Disqualification under Section 164 (2): retrospective or prospective?

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsFAQs on Disqualification of Directors under Companies Act, 2013

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsBy Team Vinod Kothari & Company (corplaw@vinodkothari.com)

This version is dated October 3, 2017

________________________________________________________________________________

Continuing the crackdown on shell companies, MCA in its Press Release[1] issued on September 6, 2017, expressed that the government will soon take steps against the directors of the shell companies which have not filed returns for three or more years. Post this, the Registrar of Companies of the respective states started issuing the list of disqualified directors[2] u/s 164 (2) (a) of the Companies Act, 2013. Read more →

Striking off under Companies Act, 2013

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsPresentation on Related Party Transaction(RPTs)- An Overview

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsDECIPHERING “DISPUTE” IN INSOLVENCY AND BANKRUPTCY CODE

/0 Comments/in Case laws, Corporate Laws, Insolvency and Bankruptcy /by Vinod Kothari ConsultantsBy Richa Saraf, (legal@vinodkothari.com)

-Mobilox Innovations Pvt. Ltd. v. Kirusa Software Pvt. Ltd.[1]

SEBI’s Yet Another Move to Ensure Minimum Public Shareholding

/0 Comments/in Companies Act 2013, Corporate Laws, SEBI /by Vinod Kothari ConsultantsBy Parul Bansal, (corplaw@vinodkothari.com)

Background

With the development of the economic conditions of the country, various investors including the retail investors are stepping into the securities market with the intention to earn higher return on their investments which has lead to large portion of their income being invested in shares, bonds or securities of listed companies. At this juncture, return on their investment is proportionate to the growth of listed companies. Therefore, their destiny in the stock market lies at the mercy of management and promoters of listed companies.

Stock Exchange Board of India (“SEBI”) with an endeavor to prevent the investors from the monopoly of the listed companies and to debar/prevent the undesirable/illegal transactions has enacted Securities Contract (Regulation) Act, 1956 (“SCRA, 1956”) and Securities Contract (Regulation) Rules, 1957 (“Rules, 1957”) thereof.

Minimum Public Shareholding (“MPS”)

Listed Companies are those companies of which shares are listed on the stock exchange and certain percentage of such shareholding is available for the public to trade in with transparency and liquidity. If large portion of the shareholding of listed companies remain blocked in the hands of the promoters, subsidiary or associate company then the intent of listing such securities is breached and becomes redundant. The promoters will be at liberty to manipulate the price and the market tricking will be easy. This will also reduce the floating capacity of the securities of the company due to less liquidity. Ministry of Finance vide press release dated June 4, 2010 has also stated that:

“A dispersed shareholding structure is essential for the sustenance of a continuous market for listed securities to provide liquidity to the investors and to discover fair prices. Further the larger the number of shareholders, the less is the scope for price manipulation.”

To prevent such abuse, sub-rule 19 of the Rules, 1957 specifies the conditions for initial and continuous listing of a company.

Initial Listing

As per regulation 19(2)(b) of the Rules, 1957, any company proposing to list its securities shall maintain MPS as mentioned below based upon the post issued share capital of the company:

| Post issued share capital at offer price | MPS (minimum) | |

| 1 | Less than or equal to INR 600 crores | 25% of each class or kind of equity shares or

debenture convertible into equity shares issued by the company |

| 2 | More than INR 600 to INR 4000 crores | Such % of each class or kind of equity shares or debentures convertible into equity shares issued by the company equivalent to the value

of four hundred crore rupees |

| 3 | More than INR 4000 crores | 10% of each class or kind of equity shares or debentures convertible into equity shares issued by the company |

| In case of 2 and 3, company shall attain MPS equal to 25% within 3 years from the date of listing its securities | ||

Relaxation by SEBI

SEBI has, vide circular dated March 10, 2017, laid down criteria for Schemes of Arrangement by Listed Entities and relaxation under Rule 19 (7) of the Securities Contracts (Regulation) Rules, 1957 (SCRR). Further, to align with the rules of Rule, 1957, amendments were carried out therein through circular dated September 21, 2017.

