Grey Areas under CODS- 2018 & FAQs

/0 Comments/in Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsCOMPARATIVE ANALYSIS OF AMENDMENTS TO INVIT’S AND REIT’S REGULATIONS, 2017

/0 Comments/in Alternative investment Vehicles, Financial Services, Housing finance, SEBI /by Vinod Kothari ConsultantsBy Saloni Mathur & Kirti Sharma , (finserv@vinodkothari.com)

The SEBI in its Board Meeting on 18th September, 2017[1] approved several changes to the regulations issued for REITs.

The recent amendments by way of Securities and Exchange board of India (Infrastructure Investment Trusts) (Amendment) Regulations, 2017[2] and the Securities and Exchange board of India (Real Estate Investment Trusts) (Amendment) Regulations, 2017[3] has brought about several changes in the existing regulations, which are the necessary incorporations to the changes that were proposed in the board meeting held on September 18th, 2017. SEBI in its Board Meeting made certain amendments to the SEBI (infrastructure Investment Trusts) Regulations, 2014 and SEBI (Real Estate Investment Trusts) Regulations, 2014 (referred to as ‘REIT Regulations’).

Defaulting Companies Celebrate New Year With CODS-2018

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsMCA attempts to realign RPTs with Listing Regulations

/0 Comments/in Corporate Laws, SEBI /by Vinod Kothari ConsultantsBy Vinita Nair (corplaw@vinodkothari.com)

Companies will have a tough time in complying with ever changing provisions relating to RPTs. In view of several recommendations made in the Company Law Committee report (CLC Report) dated 1st February, 2016, Companies (Amendment) Bill, 2016 (Bill, 2016) was introduced in Lok Sabha on 16th March, 2016[1], 37th Standing Committee Report of December, 2016 and Companies (Amendment) Bill, 2017 (Bill, 2017) as passed by both Houses of Parliament. .

Key concerns relating to RPTs that were discussed in the CLC Report:

- Companies incorporated outside India (such as holding/ subsidiary/ associate / fellow subsidiary of an Indian company) were excluded from the purview of related party of an Indian company;

- Lack of clarity among stakeholders on the extent of responsibility entrusted to the Audit Committee, and whether Audit Committee has been specifically mandated to approve or modify all related party transactions;

- Absence of provision enabling Audit Committee to ratify RPTs entered into by the companies;

- Inconsistency with provisions under SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (Listing Regulations) with respect to transaction between holding company and its wholly owned subsidiaries;

- Misinterpretation of MCA Circular no. 30/ 2014 clarifying the requirements of second proviso to section 188 (1) and need to withdraw the same;

Proposed amendments in Companies (Amendment) Bill, 2017

This article analyses the amendments proposed and whether same bridges the gap between the provisions of Listing Regulations and Act, 2013.

Definition of related party

With the intent to capture companies incorporated outside India within the purview of meaning of related part, words ‘any company’ reflecting in clause (viii) of sub-section (76) of section 2 of Act, 2013 was substituted with ‘any body corporate’ in Bill, 2016. The revised provision read as under:

“(viii) any body corporate which is –

(A) a holding, subsidiary or an associate company of such company;

(B) a subsidiary of a holding company to which it is also a subsidiary;

(C) an investing company or the venturer of a company”

Instead of replacing ‘company’ with ‘body corporate’ in the aforesaid clause, the correct amendment would have been inserting an explanation similar to explanation (c) to section 2 (87) in the definition of associate company under section 2 (6) of Act, 2013. In the absence of the same, the term ‘associate company’ cannot include associates incorporated outside India.

In case of a subsidiary and holding company, by virtue of explanation (c) to section 2 (87), company includes a body corporate. However, if the intent was to make it absolutely clear, an explanation similar to explanation (c) aforesaid could be inserted in section 2 (46).

