Debenture trustees’ nominees on Corporate Boards: FAQs

– Team Corplaw | corplaw@vinodkothari.com

Table of Contents

| Appointment of Nominee director | Disqualification under CA, 2013 |

| Resignation, removal | Roles, responsibilities and liability |

| Board composition | Applicability and immediate actionable under present amendment |

Brief Introduction

A Nominee Director is a representative of a stakeholder/ stakeholder group (“nominator”), put by the nominator on the board of a company, to ensure that the interests of the nominator, and the general interests of the Company, are safeguarded. While, the enabling provisions for appointment of nominee director is primarily set out in Sec. 161(3) of CA, 2013 authorisation in the Articles of Association of the Company is a prerequisite. Under CA, 2013 the power to appoint director vests with shareholders. The Board has the power to appoint an additional director, alternate director and a nominee director only where specifically authorised under the AOA.

A nominee director is a director, and therefore, except for specific provisions of law, articles or the terms of the agreement under which the right of nomination comes, the position, appointment process, etc., of the nominee director are the same as those of any director. The similarities and the differences are tabulated as under:

| Particulars | Regular director | Nominee director |

|---|---|---|

| A director for all purposes of the law? | Yes | Yes, unless there is a specific carve out, either in the statute, or the AoA |

| Counted for the cap on the number of directors in sec. 149 (1)? | Yes | Yes |

| Counted for the cap on the number of directorships that an individual can take, in terms of sec. 165 of CA, 2013? | Yes | Yes |

| Counted for the cap on the number of listed companies, of which one can be a director, in terms of Reg. 17A of SEBI LODR? | Yes (the count for the number of listed entities on which a person is a director / independent director shall be only those whose equity shares are listed on a stock exchange) | Yes (the count for the number of listed entities on which a person is a director / independent director shall be only those whose equity shares are listed on a stock exchange) |

| Counted for the composition of board in terms of Reg. 17 (1) of SEBI LODR | Yes. | Yes |

| Appointment by general meeting required in terms of sec. 152 (2) of CA, 2013 | Yes | Yes. Refer discussion in FAQ 11 and 17 below |

| Appointment by shareholders within 3 months of appointment, in terms of Reg 17 (1C) of LODR Reg | Yes | Yes |

| Whether required to follow Code of Conduct framed by the Company under SEBI LODR in case of equity listed entity and HVDLE? | Yes | Yes |

| Liable to retire by rotation | Typically yes, except where appointed as non rotational or independent director, in terms of Section 152 (6) of CA, 2013. | Typically yes, except where appointed as non rotational, in terms of 152 (6) of CA, 2013. However, upon re-appointment by the shareholders, the director once again becomes a nominee director. |

| Whether a designated person for the purpose of SEBI (Prohibition of Insider Trading) Regulations, 2015 where applicable? | Yes | Yes |

| Nomination and remuneration, resignation, reappointment | ||

| Nomination by the NRC required before board appointment? | Yes | Yes. However, the NRC shall go based on the nomination(s) given by the nominator. Should the NRC have a negative view about the nominee, the NRC may ask the nominator to provide alternative names. |

| Payment of sitting fees | Yes, except where a wholetimer | Yes |

| Payment of commission payable to directors | Yes, except where a wholetimer | Normally, no. |

| Resignation to | The board | The nominator |

| Re-appointment, or replacement of the nominee | To be done by board, as in case of casual vacancy | To be done by the nominator |

| Powers, duties, liabilities | ||

| Powers, role – whether extends to all the directorial functions? | Yes – board level supervision in case of non-executive director, and executive role in case of executive directors | Non-executive role – supervisory role over all the board matters |

| Are powers limited to the concerns of the stakeholder? | Not applicable | Not really. The nominee director is appointed to specifically safeguard the interest of the nominator, but having been appointed as a director, the ND puts on the shoes of a director, with the conspectus of attention extending to everything that comes to the board meeting |

| Any special powers? | Not applicable | There may be special powers conferred by the articles/ For example, nominees appointed by JV partners or strategic investors may be mandatorily needed for constituting quorum. Further, they may be given rights to block certain resolutions too. However, in absence of any such special powers, the powers are the general powers of directors |