Pursuant to aforesaid circulars, any listed issuer may for the purpose of arrangement submit a draft scheme of arrangement under sub-rule 19 of Rules, 1957 for seeking relaxation from the applicability of strict provisions of sub-rule 19(2) of Rules, 1957, for listing of its equity shares on a recognized Stock Exchange without making an initial public offer, on satisfying the conditions as mentioned in para III of Annexure I thereof. In terms of such conditions at least 25% of the post-scheme paid up share capital of the transferee entity shall comprise of shares allotted to the public shareholders in the transferor entity. However, on fulfillment of following condition, requirement to attain such MPS may be waived off:

- The entity has a valuation in excess of INR 1600 crore as per the valuation report;

- The value of post-scheme shareholding of public shareholders of the listed entity in the transferee entity is not less than INR 400 crore;

- At least 10% of the post-scheme paid up share capital of the transferee entity comprises of shares allotted to the public shareholders of the transferor entity; and,

- MPS of 25% shall be attained within a period of one year from the date of listing of its securities and an undertaking to this effect is incorporated in the scheme” .

Continuous Listing

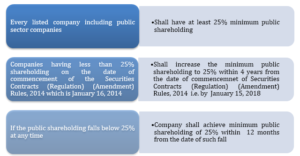

Pursuant to sub-rule 19A of the Rules, 1957 every listed company including the Public Sector Company shall maintain MPS of 25% of the total shareholding of the Company. Initially, limit for the Public Sector Companies was fixed at 10% but later on the same was also increased from 10% to 25% to provide equal footing to listed companies and PSUs.

What if MPS is less than 25% in case of continuous listing?

Pursuant to proviso of sub-rule 19A of Rules, 1957, every listed company which is not meeting the minimum public shareholding specified under sub-rule 19 of the Rules, 1957 shall in accordance with the provision of sub-rule 19A accomplish the same within the stipulated time period which is 4 year from the date of commencement of SCRA Amendment Rules, 2014 i.e. by January 15, 2018. Earlier the time specified was upto January 15, 2017 and listed companies failing to comply with the same has faced severe consequences in past. Albeit, strict steps have been taken by SEBI against such companies, public shareholding of such companies was still below the requirement. Therefore, SEBI has, once again vide circular on July 03, 2017, extended the time limit for achieving the minimum public shareholding by one year i.e. January 15, 2018.

This extension of time yet again by SEBI is a clear indication of the its accommodative and perceptive regulatory approach and takes cognizance of the need for a reasonable timeframe within which non-compliant companies may take remedial action with respect to public holding requirements. SEBI has not only increased the time limit for bringing the public shareholding within specified limits but has also amended various Regulations and Acts thereof for achieving the requirement of minimum public shareholding.

Steps taken by SEBI to achieve minimum public shareholding

SEBI has vide circular dated December 16, 2010 and August 29, 2012 specified the methods for complying with the minimum public shareholdings such as issuance of shares to public through prospectus, offer of shares held by promoters to public, right issues/ bonus issue to public shareholders with promoters or promoter group shareholders forgoing their entitlement, etc.

Subsequently, another circular was issued by SEBI on February 08, 2012 through which listed companies were allowed to achieve minimum public shareholding through institutional placement programme. Along with the aforesaid, SEBI has also specified that listed companies desirous of achieving the minimum public shareholding may approach SEBI with the appropriate details and the same will be entertained by it on the basis of merits.

Result of non-compliance

Despite aforementioned efforts of the SEBI to facilitate achieving minimum shareholding, various companies have not complied with the same. As a result SEBI has taken stern actions like freezing of voting rights, delisting of securities, exclusion of scrips from F&O segments etc.

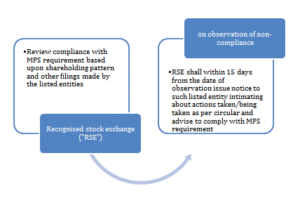

SEBI has once again vide circular dated October 10, 2017[1], in order to bring uniformity of approach in enforcement of MPS norms and to ensure compliance with same, laid down following procedure:

Steps to be taken by RSE on observing non-compliance

- Fine of ₹5,000 per day (₹10,000 per day if non compliance continues for more than 1 year) of non-compliance on the listed entity till the date of compliance. In case the listed entity fails to pay the fine despite receipt of the notice as stated above, the recognized stock exchange may initiate appropriate action.

- Freezing of shareholding of promoter/promoter group till the date of compliance (this shall not be an impediment for the entities complying with MPS norms through the methods specified/approved by SEBI).

Provided that where it is observed that the listed entity has adopted a method for complying with MPS requirements which is not prescribed by SEBI under clauses (2)(i) to (vi) under SEBI circular[1] dated November 30, 2015 and approval for the same has not been obtained from SEBI under clause 2 (vii) of the said circular, the recognized stock exchanges shall refer such cases to SEBI.