Bill, 2016 further proposed to insert a new sub-clause to cover ‘investing company’ or ‘venturer of a company’ within the ambit of related party. The intent was to cover upstream entities, i.e. the companies making investment, within the ambit of related party. The current definition of ‘associate company’ regards the entity in which the investment is made, as a related party. For example A Ltd exercises significant influence over B Ltd. Therefore, B Ltd is a related party of A Ltd but vice versa is not true. However, by virtue of the proposed amendment A Ltd (the investing company) will be regarded as related party to B Ltd. But there was a huge gap as the proposed amendment in Bill, 2016 had the possibility of leading to an understanding that every investing company (even if investing 1-2%) will be a related party. This certainly was not the intent for the amendment.

Similarly, definition of associate company includes a joint venture company. As explained above, the intent is to cover upstream entities. Therefore, the term ‘venturer of a company’ means the company investing in the joint venture and not fellow-venturer. For example A Ltd & B Ltd formed a joint venture entity C Ltd. C Ltd is a related party of A Ltd ( vice versa not holding being true), however, A Ltd & B Ltd are not related parties. By virtue of proposed amendment, A Ltd being the venture will be a related party of C Ltd. The manner in which the sub-clause (C) has been worded may lead to confusion that the fellow-venturer is also a related party.

Bill, 2017 inserted an explanation in Section 2 (76) to bridge the gap to the following effect:

“Explanation- For the purpose of this clause, “the investing company or the venturer of a company” means a body corporate whose investment in the company would result in the company becoming an associate company of the body corporate.”

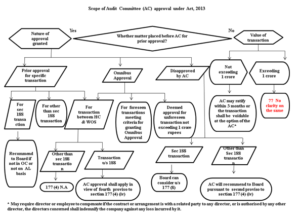

Scope of Audit Committee in approving RPTs

Section 177 of Act, 2013 specifies the scope of Audit Committee with respect to approving the transactions entered into with related parties and subsequent modifications thereof. The reason behind the same is that the Audit Committee comprises of majority of independent directors i.e. disinterested members of the Board. The transactions for which Audit Committee approval needs to be obtained, are not limited to those specified under section 188 (1) (a) to (g) but all transactions entered into with the related parties specified under section 2 (76). In case of listed entities, the scope expands to all related parties under section 2 (76) and applicable accounting standards (i.e. AS18 or IND-AS 24 as the case may be). While section 177 does not specifically mandate prior approval, the CLC report has clearly specified that the existing requirement to pre-approve all RPTs should continue.

Bill, 2017 proposes to insert a proviso in section 177 (4) (iv) mandating Audit Committees to submit its recommendation to the Board on such transactions, other than transactions referred to in section 188, where Audit Committee does not approve the same. Transactions entered into under section 188 (1) that are not in the ordinary course of business and/or not on arm’s length basis anyways require prior approval of Board by virtue of section 188 (1).

As evident from the proposed amendments to Section 177, there seems to have a vertical distinction made in relation to transactions covered under section 188 and those not covered under the same. Power to ratify transactions have been granted only for any transaction involving any amount not exceeding 1 crore rupees. This seems to be contradicting with the provisions relating to omnibus approvals, as provided under proviso to sub-rule (4) of Rule 6A of Companies (Meetings of Board and its Powers) Rules, 2014 as reproduced hereunder:

“Provided that where the need for related party transaction cannot be foreseen and aforesaid details are not available, audit committee may make omnibus approval for such transactions subject to their value not exceeding rupees one crore per transaction.”

The proviso above grants a deemed omnibus approval for such transactions. Why will the need to ratify such transactions from Audit Committee ever arise? While the intent was to address the concern of possible misuse of the flexibility to ratify transactions within 3 months from the date of transaction, the committee recommended prescribing an upper threshold of 1 crore rupees. However, the same appears to be inconsistent with the existing provisions of the Act, 2013. If the said ratification is not obtained, such transaction shall be voidable at the option of the Audit Committee and if the transaction is with the related party to any director or is authorised by any other director, the director concerned shall indemnify the company against any loss incurred by it.

Further, what will be the fate of RPTs exceeding value of Rs. 1 crores, not placed before Audit Committee for prior/ omnibus approval remains unanswered. In case Audit committee disapproves any transaction, the Board may still consider approving the same subject to ensuring compliance of section 177 (8).