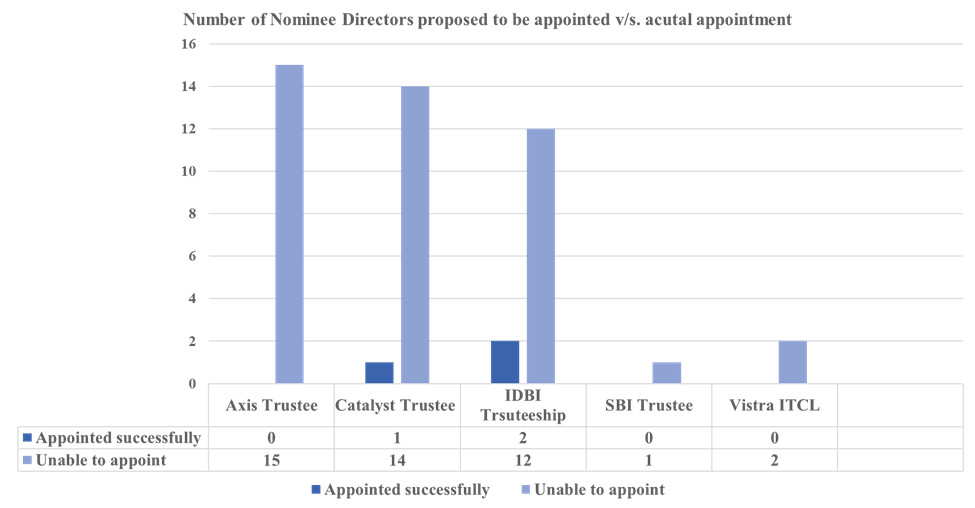

Sec. 71(6) of CA, 2013 read with rule 18(3)(e) of SH Rules requires the Debenture Trustee DT to appoint a nominee director in the event of certain default made by the company. Similar requirement is also set out in Reg. 15(3)(e) of the DT Regulations. However, it was noticed that the DTs were facing difficulty in appointment of nominee directors on the board of issuer companies that defaulted in last 5 years, based on the data provided hereunder:

Source: Agenda papers of SEBI Board Meeting dated December 20, 2022.

The reasons were as under twofold:

- in the absence of any regulatory mandate, the issuer company delays the appointment of a director nominated by the Debenture Trustee on its Board of Directors; and

- eligible candidates express reservations in being appointed as nominee director, citing Section 164(2)(b) of the Companies Act, 2013, as it does not distinguish between executive directors and nominee directors when it comes to disqualification rules.

In order to plug this anomaly, SEBI notified the present amendment in the SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 (NCS Regulations)` vide notification dated February 2, 2023 which, inter alia, mandates the listed issuers of debt securities which have made default (explained below) to appoint the nominee directors nominated by the DTs within 1 month from the date of receipt of nomination from the DT. It further mandates all the issuers which have listed their debt securities as on February 2, 2023 to amend their AOA and DTD, for existing listed debt, to insert the requirement of nominee director on or before September 30, 2023. SEBI has also indicated a timeline for entities that will be listing its debt for the first time hereinafter. On the disqualification aspect, SEBI made a representation to MCA, as discussed in FAQ No. 20.

We have discussed various aspects in relation to appointment of nominee directors, including the actionable pursuant to the present amendment, in these FAQs.

Glossary

| Act | The Companies Act, 2013 |

| Amendment Regulations | SEBI (Issue and Listing of Non-Convertible Securities) (Amendment) Regulations, 2023 |

| SEBI LODR | SEBI (Listing Regulations and Disclosure Requirements) Regulations, 2015 |

| SEBI NCS | SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2023 |

| SH rules | Companies (Share Capital and Debentures) Rules, 2014 |

| DT Regulations | SEBI (Debenture Trustee) Regulations, 1993 |

| DT | Debenture Trustee |

| ID | Independent Director |

| KMP | Key Managerial Persons |

| NED | Non-Executive Director |

| MD | Managing Director |

| DTD | Debenture Trust Deed |

| AOA | Articles of Association |

Appointment of Nominee director

1. What is the trigger point for appointment of a nominee director?

As per Reg. 15(1)(e) of the DT Regulations, a DT is required to appoint a nominee director on the board of issuer in the event of the following:

- two consecutive defaults in payment of interest to the debenture holders; or

- default in creation of security for debentures; or

- default in redemption of debentures.