- Promoters, promoter group and directors shall not hold any new position as director in any other listed entity till the date of compliance by such entity (listed entity shall give intimation of the same to RSE and promoters, promoter group and directors)

- RSE may consider compulsorily delisting of non-complaint entity in accordance with SCRA, 1956, Rules, 1957 and SEBI (Delisting of Equity Shares) Regulations, 2009.

- RSE may keep in abeyance the action or withdraw the action in specific cases where specific exemption from compliance with MPS requirements under the Listing Regulations/ moratorium on enforcement proceedings has been provided under any Act, Court/Tribunal Orders etc.

Upon intimation of compliance and on being satisfied, RSE shall remove the aforementioned restriction levied on the listed entities, its promoter, promoter group and directors.

Aforementioned actions taken by SEBI are without prejudice to its power to take action under the securities laws for violation of the MPS requirements.

International practice

Colombo Stock Exchange

Pursuant to rule 7.13 of the listing rules[2] of the Colombo Stock Exchange, every company listed on the main Board shall maintain a minimum public shareholding as stipulated therein. Previously, such listed companies were required to comply with this requirement of minimum public shareholding by December 31, 2016. However, likewise SEBI, Stock Exchange Commission in consultation with Colambo Sock Exchange has extended the timeline to June 30, 2017 for the listed companies not complying with the requirement of minimum public shareholding.[3]

Europeon Union (Euronext)

Pursuant to the regulations of Euronext Amsterdam[4], minimum public shareholding maintained by the companies shall be 25% of the issued shares of the company. Unlike, SEBI, Colambo Stock Exchange, Euronext considers the free float/liquidity available for the security of the company. In case a large number of shares of the company are available to public, ensuring enough liquidity for the such shares, irrespective of the percentage, minimum public shareholding may go below 25% subject to the condition that minimum public shareholding shall never be lower than 5% and the free float shall always represent at least EUR 5 million (based on the offering price).

[1] http://www.bseindia.com/downloads/whtsnew/file/Manner%20of%20achieving%20MPS%20301115.pdf

[2] https://cdn.cse.lk/pdf/Section-7.pdf

[3] https://cdn.cse.lk/cmt/upload_cse_report_file/directives_24_18-11-2016.pdf

[4] https://uk.practicallaw.thomsonreuters.com/9-572-8048?transitionType=Default&contextData=(sc.Default)&firstPage=true&bhcp=1

MCA liberalizes acceptance of Deposits from Members

/0 Comments/in Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsNew rules of corporate control: Limit on layers of subsidiaries

/1 Comment/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsBy CS Vinita Nair, (corplaw@vinodkothari.com)

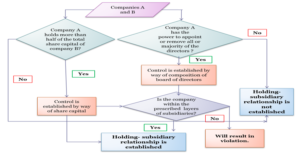

MCA has issued a notification notifying the Companies (Restriction on Number of Layers) Rules, 2017[1], imposing a limit of two layers of subsidiaries which shall be effective from September 20, 2017[2]. Earlier, MCA vide public notice dated 1 June 28, 2017[3] had conveyed its intent of issuing a notification proposing amendments to the Companies (Specification of Definitions Details) Rules, 2014 containing the restriction on layers of subsidiaries beyond prescribed number and had invited suggestions on the draft notification. This write up initially discusses the conditions imposed and thereafter analyses the permitted combinations.

Proviso to Section 2 (87) along with explanation (d) was proposed to be omitted in Companies (Amendment) Bill, 2016. However, in view of reports of misuse of multiple layers of companies, where companies create shell companies for diversion of funds or money laundering, MCA has decided to retain the provisions and commence the aforesaid proviso and explanation. Further, MCA had no intent to exempt private companies from the requirement as well. Companies (Amendment) Bill, 2017 as passed by Lok Sabha omitted the amendment proposed in Proviso to Section 2 (87).

Figure 5 of Taxmann’s Your Queries on Companies Act, 2013

Exempted companies

Rule 2(2) of Companies (Restriction on number of layers) Rules, 2017 shall not apply to following classes of companies, namely:-

(a) a banking company;

(b) a non-banking financial company as defined in the Reserve Bank of India Act, 1934 (2 of 1934) which is registered with the Reserve Bank of India and considered as systemically important non-banking financial company by the Reserve Bank of India; (Nothing specified in relation to housing finance companies/ NBFC CICs).

