SEBI Settlement Scheme 2020

SEBI during FY 2018-19 conducted an investigation into the trading activities in illiquid stock options at BSE for a period of 1st April, 2014 to 30th September, 2015. As a result of the investigation, SEBI observed that there were large scale reversal trades executed in stock options by various entities.

Reversal trades refers to trading i.e. buying and selling of stocks from and to the same counterparty during a day which creates artificial trade units of stocks in the question. In such trades one party suffer losses and buy stock at higher rate and within seconds execute reversal trade and sell these stocks to the same counter party at a relatively lower rate thereby resulting to gains for other party. Supreme Court in the appeal no. 1969 dated 8th February, 2018 quoted:

“Trading is always with the aim to make profits. But if one party consistently makes loss and that too in pre-planned and rapid reverse trades, it is not genuine, it is an unfair trade practice.”

Such kind of transactions executed by entities were considered non-genuine by SEBI as they were not executed with the basic trading rationale. These transactions were prohibited pursuant to the provisions of section 4(2) of SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003 (‘PFUTP Regulations’) which provides:

“(2) Dealing in securities shall be deemed to be a fraudulent or an unfair trade practice if it involves fraud and may include all or any of the following, namely: —

(a) indulging in an act which creates false or misleading appearance of trading in the securities market;”

Pursuant to such restriction under the PFUTP Regulations, SEBI issued show cause notices to various entities (approximately 14000 entities) demanding justification for executing reversal trades at a loss. Entities who were involved in executing such trades were liable for penalty under section 15J of the SEBI Act. Generally, SEBI has levied a fine of approximately Rs. 5 lakhs on entities i.e. the minimum under section 15J of SEBI Act, however, the parameter of determination of fine was subjective and hence even higher fine has been levied to some entities.

Rationale behind the scheme

SEBI was penalising entities for non-genuinely trading in illiquid stock options through price manipulation under the PFUTP Regulations and SEBI Act. However, tax evasion with respect to such trading activities were to be separately investigated and penalised by IT Authorities. Hence, most entities were contesting the SEBI order with higher authorities to avoid notice/regulatory action from the IT Authorities.

The Hon’ble SAT vide its order dated 14th October, 2019 in the matter of R S Ispat Ltd vs SEBI directed:

“We are adjourning this matter today, so that SEBI may consider holding a Lok Adalat or adopting other alternative dispute resolution process with regard to the illiquid stock options”

Hence, to settle the proceedings initiated for such entities, SEBI introduced a scheme to settle the matter.

Scheme

Regulation 26 of SEBI (Settlement Proceedings) Regulations, 2018, empowers SEBI to specify settlement schemes as and when desirable for defaults conducted by entities. SEBI for the purpose of reducing the administrative burden of pending proceedings relating to trading in illiquid stock options, issued a public notice on 27th July, 2020 for introduction of Settlement Scheme, 2020.

Pursuant to the scheme a one-time settlement opportunity is being provided to entities involved in dealing of illiquid stock options during the period from 1st April, 2014 to 30th September, 2015. The validity of the scheme is for a period ranging from 1st August, 2020 to 31st October, 2020.

Settlement mechanism

The scheme provides an indicative criteria for determining the settlement amount on the basis of:

- Artificial volume created

- Number of non-genuine trades

- Numbers of contracts resulting in creation of artificial trades

Further, uniform consolidated settlement factor of 0.55 shall be applied to calculate the net settlement amount payable by entities. For the purpose of determination, SEBI has introduced a separate web page where settlement amount for the purpose of such orders can be calculated. This can be accessed at Link

| Process of determination of settlement amount | ||

| 1. | Company has to provide two information:

a) Category of payment i.e. for order or settlement b) PAN details of the entity |

|

| 2. | The following details gets auto filed by providing PAN details: | |

| i) Name of the entity | ||

| ii) Entity type | ||

| iii) Number of contracts reversed | ||

| iv) Number of non-genuine trades | ||

| v) Artificial volume of trades | ||

| 3. | The settlement amount gets automatically calculated. The payment amount is segregated as follows: | |

| a) Settlement amount (as calculated using the 0.55 factor) | b) Registration fees

For bodies corporate: Rs. 25,000 For individuals: Rs. 15,000 |

|

| 5. | Mandatory attachments:

1. Income tax returns for last 3 years 2. Copy of PAN card of the entity/individual 3. Undertaking and waivers as required under the SEBI (Settlement Proceedings) Regulations, 2018 |

|

| 5. | Payment process:

