State of Indian Capital Markets

By Mayank Agarwal (finserv@vinodkothari.com )

Capital market is the one-stop solution for both companies and investors looking to utilize idle money in the most financially sound manner. While money markets provide short-term (generally less than one year) route of raising money, capital markets provide a much broader avenue. Although businesses rely upon money market sources to address liquidity issues, capital markets are explored with the intention of improving the solvency situation of the businesses.

A healthy and booming capital market is a clear-cut indication that the domestic people have confidence in the financial ecosystem of the country and that they trust the government and financial institutions with their money. Strong capital market volume aids economic growth by mobilization of savings and providing funds to those in need, thus increasing productivity.

The Indian capital market has been performing quite well in the recent times, competing shoulder-to-shoulder with the most developed of economies globally in terms of Return on Investment (ROI). Flagship indices such as Sensex and Nifty are at an all-time high, foreign inflows in the Indian market have increased significantly in the past few years, the mutual fund space has also been very active and innovative fintech solutions bring buying and selling securities at the fingertips of the investor. Sweeping reforms announced by the Securities and Exchange Board of India (SEBI) at regular intervals facilitate transparency and efficient pricing in the market and have made the Indian capital market the apple of the eye of domestic as well as foreign investors.

With the country’s spending pattern experiencing a structural shift as more and more houses choose to invest in financial instruments rather than lock their money in a bank account, the Indian capital market seems poised to maintain its uptrend for a long time.

Touching higher highs on a regular basis, the Indian markets have backed the promising returns with stability, repaying the trust of the public, while defying the suspicions of others. Such robust performance is testimony to the fact that the numbers are not a fluke, instead, introduction of shrewd policies that promote transparency, efficiency and accessibility have made the financial environment immune to global and domestic breakdowns (case in point being Brexit, Demonitisation, GST).

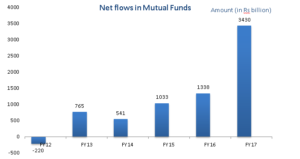

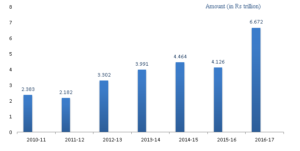

Ever since 2016, the Indian capital markets have charted such an astounding performance that it left even the most astute investors scratching their heads. Delivering higher than expected returns in most investments, the Indian stock market lured not only the domestic crowd, but attracted attention of global stalwarts as well. The figure below shows the trend of investments made foreign institutional investors/ foreign portfolio investors in the Indian capital market during the past few calendar years.

Source: National Securities Depository Limited.[1]

As is clear from the Figure above, the volume of the foreign investments reached its peak in the recent years in 2014, which gradually came down from the very next year and in 2016 the net foreign investments by FII/ FPIs became negative, this is mainly due to high level of withdrawals during the last two months of the year, i.e., November and December, during which the country was undergoing the crisis of demonetization. However, the market bounced back very sharply within a year only, with the net foreign investments growing by over 8 times.

The intention of this article is to discuss the happenings in the various segments of the Indian capital market, be it from the performance viewpoint or from regulatory viewpoint. The article has been divided into three parts – a) Equity segment, b) Debt segment, and c) residuary segment covering the other types of securities issued in the Indian capital market.

Equity Segment

IPOs

Indian IPO issuances primarily occur during times of booming economic environment and when the company sees a dominant bullish sentiment in the market. They are usually priced at very low prices so that market outlook remains positive when it gets over-subscribed. IPOs may be issued by established stalwarts- like Avenue Supermart or by younger companies looking to stretch their capital horizons- case in point being Prataap Snacks.

Indian companies choose this route generally when they are looking to repay existing debts that the company may have and to finance future projects. The Indian primary market has kept pace with the secondary market performance and has resulted in investors earning quick and positive returns. The Indian IPO market has experienced a structural change; earlier, IPOs used to be bought generally by specialized and long term investors but these days IPOs have become very popular among the retail investors as well.

