Implication of definitional change in related parties- As per the Companies (Amendment) Act, 2017

By Smriti Wadehra (corplaw@vinodkothari.com)

Introduction

The Companies Act, 1956 (“Act, 1956”) did not define the word ‘related party’, however, in 12th September, 2013, MCA enforced the relevant provisions of the Companies Act, 2013 (“Act, 2013”) which defined the above term for the first time, and ever since then the definition has been changing to broaden its scope.

Ministry has brought significant changes in the definition of related party through the Companies (Amendment) Act, 2017 (“Amendment Act, 2017”) which has been made effective from 9th February, 2018. In this article we have majorly covered the changes brought in the definition of related party and its implications from compliance perspective.

Relevant Provision of Law Before and After The Change

Before amendment:

The provisions as per Section 2(76) of the Companies Act, 2013 are:

“(viii) any company which is—

- a holding, subsidiary or an associate company of such company; or

- a subsidiary of a holding company to which it is also a subsidiary;

XX”

After amendment:

The provisions substituted as per Section 2(xi) of the Companies (Amendment) Act, 2017 are:

“(viii) any body corporate which is—

(A) a holding, subsidiary or an associate company of such company;

(B) a subsidiary of a holding company to which it is also a subsidiary; or

(C) an investing company or the venturer of the company;

XX“;

Explanation.—For the purpose of this clause, “the investing company or the venturer of a company” means a body corporate whose investment in the company would result in the company becoming an associate company of the body corporate.”

Analysis

The provisions of section 2(76)(viii) of the Act, 2013 prior to the amendment failed to cover the entities (holding, subsidiary or associate companies) incorporated outside India. Even though the intention could have never been to exclude foreign entities, the language was loosely drafted and therefore, companies did not follow the compliance for entering into related party transactions while transacting with the said parties.

Further, bodies corporate like limited liability partnership were also precluded from the definition of related party (being the holding, subsidiary or associate company). The Amendment Act, 2017 has undone the loose drafting of the definition of related party.

Further, the definitional change will also allow the inclusion of upstream entities exercising significant influence on the companies to be regarded as related parties.

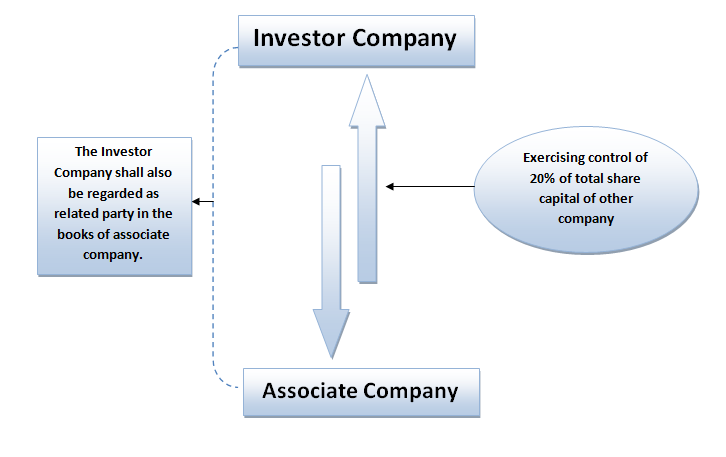

Another significant change in the definition of related party from the investor perspective, is that the related party relationship has become two fold to include both associate and investor company.

To elaborate previously only associate company was regarded as related party as per section 2(76)(viii) for the investor company, however, the vice-versa situation was not present. By virtue of the change, investor company will also be regarded as related party for the associate company.

Prospective application of amendment

The implication of the changes in the definition of related party shall apply prospectively for all companies as the notification enforcing the amendment does not mention anything regarding the retrospective application of the amendment.

Accordingly, companies will have to take into account compliances relating to transactions entered with such new related parties. Further, the changes brought in the definition of related party has surely widened the provisions of related party however will also increase compliance burden on the companies.

Action points

Pursuant to the changes introduced in the Amendment Act, 2017, the companies need to ensure the following compliance:

1. Audit Committee Approval

Any transaction entered with the new related party shall require approval of the Audit Committee pursuant to section 177(4)(iv) of Act, 2013. Further, it shall be the responsibility of the Audit Committee to review such transactions on periodic basis.

Also as a matter a good governance the company should place the list of ongoing transactions with such new related parties, entered before the amendment so that the committee can take note of the same.

2. Board Approval and Shareholders Approval

Pursuant to section 188 of the Act, 2013 any transaction which is not in ordinary course and at arm’s length basis and is falling under the arrangement of sub-section (1) shall require approval of the board of directors. Further, pursuant to Rule 15 of Companies (Meetings of Board and its Powers) Rules, 2014 if such transaction exceeds the prescribed limit as mentioned in the said section shall require approval of the shareholders at the general meeting. Therefore, in case the transactions entered with the new related party exceeds the limit and fall under the ambit of transactions of section 188 of the Act, 2013 the Company shall require approval of board and shareholders for executing such transactions.

3. Register of Contracts or Arrangements in which directors are interested

Pursuant to section 189 of the Act, 2013, once the transactions is approved by the board and the shareholders (if applicable) the Company has to enter details contracts or arrangements entered with such new related party as per section 188 of the Act, 2013 in the register MBP-4 along with other details as required in the Act, 2013 read with allied rules.

4. Disclosure in Board’s Report

Section 188(2) of the Act, 2013 provides “Every contract or arrangement entered into under sub-section (1) shall be referred to in the Board’s report to the shareholders along with the justification for entering into such contract or arrangement.”

Therefore any transactions entered with such related party pursuant to section 188(1) shall be required to be disclosed in board’s report as per section 134(3)(h) in form AOC-2.

Changes in the definition of related party as per AS-18 and IND-AS-24

The change in the definition of related party as per Companies (Amendment) Act, 2017 shall have no impact on the definition of related party as per AS-18 and IND-AS 24 as the same already broad enough to incorporate all the new related parties as introduced in the amendment act.

Conclusion

The requirements concerning related party transactions have always been a matter of significant debate since their introduction in Act, 2013. However, the changes introduced in Amendment Act, 2017 by the ministry has undone the loose drafting under the Act, 2013.

The intention of law was always to include all the companies including foreign company into the ambit of related party however the language of law of 2013, Act did not interpreted the same therefore the Ministry amended the term to remove ambiguities.

Further, inclusion of investor companies in the definition of related party has been done to align the provisions with AS-18 and IND-AS 24.

Leave a Reply

Want to join the discussion?Feel free to contribute!