IT Governance, Risk, Controls and Assurance Practices Direction, 2023

/0 Comments/in Financial Services, Information Technology, RBI, Risk Management /by Team FinservAnalysis of Impact on Financial Sector Entities

Kaushal Shah & Subhojit Shome | finserv@vinodkothari.com

Loading…

Loading…

Read our other resources

- RBI regulates outsourcing of IT Services by financial entities

- Draft Master Direction on IT Governance, Risk, Controls and Assurance Practices

- Erstwhile Directions on IT Framework for the NBFC Sector – RBI keen on implementing several operational requirements

Access our resource centre on SBR Framework :

Contra trade restrictions – traversing out of PAN to common control

/0 Comments/in Capital Markets, PIT, SEBI /by Anushka VohraAnushka Vohra | Senior Manager

corplaw@vinodkothari.com

Introduction

The SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’) impose certain restrictions and obligations on the DPs, one of which is contra trade restriction.

The DPs and their immediate relatives are restricted from entering into contra trade which refers to opposite trades executed viz. buy / sale within a shorter period of time usually within a period of 6 months with an intent to book short term profits. Where contra – trade is executed in violation of the restriction, the profit earned is to be disgorged for remittance to the IPEF.

In case of an individual DP (promoters / directors / etc. as recognized by the listed company), the immediate relatives also have certain obligations under the Regulations as their trades may be said to be influenced by the DPs. Similarly, in case of non-individual DPs (promoters), there may be other promoters and persons belonging to the promoter group who may act in concert with a particular non-individual promoter.

Having said that, it is important to understand the intent of contra trade, whether the same would apply individually on DPs based on trades executed against their PAN or the same would apply jointly on DPs and their immediate relatives or the entire promoter group inter-se. The same has been a matter of discussion in various Informal Guidance (‘IG’) of SEBI. We discuss the same briefly along with other illustrations.

Informal Guidance

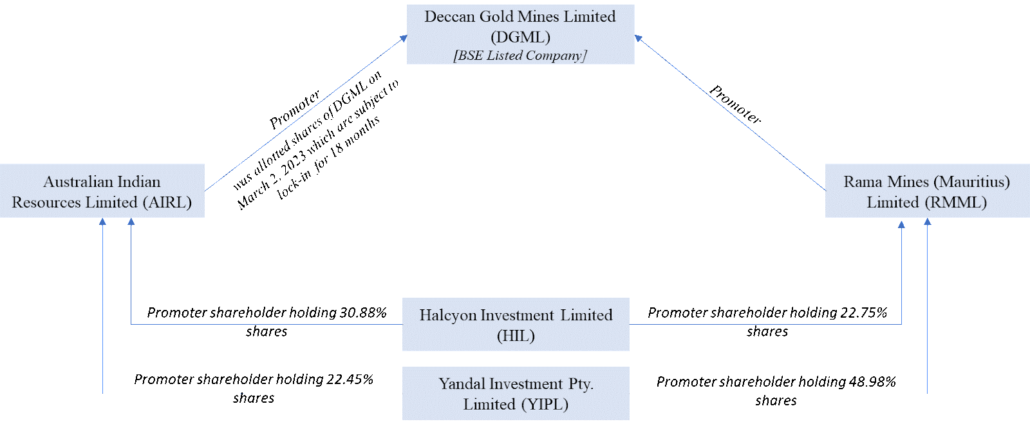

Generally, the concept of Persons Acting in Concert (‘PACs’) is used in the Takeover Code and under the PIT Regulations, the perspective so far has been PAN based. In the recent IG in the matter of Deccan Gold Mines Ltd[1], SEBI in its interpretative letter has given the view that contra trade restrictions would apply on the promoter group jointly, given the case in hand. The facts of the case have been represented diagrammatically below.

We see that the listed company is being held by two corporate promoters, which in turn are held by common shareholders. Here, RMML intended to sell its shareholding in open-market within 6 months of the allotment made to AIRL.

Since there is common control in both the promoter entities, it was stated that contra-trade restriction would apply jointly on both.

