Tailoring still to fit: CSR Law continues to evolve with contemporary needs

/0 Comments/in Uncategorized /by Vinod Kothari ConsultantsVinod Kothari and Smriti Wadhera

As the CSR framework moves from ‘comply or explain’ principle to the rule of ‘comply or pay penalty’, we see how the CSR provisions in India have uniquely evolved over the years. On one side while there is penalty, on the other side, there is motivation – prominently in the form of an extended list of activities which can qualify for CSR. The article covering CSR in detail was published in the November 2020 edition of Chartered Secretary of the Institute of Company Secretaries of India.

Our other related material on CSR can be accessed through below link:

Presentation on Decoding Due Date for AGM Extension

/0 Comments/in AGM, Companies Act 2013, Corporate Laws, Uncategorized /by Vinod Kothari Consultants

Our related Content:

Enforcement Status of Companies (Amendment) Act, 2020

/0 Comments/in Amendments to the Companies Act 2013, Corporate Laws, Uncategorized /by Vinod Kothari Consultants

Important Links:

- The Companies (Amendment) Act, 2020 : https://www.mca.gov.in/Ministry/pdf/AmendmentAct_29092020.pdf

- MCA notification dated December 21, 2020: https://www.mca.gov.in/Ministry/pdf/AmendmentAct_29092020.pdf

- MCA notification dated January 22, 2021: http://egazette.nic.in/WriteReadData/2021/224637.pdf

- MCA notification dated March 18, 2021: http://www.mca.gov.in/Ministry/pdf/CommencementNotification_18032021.pdf

Our other write ups covering Companies (Amendment) Act, 2020:

- Highlights of Companies (Amendment) Bill, 2020: http://vinodkothari.com/2020/03/highlights-of-the-companies-amendment-bill-2020/

- Companies (Amendment) Act, 2020 PowerPoint presentation: http://vinodkothari.com/2020/09/companies-amendment-act-2020/

SEBI proposes enhanced disclosures for meetings with analyst, investors, etc.

/0 Comments/in Corporate Laws, SEBI, Uncategorized /by Vinod Kothari Consultants– To curb information asymmetry and risk of divulging UPSI

Shaifali Sharma | Vinod Kothari and Company

Introduction

Analyst and investor meets are one of the many ways of communicating and sharing information. Conducting periodical meetings, conferences, one-to-one meetings or con-calls with analysts or investors who wish to know more about the company, its historic performance, financial details, future prospects, etc. is a common practice for the listed entities. The most common amongst these meetings are the earning calls which is called immediately following the release of the quarterly or annual financial results. Whereas, one-to-one meets or conference calls with selective investors/ analysts are also conducted in the normal course of business of the companies.

With the intent to rule out any information asymmetry in the market, the schedule, presentations or any information material used during such analyst or institutional investor meetings are required to be disclosed by companies to stock exchange(s) and also hosted on the company’s website as required under the SEBI (Listing Obligations and Disclosure Requirements), Regulations, 2015 (‘Listing Regulations’).

Moreover, the SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’) requires fair disclosure of material events and therefore, provides principles for fair disclosure which includes

- publication of transcripts or recordings of analyst/ investor meetings on company’s website; and

- ensuring information shared with analysts and research personnel is not an unpublished price sensitive information (‘UPSI’).

The governing Regulations are discussed in this article.

However, looking at the practice of most of the listed companies, it has been observed that such disclosures are simply box ticking exercise where disclosure of mere PowerPoint slides of presentation are given instead of what is discussed in the meeting to give an example.

The concerns relating to disclosures in respect of analyst meets/ institutional investors meet/ conference calls were discussed by Primary Market Advisory Committee (‘PMAC’) constituted by SEBI in July, 2020 which then formulated a Sub-Group to recommend specific disclosure requirements to strengthen analyst/ investor meets. In this regard, a ‘Report on disclosures pertaining to analyst meets, investor meets and conference calls[1]’ (‘Report’) has been issued on November 20, 2020 seeking public comments on or before December 21, 2020. The Sub-Group has recommended to make the disclosure requirements optional for the initial one year and mandatory thereafter for all the listed companies. This article attempts to analyse the recommendations and their probable impact on the current regime under the Listing Regulations and PIT Regulations.

