LIBERAL INTERPRETATION OF SECTION 8 AND 9(3)(C) OF THE IBC BY THE APEX COURT

/0 Comments/in Case laws, Insolvency and Bankruptcy /by Vinod Kothari ConsultantsBy Vishal Hablani (resolution@vinodkothari.com) Read more →

NO EMBARGO ON PROCEEDINGS IN FAVOUR OF CORPORATE DEBTOR U/S 14(1) OF THE CODE

/0 Comments/in Case laws, Insolvency and Bankruptcy /by Vinod Kothari Consultants-By Sikha Bansal & Vishal Hablani (resolution@vinodkothari.com) Read more →

IBBI’s Grievance Handling Regulations to keep a check on service providers

/0 Comments/in Insolvency and Bankruptcy /by Vinod Kothari ConsultantsVallari Dubey

The Insolvency and Bankruptcy Board of India (“IBBI”) has notified a new set of regulations, named the Insolvency and Bankruptcy Board of India (Grievance and Complaint Handling Procedure) Regulations, 2017 (“Grievance Handling Regulations”) vide Gazette Notification dated 6th December, 2017, effective from 7th December, 2017[1][2].

The Regulations shall seek to protect the interests of stakeholders by getting their redressals addressed against any alleged contravention and /or suffering caused to them on an alleged conduct of service providers. There are eight Regulations, divided into 5 Chapters.

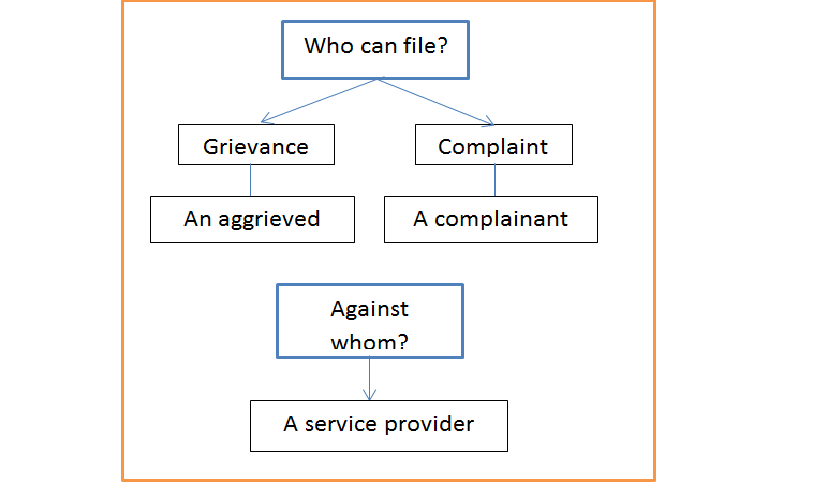

Grievance v. Complaint

The Regulations make a clear distinction between ‘grievance’ and ‘complaint’. Both are defined separately (refer definitions later) and the process of filing and disposal is different.

A grievance, as defined is filed by a stakeholder, called an aggrieved, when any suffering is caused to him/her/it due to a wrongful conduct of a service provider. On the other hand, a complaint is specifically filed by a stakeholder, called a complainant, when there is a contravention/breach alleged against a service provider. A complaint may or may not include a grievance.

Filing of Grievance

Regulation 3 of the Regulations provides the process of filing of grievance and complaint both.

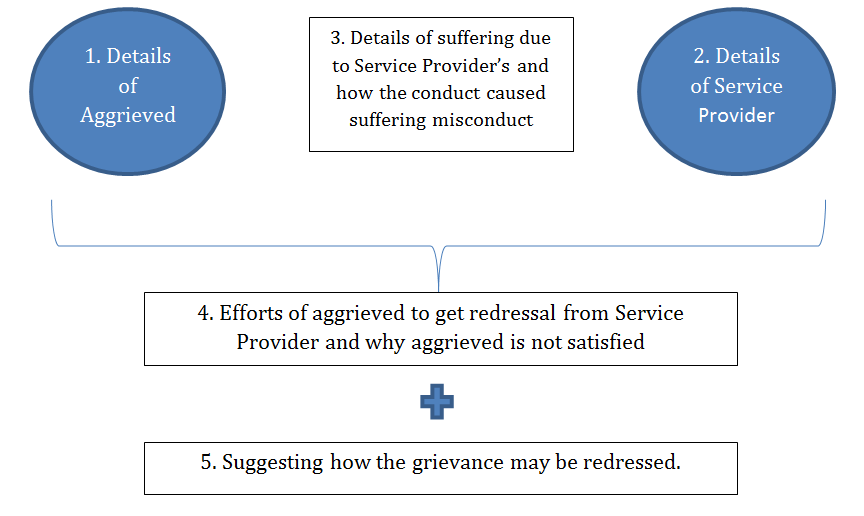

In case of grievance, it shall contain following details as provided under Regulation 3(2):