(c) an insurance company being a company which carries on the business of insurance in accordance with provisions of Insurance Act, 1938 and Insurance Regulatory Development Authority Act, 1999;

(d) a Government company referred to in clause (45) of section 2 of the Act.

Exemptions in cases of Housing Finance Companies, Core Investment Companies as well as Non-Operative Financial Holding Company, Companies that become subsidiary entities pursuant to lenders acquiring majority of shareholding in the borrowing entity as a measure to deal with stressed assets in accordance with the guidelines issued by the Reserve Bank of India from time to time are missed out in the Rules notified.

Exempted subsidiaries – subsidiaries incorporated outside India

First proviso to Rule 2 of the Rules provides exemption to a Company from acquiring a company incorporated in a country outside India with subsidiaries beyond two layers as per the laws of such country.

The exemption in case of acquiring of subsidiaries incorporated outside India should be extended equally to subsidiaries freshly incorporated outside India. There need not be a distinction in acquisition and incorporation of subsidiary outside India. Either a company may acquire a subsidiary outside India which in turn has several layers of downstream investment or it may float a subsidiary outside India which will keep on further incorporating or acquiring subsidiaries outside India.

It cannot be interpreted that a Company incorporating subsidiaries outside India will have to adhere to the restriction of layers even if the same is permitted as per law of that country.

Exempted subsidiaries – wholly owned subsidiaries

One layer which consists of one or more wholly owned subsidiary or subsidiaries shall not be taken into account while computing the number of layers. The proposed Rule provided the explanation to the effect that one layer which is represented by a wholly owned subsidiary shall not be taken into account.

‘Layer’ cannot mean ‘Layers’ based on interpretation that singular includes plural. Therefore, it should not be read as any layer represented by a wholly owned subsidiary. The whole purpose will get defeated if companies are allowed to incorporate layers of wholly owned subsidiaries without any restriction.

It is very pertinent to ponder whether the wholly owned subsidiaries can be at layer not immediately following the layer of holding company.

Example 1: Company ‘A Ltd’ has a subsidiary ‘B Ltd’ which in turn has a subsidiary ‘C Ltd’. ‘C Ltd’ forms a wholly owned subsidiary ‘D Ltd’. How can Company ‘A Ltd’ avail the exemption for the layer represented by ‘D Ltd’ which is not wholly owned subsidiary of ‘A ltd’.

Example 2: Company ‘A Ltd’ has wholly owned subsidiaries ‘B Ltd’ and ‘C Ltd’. Both of these wholly owned subsidiaries hold shares in ‘D Ltd’ in the ratio of 60% and 40% respectively. Thereafter, ‘D Ltd’ forms a subsidiary ‘E Ltd’. In this case, the layer represented by ‘B Ltd’ and ‘C Ltd’ shall not be considered.

Therefore, the layer of wholly owned subsidiary has to reflect in the first layer and not thereafter in order to avail the exemption.

Limit prescribed under Section 186 (1)

Similar restriction on number of layers of investment companies has already been in force under Section 186 (1). The provisions of this rule shall not be in derogation of the proviso to sub-section (1) of section 186 of the Act.

Rules are prospective in nature

The holding companies, other than exempted companies, that breach the conditions of layers of subsidiaries as on the date of commencement of provision are prohibited from incorporating additional layer of subsidiaries.

Such holding companies shall file return in Form CRL-1 with the Registrar within a period of 150 days from the date of publication of these rules in Official Gazette. The form requires specifying layer number of the subsidiary and percentage of shares held by holding company.

The Rules further provide that, such Company shall not, in case one or more layers are reduced by it subsequent to the commencement of these rules, have the number of layers beyond the number of layers it has after such reduction or maximum layers allowed in sub-rule (1), whichever is more.

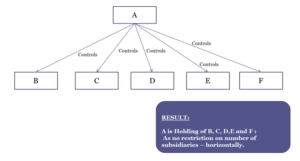

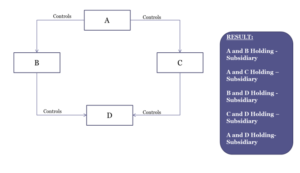

No restriction on horizontal propagation

All the below mentioned structures are permitted and well in compliance

Figure 9 of Taxmann’s Your Queries on Companies Act, 2013

Figure 9 of Taxmann’s Your Queries on Companies Act, 2013

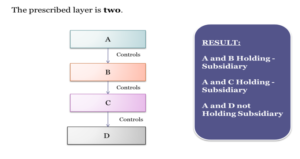

Permitted and prohibited combinations

Case 1:

Figure 8 of Taxmann’s Your Queries on Companies Act, 2013

In the aforesaid structure, if we consider on as is basis, there exists more than 2 layers of subsidiaries. Therefore, an existing company cannot go beyond ‘D’. Once the provisions are enforced, an existing holding company A will not be able to float ‘D’ unless any exemptions/ relaxations become applicable.

