Inherent inconsistencies in quantitative conditions for capital relief

Abhirup Ghosh

– Updated as on 16th June, 2020

On 8th June, 2020, RBI issued the Draft Framework for Securitisation of Standard Assets taking into account existing guidelines, Basel III norms on securitisation by the Basel Committee on Banking Supervision as well the Report of the Committee on the Development of Housing Finance Securitisation Market chaired by Dr. Harsh Vardhan.

With this, one of the main areas of concern happens to be capital relief for securitisation. The concerns arise not just for new exposures but also existing securitisation exposures, as Chapter VI (dealing with Capital Requirements) shall come into immediate effect, even for the existing securitisation exposures.

Earlier, due to the implementation of Ind-AS, concerns arose with respect to capital relief treatment as most of the securitisation exposures did not qualify for derecognition under Ind-AS. However, on March 13, 2020, RBI came out with Guidance on implementation of Ind-AS, which clarified the issue by stating that securitised assets not qualifying for derecognition under Ind AS due to credit enhancement given by the originating NBFC on such assets shall be risk weighted at zero percent. However, the NBFC shall reduce 50 per cent of the amount of credit enhancement given from Tier I capital and the balance from Tier II capital.

Once again, the issue of capital relief arises as the draft guidelines may cause an increase in capital requirements for existing exposures.

Capital requirement under the Draft Framework

The Draft Framework lays down qualitative as well as quantitative criteria for determining capital requirements. As per Para 70, lenders are required to maintain capital against all securitisation exposure amounts, including those arising from the provision of credit risk mitigants to a securitisation transaction, investments in ABS or MBS, retention of a subordinated tranche, and extension of a liquidity facility or credit enhancement. For the purpose of capital computation, repurchased securitisation exposures must be treated as retained securitisation exposures.

The general provisions for measuring exposure amount of off-balance sheet exposures are laid down under para 71-78 of the Draft Framework.

The quantitative conditions are however, laid down in paragraphs 79 (a) and (b). The intention here is to delve into the impact of the quantitative conditions only, keeping aside the qualitative conditions for the time being.

Substantial transfer of credit risk:

The first condition (79(a)) is that significant credit risk associated with the underlying exposures of the securities issued by the SPE has been transferred to third parties. Here, significant credit risk will be treated as having transferred if the following conditions are satisfied:

- If there are at least three tranches, risk-weighted exposure amounts of the mezzanine securitisation positions held by the originator do not exceed 50% of the risk-weighted exposure amounts of all mezzanine securitisation positions existing in this securitisation;

- In cases where there are no mezzanine securitisation positions, the originator does not hold more than 20% of the exposure values of securitisation positions that are first loss positions.

Taking each of the two points at a time.

The first clause contemplates a securitisation structure with at least three tranches – the senior, the mezzanine and the equity. Despite the presence of three tranches, the condition for risk transfer has been pegged with the mezzanine tranche only, however, nothing has been discussed with respect to the thickness of the mezzanine tranche (though the draft Directions has prescribed a minimum thickness for the first loss tranche).

If the language of the draft Directions is retained as is, qualifying for capital relief will become very easy. This can be explained with the help of the following example.

Suppose a securitisation transaction has three tranches, the composition and proportion of which has been provided below:

| Tranche | Rating | Proportion as a part of the total pool | Retention by the Originator | Effective retention of interest by the Originator |

| Senior Tranche – A | AAA | 85% | 0% | 0% |

| Mezzanine Tranche – B | AA+ | 5% | 50% | 2.5% |

| Equity/ First Loss Tranche – C | Unrated | 10% | 100% | 10% |

| 12.5% |

As may be noticed, both the senior and mezzanine are fairly highly rated as the junior most tranche has a considerable amount of thickness and represents a first loss coverage of 10%. Additionally, it also retains 50% of the Mezzanine tranche. Therefore, effectively, the Originator retains 12.5% of the total pool, yet it will qualify for the capital relief, by virtue of holding upto 50% of the Mezzanine tranche, despite retaining 10% in the form of first loss support.

The second clause contemplates a situation where there are only two tranches – that is, the senior tranche and the equity tranche. The clause says that in absence of a mezzanine tranche, the retention of first loss by the Originator should not be more than 20% of the total first loss tranche.

Given the current market conditions, it will be practically impossible to find an investor for the first loss tranche, hence, the entire amount will have to be retained by the Originator. Also, it is very common to provide over-collateral or cash collateral as first loss supports in case of securitisation transactions, even in such cases a third party’s participation in the first loss piece is technically impossible.

Also, there is a clear conflict between this condition and para 16 of the draft Directions, which gives an impression that the first loss tranche has to be retained by the originator itself, in the form of minimum risk retention.

Therefore, in Indian context, if one were to take a holistic view on the conditions, they are two different extremes. While, in the first case, capital relief is achievable, but in the second case, the availing capital relief is practically impossible. This will make the second condition almost redundant.

In order to understand the rationale behind these conditions, please refer to the discussion on EU Guidelines on SRT below.