The IPO market has kept climbing the ladder in recent years and attracted more and more prospective companies to register themselves with SEBI. Shares of Avenue Supermart speak for the IPO market as a whole, with investors doubling their wealth in the stock in a single day!

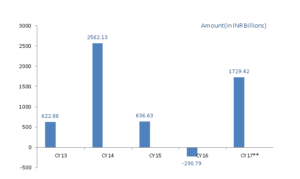

Fundraising via IPOs touched a record high as 28 companies raised approximately Rs. 52,125 crores in the Calendar Year 2017 (CY17). As per data published by Prime Database, more and more promoters and existing investors are selling off their share in the IPO issuance, as witness by the growing rate of Offer For Sale transactions taking place.

Source: Prime Database[2]

The BSE IPO Index, which tracks the performance of recently listed entities, has registered a growth of approximately 14% in the HY1 of FY17-18.[3] The boom in IPO market is evidenced by the fact that the Investment Banks earned a handsome fee of Rs. 404 crore since the beginning of 2017. Credit Suisse estimates that the Indian IPO issuance is likely to be higher by 35% in FY18 compared to the peak fiscal year in 2008.[4] Analysts expect 40-50 IPOs to come out in the FY18, with Reuters estimating the market to touch a figure of $8.5 billion.[5]

However, the uproar to IPOs in the recent years comes along with a superficial fear of over-valuation and greed among the bulls in the market- with Pradeep Snacks’ IPO, over-subscribed 30 times, commanding a Price-to-Earnings (PE) multiple of 200! There seems to be a rife of poorly researched and frenzied investors in the market, who are advised to tread cautiously and analyze properly given the uncertain belief prevalent in the primary market.

ADR/GDR

Once a very popular choice of raising funds, American Depository Receipt and Global Depository Receipt market has become stagnant, with not a single company opting to issue one in order to raise funds overseas. ADRs and GDRs allowed Indian companies to capture a more diverse set of investors and advertise their company beyond domestic territories as well. In recent years, fewer and fewer companies opt for this method given the high regulatory requirements put in place and the fact that the country is experiencing a net inflow of foreign money rather than outflow, not to mention the strong rupee performance globally. Those companies that still need foreign investment are choosing to issue foreign currency convertible bonds instead, which has proven to be a more lenient and efficient way of raising funds. The steep decline in issuance of ADR and GDR market is evident by the recent year’s figures, with not a single issuance taking place in the year 2017.[6]

Debt Segment

Private Placement

Private placement has proven to be an attractive source of finance for various start-ups and up and coming SMEs and listed entities on the look-out for strategic investors. Institutional Investors such as banks, pension funds, etc. and Venture Capitalists help kill two birds with one stone as not only do they provide finance, the strategic advise that comes along is certainly the icing on the cake. Such financing has been regarded to be a lucrative option to those companies for whom counsel is more important than cash.

The rising prominence of private placement market is evidenced by the fact that the year 2016-17 accounted for the highest volume and amount of issuances, with a record 3436 deals amounting to Rs. 6.67 trillion as per RBI data.[7] The market maintained pace as Indian companies raised approximately Rs 3.24 trillion in the first half year (HY1) of FY17-18- an increase of 4% from the corresponding period a year ago.[8]

Financial institutions invest in listed entities either by purchasing bonds or by investing in shares of the company. Although firms are reluctant to offer shares as it hurts the current group of shareholders by diluting their holdings, improved performance due to the intervention of such institutions does benefit the shareholders by driving the price of shares upwards. Debt offering in the form of bonds and debentures may also be offered but firms usually deter from showing debt in their balance sheet.