Approval in case of transaction between holding company and WOS

Listing Regulations as well as erstwhile Clause 49 exempted the transaction between holding company and its wholly owned subsidiary[2] from the requirement of obtaining prior approval of Audit Committee and shareholder’s approval in case of same being material RPTs. Provisions relating to granting of omnibus approvals, in order to align the provisions with Clause 49/Listing Regulations, were inserted vide Companies (Amendment) Act, 2015 and were enforced with effect from 15th December, 2015. However, corresponding exemption in case of transactions between holding company and its wholly owned subsidiary were not provided under Section 177 (4) (iv).

Bill, 2017 has made an attempt to exempt such transactions by way of inserting the following proviso:

“Provided also that the provisions of this clause shall not apply to a transaction, other than a transaction referred to in section 188, between a holding company and its wholly owned subsidiary company.”

The insertion seems to provide that transactions between holding company and wholly owned subsidiaries that are entered into under section 188 (1) still require approval of the Audit Committee by virtue of omnibus or specific approval. Exemption granted for transactions between holding company and wholly owned subsidiary under Section 188 (1) does not exempt from the requirements of obtaining approval of Audit Committee under Section 177. The proposed amendment will fail to fill the gap in the provisions as compared to Listing Regulations.

Scope of approval of Audit Committee under Act, 2013 is presented below in the form of a flowchart:

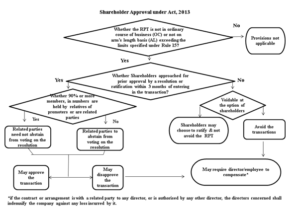

Shareholder’s approval for RPTs moves to majority of minority regime

Transactions specified under section 188 (1) (a) to (g) entered into not in the ordinary course of business and/or not on an arm’s length basis will require prior approval of shareholders in case such transactions exceed the amounts specified under Rule 15 of Companies (Meetings of Board and its Powers) Rules, 2014 as amended from time to time.

In case of shareholders approval obtained under Clause 49/ Reg. 23 of Listing Regulations, all related parties are required to abstain from voting on such resolutions. However, in case of approval obtained under section 188 it was clarified by virtue of MCA Circular no. 30 of 2014 dated 17th July, 2014 that related parties who are parties to such contracts being approved, shall abstain from voting. The proposed insertion as well the recommendation in the CLC report clarifies that the intent always was to mandate all related parties to abstain from voting. Accordingly, Bill, 2017 proposes a carve out by exempting companies in which ninety percent or more members, in numbers, are relatives of promoters or are related parties, from complying with the said requirements. The objective is to remove the difficulty faced by closely held public companies while obtaining approvals for such transactions.

The proposed amendment will lead to interesting scenarios, as discussed below:

Case 1 – Shareholding pattern of A Ltd comprises of B Ltd holding 91% of paid up capital and 100 shareholders holding remaining 9% of paid up capital.

In this case, since B Ltd does not hold majority of shares in numbers, the ones holding 9% of paid up capital will decide the fate of the RPTs. If they choose to block the RPTs, there is no way to get the same approved unless the RPT is in ordinary course of business and on arm’s length basis.

Case 2 – Shareholding pattern of X Ltd comprises of Mr. Y (promoter) along with one of his relative holding 91% of paid up capital and Z Ltd (an unrelated entity) holding 9% of the paid up capital.

In the instant case, Mr. Y and his relative need not abstain from voting on the transaction as they hold majority of shares in numbers.

While numerical majority has always been considered in cases such as amalgamations and mergers, but RPTs involves a far more frequent exercise of majority wishes than a corporate restructuring. Is it worthwhile that even with over 90% shareholding strength, the majority cannot have its way? There are several situations where the minority may use this as a power of blackmail. On the contrary the ends of justice are better served by the minority giving the right to seek redressal under oppression relief provisions. After all companies have to continue to run based on shareholding majority.