Filing of Complaint

A complaint shall be filed as per Regulation 3(3) containing details as may be prescribed in Form A. The Form has to be accompanied along with a fee of Rs. 2,500[3]. Form A contains all the details as provided under Regulation 3(2), with following differences:

- Name and identity of the authorized representative of the complainant, if any;

- Details of the alleged contravention of any provision of the Code or rules, regulations, or guidelines made thereunder or circulars or directions issued by the Board by a service provider or its associated persons;

- Details of alleged conduct or activity of the service provider or its associated persons, along with date and place of such conduct or activity, which contravenes the provision of the law;

- Details of evidence in support of alleged contravention;

- Does the complainant have a grievance? If so, how it may be redressed?;

- Details of fees paid;

- Option of complainant to keep its identity confidential;

- List of documents attached to the Form.

Submission

The grievance and complaint, as the case may be, shall be submitted online on the website of IBBI. However, till such arrangement is facilitated, it can be submitted either through e-mail or by post/hand delivery.

Confidential Identity

A stakeholder (aggrieved or complainant, as the case may be), may request the IBBI to keep its identity confidential. IBBI may allow the same unless, it disclosure is required to process the grievance/complaint or as required by law.

Registration Number

Each grievance and compliant shall be allotted a unique registration number, which shall be communicated to the aggrieved or complainant, as the case may be, within a week of its receipt.

In case more than one grievance/complaint is received in relation to single matter, such grievances/complaints shall be clubbed together for the purpose of disposal.

Disposal of Grievance/Complaint

Grievance

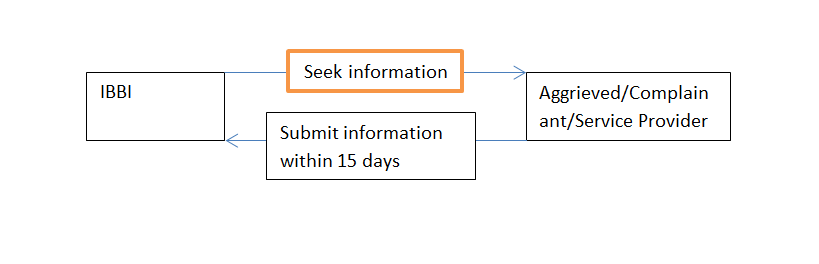

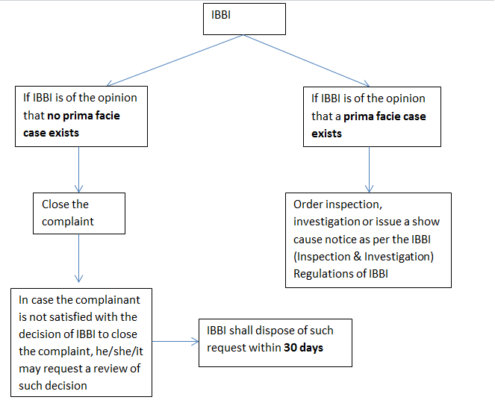

IBBI shall seek information from aggrieved person or service provider, if required and shall thereon dispose of the grievance within 45 days of its receipt.

The Regulations however, do not provide for the cases where the Service Provider does not redress the grievance or ignore the direction of IBBI as above. In such cases, there is a chance that the grievance of the aggrieved remains unattended and his/its interest prejudiced.

Complaint

Alike grievance, a complaint shall also be disposed of within a period of 45 days of its receipt.

Statistics

IBBI shall disclose on its website, summary statistics of the grievances and/or complaints received and disposed of, periodically.

Conclusion

In absence of any specific regulation in this regard, protection of interest of stakeholders would not be managed properly by the IBBI. Due to such Regulations, it will now on be possible to keep a check on misconduct of any fraudulent service providers, having malafide intent or those that have supposedly breached any provisions of law, which may be prejudicial to the interest of a stakeholder(s).