Impact on the existing transactions

As noted earlier, this part of the draft Directions shall be applicable on the existing transactions as well. Here it is important to note that currently, most of the transaction structures in India either have only one or two tranches of securities, and only a fraction would have a mezzanine tranche. In all such cases, the entire first loss support comes from the Originator. Therefore, almost none of the transactions will qualify for the capital relief.

In the hindsight, the originators have committed a crime which they were not even aware of, and will now have to pay a price.

The moment, the Directions are finalised, the loans will have to be risk-weighted and capital will have to be provided for.

This will have a considerable impact on the regulatory capital, especially for the NBFCs, which are required to maintain a capital of 15%, instead of 9% for banks.

Thickness of the first loss support:

This requirement states that the minimum first loss tranche should be the product of (a) exposure (b) weighted maturity in years and (c) the average slippage ratio over the last one year.

The slippage ratio is a term often used by banks in India to mean the ratio of standard assets slipping to substandard category. So, if, say 2% of the performing loans in the past 1 year have slipped into NPA category, and the weighted average life of the loans in the pool is, say, 2.5 years (say, based on average maturity of loans to be 5 years), the minimum first loss tranche should be [2% * 2.5%] = 5% of the pool value.

In India, currently the thickness of the first loss support depends on the recommendations of the credit rating agencies (CRAs). Typically, the thresholds prescribed by the CRAs are thick enough, and we don’t foresee any challenge to be faced by the financial institutions with respect to compliance with this point.

EU’s Guidelines on Significant Risk Transfer

The guidelines for evidencing significant risk transfer, as provided in the draft Guidelines, are inspired from the EU’s Guidelines on Significant Risk Transfer. The EU Guidelines emphasizes on significant risk transfer for capital relief and states that a high level, the capital relief to the originator, post securitisation, should commensurate the extent of risk transferred by it in the transaction. One such way of examining whether the risk weights assigned to the retained portions commensurate with the risk transferred or not is by comparing it with the risk weights it would have provided to the exposure, had it acquired the same from a third party.

Where the Regulatory Authority is convinced that the risk weights assigned to the retained interests do not commensurate with the extent of risk transferred, it can deny the capital relief to the originator.

Under three circumstances, a transaction is deemed to have achieved SRT and they are:

- Where there is a mezzanine tranche involved in the structure: the originator does not retain more than 50% of the risk weighted exposure amounts of mezzanine securitisation positions, where these are:

- positions to which a risk weight lower than 1,250% applies; and

- more junior than the most senior position in the securitisation and more junior than any position in the securitisation rated Credit Quality Step 1 or 2.

- Where there is no mezzanine tranche involved in the structure: the originator does not hold more than 20% of the exposure values of securitisation positions that are subject to a deduction or 1,250% risk weight and where the originator can demonstrate that the exposure value of such securitisation positions exceeds a reasoned estimate of the expected loss on the securitised exposures by a substantial margin.

- The competent authority may grant permission to an originator to make its own assessment if it is satisfied that the originator can meet certain requirements.

In case, the originator wishes to achieve SRT with the help of 1 & 2, the same has to be notified to the regulator. If as per the regulator, the risk weights assigned by the originator does not commensurate with the risks transferred, the firms will not be able to avail the reduced risk weights.

Underlying assumptions behind the SRT conditions

The underlying assumptions behind the SRT conditions have been elucidated in the EU’s Discussion Paper on Significant Risk Transfer in Securitisation.

- Mezzanine test: This is applicable where the transaction has a mezzanine tranche. Usually the first loss tranches are meant to cover up the expected losses in a pool and the mezzanine tranches are meant for covering up the unexpected losses, irrespective of whether the equity/ first loss tranche is retained by the originator or sold off to a third party. The mezzanine test is indifferent with regard to the retention or transfer to third parties of securitisation positions mainly or exclusively covering the EL — given potential losses on these tranches are already completely anticipated through the CET1 deduction/application of 1250% risk weight if they are retained.

- First loss test: This is applicable where the transaction does not have a mezzanine tranche. In such a situation, the first loss tranche is expected to cover up the entire expected and unexpected losses. This is clear from the language of the EU SRT guidelines which states, that the securitisation exposure in the first loss tranche must be substantially higher than the expected losses on the securitisation exposure. In this case, due to the pari passu allocation of the actual losses to holders of the securitisation positions that are subject to CET1 deduction/1250% risk weight (irrespective of whether these losses relate to the EL or UL), the first loss test may effectively require the originator to transfer also parts of the EL, depending on the specific structure of the transaction and, in particular, on which portion of the UL is actually covered by the positions subject to CET1 deduction/1250% risk weight