Private and Government companies remain exempt

MCA exemption notification dated 5th June, 2015 exempted private companies from complying with the second proviso to section 188 (1). By virtue of similar notification dated 5th June, 2015 government companies are exempted from the requirement of complying with first and second proviso of section 188 (1) in following cases:

- a) in respect of contracts or arrangements entered into by it with any other government company;

- b) in respect of contracts, other than those covered above, entered into by unlisted government company by obtaining prior approval of the Ministry or Department of the Central/ State government which is administratively in charge of the company.

However, no exemption has been provided under Section 177 for approval of Audit Committee or under section 188 (1) from obtaining approval of the Board.

Power to ratify by the Shareholders

Lastly, Bill, 2017 provides an option to the shareholders to regard such contracts or arrangement as voidable, that are entered into by a director or any other employee, without obtaining prior approval by way of a resolution under sub-section (1) or without getting the same ratified within three months from the date of entering into such contracts. The proposed amendment fills the gap that existed in case of RPTs for which prior approval or ratification was not obtained. It seemed improper to grant the power to the Board to ratify the same.

Scope of approval by shareholders has been presented below in the form of a flowchart.

Amendment proposed in Listing Regulations in UKC Report[3]

Report of the Uday Kotak Committee on Corporate Governance issued on October 5, 2017 proposed following amendments in Listing Regulations in relation to RPTs:

Disclosure Requirement:

- Half yearly disclosure of RPTs on a consolidated basis, in the disclosure format required for RPT in the annual accounts as per the accounting standards, on the website of the listed entity within 30 days of publication of the half yearly financial results. Copy of the same to also be submitted to the stock exchanges.

- The annual report shall include disclosure of transactions of the listed entity with any person or entity belonging to the promoter/promoter group which hold(s) 10% or more shareholding in the listed entity, in the format prescribed in the relevant accounting standards for annual results;

Definition

- Insertion of a proviso that any person or entity belonging to the promoter or promoter group of the listed entity and holding 20% or more of shareholding in the listed entity shall also be a related party:

Approval

- All material related party transactions shall require approval of the shareholders through resolution and no related party shall vote to approve such resolutions whether the entity is a related party to the particular transaction or not.

Materiality in case of brand usage or royalty

- a transaction involving payments made to a related party with respect to brand usage or royalty shall be considered material if the transaction(s) to be entered into individually or taken together with previous transactions during a financial year, exceeds five percent of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity.

Conclusion

While MCA has made a decent attempt to align the provisions of Section 188 with that of Listing Regulations, Bill 2017 does not ensure absolute alignment and leaves few gaps unfilled. In the meantime, SEBI is in the process of inching forward by imposing stricter restrictions on listed entities.

[1] http://www.prsindia.org/billtrack/the-companies-amendment-bill-2016-4232/

[2] whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval

SEBI asks companies to strengthen controls on handling of UPSI

/0 Comments/in Companies Act 2013, Corporate Laws, SEBI /by Vinod Kothari Consultantsby CS Vinita Nair, (corplaw@vinodkothari.com)

Preamble

SEBI framed SEBI (Prohibition of Insider Trading) Regulations, 2015 (the Regulations) to combat the wrong of trading in securities with the advantage of having asymmetrical access to unpublished information which when published would impact the price of securities in the market. Originally framed in 1993 and thereafter, replaced with revised regulations in 2015.

The Regulations mandates listed entities to frame Code of Conduct for Prohibition of Insider Trading and Code of Fair Disclosure. The Code of Conduct is for all employees and connected persons to adhere and comprises of requirement of pre-clearance of trade, disclosure of trade, prohibition to trade when the trading window is closed, restriction on contra trade and reporting of violations to SEBI and taking disciplinary action against those who violate the Code of Conduct. In order to ensure successful implementation of Code of Conduct, it is of utmost importance to sensitize the employees about the requirements of the Regulations and the Code of Conduct, what is expected out of them, what are the Do’s and Don’ts that such employees and connected persons are required to adhere to. Additionally, the Compliance officer is also expected to carry out timely reporting to Chairman of Audit Committee/ Board, maintain grey list, ensure the employees update the list of immediate relatives, ensure that action is taken against those who violate the Code.