Intent of contra-trade

The intent of contra trade, as also mentioned above is to ensure that the persons who are privy to UPSI do not make short term profits in the securities of the listed company. For instance, if a DP has bought a security of the listed company in anticipation of a rise in prices that might be caused by the UPSI, such DP cannot sell such security within 6 months of the purchase. While trades can be executed by different DPs having different PAN, however where a single person is the “driving force” (as cited by the SAT in Shubhkam Ventures (I) Private Limited v. SEBI[2], it cannot be said that the persons acted in their individual capacity.

There have been instances in the past where SEBI has given the view that contra trade restrictions apply individually on DPs. The view seems to be supported by the interpretation of clause 10 of Schedule B of the Regulations, which states that:

The code of conduct shall specify the period, which in any event shall not be less than six months, within which a designated person who is permitted to trade shall not execute a contra trade. XXX

Previously, in 2020, in the matter of Raghav Commercial Ltd[3], SEBI in its interpretative letter took the view that the contra trade restrictions apply to trades made by promoters individually and not the entire promoter group.

Taking the case of individual DPs, in the matter of Star Cement Limited[4], while answering the question on applicability of contra trade restrictions – whether individually or to the entire promoter group, SEBI cited the above clause 10 stating that the same applies individually.

Reference of the above case was taken in 2019 in the matter of Arvind Limited[5], where contra trade restrictions were said to apply individually on DP through PAN, disregarding who took the trading decision. Our detailed article on the same can be read here.

The current case makes it quite clear that the facts of the case have to be considered to analyze whether there is a single person taking trading decision.

Let us take several other examples to understand the intent of contra trade.

1.

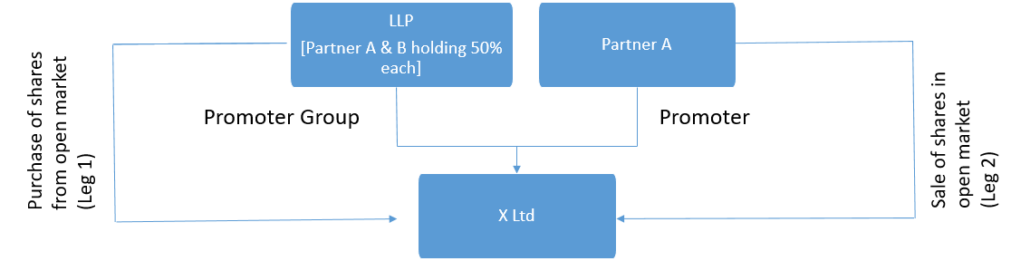

Whether Leg 2 will be contra to Leg1? Here we see that significant stake i.e. 50% is being held by Partner A (promoter of X Ltd) in the LLP. The trades of LLP can be said to be influenced by the decision of Partner A. This can be a case of common control and therefore Leg 2 becomes contra to Leg 1.

2.

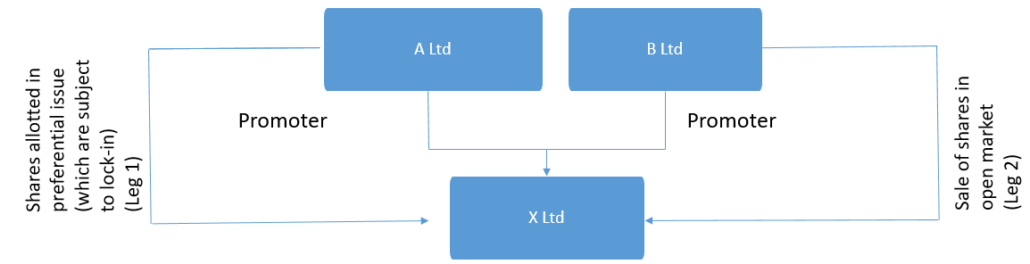

In this case, we will have to see who is behind A Ltd and B Ltd. If both A Ltd and B Ltd are held by the same set of shareholders, Leg 2 would become contra to Leg 1.

Further, there are certain exemptions w.r.t. contra-trade restrictions that have been prescribed in the PIT Regulations and also in SEBI FAQs.

