Archive for month: September, 2019

From manufacturing to providing services: How does it transform?

/0 Comments/in Financial Services /by Vinod Kothari Consultants-Kanakprabha Jethani | Executive

(kanak@vinodkothari.com)

Background

Servitization is that foreign business term that does not find place in any dictionary but is in steps to becoming essence of many businesses. It is a transformation, from manufacturing to providing solutions, from being product-centred to being complete-solution centred. Essentially, it is a business model in which, manufacturer of a product also engages in provision of services relating to that product.

The concept of servitization arises from the traditional ideology of business of maintaining life-long relationship with customers. Cranfield University defines servitization as “the innovation of organisation’s capabilities and processes to better create mutual value through a shift from selling product to selling Product-Service Systems.”

For instance, a laptop manufacturing company, say A Co. manufactures and sells “laptops”, it is a manufacturing concern. However, when A Co. sells a “package” which includes a laptop along with provision for after-sale services, software to support operations on the laptop, anti-virus software, cloud-space for data storage etc. it is said to be servitization.

How does this model operate? How do the parties earn? Are there any existing models operating? What is their structure of operation? Why does a manufacturer need to adopt this model? How will this be implemented? The following write-up answers all these questions and seeks to provide an all-round insight to the concept of servitization.

Structure of a servitization model

The concept of servitization has evolved answering the calls of the market that arose from phased transitions in customers approach to the products.

- Initially, a product-oriented market was prevalent in which the manufacturer and seller had just a buy and sell relationship. They became strangers right after the sale.

- This approach then shifted to product-oriented services, under which the manufacturer started providing additional services with respect to the product sold by it such as delivery, product installation, spare parts, updates and upgrades, warranty, maintenance etc.

- With Rolls Royce making leaps into innovation, the concept of use-oriented services came into place. Under this companies offer product leasing, sharing, renting, and pooling services where the customer pays fee for using the product.

This concept is however different from leasing as leasing provides exclusive rights to use to the lessee. In this model, the product can be shared between two or more customers or the owner and the customer.

- Later, the approach shifted to result-oriented services where the consideration for service provider is directly linked to the output generated by the customer.

Servitization model is a customer-oriented services model which combines features of all of the aforementioned approaches. This model serves the customers’ demand for real-time responses, effective self-service options, predictive maintenance etc.

An ideal servitization model involves an entire process from manufacturing of a product, its delivery, installation and training for its use to ongoing maintenance and consultancy relating to the product. It provides for an all-round cover of the product along with support services to the customer.

Money matters: How does the service-provider/manufacturer earn?

A typical servitization model of a manufacturer includes the following:

- Sustainable production process

- Supplier and customer interdependencies

- Lifetime product maintenance

- Repairs

- Recycling of end product

- Help desk

- Customer specific support agreements

An ideal servitization relationship includes incentives for the supplier to reduce costs. It shares risks, financial risk especially, and it is based on achieving the highest performance possible. The optimal contract consists of a fixed payment or fixed price, cost-sharing and performance-based compensation.

Through servitization, the seller is bound to provide services to the buyer till the product exists. This bond is achieved by tying the supplier’s compensation to the output value of the equipment generated by the customer. This creates a lasting relationship between the seller and buyer. This is the transformation from earning profits to creating mutual value.

Economics of servitization

For a business, the essence of servitization lies in establishing long-term relationship with customers. This lengthened relationship results in maintenance of steady revenues which then results in greater profitability and customer retention. Further, streamlining the supply and services reduces the risk of quality deterioration. To sustain in the market, it is very necessary to provide value addition. The market wants innovation and new offerings every day and has offerors all around. For a business to stay, will have to provide more than just a product. Providing aftersales services and advanced services such as consultancy services and solutions enables a business to meet customers’ demand for complete solution packages and thus ensures sustainability.