With the hands of banking institutions tied as they are riddled with NPAs, the non-bank source of raising funds has caught up in recent years, with RBI data highlighting how ECBs have come back in the spotlight. The total share of non-bank credit to total new debt has risen from 20% in 2015 to 53% in 2016 given the fact that companies are looking to minimize their cost of capital as much as possible and hence look for sources of funds other than banks.[9]

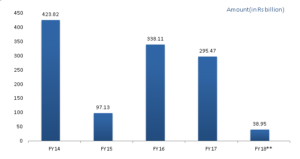

Public Issue

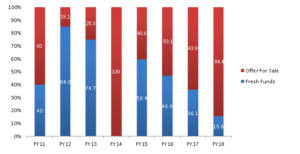

Listed entities on NSE and BSE raised approximately Rs.295.47 billion in FY17 through issuance of corporate bonds. So far in FY18, companies have raised 38.95 billion.[10]

Debt issuance has proved to be an effective way for young companies who are not willing to part with equity but are in need of financing and hence choose to raise funds by issuing bonds. The rise in mutual funds industry in India, along with a more favourable outlook towards stock market rather than commodity investment such as real estate and gold has been part of the reason why public issuance has flourished in the country. The surge of foreign investments in the country has primarily comprised of investment in the corporate bond market- piggy-riding the domestic sentiment on its back as well. In the year 2017, foreign investment in corporate bonds has risen by a staggering 44%, amounting to Rs. 2.3 trillion[11], coming dangerously close to the cap of Rs. 2.4 trillion permitted by RBI to foreign investors. This space of around Rs. 44,000 crores is likely to be filled further as there remains a big hole left by masala bonds, which will now be categorized as ECBs.

Source- SEBI[12] **-As of 24th Oct, 2017

The Indian debt market is yet to realize its full potential, as it is much less in volume as compared to other economies around it. With the value of domestic corporate bond outstanding in 2014 to GDP being only 17%, there is room to expand for Indian companies, with its foreign counterparts commanding a much higher rate- China and Brazil registering figures of 46% and 42% respectively.[13] While the banking sector in India remains over-shadowed by a cloud of rising NPAs and poor financial health, it seems likely that the debt market in India will continue to maintain its below moderate growth for at least a couple of more years.

Masala bonds

Masala bonds are debt instruments issued by Indian companies to foreign investors in rupee denomination. These instruments are favoured by domestic companies looking to raise funds from foreign lands given the fact that the denomination in rupee eliminates the forex risk associated with overseas funding. In recent years, the masala bond market has had its ebbs and flows- with the market recently coming under ECB category, which is sure to boost the performance further as foreign holding cap in corporate bond goes away for good.

In recent years, the masala bond market has picked up pace as the country’s largest mortgage lender, HDFC alongwith NHAI and NTPC ventured into this form of financing. As per Bloomberg data, Indian companies have raised approximately Rs. 200 billion through such instruments, with an average tenor of less than 5 years.

Although caps on price and maturity still exist, the decision to categorise Masala bonds under ECBs is a step in the right direction and is sure to boost this sector in years to come.

Residuary Segment

REITs/InvITs

Real Estate Investment Trust(REIT) and Infrastructure Investment Trust(InvIT) is a form of alternative investment vehicle. The working mechanism of a REIT involves purchase of commercial properties and then providing them on rent to tenants. The funding is done through issuance of units to public which are tradable on stock exchanges. The main advantage of a REIT structure is grounded on the tax exemptions that it receives.

Basically, REITs can be labeled as mutual funds for real estate markets. According to a recent report by Cushman & Wakefield, commercial properties in India that are ‘REITable’ investment opportunities, are between $43 billion and $54 billion across the top cities.[14] The year 2016 accounted for highest investment in REITs since the sub-prime crisis, with investment in this asset class reaching a figure of $3.6 billion.[15] With the country commanding a gigantic lower middle class population of around 267 million as of 2016, REITs are yet to fully tap in a market which is sure to boost its growth as owning a house remains a dream for most. Further, the rising trend in the country to lease out office space rather than own one provides another untapped segment for REITs.