As per PIT Regulations, contra trade shall not apply for trades pursuant to exercise of stock options. SEBI Faqs further elaborate on the same stating that, in respect of ESOPs, subscribing, exercising and subsequent sale of shares, so acquired by exercising ESOPs (hereinafter “ESOP shares”), shall not attract contra trade restrictions.

Further trades pursuant to any non- market transaction is exempted (SEBI Faqs).

The rationale behind exemption is that for stock options and non-market transactions, the exercise price / purchase price is predetermined. The selling transaction pursuant to exercise of stock options or pursuant to acquisition of shares in non-open market is not influenced by purchases made basis some UPSI. The exercise price / acquisition price is already decided by the company.

Let us understand another example.

3.

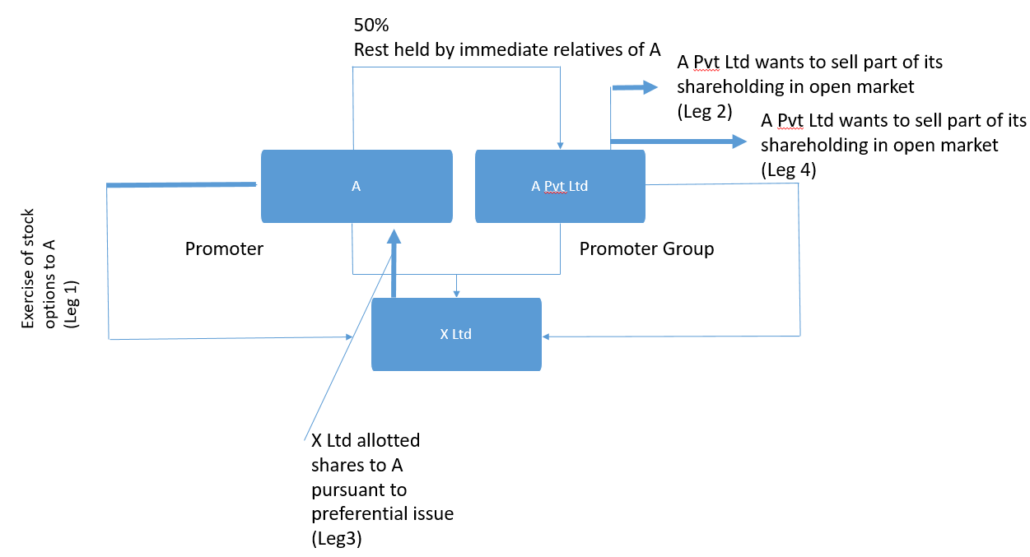

In the above case, it is evident that A is the decision maker for A Pvt Ltd. Here, Leg 2 is not contra to Leg 1.Leg 4 is contra to Leg 3 as there is no exemption provided.

Often, it is also interpreted that contra-trade is applicable share wise. To take an example, suppose; first – stock options are acquired by a DP, second – open market purchase is done, third – stock options are sold (all three within a period of 6 months). Here, it is interpreted that third would not be contra to first and second. This is a wrong interpretation, as the moment the DP makes any open market purchase or already has the company’s shares in portfolio, the immunity w.r.t. selling shares acquired pursuant to exercise of stock options is lost. One cannot differentiate between the shares as what is important to establish for contra-trade is the intention to make short term profits. Such intention, also, is evident when trading decisions are made by a single person, irrespective of the different individuals executing trades.

Global scenario

Contra-trade is understood by different names in other jurisdictions. It is referred to as short swing in the US and reversal trade in some jurisdictions.

- United States – Securities Exchange Commission Act, 1934[6]

Section 16(b) deals with prohibition on short-swing trades by beneficial owner, director, or officer of the companies. The section reads as under:

“For the purpose of preventing the unfair use of information which may have been obtained by such beneficial owner[7], director, or officer by reason of his relationship to the issuer, any profit realized by him from any purchase and sale, or any sale and purchase, of any equity security of such issuer (other than an exempted security) or a security-based swap agreement involving any such equity security within any period of less than six months, unless such security or security-based swap agreement was acquired in good faith in connection with a debt previously contracted, shall inure to and be recoverable by the issuer, irrespective of any intention on the part of such beneficial owner, director, or officer in entering into such transaction of holding the security or security based swap agreement purchased or of not repurchasing the security or security-based swap agreement sold for a period exceeding six months.XXX”