Further, on perusing the Report it has been observed that it explicitly distinguishes between scheduled meeting with the analysts and investors and unscheduled one-to-one calls with them. This article discusses the intention behind such distinction recognised by SEBI itself.

Current Regulatory Framework in India governing Analyst/ Institutional Meets

Listing Regulations

Regulation 46(2)(o) of the Listing Regulations requires the listed entity to disseminate the schedule of analyst or institutional investor meet and presentations made by the listed entity to analysts or institutional investors simultaneously with submitting the same to the stock exchange. The aforesaid Regulation is reproduced below:

“46(2) The listed entity shall disseminate the following information under a separate section on its website:

xxx

(o) schedule of analyst or institutional investor meet and presentations made by the listed entity to analysts or institutional investors simultaneously with submission to stock exchange;”

Further, Part A(A)(15) of Schedule III of the Listing Regulations read with SEBI circular[2] dated September 09, 2015, requires the listed entity to disclose the schedule of analyst or institutional investor meet and presentations on financial results made to such analysts or institutional investors without any application of the guidelines for materiality as specified u/r 30(4) of the Listing Regulations.

Furthermore, Part C(8)(e) of Schedule V of the Listing Regulations requires the listed entity to disclose the presentations made to the institutional investors or analysts in the section on the Corporate Governance of the Annual Report under the head ‘Means of Communication’.

Apart from above requirements, principles governing disclosures and obligations of listed entity shall be simultaneously conformed viz. to provide adequate and timely information to recognised stock exchange(s) and investors, provide adequate and timely information to shareholders, to ensure timely and accurate disclosure on all material matters including the financial situation, performance, ownership, and governance of the listed entity, etc.

PIT Regulations

Pursuant to Regulation 8 of PIT Regulations, every listed company is required to formulate a Code of Fair Disclosure and Conduct for fair and timely disclosure of UPSI in compliance with the principles set out in Schedule A to the PIT Regulations. The principles of fair disclosure w.r.t analyst meet is as follows

- to ensure that information shared with analysts and research personnel is not UPSI; and

- to develop best practices to make transcripts or records of proceedings of meetings with analysts and other investor relations conferences on the official website to ensure official confirmation and documentation of disclosures made.

Regulatory Regime in other Countries

| Country Name | Disclosure Requirement

|

| USA |

|

| UK |

|

| Singapore |

|

| Canada |

|

Extant gaps in disclosure requirements

Information Asymmetry

As discussed above, the Listing Regulations require the listed entities to disclose the schedules and presentations for analyst or institutional investor meetings on its website and to the stock exchange(s) with 24 hours of the event taking place. However, except for few top companies, majority of the listed companies treat this as a mere formality. They disclose only the occurrence of analyst/ investor meets and circumvent disclosure of significant details of the said event.

As per the Report, it has been observed that the reports shared by the listed entities have information that does not have its source from quarterly results or investor presentation and thereby lead to selective sharing of information. Therefore, it is seen that there exists information asymmetry due to following the Regulations in letter and not in spirit.

Selective disclosure and Risk of divulging UPSI

Selective disclosure occurs when a company releases UPSI about the company to an individual or selective group of persons (e.g., analysts or institutional investors) before disclosing the information to the general public. It creates an adverse impact on market integrity similar to that of insider trading. Selective disclosure lead to asymmetry information.

For example, analyst/ investors during a one-to-one meet are provided with such price sensitive information which may not be disclosed in presentation or the financial results and is not available in public domain.

Therefore, issues concerning selective sharing of information, disclosure of incomplete information, inconsistency in the disclosures made by different listed companies have made it essential for SEBI to review the current regulatory requirements and further strengthen the disclosure regime.