Case 2 – ‘B’ is a wholly owned subsidiary of ‘A’:

In that case, the structure is permissible.

Case 3 –’C’/ ‘D’[1] is a wholly owned subsidiary of ‘A’:

In that case, the structure is not permissible for reasons stated above.

Case 4 – ‘B’/’C’ is a subsidiary incorporated outside India:

Currently, the wording of draft rule prescribes ‘acquired’ subsidiaries to be exempted. However, there is no reason to infer that the benefit cannot be extended to subsidiaries incorporated outside India if the laws of host country permit the same.

Case 5 – ‘B” is a subsidiary acquired outside India while ‘C’ and ‘D’ and subsidiaries of ‘B’ incorporated in India

So ‘A’, ‘C’ and “D’ are companies incorporated in India while ‘B’ is a subsidiary outside India. The exemption cannot be extended to ‘C’ and ‘D’ merely because it’s immediately holding company is a subsidiary acquired outside India. Therefore, the limit is likely to be breached unless ‘B’ or ‘C’ or ‘D’ is a wholly owned subsidiary.

Case 6 – ‘A’/‘B’/’C’ fall under exempted companies:

In that case, the restriction shall not apply.

Case 7 – ‘B’/’C’/ ‘D’ is an LLP:

The expression ‘company’ includes body corporate. Therefore, an existing company cannot go beyond ‘D’. Once the provisions are enforced, an existing holding company A will not be able to float ‘D’ unless any exemptions/ relaxations become applicable.

[1] Either of ‘C’ or ‘D’

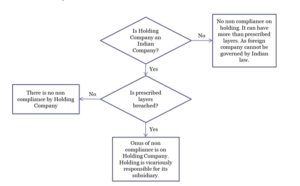

Onus of non-compliance

Figure 7 of Taxmann’s Your Queries on Companies Act, 2013

If any company contravenes any provision of these rules the company and every officer of the company who is in default shall be punishable with fine which may extend to ten thousand rupees and where the contravention is a continuing one, with a further fine which may extend to one thousand rupees for every day after the first during which such contravention continues.

[1] http://egazette.nic.in/WriteReadData/2017/179104.pdf

[2] http://egazette.nic.in/WriteReadData/2017/179105.pdf

[3] http://www.mca.gov.in/Ministry/pdf/Notice_29062017.pdf

[4] Either of ‘B’ or ‘C’ or ‘D’

Slaying the slain: the law about strike-off of companies

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsBy Nikita Snehil, (corplaw@vinodkothari.com)

Striking off of the names of companies for having remained inoperative has been a concept which has always been there, both under the 1956 Act, and under the 2013 Act. Striking-off of defunct companies is a provision in law for chopping the dead wood – if the company has lost its substratum, and there is nothing in the company, then the long process of winding up is not relevant for the company, and the RoC can strike off the name of the company as if the company never existed. Striking-off of companies is an option that exists both with the company, and with the RoC.

However, the recent massive clean-up operation, whereby RoCs started issuing public notices[1] in April, 2017 to strike off the name of the companies from the register of companies and to dissolve them unless a cause is shown to the contrary, within thirty days from the date of the notice, has come to centre of focus. Thereafter, on September 5, 2017 the government confirmed that names of over 2.09 lakh companies have been struck off from the Register of Companies for failing to comply with regulatory requirements.

There are several words which are doing rounds currently – defunct companies, shell companies, benami companies, and so on. They all mean completely different things. Defunct company is what the Companies Act talks about – a company which is left with no substance; it is either inoperative, or has no assets or liabilities. The word “shell company”, commonly used in tax parlance, refers to such companies which are merely a shell, that is, hiding the identity of the real owners. Obviously, the current environment of the drive against black money suggests that the word has been used to refer to companies which might have been used for money-laundering. The word benami company might have similar connotations.