2. Is there any corresponding requirement under CA, 2013 for appointment of nominee director by DT?

Yes, section 71 of CA, 2013 read with rule 18(3)(e) of SH Rules provides for the appointment of nominee director by DT on the board of the issuer company. The events of default are the same as given under reg. 15(1)(e) of DT Regulations. However, the applicability in this case is for every issuance where a DT is required to be appointed.

3. Whether the nominee director in terms of Section 71 of CA, 2013 is different from the nominee director appointed under section 161(3)?

No, it is the same. Section 161 (3) provides the enabling clause and Section 71 (6) read with Rule 18 (3) (e) provides the requirement when a nominee director is required to be mandatorily appointed by the DT.

4. Is it mandatory for the DT to appoint a nominee director?

Reg. 15(1) of DT Regulations as well as Rule 18 (3) of SH Rules provides that it is the duty of the DT to appoint a nominee director once the requirement gets triggered. The nature of appointment is dependent on breach of the covenant by the issuer with respect to timely payment of interest and principal and creation of security, in case of secured debentures. Therefore, the reason for appointment is more in the nature of a remedial action as a greater degree of oversight is required to serve the interest of the debenture holders, unlike in case of directors nominated by a strategic shareholder, where the nomination is to exercise its protective right.

5. What is the timeline to appoint a nominee director?

The issuer will be required to appoint such nominee director within 1 month from the date of receiving such nomination from DT in terms of Regulation 23 (6) of NCS Regulations

In cases of existing default, the appointment is required to be made within 1 month of the date of receipt of nomination or February 2, 2023 (being the date on which the provision became effective), whichever is later.

6. What will be the tenure of the nominee director? Will the appointment be valid only during the continuation of default?

In our view, the appointment is done on default on account of failure to service interest or redemption amount, failure to create security, failure of any financial or other covenants or asset cover, or in circumstances as may be mentioned in the terms of issue/ DTD. However, once the appointment is triggered, the nominee director should remain on board till the debentures in question have been repaid. While the triggering condition for appointment was remedial in nature, once triggered, the provision becomes preventive, i.e., for preventing any future breach. However, once the debentures in question have been redeemed, there is no reason for the nominee director to remain in office. Hence, the terms of appointment may say that the nominee director will cease to hold office once the debentures are repaid.

7. Should the appointing resolution say that the appointment expires on redemption of debentures?

Yes, the same should be specified in order to provide clarity on the tenure.

8. A company may have various series of debentures issuances outstanding at a time. If default occurs in one, quite likely there will be a default with some other issuances too. Will there be one ND or as many NDs as there are defaulted series?

The requirement is to have a representative to safeguard the interests of the debenture holders. The interest of all debenture holders would be general in nature and not specific to one series. Therefore, one nominee director representing all debenture holders should suffice.

9. Assuming there are multiple DTs, whose debenture series are defaulted, how does the answer above change?

In terms of the DT Regulations and provisions of CA, 2013 every DT is bound by the requirement and is required to appoint a nominee director in case of the requirement getting triggered. However, there is no restriction on having the same nominee director represent more than one DT. Therefore, the same ND may be appointed with the mutual consent of all the DTs.

10. What will be the process for appointment of nominee director?

Firstly, the AOA should provide for the appointment of a nominee director.

In case of any triggering events as stated under FAQ no. 1, the DT will be required to provide a notice of nomination to the company. In case of receipt of such nomination, the Board will be required to appoint the said person within 1 month.

The process of appointment will be same like any other director, as provided hereunder:

- Obtaining the consent and requisite disclosure from the Director;

- Recommendation of appointment by the Nomination and Remuneration Committee, if any;

- Appointment as an Additional Director by the Board;

- Approval of shareholders for appointment as a Director.

11. Whether such an appointment will require shareholders’ approval?

Yes. The power to appoint a director is with the shareholders in terms of Section 152 (2). The DT will have the right to nominate the candidate required to be inducted on the Board.