Interestingly, the Regulations do not provide for marking any copy of the grievance or complaint to the service provider, against whom the same is being/has been filed while it is being filed with IBBI. Furthermore, confidentiality of identity of the aggrieved/complainant has been provided for. Seemingly, the Regulations are favoured towards an aggrieved party and stricter towards a defaulter. Adequate protection may however, will be needed for innocent service providers.

Relevant Definitions (Regulation 2)

- “aggrieved” means a stakeholder who has filed a grievance with the Board on failing to get his grievance redressed from the concerned service provider;

- “associated person” means a proprietor, partner, director, officer, or an employee of a service provider, a professional or a valuer engaged by a service provider or any other person acting for or on behalf of a service provider;

- “complaint” means a written expression by a stakeholder alleging contravention of any provision of the Code or rules, regulations, or guidelines made thereunder or circulars or directions issued by the Board by a service provider or any of its associated persons and includes a complaint-cum-grievance;

- “complaint-cum-grievance” means a complaint and grievance in the same matter.

- “complainant” means a stakeholder who has filed a complaint or a complaint-cum-grievance with the Board;

- “grievance” means a written expression by a stakeholder of his suffering on account of conduct of a service provider or its associated persons;

- “service provider” means an insolvency professional agency, an insolvency professional, an insolvency professional entity or an information utility;

- “stakeholder” means a debtor, a creditor, a claimant, a service provider, a resolution applicant and any other person having an interest in the insolvency, liquidation, voluntary liquidation, or bankruptcy transaction under the Code.

[1] http://ibbi.gov.in/webadmin/pdf/whatsnew/2017/Dec/180723_2017-12-09%2009:58:17.pdf

[2] http://ibbi.gov.in/webadmin/pdf/whatsnew/2017/Dec/press%20release-Complaint%20handling_2017-12-09%2012:16:40.pdf

[3] Fees is refundable in case of genuine complaints

Presidential Ordinance makes Amendments to Insolvency and Bankruptcy Code

/0 Comments/in Insolvency and Bankruptcy /by Vinod Kothari ConsultantsBy Vinod Kothari, (resolution@vinodkothari.com)

The Presidential Ordinance to amend the Insolvency and Bankruptcy Code tries to address a few concerns, which seem to have been noticed in the early stages of resolution plans being approved by creditors’ committees. Essentially, under the scheme of the Code, a resolution plan may be submitted by a “resolution applicant”, who can be any person proposing a resolution alternative. The resolution applicant may, therefore, be the existing management itself, or may be a potential acquirer. Sometimes, the potential acquirer comes with a masked identity, and the true acquirer is hiding somewhere behind the screen. The true acquirer might be the existing promoters themselves, or may be someone else. Read more →

Contents of Resolution Plan redrawn, duties of RP redefined

/0 Comments/in Insolvency and Bankruptcy /by Vinod Kothari ConsultantsIBBI notifies 3rd amendment to CIRP and Fast Track Regulations

08.11.2017

Vallari Dubey

Introduction

Resolution plans pursuant to Section 30 and Section 31 of the Insolvency and Bankruptcy Code, 2016 (“the Code”) will hereon be required to contain details of the Resolution Applicant along with the Connected Persons.

A time bound corporate insolvency resolution process is linked with good resolution plans that can feasibly protect the Corporate Debtor from the curse of liquidation. With this ideology, IBBI has brought third set of amendments to the CIRP Regulations and Fast Track Regulation of the Code. Read more →

Section 14 (1) v. Section 60(2) of the Code: Creditors cannot take action against personal guarantors while on-going CIRP of a Corporate Debtor

/0 Comments/in Insolvency and Bankruptcy /by Vinod Kothari ConsultantsBy Shreya Routh & Vallari Dubey, (resolution@vinodkothari.com)

