LLPs slated for more stringent reforms

Significant provisions of the Act made applicable on LLPs

Payal Agarwal| Senior Executive| Vinod Kothari and Company

Last updated – 27th June, 2022

Introduction

Limited Liability Partnerships (LLPs) being a hybrid form of entity with characteristics of both companies as well as partnerships are governed by the provisions of Limited Liability Partnership Act 2008 (“LLP Act”). LLPs are popular since due to less compliance requirements as compared with a company.

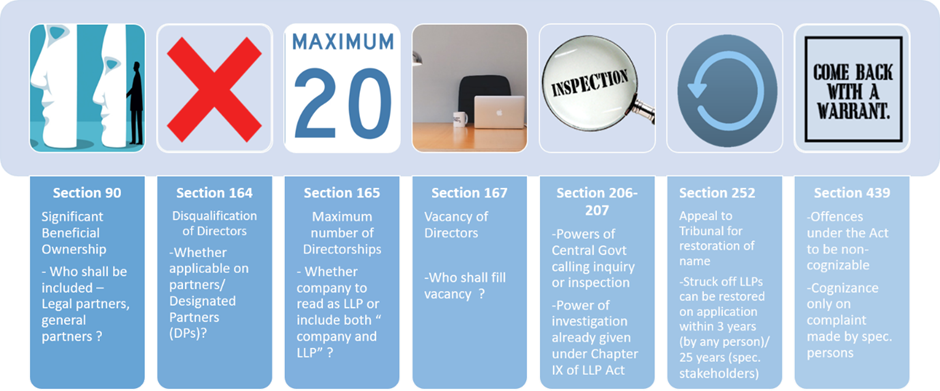

In view of the existing framework for LLPs, the Ministry of Corporate Affairs (MCA) had published a news material on its website on 18th February 2021 stating that certain provisions of the Companies Act 2013 (“the Act”) will be soon made applicable on the LLPs. The same has been made effective vide a notification dated 11th February 2022 (“Amendment Notification”). The notification specifies certain sections of the Companies Act, 2013 which shall also be applicable on LLPs. These include some very significant provisions like identification of Significant Beneficial Ownership (SBO), application of the criteria for disqualification, capping on the max number of partners/ DPs, etc.

The provisions are applicable immediately from the date of the notification itself, and will require the LLPs to review their existent position to conform that they remain compliant of the provisions newly made applicable on the same.

Intent behind the amendments

LLPs are seen to be entities having less regulatory supervisions and more benefits of the corporate forms of entities. Therefore, conversion of companies into LLPs can be sought as a means of regulatory arbitrage. However, it has to be noted that the regulatory authorities are now set to bring LLPs under the ambit of some stricter supervision. The Company Law Committee Report on Decriminalization of LLP Act also indicated that the attention of the regulatory authorities are now shifted towards the LLPs. Our write up on the same can be read here. In India, mostly the professional service providers such as law firms, practising professionals etc. are formed as LLPs. Also, the AIFs are mostly formed as LLPs. In the aforesaid report too, fund raising by way of issue of Non-Convertible Debentures (NCDs) by the LLPs were barred except for the entities regulated by SEBI or RBI. So, the intent of the Government seems to monitor the activities of LLPs.

Discussion on the changes

The specified provisions of the Act have mostly been made applicable to the LLPs, as it is under the Act, with substitution of the terms “member” with “partner”, “director” with “Designated Partner” and “company” with “LLP”, save as otherwise expressly provided below. The tabular presentation below discusses the requirements of the provisions which have been made applicable on the LLPs along with our analysis on each of them.