Further, through servitization, manufacturers are exposed to a whole new set of issues faced during operation of their products. This provides them insights for future R&D and helps them bring innovation in their products and ensure continuous product improvement.

For a customer, the prime benefit that servitization brings out is that the customer has to pay only for the value derived from the product. The customer is saved from risk of unproductive expenditure. Further, the quality of product is maintained as the manufacturing entity only does further servicing of the product. Since, the customer has to pay for what is operational, it also ensures that the ‘operational time’ is productive as well. This urges the customer to undertake profitable operations only.

Risks in servitization

- Financial risks: The transition from a manufacturing model to servitization model requires a complete shift in the operational basis of the entity. Also, the revenue generation model is completely changed by shifting the point of revenue generation from sale to outcome, which would result in elongation of operating cycle. Due to this, requirement of working capital is increased.

- Operational risks: Manufacturers face operational issues like how to assess the use of asset, level of maintenance required, frequency of updations etc. Further, the transition requires a complete turnaround in the operating team and procedures which involves a very long downtime.

- Partner risks: The concept of servitization is based on a generation of revenue when some other person is in operation. The return to manufacturer is directly linked with the operation or outcome of the customer. Thus, it poses a risk over the earning of the manufacturer.

Why does a business need to servitize?

For a business, where all competitors are trying to knock you down, survival is a lonely process. In order to stay, the business needs to keep the market interested. Following are certain factors which lead a business towards the direction of transformation:

- Economic rationale: In a competitive market, it is not possible for firms to compete on basis of cost as they already operate on very low margins. In such a case, innovation is the key to stand out from the competitors. Further, stability of revenues is yet another driving force in this direction.

- Strategic rationale: Through servitization, a business is able to retain its customers for a very long time. Lock-in customers and lock-out competitors is a clear implication of this. Moreover, customers are very much educated and aware in the present day market. They demand such models and a business that fulfils their demands, stays.

- Environmental rationale: The world is moving towards sustainability. Responding to the current environmental changes, if a single entity is engaged during the entire lifecycle of the product, it would result in preservation of resources to a great extent. A business with such values and respect towards the environment always achieves a higher place in the eyes of the customer.

Global examples

The philosophy of “co-existence” has laid its nets in the business also. The concept of mutual-benefit has become the new definition of profitability and the world is responding to this change in the following manner:

- Rolls Royce: This was the pioneering engine solution which changed the deal with customers from a transactional purchase of equipment towards a ten-year contractual relationship guaranteeing operational time of the engine. This model gave rise to the concept of ‘Performance-Based Logistics’ (PBL) which was initially introduced by Rolls Royce for jet engines. Later a similar model was proposed for the marine industry as well.

Under this model, a fixed amount for flying per hour is charged. The customer are provided with accurate projections for maintenance cost and assurance for avoidance of breakdown costs. - Xerox’s print management: This model offers a bundle of services and copier to the customer. It provides a comprehensive set of capabilities which prevent malicious attacks, proliferation of malware and misuse of unauthorised access to printers etc. as well as services to help better manage documentation. The customer is charged based on the number of sheets of paper they have copied or printed.

- MAN’s Financial Services: Offers comprehensive services around drivers’ behaviour and fuel efficiency in order to help customers operate more efficiently, with charging based on the distance trucks are driven.

This was launched with the basic motive of reducing the cost of lease during off-seasons. It enabled the lessee to pay certain sum on each kilometre travelled by the leased truckthereby reducing the downtime costs. - Lumenstream: This Britain based start-up provides customers with fully maintained LED lighting with no upfront cost. In line with the proven fact that LED lights save upto 60% energy costs, the customer is charged based on share of energy savings achieved over a period of five years.

- Small Robot Company: This company is transforming the process of farming through their Farming as a Service (FaaS) model. Under this model a series of robots (Tom, Dick and Harry) with ‘clever’ operating systems are linked to provide a full-fledged farming support. One of the robots monitors the crops, soil and weeds. The other two take care of all the feeding, seeding, and weeding. They record location of every crop and take care of each individual plant until it is entirely grown up.