- China – Securities Law of the People’s Republic of China[8]

Article 41 and 42 deals with contra trade restrictions. It reads as under:

Article 41 A shareholder that holds five percent of the shares issued by a company limited by shares shall, within three days from the date on which the number of shares held by him reaches this percentage, report the same to the company, which shall, within three days from the date on which it receives the report, report the same to the securities regulatory authority under the State Council. If the company is a listed company, it shall report the matter to the stock exchange at the same time.

Article 42 If the shareholder described in the preceding article sells, within six months of purchase, the shares he holds of the said company or repurchases the shares within six months after selling the same, the earnings so obtained by the shareholder shall belong to the company and be recovered by the board of directors of the company. However, a securities company that has a shareholding of not less than five percent due to purchase of the remaining shares in the capacity of a company that underwrites as the sole agent shall not be subject to the restriction of six months when selling the said shares.

If the company’s board of directors fails to comply with the provisions of the preceding paragraph, the other shareholders shall have the right to require the board of directors to comply.

If the company’s board of directors fails to comply with the provisions of the first paragraph and thereby causes losses to the company, the directors responsible therefore shall bear joint and several liabilities for the losses.

Concluding remarks

We had earlier in our article (supra) given the view that contra-trade should be seen jointly and not individually, considering the intent. To establish violation of PIT Regulations, one has to go beyond tracking trades based on PAN. It is important to know the decision maker behind the trades, in order to establish a clear nexus. It would be important to see whether such a view was taken by SEBI because of the case in hand or is it reflective of a new trend i.e. position of common control.

Link to our PIT Resource centre: Click here

[1] https://www.sebi.gov.in/enforcement/informal-guidance/oct-2023/in-the-matter-of-rama-mines-mauritius-ltd-under-sebi-prohibition-of-insider-trading-regulations-2015_78308.html

[2] https://www.sebi.gov.in/satorders/subhkamventures.pdf

[3] https://www.sebi.gov.in/sebi_data/commondocs/sep-2020/SEBI%20let%20Raghav%20IG_p.pdf

[4] https://www.sebi.gov.in/sebi_data/commondocs/jul-2018/StarCementGuidanceletter_p.pdf

[5] https://www.sebi.gov.in/sebi_data/commondocs/nov-2019/Inf%20Gui%20letter%20by%20SEBI%20Arvind_p.pdf

[6] https://www.govinfo.gov/content/pkg/COMPS-1885/pdf/COMPS-1885.pdf

[7] Every person who is directly or indirectly the beneficial owner of more than 10% of any class of any equity security (other than exempted security) [Ref. 16(a)(1)]

[8] http://www.npc.gov.cn/zgrdw/englishnpc/Law/2007-12/11/content_1383569.htm#:~:text=Article%201%20This%20Law%20is,of%20the%20socialist%20market%20economy.

Mandatory demat for private companies: Highlights of the 27th October notification

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws /by Team Corplaw Loading…

Loading…

You may also refer to our FAQs, detailed article and YouTube Video

Mandatory conversion of share warrants issued under CA 1956 into demat securities – Snippet on MCA Notification

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA, UPDATES /by Team Corplaw Loading…

Loading…

You may also refer to our detailed article and youtube video.

FAQs on mandatory demat of securities by private companies

/1 Comment/in Companies Act 2013, Corporate Laws, MCA /by Team Corplaw Loading…

Loading…

You may refer to our other FAQs on dematerialization of shares here and you may also refer to our Snippet, detailed article and YouTube Video

Designated Persons to reveal beneficial owners:Summary of the 27th October notification

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, UPDATES /by Team Corplaw Loading…

Loading…

You may also refer to our detailed article and YouTube video on the same.

Share warrants under cloud – are companies not allowed to issue share warrants?