| Sec No. | Deals with | Requirements of the Act made applicable to LLPs | Impact analysis and immediate actionable |

| 90 except sub-section (12) | Significant Beneficial Ownership (SBO) | -Declaration of beneficial interest by SBO( 25% or more interest or as specified in the Rules) -Company shall maintain register of SBO -Inspection of such register by members Co. shall file return of SBO with ROC -Co. shall take necessary steps for identification of SBO -Notice by co. to persons who are likely to be/have knowledge of/ were SBO and not registered. -Info to be given by concerned person within 30 days of notice -Co. shall apply to Tribunal within 15 days if info not provided by the concerned person -Tribunal may restricts rights on such shares relating to concerned persons after reasonable opportunity of hearing. -Aggrieved person may apply for lifting/ relaxation of such orders Punishment on contravention | While this provisions have been made applicable on LLPs, there could be various points to discuss so that the impact can be analysed. Some of these include: -The Act intends to identify a natural person controlling or exercising beneficial interest on the company. Under an LLP, the ownership and management need not be different as in the case of companies. LLPs can have partners of various categories like Limited Partner (one who only contributes capital) and General Partner (one who manages the LLP). As we understand, the intent behind introducing the SBO identification for LLPs should be similar to that for companies, i.e. to understand the beneficial owner. The Amendment Notification does not differentiate between the various categories of Partners and include both for the purpose of determination of SBO. -From here, we move to the next point for discussion, i.e. the meaning of beneficial interest. Section 89 of the Act defines beneficial ownership. Again, it has to be seen that the word “Significant” is defined under Section 90(1) to mean an interest of 25% or more or such other proportion as prescribed in the Rules. Currently, the same has been prescribed at 10%. Following the Amendment Notification, the LLP Amendment Rules have also been prescribed, however, no similar thresholds have been provided with respect to SBO as given under the Companies Rules. -Further, sub-section (12) has not been made applicable on account of the fact that it relates to punishment under Section 447 of the Act. -The amendments will broadly require the LLPs to – Identify the SBO Take declarations from SBO Maintain register of SBO |

| 164(1) and (2) | Disqualification of Directors | Cannot be a Director if – -Declared unsound mind -Undischarged insolvent -Applied to be adjudicated as insolvent -Convicted and sentenced imprisonment of 6 months or more and 5 years has not elapsed yet from release ( If sentenced for 7 years or more, permanently disqualified) -Disqualified by an order of Court or Tribunal -Not paid calls in respect of shares held by him for atleast 6 months from last day fixed for payment of call -Convicted of offence dealing with RPT u/s 188 during last 5 years -Not complied with Section 152(3) -Not complied with Section 165(1) — Cannot be appointed in any other co./ re-appointed in that co. for 5 years from the date of failure if is/has been a Director of a co. which has -Not filed financial statements/annual returns for 3 consecutive FYs. -Failed to repay deposits/debentures/pay interest thereon/ dividend declared for 1 year or more | -The grounds of disqualification of Directors under the Act has been made applicable to the Designated Partners of LLPs as well. -The various grounds for disqualification are linked with certain personal defaults and filing defaults. An interesting observation with respect to the Amendment is that, for the purposes of sub-section (2), a person being the “director” in a defaulting “company” is also disqualified to act as a Designated Partner in LLP, however, no similar amendments have been made in the Act to make the DPs of a defaulting LLP disqualified from acting as a director in a company. -The provisions being applicable immediately, there is a need to review the existing DPs in light of the disqualification factors so as to ensure that none of the DPs are disqualified from holding office as such. |

| 165 except sub-section (2) | Number of Directorships | Max no. of directorships- 20 -Of which public cos. – max 10 -Dormant co. not included Person holding directorships above specified limit shall within 1 year of commencement of Act- -Choose to continue in companies within specified limit -Resign from other companies -Intimate his choice to the companies and the ROC -Resignation under (3)(b) will become effective immediately from despatch of notice to the co. -No person can hold excess directorship – Once he resigns from the extra companies or Expiry of 1 year from commencement, whichever is earlier -Penalty in case of violation | -By making this section applicable on LLPs, an upper cap has been put on the maximum number of LLPs in which a person can hold the position as a DP. -The DPs have been provided with a timeline of one year within which any person holding office as a DP in more than 20 LLPs is required to choose the ones where he intends to continue and resign from the other LLPs. He is also required to provide an intimation to that effect to the LLPs as well as the Registrar having jurisdiction over such LLPs. -In case of violation, the DPs may be liable to fine ranging from Rs. 5,000 upto Rs. 25,000. |