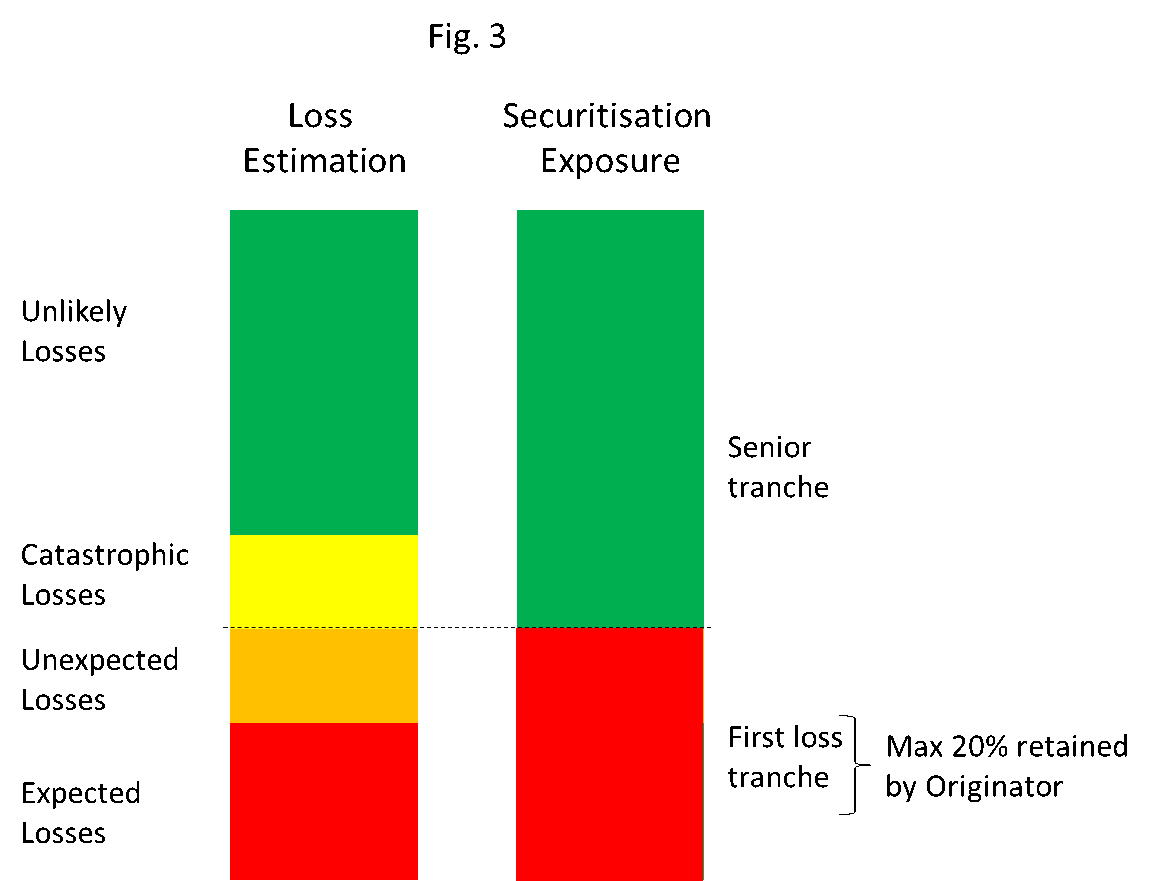

The following graphics will illustrate the conditions better:

In figure 1, the mezzanine tranche is thick enough to cover the entire unexpected losses. If in the present case, 50% of the total unexpected losses are transferred to a third party, then the transaction shall qualify for capital relief.

Unlike in case of figure 1, in figure 2, the mezzanine tranche does not capture the entire unexpected losses. The thickness of the tranche is much less than what it should have been, and the remaining amount of unexpected losses have been included in the first loss tranche itself.

Unlike in case of figure 1, in figure 2, the mezzanine tranche does not capture the entire unexpected losses. The thickness of the tranche is much less than what it should have been, and the remaining amount of unexpected losses have been included in the first loss tranche itself.

In the present case, even if the mezzanine tranche does not commensurate with the unexpected losses, the transaction will still qualify for capital relief, because, if the first loss tranche is retained by the originator, it will have to be either deducted from CET1/ assign risk weights of 1250%

In figure 3, there is no mezzanine tranche. In the present case, the first loss tranche covers the entire expected as well as the unexpected losses. In order to demonstrate a significant risk transfer, the originator can retain a maximum of 20% of the securitisation exposure.

In figure 3, there is no mezzanine tranche. In the present case, the first loss tranche covers the entire expected as well as the unexpected losses. In order to demonstrate a significant risk transfer, the originator can retain a maximum of 20% of the securitisation exposure.

Conclusion

Currently, the draft Directions do not provide any logic behind the conditions it inserted for the purpose of capital relief, neither are they as elaborate as the ones under EU Guidelines. Some explicit clarity in this regard in the final Directions will provide the necessary clarity.

Also, with respect the mezzanine test, in the Indian context, the condition should be coupled with a condition that the first loss tranche, when retained by the originator, must attract 1250% risk weights or be deducted from CET 1. Only then, the desired objective of transferring significant risks of unexpected losses, will be achieved.

Further, as pointed out earlier in the note, there is a clear conflict in the conditions laid down in the para 16 and that in the first loss test in para 79, which must be resolved.