Brief facts of the case

Petitioners had filed a writ petition with the Allahabad High Court, challenging the order[1] passed by the Debt Recovery Tribunal (“DRT”). Petitioners are the guarantors of M/s LML Limited, Kanpur (hereinafter referred as the “Company”). The State Bank of India filed an application before the Debt Recovery Tribunal, Allahabad against the Company as the principal borrower and Sanjeev Shriya and others (hereinafter referred to as the “Petitioners”) as the guarantors. On 6.7.2017 DRT heard both the parties and passed the impugned order, staying the proceeding against the Company on the basis of the order passed by NCLT Allahabad dated 30.05.2017 imposing Moratorium on legal proceedings under Section 14 of the Insolvency and Bankruptcy Code, 2016. Subsequent to this, Corporate Insolvency Resolution Process began for the corporate debtor being the Company. As far as the resolution process for the personal guarantors was concerned, the interpretation of Section 60 of the Code provided for admitting such application to NCLT. However, since such provisions are not yet notified, being an individual, initiation of insolvency proceedings were placed before DRT. Read more →

IBBI eases norms for setting up of Information Utilities

/0 Comments/in Insolvency and Bankruptcy /by Vinod Kothari ConsultantsChintan Shah

resolution@vinodkothari.com

IBBI had notified the IBBI (Information Utilities) Regulations, 2017 (‘the regulations’) on 31st March, 2017, which shall come into effect immediately. The amendment has been made in line with easing the norms for Information Utilities (“IU”).

IBBI amends CIRP and FAST Track Regulations: intends to protect interest of stakeholders

/0 Comments/in Insolvency and Bankruptcy /by Vinod Kothari Consultants09.10.2017

Vallari Dubey

IBBI has amended INSOLVENCY AND BANKRUPTCY BOARD OF INDIA (INSOLVENCY RESOLUTION PROCESS FOR CORPORATE PERSONS) REGULATIONS, 2017[1] (“CIRP Regulations”) and INSOLVENCY AND BANKRUPTCY BOARD OF INDIA (FAST TRACK INSOLVENCY RESOLUTION PROCESS FOR CORPORATE PERSONS) REGULATIONS, 2017[2] (“Fast Track Regulations”) vide its notification dated 5th October, 2017. The same shall be effective immediately.

Amendment to CIRP Regulations

Following new sub-regulation (1A) shall be added in Regulation 38:

“(1A) A resolution plan shall include a statement as to how it has dealt with the interests of all stakeholders, including financial creditors and operational creditors, of the corporate debtor.”

Amendment to Fast Track Regulations

Following new sub-regulation (1A) shall be added in Regulation 37:

“(1A) A resolution plan shall include a statement as to how it has dealt with the interests of all stakeholders, including financial creditors and operational creditors, of the corporate debtor.”

Analysis

Regulation 38[3] pertains to Mandatory contents of the resolution plan. Accordingly, a resolution plan shall have a specified list of disclosures and contents as per the Regulation. A resolution plan for an indebted entity should address the basic criteria of effective payment structure. The idea of the new amendment seems to be to justify as to how a resolution plan is suiting the requirements of the entity and how it is protecting the interests of stakeholders, especially the financial and operational creditors of the corporate person. The new inclusion of sub-regulation (1A) shall ensure greater transparency and increased protection of the interest of stakeholders.

[1] http://www.ibbi.gov.in/CIRP_amndmt_5_oct_2017-10-07_21-32-33.pdf

[2] http://www.ibbi.gov.in/Fast_Track_amndmt_5_oct_2017-10-07_21-31-30.pdf

[3] http://ibbi.gov.in/webadmin/pdf/legalframwork/2017/Sep/Insolvency%20and%20Bankruptcy%20Board%20of%20India%20(Insolvency%20Resolution%20Process%20for%20Corporate%20Persons)%20Regulations,%202016%20(Amended)_2017-09-25%2014:22:35.pdf

TIME LIMIT PRESCRIBED IN IBC- NOT MANDATORY

/0 Comments/in Insolvency and Bankruptcy /by Vinod Kothari ConsultantsBy Richa Saraf, (legal@vinodkothari.com)

In the case of Surendra Trading Company v. JuggilalKamlapat Jute Mills CO. Ltd. &Ors.[1], the Apex Court was concerned with the correctness of the order passed by the National Company Law Appellate Tribunal (NCLAT) whereby it was held that the time of 7 (Seven) days prescribed in proviso to section 9(5) of the Insolvency and Bankruptcy Code, 2016 (IBC), for admitting or rejecting a petition or initiation of insolvency resolution process, is mandatory in nature and the Hon’ble Supreme Court has set aside part of the impugned judgment of NCLAT. The ruling is broadly discussed below. Read more →