The farmer does not need to make any upfront payment for leasing the robot. Instead the farmer is charged on the basis of per-hectare subscription fee of robots working. - Philips: Philips provides LED lighting as a service to Amsterdam Schiphol airport through ‘Internet of Things’ (IoT) connectivity. Under the arrangement, Philips takes responsibility of the performance of the LED lamps. On the other hand, the airport is able to save 50% energy cost by using LED lights. A share of saved cost is paid as consideration to Philips.

How has the world responded to servitization?

Penetration of servitization model: Country-wise

Servitization has been a buzz in the recent times. Some countries have already made it the core model of their businesses while some are still struggling to get familiar with the concept itself. To understand how servitization has impacted and will continue to impact the world, it is first important to understand, how deep servitization has spread its roots in business models of various countries.

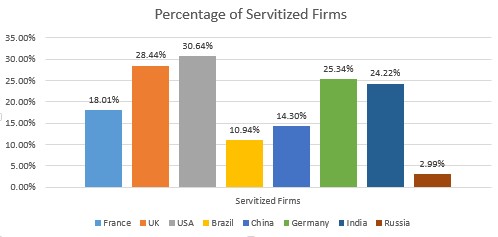

Following chart depicts that, out of certain number of entities, selected on random basis, what percentage of entities were practising servitization as on November 2013.

Source: University of Cambridge[1]

From the above figure it can be seen that USA has already embossed the concept of servitization in its ideology of business. A major chunk of the firms in USA covered by the research operate on servitization model. Seemingly, servitization model is in the steps of becoming the core model for majorly all businesses in USA. UK is following the footsteps of USA and has implemented servitization to some extent. Countries like Germany, India and France seem to be advancing in this field of innovation and some entities in these countries have initiated adopting servitization models. Russia seems to be resistant towards adoption of this innovation in its business models.

All that matters is growth

Benefits, growth, profits are the words that really matter in a business. Whether an innovation should be introduced or not? The answer lies in the benefits it gives. Businesses see benefits in growth and profitability. Increased sales, turnover, consumer base is what they look forward to.

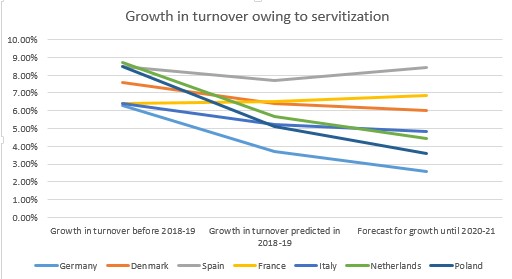

Following figure shows how servitization has effected the turnover growth in various countries and what the forecasts are for the near future.

Source: European Commission report on servitization

From its inception till 2018-19, the initial stages of implementation of servitization have shown the very high levels of growth in turnover for countries like Germany, Italy and Netherlands where servitization has been implemented upto reasonable levels. A study in France by European Commission shows that with 70% of SMEs in France being servitized, rate of employment also grew by 30% and an average annual increase of around 10% in turnover in the country was also witnessed. By 2020-21, when servitisation would already have been implemented in major countries, the pace of growth would tend to slow down. However, there are still no signs of negative growth forecasts in any of the countries. Servitization is expected to increase turnovers of various countries by averagely 3-4% in the coming years.

Striking the balance

Seemingly, the structure of servitization-based models is altogether a risky exertion. The manufacturer is exposed to huge risks as the consideration is based on the output of the customer. This might, on one hand, result in blocking of funds in the initial stages. While on the other hand, the customer base of the manufacturer is strengthened. Earning of the manufacturer depends on operations of the customer which are substantially out of the control of the manufacturer. This creates a gap in the chain of flow of income for the manufacturer.