For the purpose of making payment under the settlement scheme, the entity has to withdraw any pending proceeding in the said matter. After withdrawal, entities can use this web page for payment of settlement amount. |

|

The settlement amount is directly proportionate to the artificial volume of trades executed by the entities. We have obtained data of 15 entities on sample basis for analysis of settlement amount. The same is represented below:

| Sl.No. | No. of contracts reversed | No. of non-genuine trades executed

|

Artificial volume of trades | Settlement amount |

| 1. | 107 | 970 | 7,97,21,572 | 39,77,500 |

| 2. | 85 | 750 | 2,76,68,000 | 35,12,500 |

| 3. | 21 | 396 | 2,00,25,000 | 25,72,500 |

| 4. | 83 | 492 | 2,75,50,000 | 33,57,500 |

| 5. | 210 | 512 | 1,21,77,000 | 39,77,500 |

| 6. | 165 | 612 | 2,55,25,750 | 39,77,500 |

| 7. | 1672 | 4968 | 30,70,27,560 | 83,17,500 |

| 8. | 191 | 526 | 2,91,34,000 | 39,77,500 |

| 9. | 12 | 92 | 2,79,61,000 | 21,17,500 |

| 10. | 252 | 666 | 7,17,69,750 | 42,87,500 |

| 11. | 14 | 83 | 1,22,92,500 | 19,62,500 |

| 12. | 682 | 1646 | 7,16,45,000 | 50,62,500 |

| 13. | 9 | 194 | 81,29,000 | 21,07,500 |

| 14. | 14 | 116 | 1,25,98,000 | 21,07,500 |

| 15. | 61 | 332 | 3,37,92,000 | 30,47,500 |

Hence, basis the aforesaid table, we understand that higher the artificial trades executed, the higher will be the settlement amount. However, the point of focus here is where SEBI has levied fine of approximately Rs. 5 lakhs on entities, why will entities pay a higher settlement amount then the actual fine. Further, the whole intent of settling a proceeding is to settle it at a lower cost than actual fine. Here, the fine ranges around Rs. 5 lakhs, however, the settlement amount ranges from Rs. 20 lakhs and may go upto Rs, 83 lakhs or even higher.

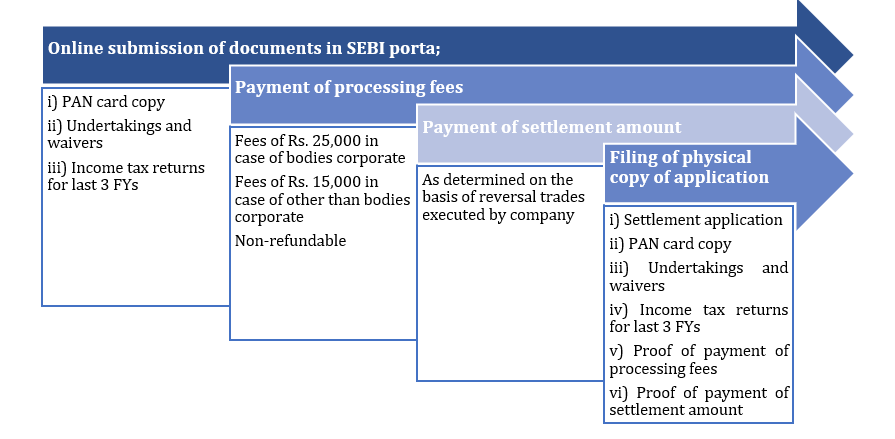

Process of availing the settlement scheme

Whether settlement proceedings shall avoid scrutiny of IT department?

As regards penal provisions under IT provisions are concerned, the details of trading in illiquid stock options is linked to the PAN details of the entity. Further, the portal also requires to attach the ITR of last three years of the entity.

In this regard, whether the intent of the settlement proceeding is also to channelize information and link the proceedings with IT department, is still unknown. Further, the fate of intention of entities to delay/waive the IT proceedings by either challenging the SEBI order in higher court or settling the proceedings shall be seen only when IT departments start sending letters to such entities.

Generally, settlement refers to neither admitting nor denying any non-compliance. Therefore, entities opting for settlement scheme may have a better chance before the IT department. However, whether this can also safeguard entities them from being penalised by the IT authorities is uncertain.

Conclusion

The entities who opt for settlement scheme has to pay the settlement amount through the portal after withdrawing any pending proceedings. As regards, entities which do not opt for such schemes, the proceedings, as is, shall continue.

Our presentation can be viewed here: https://www.youtube.com/watch?v=CK6QOm4k8Rw