The Company will have to ensure appointment on its Board within the period of 1 month from the receipt of nomination. However, shareholders approval can be obtained as per the applicable law.

Accordingly, in case of an equity listed entity or a high value debt listed entity[1], approval of shareholders will be required to be obtained within 3 months from the date of appointment in terms of Reg. 17 (1C) of SEBI LODR. In case of other debt listed entities, the approval of shareholders will be required to be obtained on or before the Annual General Meeting.

12. What will be the consequence if the shareholders reject the appointment?

The power of DT to nominate a person will remain as the nomination is pursuant to a provision of law. The DT may consider nominating a suitable candidate who will be able to discharge his/her duties as a director on the Board. The process discussed in FAQ no. 10 will have to be followed again.

13. Whether the nominee director will be entitled to sitting fees from the company for attending the board meetings?

Yes, being a member of the Board, the nominee director will be entitled to receive sitting fees for attending the meetings of the Board or other meetings in terms of Section 197(5) of CA, 2013.

Resignation, removal

14. Can the company remove the nominee director?

In terms of Section 169 (1) of CA, 2013 the shareholders can remove a director by passing of an ordinary resolution after giving him/her a reasonable opportunity of being heard.

15. What will be the procedure in case the nominee director intends to resign?

Theresignation letter of the nominee director should be first made to and approved by the Debenture Trustee and thereafter, served on the issuer for informing the Registrar and stock exchange about the change in the details.

Board composition

16. Will the nominee director be considered while determining optimum balance of the board under other applicable law?

Yes, as the nominee director is a member of the board for every purpose, it will also be considered while determining optimum balance of the board.

17. Whether the office of nominee director will be liable to determination by retirement of directors by rotation under section 152(6)?

Presently, there is no express carve out under Section 152 (6) for excluding nominee directors while computing the ‘total number of directors’. It only provides for excluding independent directors. The concept of retirement by rotation is to enable shareholders to review the office of the director and determine its continuity atleast once in three years.

In terms of Section 152 (6) of CA,2013 a Company can have a maximum 1/3rd of total number of directors (excluding IDs) whose office will not be liable to determination by retirement by rotation. In case the limit is available to include the nominee director within the said limit of 1/3rd, the Company can have the office of such nominee director not liable to retire by rotation. Otherwise, it will be regarded as non-compliance of Section 152 (6) thereby attracting penal provision under section 172 of CA, 2013

18. Whether the nominee director will be inducted as a member of committees of the Board?

The statutory requirement is to induct the nominee director on the Board. Whether the person is required to be a member of any of the Committees of the Board, will be determined by the Board. The nominee director, pursuant to being on the Board, will receive the minutes of meeting of each of the committees of the Board.

19. Whether the nominee director can appoint an alternate director?

Yes. All the rights, as available to any other director, will be available to the nominee director as well.

Disqualification under CA, 2013

20. Whether the nominee director will attract disqualification under section 164(2)(b)?

Section 164(2) states that:

“No person who is or has been a director of a company which—

- xxx

- has failed to repay the deposits accepted by it or pay interest thereon or to redeem any debentures on the due date or pay interest due thereon or pay any dividend declared and such failure to pay or redeem continues for one year or more,

shall be eligible to be re-appointed as a director of that company or appointed in other company for a period of five years from the date on which the said company fails to do so.

Provided that where a person is appointed as a director of a company which is in default of clause (a) or clause (b), he shall not incur the disqualification for a period of six months from the date of his appointment”

We understand that the DT will appoint a nominee director only after the occurrence of a trigger event. Accordingly, in terms of aforementioned provision, upon elapse of a period of one year the nominee director will attract the disqualification and will not be eligible to be re-appointed in the said defaulting company and be appointed in any other company. In terms of Section 167 (1) of CA, 2013 his office as director will vacate in all other companies.

As per the Agenda of SEBI Board Meeting dated December 20, 2022, SEBI had made a proposal to MCA to insert the following proviso in section 164(2)(b):

“Provided further that, the disqualifications as referred to in clause (b) of the sub-section (2) shall not be applicable to the nominee director appointed pursuant to the nomination by a Debenture Trustee registered with SEBI”

The Report of the Company Law Committee, March 2022 (refer Para 16.17) considered the above proposal. The corresponding amendment is pending as on date.