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, corporate governance, Corporate Laws, MCA, SEBI /by Team Corplaw- Payal Agarwal, Senior Manager | corplaw@vinodkothari.com

Share warrants are one of the widely used means to raise funds, particularly, in case of start-ups. MCA has recently notified the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023 (“Amendment Rules”) vide which Rule 9 has been amended to require mandatory conversion of the existing share warrants issued by public companies under the erstwhile Companies Act, 1956 (“Erstwhile Act”) into dematerialised form of securities.

Following this amendment, a significant question comes up to be addressed is whether public companies will not be allowed to issue share warrants altogether? We attempt to decode the implications of the present amendment in this write up.

Actionables under the present amendment

The newly inserted sub-rule (2) and (3) to Rule 9 of the PAS Rules requires every unlisted company to –

- File the details of existing share warrants with the ROC in form PAS-7 within 3 months from the commencement of the Amendment Rules, i.e., by 27th January 2024,

- Require bearers of the share warrants to surrender the same and issue dematerialised shares in the name of such bearer within 6 months from the commencement of the Amendment Rules, i.e., by 27th April, 2024, and

- Convert the unsurrendered share warrants into demat shares and transfer the same to IEPF

The company shall be required to issue notice for the bearers of share warrants in form PAS-8 on its website as well as two newspapers – in vernacular language, having wide circulation in the district and in English language having wide circulation in the state in which the registered office of the company is situated.

Share warrants covered under the present amendment

In the context of the newly inserted sub-rule (2) of Rule 9, the term share warrants is to be interpreted in a much restricted sense. The provision refers to “share warrants prior to commencement of the Companies Act, 2013 and not converted into shares”, which implies share warrants issued under the Erstwhile Act only. In this regard, one may refer to section 114 of the Erstwhile Act that allowed public companies to issue “bearer warrants” entitling the bearer of such warrants to the shares specified therein. The same was referred to as “share warrants” under the said Act, and the shares contained therein can be transferred through mere delivery of the warrant.

The present amendment requires mandatory surrender of such “share warrants” in the form of “bearer warrants” against issuance of shares in dematerialised form.

Permissibility for issuance of share warrants under the Companies Act, 2013 (“Act”)?

As mentioned above, the “share warrants” referred to under the Amendment Rules are limited to the bearer warrants issued in accordance with the Erstwhile Act, and do not extend to all share warrants which companies issue under the various provisions of law.

In general context, share warrants are actually written options to subscribe to the shares of a company on pre-agreed terms at a future date. Such warrants are fairly common in the corporate world on account of the benefits associated with the same, and the present amendment cannot be said to rule out the possibility of issuance of such share warrants. Share warrants are directly or indirectly recognised under various provisions of law, for instance:

- The definition of “securities” as provided for in section 2(h) of the Securities Contracts (Regulation) Act also includes “rights or interest in securities”. Share warrants are, in fact, a right to acquire securities at a future date, and therefore, well covered under the definition of securities

- The SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 contains specific provisions with respect to issuance of share warrants.

- The Foreign Exchange Management (Non Debt Instruments) Rules, 2019 also refers to the term “share warrants” within the overall definition of “equity instruments” and contains specific provisions with respect to the same.

- The Act refers to the conversion of “warrants” as a permissible mode for issuance of shares during the restricted period post buyback u/s 68(8) of the Act. It also contains references to employee “stock options”, which, by nature are equivalent to share warrants.

While the Act does not mention at several places under it about share warrants, however, at few places, like the provisions under section 68 dealing with buy back of securities as well as reference to employee “stock options”, which, by nature are equivalent to share warrants are given the Act.

Therefore, there are no explicit provisions that prohibit the issuance of share warrants by unlisted companies, and the same, being a “security” can very well be issued by a company, whether listed or unlisted, in compliance with the applicable provisions of law to meet the required funding as well as investment objectives.

Concluding remarks

The Amendment Rules aim at the wiping out of the bearer share warrants, since the legal and beneficial ownership of the shares are non-traceable in such a case. However, that does not eliminate the concept of share warrants as a whole, that are issued to an identified set of persons, and follows a due procedure laid down in the law for transfer of such warrants. Although not expressly defined under the Act, the concept of share warrants is legally recognised under various laws and are being widely issued by Indian companies, whether listed or unlisted, including private companies. The current set of amendments will have no impact on the permissibility of issuing share warrants issued under the Act and other laws as mentioned hereinabove.