The servitization model requires integration of operations of manufacturer and the customer. It calls for a close connection between the both. The manufacturer shall not only communicate with the person procuring the product, but also with the person actually engaged in operation of the product. The necessity of rethinking internal and external processes is highly felt while transforming from a product-based to a customer-based structure. Introduction of new technology and human resources specializing the service industry has to be the primary step in the transformation process. Extensive use of data and analytics is an inseparable part of servitization industry.

In essence, manufacturer will have to implement servitization as one major programme, which would address everything, from production processes to client communication and revenue generation. A risk-return balance will have to be achieved so that continuous inflow of income for the manufacturer is ensured.

Way forward

While some countries have implemented it to a large extent, some are advancing, some struggling and some oblivious to it, servitization seems to have entered all territories. Various sectors also have reacted differently to servitization, but reasonable growth has been recognised in all of them by now. Flaws would pop-up with time and would be handled accordingly. The concept of servitization is based on the principle of value for all. It has the potential to serve productivity and profitability at all levels of a value chain. Like every other innovation, operational aspects obviously have certain glitches which one can understand only after continuous operation. An effective implementation of servitization models would require consistent updations and modifications to achieve a feasible structure suitable to specific needs of both, the manufacturer and the customer. It’s a slow pathway to growth: Innovation and consistency are the keys.

[1]https://cambridgeservicealliance.eng.cam.ac.uk/resources/Downloads/Monthly%20Papers/2013November_ServitizationinGermany.pdf

Draft guidelines for on tap licensing of SFBs: decoded

/0 Comments/in Financial Services, NBFCs, RBI, UPDATES /by Vinod Kothari Consultants-Kanakprabha Jethani | Executive

(kanak@vinodkothari.com)

The Reserve Bank of India (RBI) has issued draft guidelines for ‘on tap’ licensing of Small Finance Banks (SFBs). The guidelines are largely similar to the existing guidelines for licensing of SFBs. However, the major difference is that the licensing will be allowed ‘on tap’. Further, there are certain changes in the eligibility requirements as well. The following write-up intends to answer all the questions relating to licensing of SFBs under the new ‘on tap’ mechanism.

What is ‘on-tap’ licensing?

Under the existing framework, the RBI issues licences for SFBs in batches i.e. all the applications are reviewed in a decided time frame and approvals for a number of SFBs are issued at once. The RBI doesn’t give out approvals as and when applications are received. Rather, when sufficient number of applications are received, they are reviewed at once and the applications that satisfy RBI’s criteria are issued with licenses.

Under the ‘on-tap’ mechanism, RBI will initiate the review of applications as and when they are received. Individual applications will be reviewed and licenses will be issued accordingly.

Who is eligible to apply?

| Eligible Promoters: | |

| Resident individuals | Atleast 10 years’ experience in banking and finance sector at senior level |

| Professionals who are Indian citizens | Atleast 10 years’ experience in banking and finance sector at senior level |

| Companies/societies owned and controlled by residents | Having successful track record of running their business for atleast 5 years |

| Conversion: | |

| Existing NBFCs, Micro Finance Institutions (MFIs), Local Area Banks (LABs) | -in private sector + controlled by residents + successful track record of running the business for atleast 5 years |

| Primary Urban Co-operative Banks (UCBs) | As per the scheme for voluntary transition. |

| Fit and Proper Criteria: | |

| Promoters/ promoter group | Past record of sound credentials and integrity, financial soundness and successful track record of professional experience or of running their business for atleast 5 years |

Who cannot apply?

Joint ventures by different promoter groups for purpose of setting up SFB. Public sector entities, large industrial houses or business groups, bodies set up under state legislature, state financial corporations, etc. Group with assets of Rs. 5000 crores or more+ non financial business accounting for 40% or more

What will be the structure of SFB?

An SFB maybe floated either as a standalone entity or under a holding company, which shall act as the promoting entity of the bank. Such holding company shall be a Non-Operative Financial Holding Company (NOHFC) or be registered with the RBI as NBFC-CIC.