SEBI order in case of Axis Bank

SEBI vide order dated December 27, 2017[1] issued directions to Axis Bank Ltd in respect of leakage of UPSI relating to financials through social networking thereby requiring Axis Bank Ltd to submit information regarding the processes controls that it has in place regarding handling of UPSI. This is relevant for all other listed entities as preparing of periodic financials is a regular phenomenon and is definitely an UPSI. SEBI attributed such leakage to the inadequacy of the processes / controls / systems that Axis bank as a listed company had put in place. SEBI stressed on the fact that while procurement or communication of UPSI by any person is identified as a violation of regulation 3 of PIT Regulations and section 12A(e) of the SEBI Act, it becomes incumbent upon every listed company to put in place.

SEBI ordered Axis Bank to strengthen its processes/ systems/ controls to ensure such instance is not repeated in future and to conduct an internal inquiry into the leakage of UPSI and take appropriate action against those responsible for the same, in accordance with law. The scope of enquiry prescribed included but not limited to determination of the possible role of following persons in relation to the aforesaid leakage of UPSI:

- Persons / members of committees involved in generation of the original data for the purpose of determination of key figures pertaining to financial figures including GNPA, NNPA, NIM, Slippage, Write-off, CASA, etc.

- Persons involved in the consolidation of the figures for the financial results.

- Persons involved in the preparation of board notes and presentations.

- Persons involved in dissemination of information relating to financial results in the public domain.

- Any other persons who had access to the information.

SEBI provided a timeline of 3 months from the date of order and asked to file a report to SEBI within 7 days from completion.

In the past, in case of Palred Technologies Limited[2], SEBI had charged a facebook ‘mutual friend’ whose trading pattern was found in deviation from the established trading pattern and when he could not reply to specific details sought by SEBI.

What’s in store for others

There is definitely a need for all other listed entities to revisit and ensure the sanctity of its own controls and processes in relation to handling of UPSI. The extent to which the employees have been sensitized will determine the effectiveness of the processes and controls. Needless to say, any such instance affects the credibility and reputation of the listed entity.

All the listed entities frame the two codes required under the Regulations, put up FAQs on the intranet and monitor the trading of the designated persons and other connected persons. But it is very essential to test the effectiveness, to re-visit, to sensitize the employees again and again, to make them aware of the repercussions of violating the Regulations or the Code.

Areas to sensitize

- Educating all insiders about the sensitivity of information and the need to restrict disclosures on “need to know” basis;

- Educating all such executives who deal with sensitive information to ensure strictest confidentiality;

- Ensuring that there is adherence to Company’s internal code/protocol while speaking to press/public forums;

- Ensuring that trading in securities of any other company, in respect of whom the company’s executives have UPSI, is barred;

- Ensuring that the investment team/investment committee/ research desk of the company has “chinese wall” protection from such team as may have UPSI in relation to clients;

- Ensuring that trading by all employees in company’s securities are disclosed, if such trades are in excess of the stipulated amount every quarter;

- Ensuring that DPs are aware of closure of trading window;

- Ensuring that DPs take prior approval for any trading while trading window is open;

- Ensuring that DPs are aware of contra trade restrictions;

- Ensuring that flow of information is clear from the respective HoDs to the compliance officers for maintenance of grey/ restricted list;

- Educating on the requirement to have differential closure of trading window depending on the nature of UPSI and manner in which information is to flow;

- For eg. the M&A team must be aware about likelihood of any acquisition and deal dynamics even before it is put up before the Board or Committee for sanction. The trading window for such team cannot commence at same time when the window is closed for those preparing board notes, agenda etc. The closure for them will commence earlier and this will be required to be communicated by the respective HoD to the compliance officer.

What should the SOP cover?

