Leasing: The way forward in the post COVID-19 world

Timothy Lopes, Senior Executive, Vinod Kothari Consultants

The leasing market has always proven to be strong and growing in emerging as well as developed markets through all stages of an economic cycle. According to a US country survey report by White Clarke Group, the US equipment finance industry at the end of 2018 was roughly US$ 900 billion. This was expected to grow at around 3.9% during 2019.

COVID-19 has disrupted businesses and entities as much as it has affected personal lives. As businesses learn to live the new normal, there have to be lot of realization for acquisition of capital assets in time to come. Businesses will arguably find it much easier to connect their payment obligations to their own revenues, so as to have minimum stress and maximum focus on operations.

Demand for capital equipment, vehicles, software, etc. would have slowed down owing to covid disruption. This lower demand results from lower cash in hand to fund any outright equipment purchases. Going forward too, post the COVID-19 scenario, “buying” equipment, etc. would not be a feasible option.

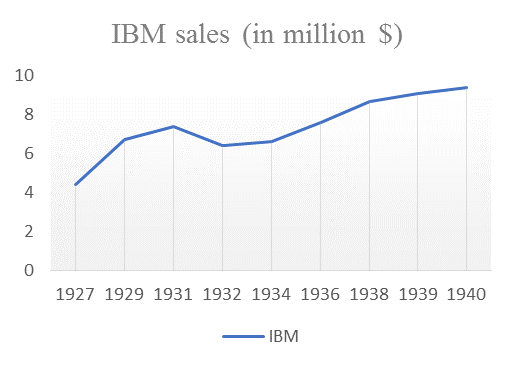

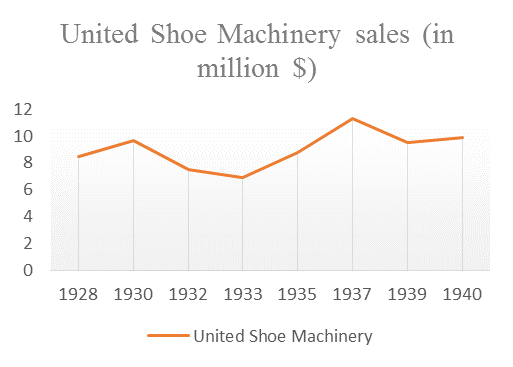

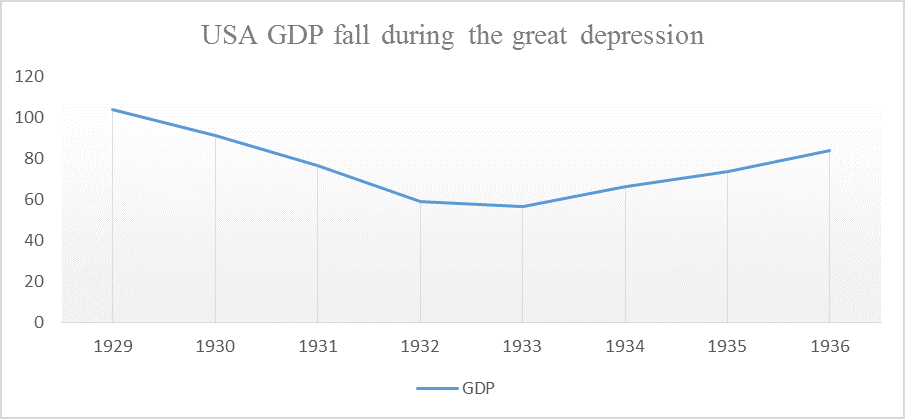

Leasing on the other hand, has in the past proven to be a strong financing alternative even at times of a depression. During the great depression back in the 1930’s, companies that resorted to leasing out equipment and software performed rather well in stress scenarios. To take an example of IBM Corporation, which then derived well over half of its income from leasing, and of United Shoe Machinery Corporation, which distributed virtually all its machine products through leases while the US GDP took a major hit during the 1930-1935 period.

