltd, has entered into a transaction with Z Ltd, involving sale of goods. Such transaction involves revenue and therefore, significance of such transaction has to be assessed as a percentage keeping the total revenue of the preceding accounting period as the base for deriving such percentage. Say for example, the revenue of S Ltd is Rs. 100 crore in the preceding financial year. Therefore 10% of it will be Rs. 10 crores. Hence, if the value of the transaction being entered by S Ltd with Z Ltd exceeds Rs. 10 crores, the same will qualify as a significant transaction for the purpose of the Regulation.

However, consider another example in which S Ltd has entered into an arrangement which impacts both the assets and expenses of the Company (creation of a new capital asset involving a huge outflow of cash). In such a case, both the assets and expenses being involved, the significance of the transaction has to be assessed for each of the bases individually and the one that hits the requirement at the lower end shall be taken for assessment of significance. Say for example, the assets and the expenses of S Ltd in the preceding financial year was Rs. 500 crores and Rs. 150 crores each. In such a case, thresholds shall be calculated based on both the figures and the lower of the two shall be the one that will determine the significance of the transaction. In the instant case, the thresholds are Rs. 50 crores and Rs. 15 crores, therefore the lower of the two i.e. Rs. 15 crores will be the one that will be considered. Hence, if the amount of transactions being undertaken exceeds Rs. 15 crores, it will qualify as a significant transaction.

Basis for assessment – standalone or consolidated?

Having settled with the parameter to be considered for various transactions, another question that may tweak our mind is whether the total revenues or expenses or assets or liabilities, as the case may be , has to be considered on a standalone basis or on a consolidated basis for the subsidiary. Here, one has to consider the fact that the compliance of the provision has to be ascertained by the listed holding company. Any company, which is a subsidiary of the subsidiary company, ultimately becomes the step-down subsidiary of the listed holding company thereby attracting Reg 24(4) of the Listing Regulations for reasons as discussed above and reporting its significant transactions or arrangements to the board of the listed company. In view of the same, an inference may be drawn that the aggregate figures for the preceding financial year shall be taken on a standalone basis, and not on a consolidated basis. This will also help in getting a clear picture and involving only those transactions that are actually significant for the subsidiary.

Determination of significance: Transactions/Arrangements based on contract

It is a very general phenomenon in companies to enter into contracts with different parties. Such contracts often extend to years and give rise to transactions. A common ambiguity that may arise in such cases is on determining the amount of such transaction for the purpose of the Regulation. Let us understand this scenario with some examples.

A Ltd., a subsidiary of B Ltd., enters into a rent agreement with X Ltd. The rent agreement extends to 5 years at a total value of Rs. 30 lakhs i.e. at a monthly rent of Rs. 50,000 per month. Now what shall be considered as the value of transaction for the purpose of the Regulation, Rs. 30 lakhs or Rs. 50 thousand? In our view, the total amount attributable to that particular financial year shall be considered for the purpose of the Regulation. In the instant case, assuming that the contract is effective from October 1, 2021, the amount shall be Rs 3 lakhs (rent during the FY 2020-21). Therefore, for assessing the significance of the transaction, the amount of Rs. 3 lakhs shall be compared against the threshold.

In the same case above, even if there has been no specific tenure of the contract but it rather would have only discussed monthly payment of Rs. 50 thousand as rent, still the amount payable in total throughout that financial year shall be taken and not the monthly rent.

The underlying principle is that the total amount of that transaction attributable to that financial year shall be considered as the amount of transaction for assessing significance under the Regulation.

