-Proposal for relaxation in pricing norms for preferential issue and making an open offer

Henil Shah | Executive

corplaw@vinodkothari.com

Introduction

In layman’s term, a company with falling share prices, inability to pay off its obligations is said to be a company with financial distress. It’s safe to say that for such a company, one of the foremost priority is to secure a source of funds in order to fund their operations to upturn its economic conditions thereby avoiding Insolvency/Bankruptcy. Keeping the same view in mind, the Securities and Exchange Board of India (‘SEBI’) deliberated the matter to its Primary Market Advisory Committee (‘PMAC’), which identified the following key issues to be addressed in order to assist the financially stressed companies to raise funds:

- Criteria for determining a company as stressed

- Determination of a reasonable price for preferential allotment

- Exemptions from open offer obligations under the SAST Regulations

Based on the recommendations given by PMAC, SEBI on April 22, 2020 released a Consultation paper “Pricing of preferential issues and exemption from open offer for acquisitions in companies having stressed assets”[1] seeking public comments till May 13, 2020.

Rationale behind the proposed changes

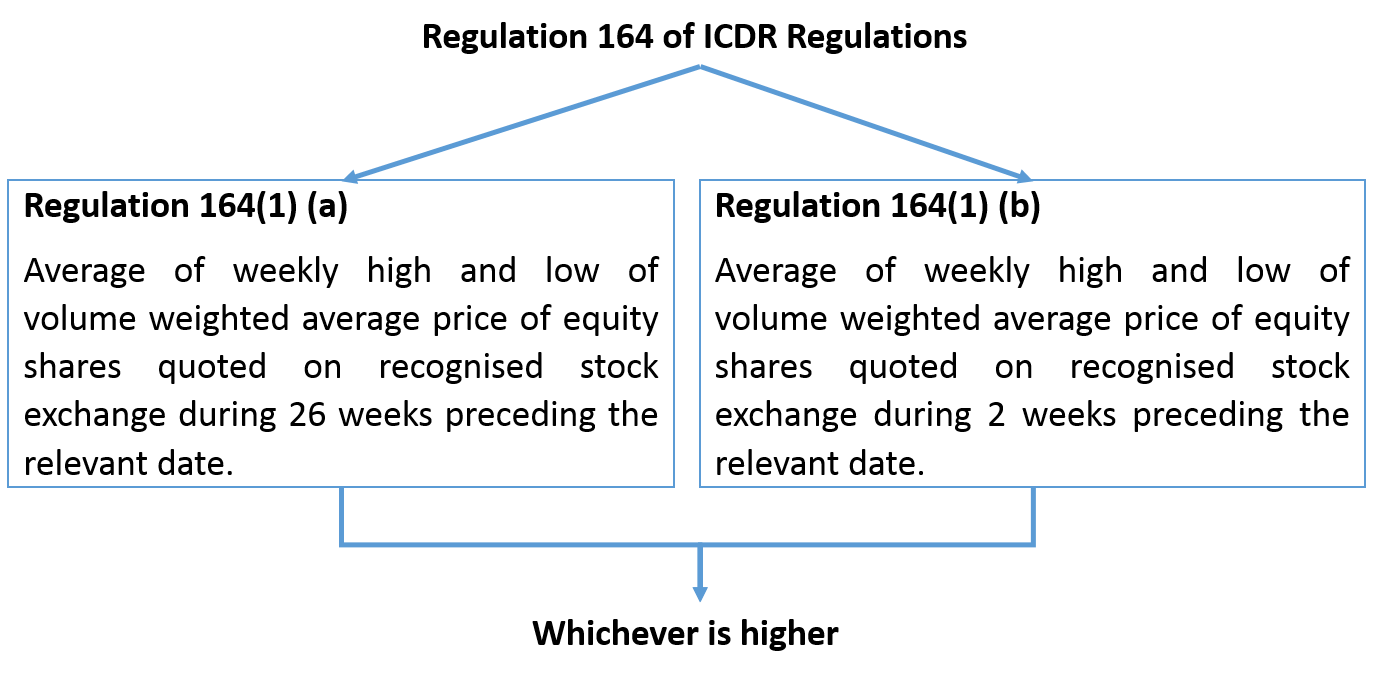

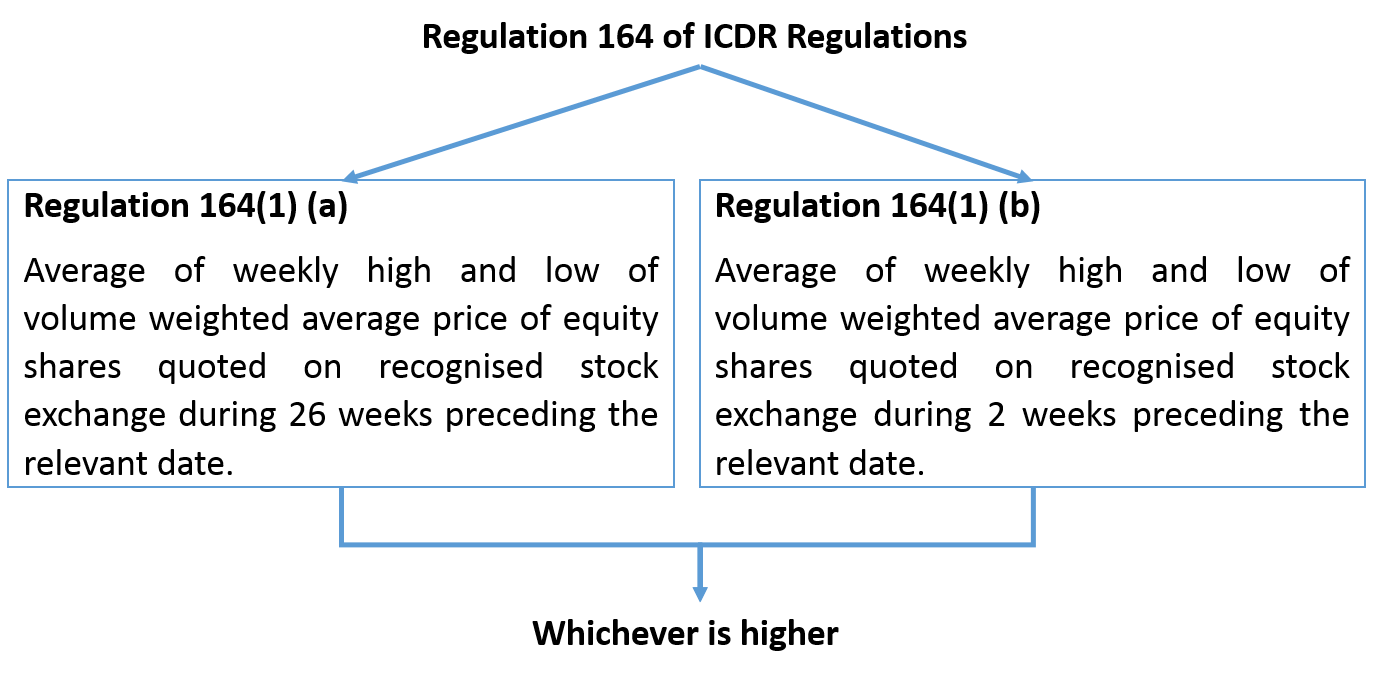

One of the key modes of raising funds by a company especially a financially distressed company is by way of preferential issue of equity shares or convertible instruments. Knowing the probable investors ready to invest in the company makes preferential issue one of the most commonly used ways for raising funds. For a listed company, under a preferential