Designated to reveal beneficiary identity: all companies mandated to name one

/2 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Payal Agarwal– MCA requires every company to designate person responsible for providing information with respect to beneficial interest in shares

– Payal Agarwal, Senior Manager | corplaw@vinodkothari.com

The concept of “beneficial owner” or BO is well-established under the Companies Act, 2013 by way of section 89 and 90 read with the rules made thereunder. The primary onus of declaration of beneficial interest lies on the person holding such beneficial interest. For the purpose of assigning responsibility to one or more person with respect to the compliance with the said provisions, Rule 9 of the Companies (Management and Administration) Rules, 2014 (“MGT Rules”) has been amended vide the Companies (Management and Administration) (Second Amendment) Rules, 2023 introducing the concept of “designated person” for the purpose of the said section. The amendment has been notified and made applicable from the date of its publication in the official gazette, i.e, 27th October, 2023.

Functions of a designated person

The concept of “designated person” has been brought in vide sub-rule (4) of Rule 9 of the MGT Rules. It requires “every company” to designate a person to be responsible for “furnishing, and extending co-operation for providing, information to the Registrar or any other authorised officer with respect to beneficial interest in shares of the company.” Therefore, a person, identified as a designated person under this rule, would be expected to be aware of, and therefore, take all reasonable steps to become aware, of the person holding “beneficial interest” in the shares of the company.

The applicability of the requirement to identify a designated person is not limited only to such companies that have received declarations with respect to “beneficial interest”, but extends to every company. It is upon the ROC/ other authorities to seek information with respect to beneficial interest from any company, and any such information, as and when sought, will be required to be provided by the designated person identified under this rule.

Who can be a designated person?

Sub-rule (5) of Rule 9 deals with the person qualified to be a designated person. It requires one of the following to act as a “designated person”:

- CS of the company, if the company is required to appoint a CS (as per section 203 of the Act), or

- any KMP of the company (as defined u/s 2(51) of the Act), or

- every director of the company, in case the company does not have a CS or other KMPs.

Therefore, a company may, acting through its board of directors, preferably through a duly passed board resolution in this regard, designate the CS, or any of the KMPs or directors of the company to act as a designated person. The use of the term “every director” does not imply that all directors shall be identified as “designated person”, rather, it would mean that either of the directors can be designated under the aforesaid rule.

“Deemed” designated person

The provisions are applicable immediately, and therefore, till the time a company designates a person for compliance with the aforesaid, the following persons shall be deemed to be designated person:

- CS of the company, if the company is required to appoint a CS (as per section 203 of the Act)

- In case a CS has not been appointed, every Managing Director or Manager of the company,

- In the absence of both (a) and (b), every director of the company.

Disclosure of details of a designated person

The details of the designated person are required to be disclosed in the annual return. The annual return is an e-form filed with ROC, and the present change would require a modification in the existing format so as to facilitate the provision of such information. Further, since the provisions are applicable from 27th October, 2023, the disclosure should be applicable for the annual return filed for FY 23-24 and onwards.

Any changes in the designated person is also required to be intimated to the ROC in e-form GNL-2. No timeline has been specified for filing the same, but should be filed within a reasonable period of time.

The introduction of the concept of “designated person” with respect to the “beneficial interest” in the shares of a company, will have the impact of assigning responsibility and accountability on the designated person with respect to compliance with the provisions of the Act relating to beneficial interest. Recently, many companies have received advisories from the ministry to ensure compliance with the provisions of declaration of beneficial ownership, and the present amendment would act as a “single point assistance” to the authorities in their inspection of companies with respect to compliance with declaration of “beneficial interest”.