Reporting: decoding the meaning of management and periodicity

Meaning of management

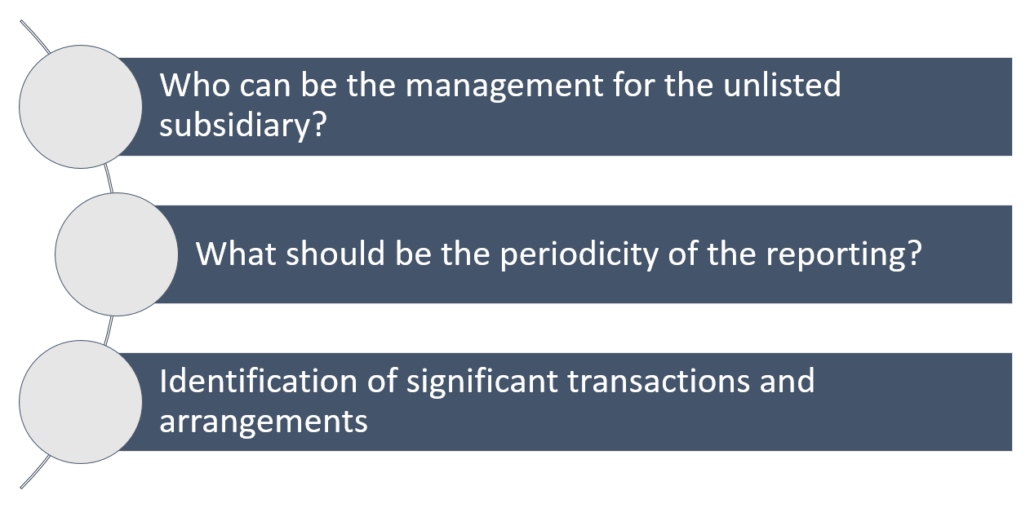

Regulation 24(4) says that “the management of the unlisted subsidiary shall periodically bring to the notice of the board of directors of the listed entity xxxxxxxxx”. This again comes up with two questions: who constitutes management and what shall be the periodicity for bringing significant transactions or arrangements to the notice of the board of the listed holding company.

Going by the general meaning as well as the intent and purpose of this requirement, the board of directors of the subsidiary as well as the KMPs/other senior executives just a level below the Board should be taken to constitute ‘management’.

Periodicity of reporting

Coming to the question of periodicity, the same has not been specified in the Listing Regulations itself, but left to the discretion of the board. However, the intent of the Regulation is to enhance corporate governance in the subsidiaries. Hence the periodicity should be reasonable enough to capture such a purpose.

Here, one may note that Regulation 17(2) of the Listing Regulations requires the board of the listed company to meet at least four times a year. Further, under Regulation 33, financial results are placed before the board quarterly which also includes results of its subsidiaries (since the results have to be submitted on both standalone and consolidated basis). Therefore, in consonance with the same, the list of significant transactions or arrangements of the subsidiaries should also be placed before the board of the listed company, if not more frequently, at least on a quarterly basis.

De-minimis exemptions – can a leeway be created?

Regulation 24(4) of the Listing Regulations, though very significant in terms of enforcing corporate governance requirements and ensuring transparency in respect of the unlisted subsidiaries of the listed company, may sometimes prove extraneous in the spirit of law. There may be cases where the subsidiary as a whole may be too small to have any significance on the accounts of the holding company.

A classic example of the same may be in case of a company, as a listed holding company, having a paid-up capital of Rs. 50 crores or above, having a subsidiary with total asset size of Rs. 1 crore. In this case, the total assets of the subsidiary amounts to mere 2% of the total asset size of the listed company. Here, a transaction involving purchase/ sale of an asset of Rs. 10 lacs will fall within the meaning of a significant transaction for the subsidiary company, however, will have a minimal impact on the listed holding company.

In such cases, going by the letter of the law, such transactions, even though having no significant impact on the listed entity as such, will have to be placed before the board thereby creating an unnecessary compliance burden producing no meaningful results.

A possible leeway that may be created as a make-through to provide certain de minimis exemptions on the basis of certain amounts or percentages. For example, a listed company may approve through its board and audit committee, that any transaction undertaken by a subsidiary, which amounts to not greater than 2% of the turnover or the paid-up capital or the networth of the listed company, will not be required to be reported to the board of the listed company.

However, while putting such de minimis exemptions, utmost care has to be taken to ensure that the self-approved exemptions do not turn out to completely erode the intentions of the law. Further, the requisite approvals have to be obtained and properly documented so as to avoid falling into a legal moss at a later stage.

Conclusion

The requirement under Regulation 24(4) enhances corporate governance standards in subsidiaries which were otherwise unlisted and exempted from such scrutiny. It allows the listed holding company to exercise due diligence in significant transactions entered by subsidiaries. However, in certain cases, the requirement becomes redundant due to absence of any material effect of subsidiary’s transactions on the overall performance of the holding company due to minimal asset size or revenue. Therefore, the idea of exempting subsidiaries below a certain threshold in terms of asset size or revenue of the listed company can be thought upon.The market regulator may also take a step to bring this as an amendment to the law, so as to ensure reduction of extra-compliance burden as recently suggested by FM Nirmala Sitharaman in her speech on the 53rd Foundation day of ICSI.

Read our other article on the subject –

‘Material Subsidiary’ under LODR Regulations: Understanding the metrics of materiality:

https://vinodkothari.com/2021/05/understanding-metrics-of-materiality/