Conflicting views of Kotak Committee on Investor/ Analyst meets

The Committee on Corporate Governance constituted under the Chairmanship of Mr. Uday Kotak Committee (‘Kotak Committee’) by SEBI issued its ‘Report on Corporate Governance[8]’ in October, 2017 wherein it took a contrary view and stated that disclosure of schedule of investor/ analyst meetings does not serve any practical purpose and therefore may not be required. Relevant extract provided below:

“The Committee was of the view that the disclosure of schedules of analyst/institutional investor meetings does not serve any practical purpose, and there have been instances of its misuse. Hence, the Committee recommended that the disclosure of schedules of analyst/institutional investor meetings may not be required. To clarify, the information to be shared at such meetings has to be strictly in compliance with the SEBI PIT Regulations.”

On the other hand, the present Report has considered institutional investors meet or conference call with analysts/ shareholders as a material event and emphasis has been placed on strengthening the disclosure framework. It is significant to note that while the Kotak Committee was of the view that putting up the schedule for investors meeting have the potential of being misused, the Sub-Group constituted by the PMAC holds a completely contrary view and has not recommended to do away with the said practice.

The Recommendations: Enhanced disclosures w.r.t analyst / investor meets/ conference calls

New disclosure requirements pertaining to post-earnings conference calls/quarterly calls

Listed companies generally organise analyst / investor meetings or conference calls after the release of quarterly financial results. To curb any information asymmetry among different class of stakeholders, the following recommendations are proposed:

- audio/video recordings

- host on the website and share with the stock exchange(s)

- immediately after the earnings call/ con-call/ analysts meeting before the next trading day or within 24 hours from the occurrence of event or information, whichever is earlier;

- written transcripts

- host on the website of the listed entity and respective stock exchanges within 5 working days after the event;

- make available audio/video recordings and the written transcripts on the website

- for a period of atleast 8 years in addition to the details disseminated on respective stock exchanges.

The idea is to immediately disclose any UPSI shared at such conference calls. Some of the top listed companies like Tata Steel[9], Reliance Industries[10], Infosys[11], Pricol Ltd[12], Power Finance Corporation Ltd[13], have already adopted the above practices and upload the audio/video recordings, transcripts of analysts / investor conference calls on their respective websites. The recommendations will now require the other listed companies to put in place an effective disclosure mechanism in this regard.

Discretion of companies to limit attendees of conference calls

Unlike in US, Indian listed companies generally restrict the conference calls to their respective analysts / investors only to avoid any unnecessary disruption of call, presence of competitors, etc.

However, genuine institutional investor or analyst may get excluded from participating in the meeting and thus, Sub-Group suggested that companies should make the provision of inclusion of certain individuals based on their request and on verification of their credentials.

Accordingly, Sub-Group has recommended to leave the discretion with the listed companies for deciding the participants for such meetings.

One-to-one meetings – Selective or effective disclosures?

Listed companies in their course of business are often seen conducting one-to-one meetings/ con-calls with investors / analysts (‘private meets’). Such private discussions are more risky due to the following:

- unscheduled and unplanned;

- company officials not prepared;

- no presentation/ information statement for discussion;

- greater risk of disclosing UPSI

Even if a company wishes to make public the proceeding of such meeting/ call, the investor may not agree to share private call records in public domain.

However, by disclosing one-to-one affairs, chances of information asymmetry will reduce. Also, other investors, particularly the minority investors, who are generally not a part of such meets may be benefitted from effective price discovery. Besides investors, regulatory authorities and stock exchanges will also be able to track such meets for any future references.

In view of the above, Sub-Group has made following recommendations:

- listed companies to provide number of one-to-one meetings with select investors as part of corporate governance report submitted by them to stock exchanges on a quarterly basis;

- an affirmation that no UPSI was shared by any official of the company in such meetings shall also be provided along with the corporate governance report;

- company shall maintain a record of all such one-to-one meetings. The data should be preserved for a period of atleast 8 years.

Unlike in case of post-earning calls, it seems recording and disclosure of private meets is not required. It is always better to look before you leap, hence companies must consider recording such private meets (written or audio) and making it public to avert possibility of selective disclosure and leak of material information.