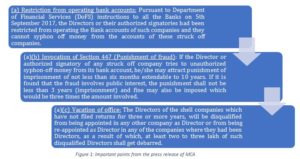

However, the Companies Act term “defunct” companies never really smelled about money laundering or a device to shield the identity of real owners. Therefore, over the years, the concept has been innocuous. In the current environment, however, the various expressions above have all been mixed up, as if to conclude that defunct companies were being used for money-laundering. If the company is really defunct, and there is no substance into it, it seems paradoxical to relate it to money laundering operations. The fact that there is no real asset or no real liability should mean that there is nothing in the company, including any evidence of untaxed wealth. However, the confusion between defunct companies and black money is quite evident in the MCA press release[2] issued on September 6, 2017 said that the action of the MCA “would not only help in checking the menace of black money” but would help the ease of doing business in India. The Press Release also sounded like a shock to the directors of such struck-off companies, as it said 3 important points:

This article endeavours to understand the provisions of the law about striking off of names of companies and the impact thereof on directors’ disqualifications.

Enabling provision of the law

As per Section 248 of the Companies Act, 2013 (‘Act’) which deals with the power of Registrar to remove name of company from register of companies:

“(1) Where the Registrar has reasonable cause to believe that—

(a) a company has failed to commence its business within one year of its incorporation;

(b) [omitted]

(c) a company is not carrying on any business or operation for a period of two immediately preceding financial years and has not made any application within such period for obtaining the status of a dormant company under section 455,

he shall send a notice to the company and all the directors of the company, of his intention to remove the name of the company from the register of companies and requesting them to send their representations along with copies of the relevant documents, if any, within a period of thirty days from the date of the notice.”

Therefore, though the public notice issued by the RoC stated the reference of Section 248 of the Act, it is pertinent to note that the said Section empowers the RoC to strike the names of the Companies only in two cases. But almost all the shell companies does not seem to have triggered any of the above two conditions.

Section 248 Vs Section 455 of the Act

Another section which empowers RoC to remove the name of a company from the register of members is Section 455 of the Act. As per the provisions of Section 455 of the Act, which deals with the provisions of dormant company:

“(4) In case of a company which has not filed financial statements or annual returns for two financial years consecutively, the Registrar shall issue a notice to that company and enter the name of such company in the register maintained for dormant companies.

(5) A dormant company shall have such minimum number of directors, file such documents and pay such annual fee as may be prescribed to the Registrar to retain its dormant status in the register and may become an active company on an application

made in this behalf accompanied by such documents and fee as may be prescribed.

(6) The Registrar shall strike off the name of a dormant company from the register of dormant companies, which has failed to comply with the requirements of this section.”

The section states the following procedure to be adopted by the the dormant company and the RoC:

(a) RoC may remove the name of an inactive company from the register of members and put the same in the register of dormant companies.

(b) The dormant company shall then comply with the requirements and retain its dormant status or make an application to become an active company.

(c) Thereafter, if the dormant company fails to comply with the requirements of the section, then the RoC can finally remove the name of such company from the register of dormant company as well.

However, in the current situation, the above mentioned procedure is not followed by the RoCs and names of the companies are directly struck off from the register of members.

Hence, there does not seems to be an enabling section under which the RoC has struck off the names of the companies.

Vacation of office of Directors

As per the Press release issued by MCA, the next move of MCA will be to compel the Directors of such shell companies which have not filed returns for three or more years to vacate the office.

Provisions of law:

Section 164 (2) of the Act, which deals with the disqualifications of appointment of directors, provides the following:

“No person who is or has been a director of a company which—

(a) has not filed financial statements or annual returns for any continuous period of three financial years; or

(b) has failed to repay the deposits accepted by it or pay interest thereon or to redeem any debentures on the due date or pay interest due thereon or pay any dividend declared and such failure to pay or redeem continues for one year or more,

shall be eligible to be re-appointed as a director of that company or appointed in other company for a period of five years from the date on which the said company fails to do so.”

Further, Section 167(1)(a) of the Act directs that the office of a director shall become vacant in case he incurs any of the disqualifications specified in section 164 of the Act.

Therefore, reading both the sections, it can be concluded that, the directors of such companies will:

1. have to vacate their office, due to the disqualification incurred;

2. not be able to be re-appointed as a director of that company;

3. not be eligible to be appointed in any other companies as well.

The second and third effect will last upto a period of five years from the date on which the said company fails comply with the provisions of section 164 (2) of the Act.