What activities can an SFB carry out?

Primarily, an SFB is allowed to carry out basic banking activities.

Apart from the primary functions, SFBs can also undertake non-risk sharing simple financial activities, not requiring commitment of their own funds, after obtaining approval of the RBI. Also, they are allowed to become Category II Authorised Dealer in foreign exchange business.

An activity that involves commitment of funds of the SFB, such as issue of credit cards, shall not be allowed.

What will be the capital structure in SFB?

| Minimum paid-up equity capital: | |

| All applicants | Rs. 200 crores |

| For UCBs converting into SFB | Initially Rs. 100 crores, which shall be required to be increased to Rs. 200 crores within 5 years |

| Capital Adequacy Ratio: | |

| Tier I capital | 7.5% of total risk-weighted assets |

| Tier II capital | Maximum 100% of tier I capital |

| Capital | 15% of total risk- weighted assets |

| Promoters Contribution: | |

| Promoters’ holding | Minimum 40% of paid-up voting equity capital

· Bring down to 30% in 10 years · Bring down to 15% in 15 years |

| In case of conversion of NBFC/MFI to SFB, if promoters’ shareholding is maintained below 40% but above 26% due to regulatory requirements or otherwise, the same shall be acceptable. Provided that promoters’ shareholding doesn’t fall below 20%. | |

| Lock-in on promoters’ minimum holding | 5 years |

| If promoters’ shareholding > 40% | Bring down to 40%

· within 5 years from commencement of business (in case of other SFB) · within 5 years from the date paid-up capital of Rs. 200 crores is reached (in case of conversion from UCB) |

| No person other than promoters shall be allowed to hold more than 10% of the paid-up equity capital. | |

| Foreign Shareholding: | |

| Under automatic route | Upto 49% |

| Government route | Beyond 49% upto 74% |

| Atleast 26% of the paid-up equity capital should be held by resident shareholders. | |

Will the SFB be listed?

An application for listing of the SFB can be made voluntarily after obtaining approval of the RBI. However, on reaching a paid-up equity capital of Rs. 500 crores, listing shall be made mandatory.

What will be the compliance requirements for SFBs?

- Have in place a robust risk management system.

- Prudential norms as applicable to commercial banks shall be applicable.

- 75% of Adjusted Net Bank Credit (ANBC) shall be extended to priority sectors.

- The maximum loan size to a single person or group shall not be more than 10% of SFB’s capital funds.

- The maximum investment exposure to a single person or group shall not be more than 15% of SFB’s capital funds.

- Atleast 50% of loan portfolio should consist of small size loans (upto Rs. 25 lakhs per borrower).

- There should be no exposure of the SFB to its promoters, shareholder holding 10% or more of the paid-up capital, and relatives of promoters.

- Payments bank may make application to set up an SFB, provided that both the banks shall be under NOHFC structure.

- SFB cannot be a Business Correspondent of other banks.

Are there any specific compliance requirements for NBFCs/MFIs/LABs converting into SFB?

Following are the specific requirements to be complied with in case of conversion from NBFC/MFI/LAB:

- Have minimum paid-up capital of Rs. 200 crores. In case of deficiency, infuse the differential capital within 18 months.

- Convert the branches of NBFC/MFI to branches of the SFB within 3 years from commencement of operations.

- In case any floating charges stand in the balance sheet of the NBFC/MFI, the same shall be allowed to be carried until the related borrowings are matured.

How to make an application to set up an SFB?

An application shall be made to the RBI in Form III along with a business plan and detailed information of the existing as well as proposed structure, a project report regarding viability of the business of SFB and any other relevant information. The application shall be submitted to the RBI in physical form in an envelope superscripted “Application for Small Finance Bank” addressed to the Chief General Manager of the RBI.

In case, the application satisfies the RBI criteria, the fact of approval shall be placed on the RBI website. In case, the application is rejected, the applicant will be barred from making fresh application for a period of three years from such rejection.