Further, in addition to the affirmation by official of company involved, a confirmation from the concerned party (investor/ analyst) shall also be obtained confirming that no material public information was shared with the concerned analyst during such meeting, and that the information shared in the meeting was only clarification of facts/information already available in public domain.

Concluding Remarks

After the recommendations of Kotak Committee in the year 2017 to discard the requirements of disclosing the schedule of analyst / institutional investor, a new approach of SEBI to enhance transparency and strength disclosure framework of analyst/ investor meets is evident from the recommendations of the Sub-Group.

An effective disclosure mechanism will be required to be put in place by companies for adequate and timely disclosures. A measure of ‘silent or quiet period’ may be adopted where companies for a specified period (generally prior to release of financial results) refrain from interaction with the analyst/ investor/ media in order to avoid inadvertent disclosures of UPSI on selective basis. To conclude, the recommendations seems to promote a culture of corporate governance encouraging companies to follow the compliance in spirit of law.

Other reading materials on the similar topic:

- ‘A date to remember: Ad-hoc Analyst/Investor meets become a passé affair’ can be viewed here

- SEBI eliminates one-to-one analyst meets from the purview of LODR can be read here

- SEBI’S STEWARDSHIP CODE FOR INSTITUTIONAL INVESTORS can be read here

- Our other articles on various topics can be read at: http://vinodkothari.com/

Our Youtube Channel: https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

[1] https://www.sebi.gov.in/reports-and-statistics/reports/nov-2020/report-on-disclosures-pertaining-to-analyst-meets-investor-meets-and-conference-calls_48208.html

[2] https://www.sebi.gov.in/legal/circulars/sep-2015/continuous-disclosure-requirements-for-listed-entities-regulation-30-of-securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-regulations-2015_30634.html

[3] https://www.sec.gov/rules/final/33-7881.htm

[4] https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32014R0596

[5] http://rulebook.sgx.com/rulebook/703-0

[6] http://rulebook.sgx.com/rulebook/appendix-71-corporate-disclosure-policy

[7]https://webfiles.thecse.com/resource/CSE%20Policy%205%20%E2%80%93%20Timely%20Disclosure,%20Trading%20Halts%20and%20Posting%20Requirements.pdf

[8] https://www.sebi.gov.in/reports/reports/oct-2017/report-of-the-committee-on-corporate-governance_36177.html

[9] https://www.tatasteel.com/investors/financial-performance/analyst-call-recording/

[10] https://www.ril.com/InvestorRelations/FinancialReporting.aspx

[11] https://www.infosys.com/investors/news-events/analyst-meet/2020/india/main.html

[12] https://www.pricol.com/investor-call-transcripts.aspx

[13] https://www.pfcindia.com/Home/VS/109

New Model of Co-Lending in financial sector

/0 Comments/in Financial Services, NBFCs, RBI, Uncategorized /by Vinod Kothari ConsultantsScope expanded, risk participation contractual, borders with direct assignment drawn

-Team Financial Services (finserv@vinodkothari.com)

[This version dated 20th March, 2021]

Co-lending is coming together of entities in the financial sector – mostly, something that happens between banks and NBFCs, or larger banks and smaller banks. Financial interfaces between different financial entities may take the form of securitisation, direct assignment, co-lending, banking correspondents, loan referencing, etc.

While direct assignment and securitisation have been around for quite some time, co-lending was permitted by the RBI under its existing guidelines on ‘Co-origination of loans between banks and NBFC-SIs for granting loan to the priority sector’[1]. As per the Statement on Developmental and Regulatory Policies issued by the RBI dated October 9, 2020, it was decided to expand the scope of co-lending, currently permitted only for NBFC-SIs, to all NBFCs. Accordingly, the RBI came, vide notification on co-lending by banks and NBFCs (Co-Lending Model/CLM)[2] dated November 5, 2020, with a new regulatory framework for co-lending, of course, in case of priority sector loans. The CLM supersedes the existing guidelines on co-origination.