| 167 except sub-section (4) | Vacation of office by Director | Office of Director becomes vacant when -Incurs disqualifications under Section 164 -Contravention of Section 188Fails to disclose interest u/s 184 -Disqualified by an order of Court/Tribunal -Convicted and sentenced for imprisonment of 6 months or more -Removed in pursuance of this Act -Punishment on violation -Where all Directors vacate, the promoter ( CG in his absence) shall appoint required number of Directors till appointment of Directors in GM | On account of disqualification incurred, the DPs will be required to vacant their positions. Where all the DPs vacate office in pursuance of section 164, the partners, or, in their absence, the Central Government shall appoint DPs to meet the minimum requirements of law. |

| 206(5) | Inspection | The Central Government may, if it is satisfied that the circumstances so warrant, direct inspection of books and papers of a company by an inspector appointed by it for the purpose. | Powers of inspection into the affairs of LLP has been given to Central Government by way of inclusion of these provisions under the LLP Act. It is to be noted that powers of investigation already lies with the Central Government under Chapter IX of the LLP Act. |

| 207(3) | Conduct of Inspection and Inquiry | Notwithstanding anything contained in any other law for the time being in force or in any contract to the contrary, the Registrar or inspector making an inspection or inquiry shall have all the powers as are vested in a civil court under the Code of Civil Procedure, 1908, while trying a suit in respect of the following matters, namely:— (a) the discovery and production of books of account and other documents, at such place and time as may be specified by such Registrar or inspector making the inspection or inquiry; (b) summoning and enforcing the attendance of persons and examining them on oath; and (c) inspection of any books, registers and other documents of the company at any place. | Necessary powers with respect to the conduct of inspection and inquiry has been vested upon the concerned officer by way of these provisions. |

| 252 | Appeal to Tribunal against strike-off | -Agg person against order of ROC dissolving a company, may appeal to Tribunal within 3 years to get the name restored -ROC may also file app. for restoration if satisfied that name struck off on incorrect particulars -Tribunal’s order filed with ROC within 30 days to restore name -Company, its member, creditor, or workman, if aggrieved, can apply to Tribunal within 20 years of striking off order. | The striking off of LLPs are governed by Section 75 of the LLP Act read with Rule 37 of the LLP Rules. The inclusion of the given provision will provide a way for restoration of LLPs whose names were struck off. The time period of 20 years for an application for restoration of name has been reduced to 5 years in case of LLPs. |

| 439 | Non-cognizable offences | -Notwithstanding CrPC, every offence under this Act shall be deemed to be non-cognizable -No court shall take cognizance unless complaint made by ROC, a shareholder or member of company, or person authorised by CG -Personal appearance of ROC, or person auth. by CG not necessary unless Court requires the same -The provisions of (2) shall not apply on actions taken by liquidator on any offence during winding up. | Section 212(6) of the Act provides that only those offences that are covered under Section 447 of the Act are cognizable. Section 447 of the Act dealing with fraud is not recognised under the LLP Act. This renders a non-cognizable nature to the offences of the LLP. No court will be able to take cognizance of any offence by an LLP or its partners/DPs unless complaint is made by some specified persons, such as Registrar, or any person authorised by Central Government. This may be said to be in furtherance of the Report on Decriminalization of offences of LLPs. |

Conclusion

The provisions of the Act that have been incorporated under the LLP Act is likely to cause a wide-spread effect The provisions of the Act have been made applicable immediately, without providing any preparatory time to the LLPs. The amendments result into an increased level of supervision and control on the working and management of the LLPs. The integration of various provisions of the Act with the LLPs indicate an era of LLPs becoming similar with companies.

Leave a Reply

Want to join the discussion?Feel free to contribute!