issue, the issue price has to be determined as per the pricing provisions of Chapter V of SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (“ICDR Regulations”). The ICDR Regulations provides the pricing mechanism for both frequently traded shares and infrequently traded shares. In case of frequently trades shares, the price shall be determined as per the provisions of Regulation 164(1) (a) & (b) of the ICDR Regulations which are as follows.

i. Onerous pricing mechanism

Considering the continuous falling prices of the shares over a period of 26 weeks due to the company being in stress, the determination of the price as per the pricing mechanism provided in Regulation 164(1)(a) becomes too onerous for the investor. Further, the price under Regulation 164(1)(a) is much higher than that as determined as per Regulation 164(1)(b). Hence, the pricing mechanism acts as a major deterrent for the investors from subscribing to the shares offered under the preferential issue.

ii. Exemptions only to 5 QIBs restricting investor pool

Though the ICDR Regulations allow issuance to QIBs at a price determined as per regulation 164(1) (b) however, the same is restricted to only 5 QIBs and is not applicable to the investors other than QIBs thereby restricting the investor pool.

iii. Open offer obligations for the acquirer

Another roadblock which the issuers tend to face is from the view point of the investors i.e. an incoming investor who has an impending burden on complying with an open offer obligation in case where the subscription to the preferential offer leads to the triggering of the open offer obligations under SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011(‘SAST Regulations’).