There is no clarity, still, on whether the non-priority sector loans (PSL or Non-PSL) will also be covered by this regulatory discipline, or any discipline for that matter. In this write-up, we explore the key features of the co-lending regime, and also get into tricky questions such as applicability to non-PSL loans, the borderlines of distinction between direct assignments and co-lending, the sharing of risks and rewards, etc.

Applicability

The erstwhile Regulations for priority sector lending covered co-lending transactions of Banks and Systemically Important NBFCs. However, under the Co-Lending Model.The CLM covers all NBFCs (including HFCs) in its purview.

There is a whole breed of new-age fintech companies using innovative algo-based originations, and aggressively using the internet for originations, and these companies pass a substantial part of their lending to either larger NBFCs or to banks. Thus, the expanded ambit of the Co-Lending Model will increase the penetration and result into wider outreach, meet the objective of financial inclusion, and potentially, reduce the cost for the ultimate beneficiary of the loans. Smaller NBFCs have their own operational efficiencies and distribution capabilities; hence, this is a welcome move.

Further, the RBI has excluded foreign Banks, including wholly owned subsidiaries of foreign banks, having less than 20 branches, from the applicability of the CLM. Also, Small Finance Banks, Regional Rural Banks, Urban Cooperative Banks and Local Area Banks have been excluded from the applicability of CLM.

An interesting question that comes up here is whether such exclusion should be construed as a restriction on such entities from entering into co-lending transactions, or a relaxation from the applicability of the Co-Lending Model? It may be noted that the CLM a precondition for PSL treatment of the loans. This is clear from the title ‘Co-Lending by Banks and NBFCs to Priority Sector’. The intent is not to put a bar on existence of co-lending arrangements outside the CLM. That is to say, if the loan, originated by the principal co-lender, is a priority sector loan, then the participating co-lender will also be able to treat the participant’s share of the loan as a PSL, subject to adherence to the conditions specified in CLM. The implication of this is that where the loan does not meet the conditions of CLM, then the participating bank will not be able to accord a PSL status, even though the loan in question is a PSL loan.

With that rationale, in our view, there is no absolute prohibition in the excluded banking entities from being a co-lender. However, if the major motivation of the co-lending mechanism under the CLM is the PSL tag, that tag will not be available to the excluded banks, and hence, the very inspiration for falling under the arrangement may go away. This is also clear from the PSL Master Directions[3] which recognises co-origination of loans by SCBs and NBFCs for lending to the priority sector and specifically excludes RRBs, UCBs, SFBs and LABs.

Applicability date and the fate of existing transactions

In the absence of any specified timelines, the CLM supersedes the existing co-lending guidelines with immediate effect. However, it specifies that outstanding loans in terms of the erstwhile guidelines would continue to be classified under priority sector till their repayment or maturity, whichever is earlier.

This would mean grandfathering of existing loans, and not existing lending arrangements. That is to say, if there are existing co-lending arrangements, but the loan in question has not yet originated, even existing co-lending arrangements will have to abide with the Co-Lending Model. Needless to say, any new co-lending arrangements will nevertheless have to abide by the Co-Lending Model.

As we note below, one of the very important features of the Co-Lending Model is that risk-sharing and loan-sharing do not have to follow the same proportion. Additionally, it is possible for the participating bank to have an explicit recourse against the originating co-lender. This feature was not available under the earlier framework. This alone may be a sufficient motivation for existing CLMs to be revised or redrawn.

Co-lending, Outsourcing and Direct Assignment – new borderlines of distinction

For the purpose of entering into co-lending transactions, banks and NBFCs will have to enter into a ‘Master Agreement’. Such agreement may require the bank either to mandatorily take the loans originated by the NBFC on its books or retain discretion as to taking the loans on its books.