Roles, responsibilities and liability

21. What are the responsibilities of the nominee director?

The role of the nominee director will not be limited to protection of interest of the debenture holders. The nominee director, being part of the Board, will have the same responsibilities as that of any other director on the Board.

22. Will the nominee director be considered as ‘interested director’ for the matters dealing with debentures? Whether such director can vote on the resolution affecting debenture holders?

The whole purpose of inducting a nominee director is to protect the interests of the debenture holders. If the nominee director is treated as ‘interested director’ for the matters affecting the rights of the debenture holders, then the whole purpose for appointing a nominee director would get defeated. Therefore, such director will not be considered as an interested director and can vote on the resolution affecting debenture holders.

Our article on this topic can be accessed here.

23. Whether the nominee director will be held liable for the acts of the company?

Section 149(12) provides immunity to the ID and NEDs, who are not promoters or KMP. They are held liable only in respect of such acts of omission or commission by a company which had occurred with their knowledge, attributable through Board processes, and with their consent or connivance or where he had not acted diligently.

A nominee director appointed as a non-executive director would also be benefited with the said immunity.

Applicability and immediate actionable under present amendment

24. The present amendment is applicable to which entities?

The amendment is applicable to all listed entities having its debt securities listed or proposed to be listed.

25. What is the effective date of the amendment?

These amendments are effective from their date of publication in the Official Gazette, i.e. February 02, 2023.

26. What are the immediate actionables arising out of the amendment?

Pursuant to the amendment, the issuers whose debt securities are listed as on February 02, 2023, are required to amend their Debenture Trust Deed and the Articles of Association (‘AOA’) on or before September 30, 2023 to incorporate the clause enabling the appointment of director nominated by the DT.

Further, in case any issuer has already received a nomination letter from the DT, the appointment is required to be made within the timeline provided in FAQ No. 10.

For fresh issuances made by an existing debt listed issuer, the DTD should cover the enabling clause for appointment of director nominated by DT.

27. What is the timeline for a first time issuer of debt securities?

Pursuant to SEBI Circular dated February 9, 2023 entities issuing and listing debt security for the first time will have a time till six months from the date of listing the debt. Such issuer will have to furnish an undertaking at the time of seeking in-principle approval from the stock exchange to this effect and stock exchanges will be monitoring the compliance with the same.

28. What should the AOA provide?

The AOA should firstly provide an enabling provision permitting appointment of a nominee director by a DT. In case there is an existing clause in accordance with Section 161 of CA, 2013 in that case the permissibility for a DT to appoint pursuant to the said clause should be ascertained.

In our view, in addition to specific enabling clause, guidance on other aspects of office of nominee directors should also be covered, as indicated hereunder:

- Manner of appointment/ removal

- Tenure of nominee director;

- Role and responsibilities;

- Whether office liable to retire by rotation;

- Power to attend general meetings;

- Power to appoint alternate directors;

- Coverage under D&O;

- Remuneration;

29. What will be the consequence of not amending the DTD and AOA before September 30, 2023?

As the NCS Regulations do not provide for a penal provision, the issuer will attract penalty under section 15HB of SEBI Act, 1992. (Penalty for contravention where no separate penalty has been provided) i.e., not less than Rs. 1 lakh which may extend to Rs. 1 crore.

[1] A listed entity which has listed its NCDs and has an outstanding value of listed NCDs of ₹ 500 Crore and above.

Our articles on nominee directors can be accessed at:

- Role of Nominee Directors : Balance is the Key

- Whether a nominee director is accustomed to act as per instructions coming from his nominator- a perplexity!

- When can a nominee director be interested, by Nitu Poddar

- Removal of Directors: A guide to forced exit of directors

- Board Observer: A silent observer or a game changer?

Will it be necessary to alter AOA by a Debt Listed Company latest by 30 th September,2023,even if it is not a defaulter in payment of Principal and interest on debentures?

Are the requirements of the appointment of nominee director by the Debenture Trustees applicable to a Debt Listed Company whose net worth is less than Rs.500 crores?

Very informative and we’ll written article