A Standard Operating Procedure (SOP) may be separately framed to implement to Codes under the Regulations or this may be incorporated in the Code itself. Apart from the introduction and provisions of law, the SOP should cover following:

| Parameter | Points to be covered |

| Dealing in securities | · The employees shall be informed about period when the employee including his/her Immediate Relatives shall not trade;

· The employee shall be required to seek permission of respective HoD or Compliance Officer before sharing of an UPSI for legitimate purpose/ on a ‘need to know basis’ i.e. for performance of duty or discharge of legal obligations. While seeking permission, the need to know requirement shall be justified. Till receipt of sanction, the information shall not be shared. · The HoD/ Compliance Officer sanctioning such a requirement may mandate entering of NDA and any other compliance arising under the Code for such designated person. |

| Updating information | · The listed entity shall provide a robust system to ensure timely updation of list of immediate relatives by designated persons, online application for pre-clearance, reporting of trade, submitting disclosure, seeking permission for sharing of UPSI for legitimate purposes in order to do away with the excuse of not being able to send information on time;

|

| Period of Trading Window closure | · It is not relevant whether the intimation of trading window closure is given to stock exchange or not. The closure is for the insiders and not outsiders. Therefore, the Code/ SOP should clearly specific tentative period when the trading window shall remain closed.

· The Compliance Officer in consultation with executive director shall have the power to decide and close the trading window for any other period during which certain identified employees shall be prohibited from trading in securities of the Company or any other company of which such employees is expected to have access to UPSI. · The period of closure shall be informed to the employees by way of intranet and/or email. The email should mandate a read receipt. |

| Pre-clearance and Reporting of Trade undertaken | · The employees shall be sensitized about the requirement to seek pre-clearance and also to report the trade undertaken pursuant to such trade.

· When the trade is reported, immediately an email can be sent intimating about the contra trade restrictions. · Instances when a waiver will be granted should be adequately captured in the Code and also sensitized to employees. · The RTA should also be given the details of PAN of the designated employees to be able to pull out the beneficiary position of such DPs separately in order to track the change in holding of shares. |

| Responsibility of Compliance Officer | · The Compliance Officer shall sensitize the employees on recent orders, informal guidance given by SEBI in simplified manner;

· The Code shall provide the option to contact the Compliance Office in case of any doubt/ confirmation in relation to Regulations to ensure that employees don’t sleep walk into non-compliance. · Regular tracking of trades by employees, issuance of warning letters, periodic internal reporting, taking disciplinary action and informing SEBI of violation of Code by DPs. |

| Chinese Wall mechanism | · The access to those departments that are expected to be in possession of UPSI should be restricted;

· Within such departments, use of cell phones/ gadgets which could potentially aid in sharing UPSI should be avoided; · The documents/ records/ systems storing UPSI should be stored with password protection or other security feature that the entity adopts in general; · Strict instruction shall be given in relation to manner of handling of such records for legitimate purpose till the particular UPSI becomes a generally available information. |

Conclusion

Unlike other SEBI Regulations, this Regulation is required to be complied by the listed entity as well as its employees and connected persons. Therefore, the onus is on the listed entity to sensitize, facilitate, monitor and report.

[1] https://www.sebi.gov.in/web/?file=../../../sebi_data/attachdocs/dec-2017/1514383873200.pdf#page=1&zoom=auto,-22,842

[2] https://www.sebi.gov.in/sebi_data/attachdocs/1454682584239.pdf

Secretarial Standards 3 – a voluntary guideline for companies!

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari Consultants-By Megha Saraf (corplaw@vinodkothari.com)

Introduction

The Institute of Company Secretaries of India (“ICSI”) vide its earlier notification had brought an exposure draft on Secretarial Standards-3 (“SS-3/Standards”) on Dividend which was put forward for public comments. After considering the suggestions/comments received on the draft, ICSI has finalized the Standard and has made it enforceable from 1st January, 2018. Although, SS-3 is getting enforced, however being voluntary in nature the question of adopting the same is uncertain by the companies.

This article is an attempt to jot down the major highlights of the Standards covering its scope which shall present an idea on the list of compliance for a company.

Applicability

The Standard is applicable on all companies except a company limited by guarantee and a company declaring dividend under liquidation.

Major highlights of the Standards

- Dividend to be declared only once the deposits accepted under the Act has been repaid with interest, debentures and preference shares issued have been redeemed with interest, term loan with any bank or financial institution have been repaid with interest.