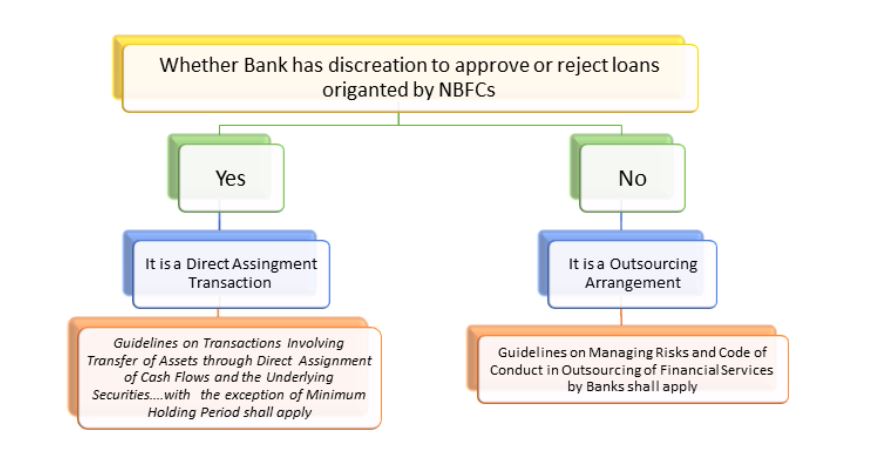

Where the participating bank has a discretion as to taking its share of the loans originated by the originating partner, the transaction partakes the character of a direct assignment. Para 1(c) of the CLM says that ”…if the bank can exercise its discretion regarding taking into its books the loans originated by NBFC as per the Agreement, the arrangement will be akin to a direct assignment transaction. Accordingly, the taking over bank shall ensure compliance with all the requirements in terms of Guidelines on Transactions Involving Transfer of Assets through Direct Assignment of Cash Flows and the Underlying Securities….with the exception of Minimum Holding Period (MHP) which shall not be applicable in such transactions undertaken in terms of this CLM.

That would mean, a precondition for the arrangement being treated as a CLM is that the participating bank takes the loans originated by the originating partner without discretion exercisable on a cherry-picking basis.

Does this mean that irrespective of whether the loan originated by the originating partner fits into the credit screen of the bank or not, the bank will still have to take it, lying low? certainly, this is not the intent of the CLM This is what comes form clause 1(a)- ‘…..the partner bank and NBFC shall have to put in place suitable mechanisms for ex-ante due diligence by the bank as the credit sanction process cannot be outsourced under the extant guidelines.’

Thus, even in case the bank gives a prior, irrevocable commitment to take its share of exposure, the same shall be subject to an ex-ante due diligence by the bank. Ex-ante obviously implies a prior As per the outsourcing guidelines for banks[4], the credit sanction process cannot be outsourced. Accordingly, it must be ensured that the credit sanction process has not been outsourced completely and the bank retains the right to carry out the due diligence as per its internal policy. Notwithstanding the bank’s due diligence exercise, the co-lending NBFC shall also simultaneously carry out its own credit sanction process.

The conclusion one gets from the above is as follows:

- The essence of co-lending arrangement is that the participating bank relies upon the lead role played by the originating bank. The originating bank is the one playing the fronting role, with customer interface. The credit screens, of course, are pre-agreed and it will naturally be incumbent upon the originating bank to abide by those. Hence, on a case by case basis or so-called “cherry picking” basis, the participating bank is not selecting or dis-selecting loans. If that is what is being done, the transaction amounts to a DA.

- Subject to the above, the participating bank is expected to have its credit appraisal process still on. Where it finds deviations from the same, the participating bank may still decline to take its share.

It is important to note that if DA comes into play, the requirements such as MHP, MRR, true sale conditions will also have to be complied with. However, co-lending transactions do not have any MHP requirements, unlike in case of either DA or securitiastion. Of course co-lending transactions do have a risk retention stipulation, as the CLM require a 20% minimum share with the originating NBFC. Hence, the intent of the RBI is that co lending mechanism must not turn out to be a regulatory arbitrage to carry out what is virtually a DA, through the CLM.