You may also refer to our Snippet and YouTube video

Our other resources on beneficial owners can be accessed here –

Diktat of demat for private companies

/3 Comments/in Corporate Laws, MCA /by Payal AgarwalMCA notifies mandatory dematerialisation for securities of private companies

- Payal Agarwal, Senior Manager | corplaw@vinodkothari.com

Two major amendments have been notified by MCA on 27th October, 2023 impacting all companies, and majorly the private companies. These include the Companies (Management and Administration) (Second Amendment) Rules, 2023 introducing the concept of “designated person” with respect to beneficial interest in shares of a company[1] and the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023 (“PAS Amendment Rules”). The PAS Amendment Rules encompass two major amendments: (i) with respect to the bearer share warrants under the erstwhile Companies Act, 1956, and (ii) mandatory dematerialisation for all private companies excluding small companies. In this write-up, we briefly discuss the amendments with respect to mandatory dematerialisation of securities for the private companies and the implications thereto.

Regulatory basis of present amendment

Sub-section (1A) was inserted under Section 29 of the Companies Act 2013 (“the Act”) facilitating the Central Government to prescribe such class or classes of unlisted companies for which the securities shall be held and/ or transferred in dematerialised form only. In exercise of the powers conferred under the said section, Rule 9B has been inserted vide the PAS Amendment Rules specifying the requirement of mandatory dematerialisation of securities issued by private companies.

Applicability of mandatory dematerialisation on private companies

The mandatory dematerialisation requirement is applicable on all securities of every private company, excluding small companies[2] and government companies. The provisions are applicable with immediate effect, and a timeline of 18 months is provided from the closure of the financial year in which a private company is not a small company for the compliance with the mandatory dematerialisation requirements.

For example, a private company (other than a company that is a small company as on 31st March, 2023) is required to comply with mandatory dematerialisation of securities within a period of 18 months from the end of FY 22-23, i.e., on or before 30th September 2024.

In case a company ceases to be a small company after 31st March, 2023, the timeline of 18 months triggers from the close of the financial year in which it ceases to be a small company. Therefore, if a company ceases to be a small company at any time during FY 23-24, the timeline of 18 months will trigger from 31st March, 2024 and therefore, shall be complied with by 30th September 2025.

Applicability on a wholly-owned subsidiary

Rule 9B of the PAS Rules, enforcing mandatory dematerialisation of the securities of private companies, is applicable on all private companies other than the following:

- Small company, and

- Government company

In case of unlisted public companies, sub-rule (11) of Rule 9A extends a similar exemption from dematerialisation requirements. The said sub-rule covers the following public companies –

- Nidhi company,

- Government company, and

- A wholly owned subsidiary.

It is important to note that a wholly owned subsidiary, though exempt from the dematerialisation requirements under Rule 9A, similar exemption does not extend to a private company under Rule 9B. Therefore, currently it seems that a wholly-owned subsidiary, incorporated in the form of a private company, is not exempt from dematerialisation requirements.

Further, for a private company that is a wholly-owned subsidiary of a public company, and therefore, a deemed public company, it remains an open question as to whether it will be exempt under sub-rule (11) of Rule 9A or the provisions of Rule 9B will apply.

The position may be summarised as below –

| Nature of wholly-owned subsidiary | Nature of holding company | Applicability of dematerialisation provisions |

| Public company | Public company | Exempt under Rule 9A(11) |

| Public company | Private company | Exempt under Rule 9A(11) |

| Private company | Private company | Covered under Rule 9B as of now |

| Private company | Public company | The same being a deemed public company, there is no clarity on whether Rule 9A applies or Rule 9B. If considered to be a private company – covered under Rule 9B If considered to be a public company – exempt in terms of Rule 9A(11) |

Compliances applicable to private companies

A private company, covered under the provisions of mandatory dematerialisation shall –

- Issue all securities in dematerialised form only;

- Facilitate dematerialisation of all existing securities (as and when request is received from the holder of such securities);

- Ensure that the entire holding of its promoters, directors and KMPs are held in dematerialised form only, prior to making any offer for issuance or buyback of securities

Apart from the aforesaid, the compliances applicable to an unlisted public company under sub-rule (4) to (10) of Rule 9A are also applicable to private companies. These include –

- Application with depository for dematerialisation of all existing securities and securing ISIN for each type of security;

- Inform the existing security holders about the facility of dematerialisation;