InvITs , on the other hand, are a globally popular financial instrument that have only recently entered the Indian market. Scoring points due to its tax-efficient nature(not liable to pay Dividend Distribution Tax(DDT) and corporate tax) and higher yields compared to global markets, it seemed InvITs would have taken to the Indian ecosystem by storm, but the reality has been the opposite. The two issuances that occurred in 2017, IRB InvIT Fund and India Grid Trust, have both under-performed, trading below their issue price. A slew of factors such as lack of clarity on taxation, high penalty charges, cash flow timing mismatch and the fact that SEBI has imposed a minimum investment hurdle of Rs. 10 lakhs have deterred prospective investors into the fund.

Since, REITs mechanism observed a complete downfall and the fact that till date no REIT has been listed with SEBI, the proposed amendments come as a saviour intending to gear up the market for REITs.

SEBI in its Board Meeting on 18th September, 2017 made certain amendments to the SEBI (infrastructure Investment Trusts) Regulations, 2014 and SEBI (Real Estate Investment Trusts) Regulations, 2014 (referred to as ‘REIT Regulations’). The text of the amendment has been reproduced as under:

“In order to facilitate growth of Infrastructure Investment Trusts (InvITs) and Real Estate investment Trust (REITs), SEBI Board, has approved certain changes in the captioned regulations, which, inter alia, include the following:

- Allowing REITs and InvITs to raise debt capital by issuing debt securities

- Introducing the concept of Strategic Investor for REITs on similar lines of InvITs

- Allowing single asset REIT on similar lines of InvIT

- Allowing REITs to lend to underlying Holdco/SPV

- Amending the definition of valuer for both REITs and InvITs

The Board, after deliberations, decided to have further consultation with the stakeholders on a proposal of allowing REITs to invest at least 50% of the equity share capital or interest in the underlying Holdco/SPVs, and similarly allowing Holdco to invest with at least 50% of the equity share capital or interest in the underlying SPVs.

Based on the amendments proposed by SEBI, it can be clearly stated that laws pertaining to investment in real estate sector is being liberalised to allow the overall economic development of the country. The changes approved by SEBI is yet another attempt to accelerate the growth of REIT regime. While globally both InvITs and REITs are popular instruments, India is just seeing their emergence. It is prevalent that a market for a new instrument takes its own time for development and undergoes its own dynamics and hence, SEBI is taking its own initiative accordingly, for the development of the REIT market. Although domestic REITs and InvIT market has a lot of catch up to do with that of its foreign counterparts, the country seems to provide the right ingredients for the market to springboard in the coming years.

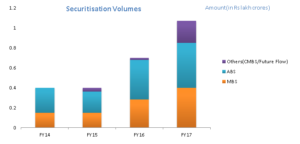

Securitisation in India

Still taking its first steps in the Indian scene, Securitisation remains in nascent stage in the country. The Indian securitization market has started to take off in recent years, with FY17 charting the highest figures of around Rs 1.02 lakh crores in terms of value of securitized transactions. This increase has majorly been on account of abolishment of Distribution Tax on the income distributed by the trust to investors. The new regime instead transfers the liability of securitization distribution tax from the hands of the trust to the investors. This was a major reason behind the growth in issuance of Pass-through Certificates or PTCs, which rose by almost 74% to Rs. 42800 crores.[16]. Further, the fact that PTCs are the only route available to mutual funds, bank treasuries and NBFCs looking to sell securities is another weapon in its arsenal.

Source: CRISIL estimates[17]

Mortgage Backed Security (MBS) remains the most preferred asset class, with total volumes climbing 39% to Rs 41000crores in FY17, also accounting for 45% of securitized deals. While in previous years growth was led by public banks, in recent years private investment has carried the torch for securitization market in the county. Vehicle loans have comprised the bulk of Asset Backed Securities (ABS) in the country, mainly due to Priority sector lending criterion.

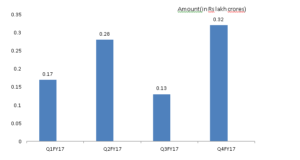

Securitization remains in a volatile phase in the country given the fact that it is a relatively new and complex instrument for most to comprehend. The securitization volume in the recent quarters are as follows-

Source: CRISIL[18]

Mutual Funds

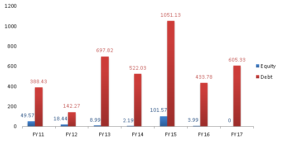

2017 can aptly be labelled as “The year of Mutual Funds” in India. If there is one sector that has played all its cards right and gotten more than it has bargained for, it has to be the Mutual Fund industry in India. Perhaps the only industry that has been making headlines for all the right reasons since the implementation of Demonitization, Mutual Fund has been the lips of every household, even the ones who have no idea what a mutual fund is, have at least heard of the dialogue “Mutual Fund investments are subject to market risks…” and so on, such has been the powerful marketing campaign as chosen by the Association of Mutual Funds in India(AMFI), another major factor behind the rising clout of Mutual Funds industry.

Net inflows into mutual funds in 2016-17 reached Rs. 3.43 trillion, a staggering leap of around 155% compared to the year before and the highest figure since its inception in the country. The Assets Under Management (AUM) of the Mutual Fund industry reached a high of Rs. 19.5 lakh crores in FY17, a threefold growth in the last 5 years. The fact that Sensex has soared to levels of 32600 and increased by 22% since the turn of year, has made investment in Mutual Fund a popular choice as every other Indian household entrusts their money with the fund to provide them a piece of the pie that is the Indian stock market. The equity assets of Mutual Fund comprise around one-third of the total portfolio, with the Mutual Funds holding 5.5% of the outstanding equity stock as per AMFI-CRISIL study[19], with the figure having huge significance as only 53% of the shares are freely tradeable, the rest being held by promoter groups, meaning mutual funds own more than 10% of the freely tradeable shares.

High taxation benefits and rising Sensex and Nifty levels has attracted the interest of the huge uneducated investor crowd in the country who have been lured by the green charts prevalent on their TV screens and have thus wanted to earn easy money by handing over their savings to the Mutual Fund. Catering to various investors as per their risk appetite, Mutual Funds have been gaining muscle due to introduction of a flurry of different schemes. The introduction of Systematic Investment Plans(SIPs) has brought a sea of change in the retail investment mentality and can aptly be termed the magic wand that has flipped the fortunes of the Mutual Fund industry.Gone are the times when the foreign investors had the Indian stock market by the scruff of its neck, as a new era of retail investor domination sets in the country, snatching the power right out their hands.

The rise in Mutual fund investments is much needed, given the fact that in FY16 it has accounted only for 2% of gross financial savings, compared to deposits with banks and investment in provident funds, which account for 44% and 39% of gross financial savings respectively.[20] In a bid to further increase investor participation in Mutual Funds and to curb the disproportionately high distribution of money among the AMCs, SEBI released a circular on 6th October, 2017[21] introducing a system of One-Scheme per category. This will result in a significant clampdown on the plethora of schemes that the AMCs have laid out in the current system and hence offer investors a more selective choice.

It remains too early to say if the Mutual Fund industry will maintain such performance in the years to come, but once a jolt hits the stock market, the stability of this sector is sure to be tested and it is hoped that the sector proves resilient to such a phenomena given it commands a huge retail investor holding, with the less affluent regions such as the beyong-15 cities of the country accounting for 17.7% of the total industry investment.

Conclusion

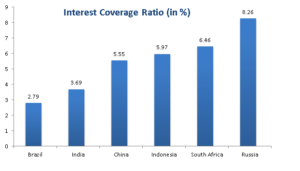

While the party for the capital markets in India seems to have just started, a closer look at the figures do reveal reasons for concern. Domestically, the banking institutions remain decapitated by the woes of rising stressed assets, which have reached a perilous figure of Rs. 7 lakh crores. This has led to over-reliance on ECBs and FIIs, which exposes more and more companies to currency risk and exposes the fragility that surrounds the industry. Further, the fact that revenue growth has failed to keep pace with the growth in the corporate debt market has resulted in abysmal Interest Coverage ratio, with a report from IMF highlighting the adverse figures that Indian market registers as compared to its peer emerging economies.

Source: IMF Report[22]

Domestic rating agency ICRA estimates the Indian bond market to grow at 22% in the current year.[23] In order to maintain the growth, the next step for Indian authorities must be to increase retail investor participation and curb the reliance on overseas funding. Introduction of schemes such as Demonitisation and GST, alongwith SEBI introducing reforms continually to make the markets more price-efficient and transparent, are steps in the right direction. The years to come will test the maturity of the capital markets and the economy seems to be well setup to resist any major headwinds.

[1] https://www.fpi.nsdl.co.in/web/Reports/Yearwise.aspx?RptType=6

[2] https://economictimes.indiatimes.com/markets/ipos/fpos/year-of-record-harvest-for-ipos-on-dalal-street/articleshow/61027577.cms

[3] http://www.moneycontrol.com/indian-indices/s&p-bse-ipo-33.html

[4] http://www.livemint.com/Money/6hinqehb9dXDmQG3H3t2PL/IPO-rush-seen-continuing-as-markets-trade-at-record-highs.html

[5] http://www.financialexpress.com/market/2017-ipo-dream-run-rs-30000-crore-raised-so-far-bubble-to-burst-soon/871397/

[6] http://www.livemint.com/Money/ttPGDOVUFYonTSNL8vg6ZP/The-demise-of-overseas-equity-offerings-by-Indian-companies.html

[7] https://rbi.org.in/Scripts/PublicationsView.aspx?id=17850

[8] http://www.livemint.com/Companies/S3JspIkimNF6sWZ4DEz71K/Indian-firms-raise-Rs324-trillion-via-debt-placement-in-Apr.html

[9] https://www.rbi.org.in/Scripts/MSM_Mintstreetmemos6.aspx

[10] http://www.sebi.gov.in/reports/handbook-of-statistics/may-2017/handbook-of-statistics-2016-a-href-cms-sebi-data-attachdocs-hbs2016parti-xlsx-target-blank-style-color-8b0101-part-1-a-andnbsp-a-href-cms-sebi-data-attachdocs-hbs2016partii-xlsx-target-_34939.html

[11] https://www.ft.com/content/0cad270c-72ad-11e7-aca6-c6bd07df1a3c

[12] http://www.sebi.gov.in/statistics/corporate-bonds/publicissuedata.html

[13] https://crisil.com/bond-market/pdf/Are-Stars-Aligning-for-Growth-of-Corporate-Bond-Market-in-India.pdf

[14] https://housing.com/news/end-users-guide-investing-reits/

[15] https://economictimes.indiatimes.com/wealth/by-2020-indian-realty-to-provide-77-billion-reit-investment-opportunity-report/articleshow/55703151.cms

[16] https://www.bloombergquint.com/markets/2017/08/07/indian-securitisation-market-hits-all-time-high-but-new-instrument-casts-doubt

[17] https://www.bloombergquint.com/markets/2017/08/07/indian-securitisation-market-hits-all-time-high-but-new-instrument-casts-doubt

[18] https://www.bloombergquint.com/markets/2017/08/07/indian-securitisation-market-hits-all-time-high-but-new-instrument-casts-doubt

[19] http://www.thehindu.com/business/Economy/the-rising-clout-of-mutual-funds/article19198715.ece

[20] https://m.economictimes.com/wealth/invest/how-mutual-funds-have-won-over-risk-averse-indian-household/articleshow/59752496.cms?from=desktop

[21] http://www.sebi.gov.in/legal/circulars/oct-2017/categorization-and-rationalization-of-mutual-fund-schemes_36199.html

[22] http://www.imf.org/external/pubs/ft/gfsr/2016/02/pdf/text.pdf

[23] http://www.thehindubusinessline.com/economy/corporate-bonds-issuance-may-grow-at-22-next-fiscal-icra/article9553846.ece

Leave a Reply

Want to join the discussion?Feel free to contribute!