(Almost) A new model of direct assignments: assignments without holding period

Para 1 c. of the Annex seems to be leading to a completely new model of direct assignments – direct assignments without a holding period, or so-called on-tap direct assignments. Reading para 1 c. suggests that while co-lending takes the form of a loan sharing at the very inception, the reference in para 1 c. is to loans which have already been originated by the NBFC, and the participating bank now cherry-picks some or more of those loans. The cherry-picking is evident in “if the bank can exercise its discretion regarding taking into its books the loans originated by NBFC”. However, unlike any other direct assignment, this assignment happens on what may be called a back-to-back arrangement, that is, without allowing for lapse of time to see the loan in hindsight.

In essence, there emerge 3 possibilities:

- A non-discretionary loan sharing, which is the usual co-lending model, where the originating co-lender has a minimum 20% share.

- A discretionary, on-tap assignment, where the originating assignor needs to have a minimum 20% share

- A proper direct assignment, with minimum holding period, where the assignor needs to have a minimum 10% share.

The on-tap assignment referred to above seems to be subject to all the norms applicable to a direct assignment, other than the minimum holding period.

Interest Rates

The erstwhile guidelines require that the interest rate charged on the loans originated under the co-lending guidelines would be calculated as per Blended Interest Rate Calculations, that is to say the rate shall be calculated by assigning weights in proportion to risk exposure undertaken by each party, to the benchmark interest rate of the respective lender.

The current guidelines require that the interest rate shall be an all inclusive rate that is mutually agreed by the parties. However it shall be ensured that the interest rate charged is not excessive as the same would breach the provisions of fair practice code, which is to be compulsorily complied.

This change would provide flexibility to the lenders and also ensure that the cost incurred in tracing and disbursals to remote sectors as well as enhanced risk exposure is appropriately compensated.

Determining the roles

Under the erstwhile provisions, it was mandatory that the share of the co-lending NBFC shall be at least 20%. The same has been retained in the CLM as well, requiring NBFCs to retain a minimum of 20% share of the individual loans on their books.

Under the CLM, the co-lending NBFC shall be the single point of interface for the customers. Further, the grievance redressal function would also have to be carried out by the NBFC.

Operational Aspects

Escrow Account

For the purpose of disbursals, collections etc. an escrow account should be opened. The co-lending banks and NBFCs shall maintain each individual borrower’s account for their respective exposures. It is only for the purpose of avoiding commingling of funds, that an escrow mechanism is required to be placed. The bank and NBFC shall, while entering into the Master Agreement, lay down the rights and duties relating to the escrow account, manner of appropriation etc.

Creation of Security

The manner of creation of charge on the security provided for the loan shall be decided in the Master Agreement itself.

Accounting

Each of the lenders shall record their respective exposures in their books. The asset classification and provisioning shall also be done for the respective part of the exposure. For this purpose, the monitoring of the accounts may either be done by both the co-lenders or may be outsourced to any one of them, as agreed in the Master Agreement. Usually, the function of monitoring remains with the NBFC (since, it has done the origination and deals with the customer.)

Non-PSL loans: whether the framework would apply in pari materia?

The guidelines on CLM have been issued for co-lending of loans that qualify for the purpose of priority sector lending. This does not bar lenders from entering into co-lending transactions outside the purview of these guidelines. The only difference it would make is such loans would not be eligible to be classified as loans to the priority sector (which is the primary motive for banks to enter into co-lending transactions).

This seems to form a view that the guidelines would not at all be applicable in case of non-priority sector loans. However, for a transaction to be a co-lending transaction, there has to be adequate risk sharing between the co-lenders. Hence, the guidelines on CLM shall be applicable in pari-materia.