Figure – Leasing during the great depression (1930)

Source: Lease Financing and Hire Purchase, Fourth Edition 1996 by Vinod Kothari

Source: Bureau of Economic Affairs, US Department of Commerce

Under leasing plans, since the buyer does not have to put in any capital investment, he may be able to acquire equipment even during a period of depression. Thus, leasing serves to maintain the growth of a manufacturer’s sales during depressionary climate.[1]

Post COVID-19 scenario – Could leasing be the way forward?

Presently, the global economy has entered into recession which may be comparable to the situation back in the 1930s. It is unlikely that companies would be looking to purchase assets during the post COVID-19 scenario owing to several stress factors.

Thus, leasing equipment/ software/ vehicles, etc. should be the way to go during the depression scenario. Leasing allows one to structure the payments in such a way that the cashflows arising from the asset/ equipment will itself service the rentals associated with the asset/ equipment, which is the likely factor to increase the propensity to finance through leasing.

Properly structured, lease transactions have the potential to turn assets into services – enabling users to get to use assets without having to lock capital therein. It is our belief that leasing provides the way for users of capital equipment to acquire assets, keeping their businesses asset-light.

Further, according to a survey done on the impact of COVID-19 on lease financing by Equipment Leasing & Finance Foundation (ELFF), over the next four months, none of the respondents expect more access to capital to fund equipment acquisitions, while some of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months.

The Monthly Confidence Index (MCI) for the Equipment Finance Industry, for the month of May, 2020 was at 25.8%, up from 22.3% in April, 2020.

Further, another report by ELFF suggests that capital investment will suffer due to the pandemic. Leasing, however, would enable the buyer to acquire an asset while not having to put in any capital investment.

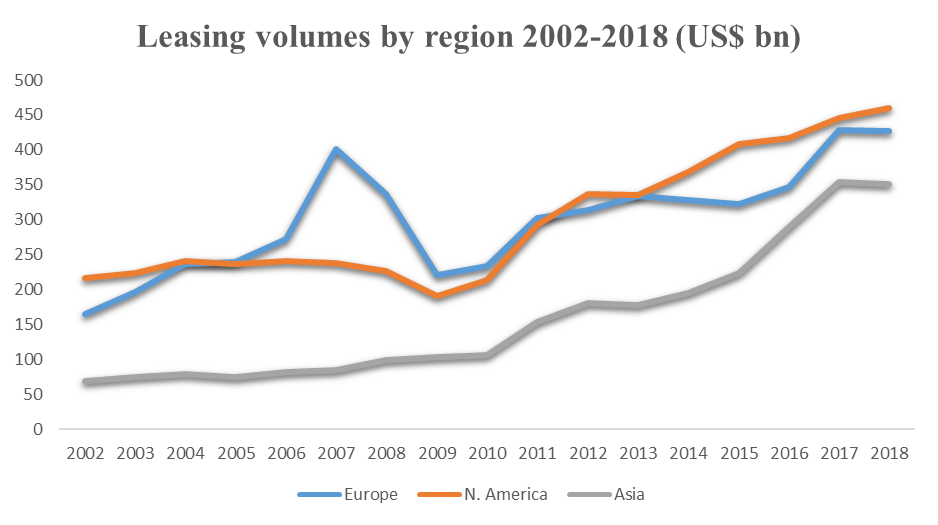

Global leasing trends

Leasing volumes have seen strong growth across geographies over the 2002-2018 period. This is reflected by the volumes in major regions reported by the White Clarke Group: Global Leasing Report 2020 shown below –

Conclusion

Leasing would be a feasible solution in the upcoming recovery period. The cashflows generated from the asset on lease would service the rentals on the asset, thereby having the asset finance itself, considering that no one would be willing to put in any major capital investment in the times to come.

In India, the penetration of leasing has been fraction of a percentage, compared to global levels, where average penetration has been upwards of 20% consistently. Several factors, including tax disparities, have been responsible.

With innovation as the working tool, solutions may be designed to provide customers with effective asset acquisition solutions.

See our resources on leasing here –

http://vinodkothari.com/leasehome/

[1] Source – Lease Financing and Hire Purchase, Fourth Edition 1996 by Vinod Kothari

Leave a Reply

Want to join the discussion?Feel free to contribute!