As per the extant provisions, the acquisition pursuant to a resolution plan approved under the Insolvency and Bankruptcy Code, 2016 is exempted from meeting the open offer obligations but no such exemption has been provided in case for acquisition in the financially distressed entity which are not under any resolution plan.

Therefore, where the listed entity is already under distress and suffering from a financial crisis, huge open offer obligations and the cost involved therein discourage the probable investors from taking any controlling interest in such entity.

Rescue mechanism by way of proposed changes

What will be regarded as “stressed”?

It is proposed that only such listed companies which meet any 2 (two) of the following 3 (three) conditions will be determined as a “stressed” company and shall be able to avail the benefits while making an offer under preferential issue once the proposed changes come alive.

- A listed company which has made disclosure of defaults on payment of interest/ principal amount of loans from banks/ financial institutions and listed and unlisted debt securities for 2 consequent quarters in terms of the SEBI Circular[2] issued in this regard;

Default for the purpose of the above circular shall mean non –payment of interest or principal in full on the pre-agreed due date. Provided in case of revolving facilities default shall be considered when outstanding balance remains continuously in excess of the sanctioned limit or drawing power, whichever is lower for more than 30 days.

- Existence of Inter-Creditor agreement in terms of Reserve Bank of India (Prudential Framework for Resolution of Stressed assets) Directions 2019[3];

Inter-credit agreement in terms of the RBI directions stands for agreement executed among all the lenders of a defaulting borrower, providing for ground rules for finalisation and implementation of resolution plan in respect to the borrower.

- Credit rating of the listed instruments of the company has been downgraded to “D”.

Proposal for relaxed pricing norms under the ICDR Regulations:

Unlike the current pricing requirements as provided in Regulations 164(1) (a) & (b) for a preferential issue, the price of the shares to be issued by a stressed company as aforesaid shall be a price which shall not be less than the average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on a recognised stock exchange during the two weeks preceding the relevant date.

Exemptions proposed under the SAST Regulations

Where due to the subscription of shares offered under preferential issue by a financially stressed company triggers open offer obligations as per SAST Regulations, the same shall be exempted.

Additional conditions for availing the exemptions

The Consultation Paper also provides for an additional set of requirements to be complied in case were the benefits of the proposed exemptions are to be availed.

- Persons/entities that are not part of the promoter or promoter group will not be eligible to participate in the preferential issue.

- Obtaining of shareholders’ consent for the exemption to make an open offer by the proposed investors along with the proposal of preferential issue. The shareholders’ approval shall be an approval of majority of minority excluding the promoters and promoter group and any proposed allottee that already hold securities in the issuer.

- Disclosure of the proposed use of the proceeds of such preferential issue in the explanatory statement. This requirement is nothing new as the provisions of regulation 163 of ICDR Regulations and Rule 13 of the Companies (Share Capital and Debenture) Rules, 2014 do provide for mandatorily mentioning object for which the preferential issue is being made in the explanatory statement of the notice.

- Appointment of a monitoring agency. Though there is no requirement of appointing a monitoring agency as per the provisions of chapter V (Preferential Issue) requirement of ICDR Regulations, the concept of the monitoring agency is not new as several chapters of the regulations provide for appointment and functions to be performed by the monitoring agency in case where offer size exceeds a predefined limit.

- Mandatory lock in requirements of shares issued on preferential basis for 3 years which is same as provided in chapter V (Preferential issue) requirement of ICDR Regulations.

Conclusion

Considering the stressed status of the company, it is believed that aligning the pricing requirement with that of pricing requirement in case of preferential issue to QIBs, shall effectively increase the pool of investors. Similarly, the proposed exemption from making of an open offer shall lessen the additional burden on an incoming investor to comply with the stringent requirements thereby attracting investors to put in money in such companies.

Accordingly, SEBI’s intention behind the proposed changes may be said to be a welcome move as it will definitely help the financially stressed companies to revive.

Our write up on prudential framework for resolution for stressed assets can be accessed at:

http://vinodkothari.com/2019/06/fresa/

Our other write ups can be accessed at: http://vinodkothari.com/category/corporate-laws/

[1] https://www.sebi.gov.in/reports-and-statistics/reports/apr-2020/consultation-paper-preferential-issue-in-companies-having-stressed-assets_46542.html

[2] https://www.sebi.gov.in/legal/circulars/nov-2019/disclosures-by-listed-entities-of-defaults-on-payment-of-interest-repayment-of-principal-amount-on-loans-from-banks-financial-institutions-and-unlisted-debt-securities_45036.html

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11580&Mode=0