SEBI’s Buyback Rules For Leverage Limits

/0 Comments/in Corporate Laws, SEBI /by Vinod Kothari ConsultantsSharing of Credit Information to Fintech Companies: Implications of RBI Bar

/0 Comments/in Financial Services, Fintech, Fintechs and Payment and Settlement Systems /by Vinod Kothari Consultants-Financial Services Division | Vinod Kothari Consultants Pvt. Ltd.

(finserv@vinodkothari.com)

The RBI recently wrote a letter, dated 16th September, 2019, to banks and NBFCs, censuring them over what seems to have been a prevailing practice – sharing of credit information sourced by NBFCs from Credit Information Companies (CICs), to fintech companies. The RBI reiterated that such sharing of information was not permissible, citing several provisions of the law, and expected the banks/NBFCs to affirm steps taken to ensure compliance within 15 days of the RBI’s letter.

This write-up intends to discuss the provisions of the Credit Information Companies (Regulation) Act, 2005 [CICRA], and related provisions, and the confidentiality of credit information of persons, and the implications of the RBI’s letter referred to above.

Fintech companies’ model

Much of the new-age lending is enabled by automated lending platforms of fintech companies. The typical model works with a partnership between a fintech company and an NBFC. The fintech company is the sourcing partner, and the NBFC is the funding partner. A borrower goes to the platform of the fintech company which provides a user-friendly application process, consisting of some basic steps such as providing the aadhaar card or PAN card details, and a photograph. Now, having got the individual’s basic details, the fintech company may either source the credit score of the individual from one of the CICs, or may use its own algorithm. If the fintech company wants to access the data stored with the CICs, it will have to rely on one of its partner NBFCs, since CIC access is currently allowed to financial sector entities only, who have to mandatorily register themselves as members of all four CICs.

It is here that the RBI sees an issue. If the NBFC allows the credit information sourced from the CIC to be transferred to a fintech company, there is an apparent question as to whether such sharing of information is permissible under the law or not.

We discuss below the provisions of the law relating to use of credit information.

Confidentiality of credit information

By virtue of the very relation between the customer and a banker, a banker gets access to the financial information of its customers. Very often, an individual may not even want to share his financial data even with close family members, but the banker any way has access to the same, all the time. If the banker was to share the financial details of a customer, it would be a clear intrusion into the individual’s privacy, and that too, arising out of a fiduciary relationship.

Therefore, the principle, which has since been reiterated by courts in numerous cases, was developed by UK courts in an old ruling in Tournier v National Provincial and Union Bank of England [1924] 1 KB 461. Halsbury’s Laws of England, Vol 1, 2nd edition, says: “It is an implied term of the contract between a banker and his customer that the banker will not divulge to third persons, without the consent of the customer, express or implied, either the state of the customer’s account, or any of his transactions with the bank or any information relating to the customer acquired through the keeping of his account, unless the banker is compelled to do so by order of a Court, or the circumstances give rise to a public duty of disclosure or the protection of the banker’s own interests requires it.”

The above law is followed in India as well.

In Shankarlal Agarwalla v. State Bank of India and Anr. AIR 1987 Cal 29[1], it was held that compulsion to disclose must be confined to the regular exercise by the proper officer to actual legal power to compel disclosure.

In case any information is disclosed without a legal compulsion to disclose, the same is wrongful on the part of the lender.