- Make timely payment and maintenance of security deposit with the depository, RTA and STA as may be agreed between the parties;

- Complies with all applicable regulations, directions and guidelines with respect to dematerialisation of securities of a private company;

- File a return in form PAS-6 with ROC on a half yearly basis within 60 days from conclusion of each half of the financial year, with respect to reconciliation of the share capital of the company;

- Bring to the notice of the depositories, any difference in the issued capital by the company and the capital held in dematerialised form;

- The grievances of any security holders under this rule (Rule 9B) to be filed with IEPF Authority, and the same, in turn, shall initiate any action against a depository or depository participant or RTA or STA, as may be required, after prior consultation with SEBI.

Compliances applicable to the holders of securities of a private company

As for persons holding securities of a private company, while the mandatory dematerialisation cannot be enforced by the private company, the same is expected to be taken care of by way of sub-rule (4) of Rule 9B that requires –

- Dematerialisation of securities by the securityholder, before the transfer of such securities; and

- Subscription to the securities issued by a private company, in dematerialised form only

Therefore, the mandatory dematerialisation of securities of a private company is ensured through placing restrictions on both a private company and the holders of securities issued by the same.

Consequences of non-compliance

There are no specific penal provisions governing the non-compliance with the provisions of section 29 of the Act read with Rule 9B of the PAS Rules, and therefore, general penal provisions under section 450 of the Act should apply.

Section 450 specifies the following:

“If a company or any officer of a company or any other person contravenes any of the provisions of this Act or the rules made thereunder, or any condition, limitation or restriction subject to which any approval, sanction, consent, confirmation, recognition, direction or exemption in relation to any matter has been accorded, given or granted, and for which no penalty or punishment is provided elsewhere in this Act, the company and every officer of the company who is in default or such other person shall be liable to a penalty of ten thousand rupees, and in case of continuing contravention, with a further penalty of one thousand rupees for each day after the first during which the contravention continues, subject to a maximum of two lakh rupees in case of a company and fifty thousand rupees in case of an officer who is in default or any other person.”

Implications of the present amendment

The existence of shell companies and personification of shareholders is not a rare scenario, and such a situation is likely to be more common in case of a private company, unlike a public company. Historically, dematerialisation of shares is looked upon by the government as a means to curb black money[3]. As for listed companies and unlisted public companies[4], the dematerialisation of securities is already a mandatory requirement. With the present amendments being notified, the private companies have also been covered by the mandatory dematerialisation requirements.

As on 31st January, 2023, more than 14 lac companies registered with MCA comprising 95% of the total active companies are private companies, out of which approximately 50,000 companies are small companies[5]. Thus, with the mandatory dematerialisation for private companies coming into existence, a large number of companies will be forced to move towards dematerialisation of shares. Further, while the company can be held accountable for the mandatory dematerialisation of securities held by promoters, directors and KMPs, given the closely held nature of private companies, barely any securityholder (particularly shareholders) will remain outside the purview of the same.

Further, it is clarified that, in no way such a mandatory dematerialisation for private companies can be taken to mean that the restriction on transfer of shares of such a company is relaxed, and adequate systems can be implemented at the depository’s level to ensure compliance with the basic distinguishing characteristic of a private company and thereby have filters before executing any transfer of securities.

You may also refer to our Snippet, FAQs and YouTube Video

[1] Read our article on the same here – https://vinodkothari.com/2023/10/companies-to-disclose-designated-person-with-respect-to-beneficial-interest-in-shares/

[2] As per the definition under the Act read with the rules made thereunder, a small company means a company, other than a public company, having paid up share capital not exceeding Rs. 4 crores and turnover not exceeding Rs. 40 crores. Further, the following cannot be a small company –

(A) a holding company or a subsidiary company;

(B) a company registered under section 8; or

(C) a company or body corporate governed by any special Act.

[3] https://www.moneycontrol.com/news/trends/legal-trends/government-looking-to-dematerialise-shares-of-unlisted-cos-to-curb-black-money-2382347.html

[4] https://vinodkothari.com/wp-content/uploads/2018/09/Physical-to-demat-a-move-from-opacity-to-transparency.pdf