[1] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11376&Mode=0

[2] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11991&Mode=0

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11959&Mode=0

[4] https://www.rbi.org.in/scripts/NotificationUser.aspx?Id=3148&Mode=0

Other related write-ups:

Workshop on Scheme for grant of ex-gratia payment of the differential interest

/1 Comment/in Uncategorized /by Vinod Kothari ConsultantsWhile compound interest is the unquestionable reality of the world of banking and finance, somehow, courts have always been disapproving of the idea of “interest on interest”. After months of litigation in the Apex Court and a lot of confusion surrounding interest on interest being charged by the lenders on loan accounts whose payments were deferred under the moratorium scheme, the Central Government (CG), on October 23, 2020, introduced a Scheme for grant of ex-gratia payment of the difference between compound interest and simple interest, whereby the lenders will refund the differential interest, that is, difference between compound interest and simple interest during the 6 month period starting 1st March, 2020. The same will be taken over by the CG.

We intend to discuss the intricacies of the said scheme in this workshop (details provided below):

Date: 30th October, 2020 at 5.00 pm, IST. Will run for about 90-120 mins.

Where: On the internet, via Zoom Meetings

Please note that the webinar has a maximum capacity of 100, including the host, and entry is on first-come-first-enter basis.

Whether interactive?

Yes. Participants may post queries, either in advance or at the time of workshop. Participants may, based on feasibility, also be allowed to speak.

Fees: The fees for the workshop shall be INR 1000 per participant exclusive of GST (payable in advance).

For registration: Click on this link and fill the form- https://docs.google.com/forms/d/e/1FAIpQLSe2Y8sT9N5AVkjTu7fC5l-D2lubfiYJlREA_VA2Us5LOxSRgQ/viewform

For queries: Drop a mail to rastogi@vinodkothari.com.

What will be covered in the workshop?

- Basics of the scheme including introduction, objective, rationale, scope etc.

- Eligibility conditions

- Getting into the intricacies- questions like- what kinds of loans will be excluded? How will MSME loans be dealt with?

- Manner of calculating ex-gratia payments

- Procedural aspects

- Grievance Redressal Mechanism (including guidance on the communication issued by the IBA)

- Modus operandi for claiming the payment from the CG

- Answers to practical issues that the industry is facing

- Answering your queries, of course.

Knowledge Resources:

- FAQs on the Scheme: http://vinodkothari.com/2020/10/interest-on-interest-burden-taken-over-by-the-government/

- Scheme Document: https://financialservices.gov.in/sites/default/files/Scheme%20Letter.pdf

- FAQs issued by the Department of Financial Services: https://financialservices.gov.in/sites/default/files/FAQs%20on%20Ex%20gratia%20Package_26.10.2020_v1.pdf

Companies (Amendment) Act, 2020

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, Corporate Laws - Covid-19, MCA, Uncategorized /by Vinod Kothari ConsultantsWebinar on RBI discussion paper on Governance in Commercial Banks in India

/2 Comments/in Uncategorized /by Vinod Kothari ConsultantsDate: 22nd June, 2020 at 05:00 pm, India time. Will run for about 90 mins.

Speaker: FCS Vinita Nair, Senior Partner, Vinod Kothari & Company

Background:

Effective Corporate Governance practices at banks plays a significant role in the banking sector and the economy as a whole. The banking industry in India witnessed governance failures in the past which seems to have triggered the need for the regulator to re-look at the governance guidelines for commercial banks in India.

RBI on 11th June, 2020 issued a discussion paper on the guidelines for Governance in Commercial Banks in India.

Scope of the webinar:

We intend to discuss the proposals put forth in the discussion paper in this webinar (expected duration around 90 mins) and comparing the proposed requirements with the existing ones.

- Scope and applicability;

- Overall responsibilities of the Board of Directors;

- Duties of director;

- Understanding and managing Conflict of Interest for banks;

- Structure, composition and role of Board Committees;

- Risk Governance Framework – The three lines of defence;

- Separation of ownership from Management;

- Whistle-blower mechanism.

Where:

On the internet, via Google Meet / Zoom Meeting

Please note that the webinar has a maximum capacity of 50, including the host, and entry is on first-come-first-enter basis.

Whether interactive:

Yes. Participants may post queries, either in advance or at the time of webinar. Participants may, based on feasibility, also be allowed to speak.

For registration:

Kindly mail with relevant details on – shaifali@vinodkothari.com.

Knowledge Resources: