RBI’s endeavour to tackle stressed assets continues

By Abhirup Ghosh, (abhirup@vinodkothari.com),(finserv@vinodkothari.com)

The Reserve Bank of India (RBI), on 12th February, 2018[1], notified the “Resolution of Stressed Assets – Revised Framework” (Revised Framework). This aims to replace the four year old, “Framework for Revitalised Distressed Assets in the Economy”[2] (Framework) read with association circulars, guidelines and directions issued from time to time. To be precise the following instructions/ mechanisms have been withdrawn to make way for this Revised Framework:

(i) Framework for Revitalising Distressed Assets

(ii) Corporate Debt Restructuring Scheme

(iii) Flexible Structuring of Existing Long Term Project Loans

(iv) Strategic Debt Restructuring Scheme (SDR)

(v) Change in Ownership outside SDR

(vi) Scheme for Sustainable Structuring of Stressed Assets (S4A)

(vii) Joint Lenders’ Forum (JLF) as an institutional mechanism for resolution of stressed accounts

The preamble of the Revised Framework states that the changes have been effected with the intention to align the measures for dealing with stressed assets with the Insolvency and Bankruptcy Code (IBC). Broadly, the Revised Framework is an attempt to ensure timeliness of resolution of these stressed accounts. Further, with this RBI has also tried to arrest the various measures resorted to by the banks for ever-greening the accounts.

The notification states that the Revised Framework will come into effect from the date of notification itself, i.e. 12th February, 2018.

In this write-up we intend to not only capture the Revised Framework at length, but also draw parallels from the existing Framework.

Identification and monitoring of stressed accounts

The manner of identification of the stress in the accounts in the Revised Framework remains the same as it was under Framework. The process of identification of stress in an account includes classification of a borrower account into various categories of “Special Mention Accounts” depending on the vintage of the default in such accounts or signals of stress in the accounts, before it becomes non-performing. The classification of an account into SMA is done in the following manner:

| SMA Sub-categories | Basis for classification –

Principal or interest payment or any other amount wholly or partly overdue between |

| SMA-0 | 1 – 30 days |

| SMA-1 | 31 – 60 days |

| SMA-2 | 61 – 90 days |

The RBI has also amended the periodicity for CRILC forms, which are meant for the purpose of the reporting and monitoring of large and stressed credits. The revised timelines and the revised scope for filing have been produced below:

| Form | Purpose | Timeline/ Frequency under the Framework | Timeline/ Frequency under the Revised Framework |

| CRILC – Main | For filing credit information, including classification of an account as SMA to CRILC on all borrower entities having aggregate exposure of ₹ 50 million (₹ 5 crores) and above with them | Quarterly | Monthly

[Starting with effect from 1st April, 2018] |

| CRILC – SMA 2 | For notifying the accounts which have become SMA-2 and whether JLF has been formed or not | As and when basis | It is not clear from the notification whether this will remain active or not. |

| Additional filing requirement | For filing the details regarding all borrower entities, with exposure of ₹ 50 million (₹ 5 crores) and above, in default | Weekly basis.

Every Friday, at the close of business hours.

If Friday happens to be a holiday, then the preceding working day.

[Starting with effect from 23rd February, 2018] |

Resolution plan and timelines for implementation

The Resolution Plan (RP), which is the equivalent of Corrective Action Plan under the erstwhile Framework, is a bail-out package to be prepared by the lender(s), singly or jointly, for the purpose of reviving the distressed account, provided the same looks feasible. The RP may involve any actions / plans / reorganization including, but not limited to, regularisation of the account by payment of all over dues by the borrower entity, sale of the exposures to other entities / investors, change in ownership, or restructuring.

As per the Revised Framework, the banks must have in place policies for resolution of stressed assets under this framework, including the timelines for resolution and the same be approved their Board of Directors.

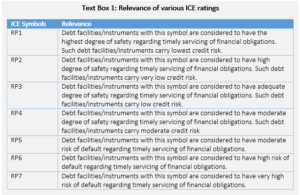

An RP involving restructuring or change in ownership will require an independent credit evaluation (ICE) of residual debt to understand if the account is eligible for the RP or not. The ICE will have to be done by independent credit rating agencies, recognised by the RBI. The following must be noted with respect to ICE:

- Where the aggregate exposure of the lenders in the borrower is ₹ 1 billion (or ₹ 100 crores) and above – At least 1 CRA must be appointed by the lender(s)

- Where the aggregate exposure of the lenders in the borrower is ₹ 5 billion (or ₹ 500 crores) and above – At least 2 CRAs must be appointed by the lender(s)

- The residual debt must be rated at least RP4 or better in order to become eligible for RP

- The CRAs must be appointed directly by the lender(s) and the fee must be borne by them.

- If the lenders appoint more number of CRAs for ICE, than what is specified, then the ratings of all them must be RP4 or better, in order to make the case feasible for RP.

This requirement shall apply with implemented with immediate effect and will be applicable even if the restructuring package is implemented before 1st March, 2018.

The Revised Framework also lays down the indicators determining if the RP has been implemented or not, this was missing in the erstwhile Framework. As per the Revised Framework, an RP will be deemed to have been implemented only upon the fulfilment of the following:

- The borrower is no longer in default with any of the lenders;

- If the RP involves restructuring, then –

- all related documentation, including execution of necessary agreements between lenders and borrower / creation of security charge / perfection of securities are completed by all lenders; and

- the new capital structure and/or changes in the terms of conditions of the existing loans get duly reflected in the books of all the lenders and the borrower.

Timeline for implementation

In the past, the RBI had come with several measures to tackle the rising level of stressed assets in the economy, but none of them worked out well. Delays in implementation of the measures can be treated as one of the most important reasons for these measures not working out. Having realised the shortcomings from the past, the RBI has prescribed timeline for implementation. For the time being, the RBI has announced the timeline for implementation of RP in case of accounts where the total exposure is ₹ 20 billion (₹ 2,000 crore), with a promise to notify the timelines for smaller accounts as well over a period of two years.

The prescribed timeline for implementation is as follows:

In respect of accounts with aggregate exposure of the lenders at ₹ 20 billion and above, on or after March 1, 2018 (‘reference date’), including accounts where resolution may have been initiated under any of the existing schemes as well as accounts classified as restructured standard assets which are currently in respective specified periods (as per the previous guidelines), RP shall be implemented as per the following timelines:

- If in default as on the reference date, then 180 days from the reference date.

- If in default after the reference date, then 180 days from the date of first such default.

Therefore, these cases get a period of 180 days for implementation of RP. This time frame is largely in line with the one under IBC; even under IBC, applicant gets time till 180 days for preparation of resolution plan and implementing the same. This is also similar to the timelines provided in the erstwhile Framework; for instance, in case of strategic debt restructuring, a period of 90 days to approve the package and another 90 days were allowed to convert the debt into equity. However, under the scheme for sustainable structuring of stressed assets, a period of only 90 days was allowed for approval and implementation of the package.

What if the RP is not implemented within the specified timeline?

The most apparent question that arises next is what would happen if the RP is not implemented within the specified timeline. As per the Revised Framework, if the lender(s) fails to implement the RP within the specified timeline, it will have to, singly or jointly with other lenders, make an application for insolvency of the borrower under the IBC within a period of 15 days from the expiry of the said timeline.

What happens if RP fails event after its implementation?

The next question that arises is, what if an account, despite the timely implementation of RP, fails to perform satisfactorily. The Revised Framework states that if an account fails to perform satisfactorily during the specified period, that is, if it defaults anytime during the specified period, the lenders shall file insolvency application during, singly or jointly, under the IBC within a period of 15 days from the date of such default.

For this purpose, the term “specified period” means the period starting from the date of implementation of the RP and ending on –

- The date by which at least 20% of the principal outstanding and interest capitalised is repaid; or

- 1 year from the date of the commencement of first payment of interest or principal (whichever is later) on the credit facility having the longest moratorium under the terms of RP,

whichever is later.

In reality, the restructuring packages in India are typically back heavy, where the amount recovered during the first few years are insignificant and larger shares of the pie are recovered towards to the end of the tenure. Therefore, in most of the cases, this specified period will be longer than what has been the case all these years. Under the existing Framework, the meaning of the term “specified period” was restricted only to the following:

Specified Period means a period of one year from the commencement of the first payment of interest or principal, whichever is later, on the credit facility with longest period of moratorium under the terms of restructuring package.

Therefore, the inclusion of the repayment clause will cause a lot of difference.

Prudential norms and norms for restructuring

The Revised Framework clearly lays down the prudential norms with respect to the accounts where RP has been implemented and norms for various aspects of restructuring these accounts and they are as follows:

- Asset classification: The assets classified as “standard” before restructuring will be downgraded to “sub-standard” immediately upon restructuring. The assets classified as “sub-standard” before restructuring will continue to have same asset classification as prior to restructuring. The downgraded accounts will be eligible for upgrading only when the same would demonstrate “satisfactory performance” during the specified period. However, for larger accounts, i.e. where the aggregate exposure is ₹ 1 billion (₹ 100 crores) or more, in addition to demonstration of satisfactory performance, credit rating on the residual debt will have to be obtained to understand if the account is eligible for upgrading. The particulars relating to this evaluation have been listed down below:

a. In case the exposure is ₹ 1 billion (₹ 100 crores) or above, at least one CRA must be engaged to rate the residual debt;

b. In case the exposure is ₹ 5 billion (₹ 500 crores) or above, at least two CRAs must be engaged to rate the residual debt;

c. The residual debt must attain investment grade rating of BBB- or above

d. If rating is obtained from more than one CRA, all of them should fetch the minimum prescribed rating

The additional requirement for large credits will act as an additional check before upgrading the account.

However, if the account fails to demonstrate satisfactory performance during specified period, the account shall have to immediately be reclassified based on the original repayment schedule that existed before the implementation of the RP.

2. Provisioning norms: Provisioning will have to be done in accordance with the requirements laid down in the Income Recognition and Asset Classification norms.

3. Treatment of additional finance – Any additional finance granted under the RP shall be treated independently from the base account. The additional finance will be treated as standard, provided the restructured account performs satisfactorily during the specified period. If at any point of time during the specified period, the borrower defaults, or if the account fails to qualify for upgrading at the end of the specified period, the additional finance shall have to be placed in the same asset classification as the restructured account.

4. Income recognition – Income on restructured standard accounts can be recognised on accrual basis, however, income on sub-standard accounts can be recognised only on cash basis.

Further, any income with respect with the additional finance, where the restructured account is classified as non-performing, will have to be recognised on the cash basis only, except where the restructuring is accompanied by change in ownership.

5. Conversion of principal into debt/ equity or conversion of unpaid interest into FITL –

- The converted instrument/ facility will have to be held in the same category as the restructured account

- The instruments shall have to be marked-to-market

- The equity instruments, if unquoted, will have to be value at book value arrived at based on the Balance Sheet casted on 31st March of the preceding year. In case the same is not available, equity shares will have to be valued at Re. 1.

Change in ownership

In case of change in ownership of the borrowing entities, credit facilities of the concerned borrowing entities may be continued/upgraded as ‘standard’ after the change in ownership is implemented, either under the IBC or under this framework. If the change in ownership is implemented under this framework, then the classification as ‘standard, shall be subject to the following conditions:

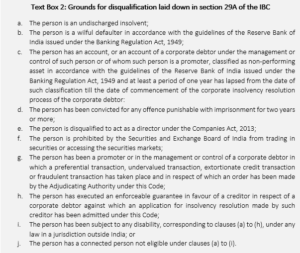

a. Banks shall have to conduct necessary due diligence in this regard and clearly establish that the acquirer is not a person disqualified in terms of Section 29A of the Insolvency and Bankruptcy Code, 2016.

b. The new promoter must acquire at least 26% of the paid up equity capital of the borrower entity and shall be the single largest shareholder of the borrower entity.

c. The new promoter must be in ‘control’ of the borrower entity as per the definition of ‘control’ in the Companies Act 2013 / regulations issued by the Securities and Exchange Board of India/any other applicable regulations / accounting standards as the case may be.

d. The conditions with respect to timeline for implementation of RP must be complied with.

The most important part of this is that section 29A of the IBC is made binding on the prospective buyer, even if the lenders decide not to adopt the NCLT route.

However, the asset classification will have to be downgraded if the account fails to demonstrate satisfactory performance during the specified period.

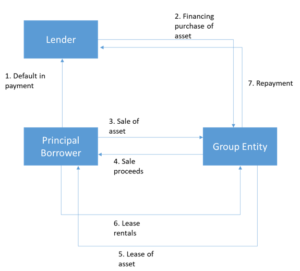

Dealing with disguised restructuring arrangements

As already stated above, the Revised Framework also attempts to arrest such arrangements which are nothing but disguised restructuring arrangements, like the one illustrated below:

These arrangements were structured in a manner that the exposures were transferred tactfully from the principal borrower to the group entity. The account which were classified or due to be classified to be sub-standard in the books of the lender, thereby inviting higher provisioning norms, removed from the books of the lenders and fresh standard exposures arose in the books in the lender.

The Revised Framework attempts to arrest these kind of arrangements and therefore, lays down that these accounts will be treated as restructuring in the books of the lenders for the purpose of IRAC with respect to the residual debt of the seller or the fresh exposure on the buyer if the following conditions are met:

- The seller of the assets is in financial difficulty;

- Significant portion, i.e. more than 50 per cent, of the revenues of the buyer from the specific asset is dependent upon the cash flows from the seller;

- 25 per cent or more of the loans availed by the buyer for the purchase of the specific asset is funded by the lenders who already have a credit exposure to the seller.

While the first and third points are self-explanatory, the second condition requires deliberation. The language used here is significant portion of the revenues of the buyer from the specific asset must be dependent upon the cash flows of the seller. Here the words “revenues of the buyer from the specific asset” must be emphasized, as it attempts to capture the situation where the asset is used effectively by the seller and the buyer only acts as the conduit in between the seller and principal lender for facilitating the movement of cash between the original parties to the financing facility.

Miscellaneous issues

Apart from what has already been discussed above, there are certain other issues which have been discussed in the Revised Framework and they are:

- The exemption casted under various regulations issued by SEBI, that were allowed under the earlier Framework, will continue to stay;

- The shares issued under the Revised Framework cannot be issued at a value less than the book value or the nominal value of the shares. However, an amendment was made in the Companies Act, 2013 vide the Companies Amendment Act, 2017, which allows issuance of securities at less than book value. Therefore, there is disconnect in the RBI regulations and the Companies Act in this regard.

- The Guidelines for revival and rehabilitation of MSMEs[3] issued by the RBI will continue to apply.

- The Guidelines for restructuring of loans in case of natural calamities[4] will continue to apply.

- Cases of frauds and wilful defaults will not be eligible cases for this framework.

Certain unanswered issues

While the RBI has tried to cover all the aspects of restructuring comprehensively under the Revised Framework, but there are certain issues which remain unaddressed, namely:

1. What will happen to the financial institutions other than banks, like NBFCs?

The Revised Framework has been addressed to banks and All India Financial Institutions, however, the same has not been addressed to other regulated financial institutions; whereas the erstwhile Framework was made applicable to all such financial institutions which are regulated by the RBI. It is important to note that the notifications which have been withdrawn pertains to banks only. The ones applicable to other regulated financial institutions will continue to stay in effect.

However, this will create problems in case of arrangements involving banks as well as such which are not covered under the Revised Framework, like NBFCs. Not only the scope of the two frameworks are like chalk and cheese, the position of the remaining regulated entities under the Revised Framework is clear. Hopefully, the RBI will come out with some clarification in this regard.

2. Is the NCLT route under IBC still open for banks after this?

While the intention of this notification is harmonise the guidelines for dealing with the stressed accounts with the IBC, however, it is not very clear from the Revised Framework, if going forward, a lender has to first take action under the Revised Framework before knocking the doors of NCLT under the IBC. Nothing in the Revised Framework bars anyone from moving an application for insolvency of the borrower in the NCLT under IBC. Therefore, theoretically, the option will still be open for the banks to adopt the IBC route instead of this. However, practically, in India, considering the self-control that can be achieved under this Revised Framework, there is a strong likelihood that this will be favoured more than the NCLT route.

3. Is the concept of JLF really dead?

While formal JLF mechanism has been abolished, joint action by unpaid lenders against a borrower will still have to be the rule, since, if the intent of the RBI was to let each unpaid lender take care of his interest separately, the guidelines were not required at all. The moment we believe that the action is joint action, the issue is – what will be the mode of voting in the joint body of lenders? Since no particular voting mechanism has been laid in the new Guidelines, it may mean (a) unanimous consent; or (b) simple majority; or (c) such majority as the lenders define for themselves.

Unanimous consent is ruled out, as the same is never achievable. The answer, therefore, lies in favour of (b) or (c).

Conclusion

The Revised Framework is a big move by the RBI towards eradication of the growing burden of sick loans from the economy. This framework leads to a shift from prescriptive guidelines of stress management by banks to automated resolution of the distressed assets. The abolishment of the JLF mechanism supports the preceding statement; earlier, the JLF had to operate as per the policies laid down by the RBI, but now the lenders can decide the mode of operation mutually.

Also, the RBI’s attempt to tighten the loose ends with respect to timeline for implementation of bail-out packages also comes as a welcome move.

[1]https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11218&Mode=0#F4

[2] https://www.rbi.org.in/scripts/NotificationUser.aspx?Id=8754&Mode=0

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=10304&Mode=0

[4] https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=11037

Leave a Reply

Want to join the discussion?Feel free to contribute!