Impact of GST on factoring transactions

By Abhirup Ghosh, (gst@vinodkothari.com)

Factoring is a very popular product mode of working capital funding across the globe. In India, however, the picture is not quite rosy for factoring companies. Nevertheless, like every other thing in the country, factoring transactions will also be affected by the introduction of GST in India. Here in this article, we intend to walk you through the probable impact, GST would create on factoring transactions.

Refreshing the concept of factoring

Before we delve into detailed intricacies of the topic, let us first quickly refresh our memory regarding the concept of factoring.

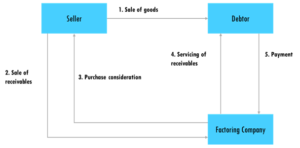

In a factoring transaction, the seller sells receivables of a debtor to a factoring company. The receivables are sold at a discount. Once the receivables are sold, the factoring company enters into the shoe of seller and carries out all the activities that the seller should have done. In fact, the servicing of the receivables is also done by the factoring company. A graphical representation of a typical factoring transaction is provided below:

Implications of GST

Under GST regime, a transaction becomes chargeable only where it qualifies to be a taxable supply. Supplies can be either in the nature of supply of goods or supply of services and each of them are treated differently. So in order to understand the tax implications on factoring transactions, we will have to first understand the whether it will qualify to be a supply of service or supply of goods.

A factoring transaction has several components attached to it and each of such components are to be examined individually to see if they are attracting the provisions of GST. The components of a factoring transaction are –

- Sale of receivables – First, there is a sale of receivables from the seller to the factoring company, for which the seller receives a consideration. The consideration is arrived at after discounting the receivables at a discounting rate.

- Processing of transaction – Second, there is a fee that is normally charged by the factoring company for processing the transaction.

- Factoring charges – Next, there is an amount charged by the factoring company to the borrower towards the charges incurred for registration of factoring transactions with the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI).

- Servicing of receivables – Once the receivables are sold to the factoring company, the servicing and collections are carried out by the factoring company only. This is an additional service that is provided by the factoring company and the consideration for the same is adjusted with the discounting rate that is fixed for discounting the receivables.

Let us now analyse the impact of GST on each of the above components.

- Sale of receivables

Receivables are actionable claims and transactions in actionable claims are dealt in the following manner under the GST regime.

The term “goods” has been defined under section 2(52) of the Central Goods and Service Tax Act, 2017 in the following manner:

(52) “goods” means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply;

The definition includes actionable claims within its purview, however, Schedule III casts an exemption on actionable claims. Schedule III states transactions in actionable claims shall neither be treated as a supply of service nor as a supply of goods. Further, the law also provides the definition of “actionable claims” under section 2(1) of the CGST Act in the following manner:

- “actionable claim” shall have the same meaning as assigned to it in section 3 of the Transfer of Property Act, 1882;

Section 3 of the Transfer of Property Act, 1882 defines the term “actionable claims” in the following manner:

“actionable claim” means a claim to any debt, other than a debt secured by mortgage of immovable property or by hypothecation or pledge of movable property, or to any beneficial interest in movable property not in the possession, either actual or constructive, of the claimant, which the civil courts recognise as affording grounds for relief, whether such debt or beneficial interest be existent, accruing, conditional or contingent;

On reading of the above text of law it can be inferred that only such claims to debt which are not secured by mortgage, hypothecation or pledge shall be considered as actionable claims.

Therefore, on reading of the above text of law, on the face of it might look that transactions in only unsecured debts shall be exempted from GST and the transaction in secured receivables will still be covered under the GST law.

But as we do a closer reading of the definition of “goods” we understand that goods exclude money; a secured debt is primarily nothing but a claim for money, the collateral is just an additional cushion for the lender which can be utilised to recover the money in case there is a default. Therefore, even secured debts should be considered as nothing more than money to money transactions.

Therefore, it can be concluded that transfer of receivables shall not be taxable under GST.

- Processing of transaction

The CGST Act defines the term “services” in the following manner:

(102) “services” means anything other than goods, money and securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged;

As is evident from the above, services exclude any money to money transaction but includes activities relating to the use of money. In a factoring transaction, processing fee is charged by a factoring company for processing the transaction, which falls within the meaning of activities relating to use of money. Therefore, processing fees charged will be charged to GST as supply of service.

- Factoring charges

Factoring charges are charged by factoring companies towards the charges incurred for registration of factoring transactions with CERSAI. As provided in the definition of services, anything other than supply of goods, money and securities shall be treated as services and this represents nothing among the three, therefore, the transaction would qualify to be a supply of services and shall be subject to GST accordingly.

- Servicing of receivables

As stated earlier in this document, once the receivables are transferred, the servicing is done by the factoring company, therefore, there is a service component involved here and ideally it should be charged to GST. The factoring company adjusts the compensation for servicing and collection with the discounting rate. Therefore, the discounting rate has two components attached to it, first, compensation towards the credit risk and next towards the servicing and collection, while the former one is exempted from GST and the latter one is subject to GST, therefore, making the transaction a mixed supply.

In a mixed supply, GST is charged on the transaction at rate at which the supply carrying the highest rate is charged.

Therefore, in the present case, the discount charged by the factoring company shall be chargeable to GST at the rate which is applicable to the supply of collection services.

Conclusion

The way the law has been moulded would require several changes to the existing transactions. Earlier, factoring transactions did not invite a lot of taxation difficulties, but going forward there will be a question of considering the taxation aspects as well.

This is one step backward for the factoring industry, which has failed to create an impact in the country, despite the several positives it brings to the table for any entity looking for short term refinancing options.

There is a need to relook at the way the transactions being structured currently and identify proper solutions so as to ensure that the transactions do not die due to tax inefficiencies.

—

For any queries drop us a mail at – gst@vinodkothari.com

Leave a Reply

Want to join the discussion?Feel free to contribute!