Credit Information Companies and sharing of information

When an RBI Working Group set up in 1999 under the chairmanship of N. H. Siddiqui recommended the formation of CICs in India, the question of confidentiality of credit information was discussed. It was noted by the Working Group that all over the world, there are regulatory controls on sharing of information by credit bureaus:

The Credit Information Bureaus, all over the world, function under a well defined regulatory framework. Where the Bureaus have been set up as part of the Central Bank, the regulatory framework for collection of information, access to that information, privacy of the data, etc., is provided by the Central Bank. Where Bureaus have been set up in the private sector, existence of separate laws ensure protection to the privacy and access to the data collected by the Bureau. In the U.S.A. where Credit Information Bureaus have been set up in the private sector, collection and sharing of information is governed by the provisions of the Fair Credit Reporting Act, 1971 (as amended by the Consumer Credit Reporting Reform Act of 1996). The Fair Credit Reporting Act is enforced by the Federal Trade Commission, a Federal Agency of the U.S. Govt. In the U.K., Credit Bureaus are licensed by the Office of the Fair Trading under the Consumer Credit Act of 1974. The Bureaus are also registered with the Office of the Data Protection Registrar, appointed under the Data Protection Act, 1984 (replaced by the Data Protection Commissioner under the new Act of 1998). In Australia, neither the Reserve Bank of Australia nor the Australian Prudential Regulation Authority (APRA) plays a role in promoting, developing, licensing or supporting Credit Bureaus. APRA holds annual meetings with the major Bureaus in Australia. The sharing of information relating to customers is regulated in Australia by the Privacy Act. This Act is administered by the Privacy Commissioner, who is vested with the responsibility of framing guidelines for protection of privacy principles and to ensure that Bureaus in Australia conform to these guidelines. In New Zealand, a situation similar to that of Australia exists. In Sri Lanka, the Bureau was formed by an Act of Parliament at the initiative of the Central Bank. A Deputy Governor of the Central Bank is the Chairman of the Bureau in Sri Lanka and the Bank is also represented on the Board of the Bureau by a senior officer. In Hong Kong, the Hong Kong Monetary Authority (HKMA), though not being directly involved in the setting up of a credit referencing agency has issued directions to all the authorised institutions recommending their full participation in the sharing and using of credit information through credit referencing agencies within the limits laid down by the Code of Practice on Consumer Credit Data formulated by the Privacy Commissioner. HKMA also monitors the effectiveness of the credit referencing services in Hong Kong, in terms of the amount of credit information disclosed to such agencies, and the level of participating in sharing credit information by authorised institutions.[2]

The inherent safeguards in the CIC Law

CICRA provides the privacy principles which shall guide the CICs, credit institutions and Specified Users in their operations in relation to collection, processing, collating, recording, preservation, secrecy, sharing and usage of credit information. In this regard, the purpose of obtaining information, guidelines for access to credit information of customers, restriction on use of information, procedures and principles for networking of CICs, credit institutions and specified users, etc. must be clearly defined.

Further, no person other than authorised person is allowed to have access to credit information under CICRA. Persons authorised to access credit information are CICs, credit institutions registered with the CICs and other persons as maybe specified by the RBI through regulations.

The Credit Information Companies Regulations provide that other persons who maybe allowed to access credit information are insurance companies, IRDAI, cellular service providers, rating agencies and brokers registered with SEBI, SEBI itself and trading members registered with Commodity Exchange.

Clearly, fintech companies or technology service providers are not authorised to access credit information. Access of information by such companies is a clear violation of CICRA.

Secrecy of customer information: duty of the lender

Paget on the Law of Banking observed that out of the duties of the banker towards the customer among those duties may be reckoned the duty of secrecy. Such duty is a legal one arising out of the contract, not merely a moral one. Breach of it therefore gives a claim for nominal damages or for substantial damages if injury is resulted from the breach.

Further, in case of Kattabomman Transport Corporation Ltd. V. State Bank of India, the Calcutta High Court held that the banker was under a duty to maintain confidentiality. An appeal[3] was filed against this ruling, the outcome of which was the information maybe disclosed by the banks, only when there is a higher duty than the private duty.

NBFCs providing access to the fintech companies is undoubtedly a private duty and thus, is a breach of duty on the part of the lender.