Hence, companies may be able to declare dividend only once they have met all their liabilities towards other security holders.

- The Standard specifically exempts Government companies from complying with the conditions laid down for declaring dividend where there are inadequate profits or no profits in the company provided the entire paid up share capital is held by the Central Government or State Government(s) or jointly by both. Further, such exemption has been made in line with the exemption provided under the Companies Act, 2013 (“Act, 2013”).

Further, the Standard also exempts Government Companies from the condition of depositing the dividend amount in a separate bank account within 5 days of its declaration. However, it does not exempt such Government Companies from the condition of paying dividend to the shareholders within 30 days of the declaration.

Therefore, such exemption has been made in line with the exemption provided under the Act, 2013 to the Government Companies.

- The Standard prohibits declaration of dividend by any Committee or by resolution by circulation except by the Board at a Board Meeting.

Considering that the decision of declaring dividend is one of the major decisions for a company which is ultimately correlated to the shareholders of the company, it is utmost important for the Board of Directors of a company being at the top most hierarchy of a company after the shareholders, to think twice before taking such decision.

Therefore, the provision may be said to empower only the board members to take such informed decision after following a lengthy discussion compared to any Committee or merely passing it through resolution by circulation.

- The Statement containing details of the Members whose dividend has remained unpaid or unclaimed required to be maintained by a company was earlier required to be maintained and updated by the company on a quarterly basis.

However, considering the tediousness of the work and suggestions made by the stakeholders, ICSI has left the timeline for such updation on the convenience of the company itself without prescribing for quarterly review.

Provisions relating to Investor Education and Protection Fund (“IEPF”)

Almost after an year, Ministry of Corporate Affairs (“MCA”) and the Depositories have made effective the transfer of shares to IEPF by issuing operational guidelines and filling up the technical gaps that was present in the earlier notifications brought in by the MCA w.r.t IEPF. For the purpose of effecting transfer of shares to IEPF, the foremost criteria is that dividend on the underlying shares must have remained unpaid and unclaimed for a period of 7 consecutive financial years.

Although, the provisions of the Standards has been kept aligned with the provisions of the Act, 2013 and IEPF (Accounting, Audit, Transfer and Refund) Rules, 2016 (including any amendment made thereto), there are still certain major loopholes in the provisions of the Standards which can be said cumbersome for a company intending to comply with the provisions of the Standard voluntarily. One such loophole is the requirement of sending individual notices to the Members before transferring any unpaid or unclaimed dividend atleast 3 months’ before the due date for such transfer.

Where on one side the provisions of IEPF (Accounting, Audit, Transfer and Refund) Rules, 2016 mandates for giving notice to those Members whose underlying shares are liable for transfer on which dividend has remained unpaid or unclaimed for 7 consecutive years, the provisions of the Standard provides for giving notice to the Members before transferring any unclaimed or unpaid dividend to the IEPF.

Thus, the provision of the Standard seems to be cumbersome for companies to follow requiring them to give notice every year before transferring any unpaid or unclaimed dividend to the IEPF.

Additional compliance for Listed companies

The Standard where on one side is a voluntary guideline for companies, it also mandates certain additional compliance on the part of listed companies alongwith the compliance of other laws applicable on such listed company such as SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“LODR Regulations, 2015”). Some of the additional compliance mentioned under the Standards provides that:

- Equity shares allotted by a company shall rank pari passu alongwith the existing equity shares in the company for the purpose of payment of dividend.

- Prior intimation to the Stock Exchange of the Board meeting in which dividend is supposed to be recommended or declared.

- Prior intimation to the Stock Exchange of the record date fixed for the purpose of payment of dividend.

- Recommendation/ declaration of dividend prior to the record date fixed for the purpose

- Intimation about the outcome of the Board meeting, in which dividend is recommended or declared, to the Stock Exchange.

- Formulation of Dividend Distribution Policy by top 500 companies based on market capitalization.

- Disclosure of the dividend payment date in the Corporate Governance Report.