Having said so, there arises a further question:

‘Does disqualification to section 164(2)(b) of Act will also apply to directors newly appointed in the company?’

It is important to note the starting lines of section 164(2)(b), which read as follows:

“No person who is or has been a director of a company which xxX”

Thus, to attract disqualification under section 164(2)(b), it is important that the individual has to be on the board of the company when the default actually happened.

Therefore, even new directors of such company will attract the disqualification, inspite of the fact that they were not at all involved in such non-compliance. Basically, the intent of law might be to deter companies from defaulting, which would demotivate any new director to join the company.

Applicability of the law – prospective or retrospective?

Sections 164 and 167 came into force on April 1, 2014. However, the disqualifications under Section 164 (2) cannot become applicable as on April 1, 2014 for any annual filings not done in any of the previous financial years. The provisions were initially inapplicable to private companies. Section 164 (2) curtails the right of directors of such companies to continue as directors, casts a new burden, imposes a new liability on such directors for having defaulted in filing financial statements for any 3 continuous financial years.

It was discussed in the Supreme Court Judgment in case

of Maharaja Chintamani Saran Nath … vs State Of Bihar And Ors on 7 October, 1999[3] that the true principle is that Lex prospicit non respicit (law looks forward not back). As Willes, J. said, retrospective legislation is `contrary to the general principle that legislation by which the conduct of mankind is to be regulated ought, when introduced for the first time, to deal with future acts, and ought not to change the character of past transactions carried on upon the faith of the then existing law.

However, in the recent case law of “Vikram Ahuja Vs. Greenstone Investments Pvt. Ltd. and ors., before the NCLT, Mumbai Bench, decided on November 11, 2016”[4], one of the point for discussion and decision before the Hon’ble bench was:

“whether the disqualification set forth in Section 164(2)(a) read with 167(1) (a) of the Act has retrospective effect or not?”.

The Hon’ble Tribunal, after considering various case laws considered that “this provision has to be read as applicable to the situations where non-filing has started, at the most in the past and continuing while this enactment has come to into existence and also to future non-filing”. Also, it has been provided that, the statute providing posterior disqualification on past conduct does not become a retrospective one because a part of a requisition for its action is drawn from a time antecedent to its passing.

Therefore, the applicability of the Section, whether retrospective or prospective is still debatable.

Legal position of the company after strike-off

By virtue of a legal process, a company is born as a separate legal entity, so is its death process. In case of dissolution of a company pursuant to the company’s name being removed from the Register by the ROC in terms of Section 248 of the Act, the corporate status of an entity ceases to subsist, its functionality stops and for all practical purposes corporate activities come to an end.

Liability of directors

The pertinent question that arises here is that whether the liability of directors and other officers of the company struck off from the records will continue and whether it could be enforced. The answer to this is yes.

The relevant clause of Section 248 of the Act provides the followings:

“(7) The liability, if any, of every director, manager or other officer who was exercising any power of management, and of every member of the company dissolved under sun-section (5), shall continue and may be enforced as if the company had not been dissolved.”

Accordingly, it can be drawn that notwithstanding the company’s dissolution, the liabilities of its directors and officers who exercised powers along with its members continue, remain unaltered and enforceable. However, the dissolution does not makes any enhancement to the enforcement of the liabilities affecting the personal capacity of the abovementioned persons.

A view can be taken that the dissolution under section 248 is not a state complete extinction. Instead it is a state of suspension for a period of twenty years from the date of dissolution, as upon the revival of the company, all its rights and liabilities are restituted with retrospective effect from the date of strike-off.

Assets of the company

Another concern for a company whose name has been struck-off by the ROC is that there may be properties and rights vested in or held on trust for the company, cash balances of the company and other current or non-current assets of the company while it was functional. The fate of such assets is a question to be addressed.

Section 352(2) and 352(7) of the Act deals with the unclaimed or undistributed estate of a company, but these sections becomes applicable where there is a liquidator involved in winding up of a company. In case a company is dissolved in pursuance of Section 248, there is no liquidator appointed. Hence, the operative part of Section 352 is not applicable in the dissolution of a company under Section 248.

A reference can be drawn from the Companies Act of England, which has a provision stating that the property of dissolved company shall be bona vacantia. The Escheat over which no one has a claim is known as bona vacantia. The term can be expressed as ‘abandoned property’ too. In bona vacantia there is no owner of the property and the State merely takes possession of the property, which is an abandoned one. In India there is no such corresponding provision in the Act. However, as per the laws in India, the property of an estate dying without leaving lawful heirs passes to the government by escheat or as bona vacantia. Similarly, it can be inferred that the property of a dissolved company shall also pass to the government by escheat or as bona vacantia, including any subsisting interest of the company on the date of dissolution.