The case of Fintech Companies and NBFC partnership:

The letter of the RBI under discussion, dated 17th September, 2019, has been seen as a challenge to the working of the fintech companies. However, to understand in what way does this affect the working of fintech companies, we need to understand several situations.

Before coming to the same, it must be noted that the RBI’s 17th September circular is not writing a new law. The law on sharing of credit information has always been there, and the inherent protection is very much a part of the CICRA itself. The RBI circular is, at best, a regulatory cognition of an existing issue, and is a note of caution to NBFCs, who, in their enthusiasm to generate business, may not disregard the provisions of the law.

The situations may be as follows:

- Fintech company using its own algorithm: In this case, the fintech company is relying upon its own proprietary algorithm. It is not relying on any credit bureau information. Therefore, there is no question of any credit information being shared. In fact, even if the fintech uses the score developed by it, without relying on CIC data, with other entities, it is a proprietary information, which may be shared.

- NBFC sharing credit information with Fintech company, which is sourcing partner for the NBFC: If the NBFC is sharing information with a fintech company, with the intent of using the information for its own lending, can it be argued that there is a breach of the provisions of the CICRA? It may be noted that regulation 9 of the CIC Regulations requires CICs to protect credit information from unauthorised access. As already discussed, access by such fintech companies is unauthorised.

- NBFC sharing credit information with Fintech company, which is not partnering with the NBFC: In case, the NBFC is not partnering with the NBFC and is still sharing credit information, there seems to be no reason for such sharing other than information trading. Several NBFCs have at many instances, been reported to have engaged in information trading for additional income.

- NBFC sharing credit information with another NBFC/bank, which is a co-lender: The NBFC may authorise its co-lender to obtain credit information from CICs and the same shall not be an unauthorised access of information, since the co-lender is also a credit institution and is registered with CICs.

- Bank sharing credit information with another NBFC which is a sourcing partner and not a c0-lender: If the sourcing partner is a member of CICs, it may access the credit information directly from the CICs. If the sourcing partner is not a member of CICs, sharing of credit information is violation of customer privacy, and thus, shall not be allowed.

Conclusion

The credit bureau reports are actually being exchanged in the system without much respect to the privacy of the individual’s data. With the explosion of information over the net, it may even be difficult to establish as to where the information is coming from. Privacy and confidentiality of information is at stake. At the same time, the very claim-to-existence of fintech entities is their ability to process a credit application within no time. Whether there is an effective way to protect the sharing of information stored with CICs is a significant question, and the RBI’s attention to this is timely and significant.

[1] https://indiankanoon.org/doc/1300997/

[2] https://www.rbi.org.in/scripts/PublicationReportDetails.aspx?ID=76

[3] https://indiankanoon.org/doc/908914/

FAQs on IEPF

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsPartial Credit Guarantee Scheme

/0 Comments/in Financial Services, Housing finance, NBFCs, News on Securitization, Securitisation, UPDATES /by Vinod Kothari ConsultantsA Business Conclave on “Partial Credit Guarantee Scheme” was organised by Indian Securitisation Foundation jointly with Edelweiss on September 16,2019 in Mumbai.

On this occasion, the presentation used by Mr. Vinod Kothari is being given here:

http://vinodkothari.com/wp-content/uploads/2019/09/partial-credit-enhancement-scheme-.pdf

We have authored few articles on the topic that one might want to give a read. The links to such related articles are provided below:

- http://vinodkothari.com/2019/08/government-credit-enhancement-for-nbfc-pools-a-guide-to-rating-agencies/

- http://vinodkothari.com/2019/08/govtcreditschemeenhancement/

- http://vinodkothari.com/2019/08/dissecting-the-gois-partial-credit-guarantee-scheme/

- http://vinodkothari.com/2019/08/gois-attempt-to-ease-out-liquidity-stress-of-nbfcs-and-hfcs-ministry-of-finance-launches-scheme-for-partial-credit-guarantee-to-psbs-for-acquisition-of-financial-assets/