It is to be noted here that the above stated compliance as said to be additional for a company are nothing but mandatory compliance for any listed company in terms of the provisions of LODR Regulations. Thus, it can be said that the above mentioned compliance are nothing but re-iteration of the provisions of LODR Regulations, 2015 which are mandatory to be followed by a listed company and therefore are not burden for a company.

Conclusion

Though ICSI has made the Standards effective from 1st January, 2018, compliance of the same is a voluntary practice for any company. Further, as the major provisions of the Standards has been kept aligned with the provisions of other laws such as the Act, 2013 or the LODR Regulations, 2015, the provisions of the Standards does not make compliance a tedious work for a company.

Therefore, compliance with the provisions of the Standards shall indirectly lead a company as a well-compliant company in terms of mandatory laws.

FAQs on Layers of Subsidiaries

/0 Comments/in Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsICSI’s Golden Jubilee Release-Governance Code for Charitable Entities

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsBy Dipanjali Nagpal (corplaw@vindokothari.com)

The Institute of Company Secretaries of India has released the Code for Charity Governance[1] at the 45th National Convention of Company Secretaries to bring about charitable entities within the ambit of good governance as envisioned by the Hon’ble Prime Minister Shri Narendra Modi for empowering the nation. Read more →

Defaulting LLPs under the radar of MCA – Clean India Drive Continues!

/0 Comments/in Companies Act 2013, MCA /by Vinod Kothari ConsultantsBy Smriti Wadehra, (corplaw@vinodkothari.com)

The recent massive clean-up operation of Ministry, whereby RoCs started issuing public notices in April, 2017 to strike off the name of the companies from the register of companies and to dissolve them unless a cause is shown to the contrary, within thirty days from the date of the notice, has come to centre of focus. Thereafter, on September 5, 2017 the government confirmed that names of over 2.09 lakh companies have been struck off from the Register of Companies for failing to comply with regulatory requirements and was decided that the Directors of such shell companies which have not filed returns for three or more years, will be disqualified from being appointed in any other company as Director or from being reappointed as Director in any of the companies where they had been Directors, thereby compelling them to vacate office. It has been reported that as a result of this exercise, at least two to three lakh of such disqualified Directors has been debarred and Roc wise list of directors was uploaded on MCA website along with MCA circular stating as:

“Pursuant to Section 164 (2) (a) of Act, 2013 the directors of the companies which have not filed financial statements or annual returns for any continuous period of three financial Years 2014, 2015 and 2016 have been hereby declared disqualified. Accordingly, Directors enlisted in Annexure A attached shall stand disqualified upto 31.10.2021.”

Further, pursuant to the action of the Ministry of Corporate Affairs of removing/striking-off and consequent cancellation of the registration of around 2,09,032 shell companies, the Department of Financial Services, Ministry of Finance has directed all the Banks to restrict operations of bank accounts of such companies by the Directors of such companies or their authorized representatives making the clean up operation a massive drive.

This drive was undertaken for companies but its seems that Ministry has extended its ambit to include Limited Liablility Partnerships (“LLPs”) registered under Limited Liability Act, 2008 (“Act”) under its scrutiny process. It is being noticed that the Ministry has recently started issuing notices to LLPs individually by way of a reminder notice to make the compliances w.r.t filing of necessary returns/ statements as per the Act failing which the LLP and its designated partners will be liable to prosecution apart from unlimited penalty.

As per the provisions of sections 23 and 34 of the Act read with Limited Liability Partnership (Amendment) Rules, 2017 all the Limited Liability Partnerships is statutorily required to file:

- the Initial Agreement constituting the LLP in Form-3 within 30 days of its incorporation;

- a Statement of Account & Solvency has to be filed in Form-8 within 30 days from the end of six months of the financial year; and

- Annual Return 11 has to be filed within 60 days of closure of its financial year.

Vide the aforesaid notices, the Ministry has provided a firm reminder to comply with the reporting requirements as aforesaid failure of which may lead to prosecution of defaulting LLPs along with their designated partners, besides being liable for unlimited penalty on per diem basis.