Though, it can be established that the doctrine of bona vacantia will be applicable for a company dissolved under section 248, however, whether the same shall come into operation immediately or after a lapse of the prescribed time period of twenty years is a debatable matter.

Effect of company notified as dissolved

As per Section 250 of the Act, where a company stands dissolved under section 248, it shall on and from the date mentioned in the notice issued by RoC in the Official Gazette, shall cease to operate as a company and the Certificate of Incorporation issued to it shall be deemed to have been cancelled from such date except for the purpose of realising the amount due to the company and for the payment or discharge of the liabilities or obligations of the company.

Recent judgements:

NCLT, at its hearing of Principal Bench at New Delhi, on March 14, 2017, in the case of Poly Auto System Pvt. Ltd. Vs. RoC Delhi[5], held that the Registrar of Companies has to comply with the comprehensive procedural obligations before passing the final order of striking off the name of the company from the register of members. The casual approach of the RoC which would lead to abrupt conclusion will not be a legal act. And the Tribunal ordered for restoration of the name of the Company in the register of members.

Similarly, the present act of the government of striking off the names of more than 2 two lakh companies, seems not to consider the post effect of such dissolution.

So, it will be interesting to see how the assets and liabilities of the companies will be managed – will there be appointment of any liquidator? How will the liabilities of the creditors will be discharged? Will the balances of the cash rest with the government? These are the few questions which will have to be addressed by the government in the due course.

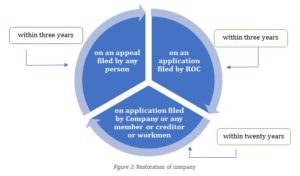

Remedial Action

Section 252 of the Act empowers the Tribunal, to pass an order for the restoration of company which has been struck off by the ROC, in the following manner:

(a) Appeal filed by any person:

Any person aggrieved by the order of the RoC may file an appeal before the Tribunal within 3 years of the order passed by RoC and if the Tribunal is of the opinion that the removal of name of company is not justified in view of the absence of any of the grounds on which the order was passed by the ROC, it may pass an order for restoration of the name of the company in the register of companies after giving a reasonable opportunity of making representations and of being heard to the ROC, the company and all the persons concerned. The genuine companies, which have been struck off, will move to file an appeal to the NCLT in this case.

(b) Application filed by ROC:

The ROC may, within a period of three years from the date of passing of the order dissolving the company under section 248, file an application before the Tribunal seeking restoration of name of such company if it is satisfied that the name of the company has been struck off from the register of companies either inadvertently or on the basis of incorrect information furnished by the company or its directors. Genuine companies may make representations to prove their innocence or bonafide reason of such non-filings, pursuant to which RoC may on valid reasons but within a period of three years, restore the name of such companies.

(c) Application filed by company or any member or creditor or workmen:

The Tribunal, on an application made by the company, member, creditor or workman before the expiry of 20 years from the publication in the Official Gazette of the notice of dissolution of the company, if satisfied that:

1) the company was, at the time of its name being struck off, carrying on business or in operation; or

2) b) otherwise it is just that the name of the company be restored to the register of companies,

may order the name of the company to be restored to the register of companies. Further, the Tribunal may also pass an order and give such other directions and make such provisions as deemed just for placing the company and all other persons in the same position as nearly as may be as if the name of the company had not been struck off from the register of companies.

Therefore, in the present situation, it will be best for the genuine companies to make representations/ applications to the RoCs proving that the companies are not involved in any fraudulent activities or involved in syphoning of funds through illicit activities. The representations/ applications may convince the RoC to restore the names of the genuine companies.

[1] http://www.mca.gov.in/MinistryV2/roc.html

[2] http://pib.nic.in/newsite/PrintRelease.aspx?relid=170579

[3] https://indiankanoon.org/doc/1293868/

[4] http://nclt.gov.in/Publication/Mumbai_Bench/2016/397_398/Greenstone%20Investments%20Pvt.%20Ltd.%2022.11.2016_.pdf

[5] http://nclt.gov.in/interim_orders/principal/14.03.2017/Poly%20Auto%20Systems%20Pvt.%20Ltd..pdf