Lease Accounting under IFRS 16- A leap towards transparency!

Megha Mittal

“Our mission is to develop IFRS Standards that bring transparency, accountability and efficiency to financial markets around the world”, the International Accounting Standards Board (IASB) is indeed on a way towards fulfilling its mission. The International Financial Reporting Standards (IFRS) have been worldwide acknowledged and appreciated as a benchmark of transparency, trust and growth. In another specimen of its attempt to increase transparency in financial markets around the world, the IASB, back in 2016, introduced the IFRS 16, to be applicable w.e.f. annual reporting period beginning on or after 01.01.2019.

Introduced with the objective of introducing a single lessee accounting model, the IFRS-16, aims at ensuring faithful representation of lease transactions and pioneers the concept of “Right-to-Use” Assets.

In this article, we intend to delve deeper into what IFRS-16 brings to the table, its objective and most importantly its impact.

Understanding the Concept

In the present financial set-up of our economy and business environment, “Lease” is an indispensable element. With the advantages it carries and the flexibility it has provided to financing, the concept of lease has penetrated to every strata of being. However, from an accounting perspective, the nexus of “lease” with “assets” makes it essential to understand the procedure of incorporating the lease transactions in the books of both the lessor (legal owner of the asset) and the lessee (user of the asset); and, IFRS-16 is the answer.

While it does not modify the accounting treatment in the books of the lessors from that laid down in IAS 17, IFRS-16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. A lessee is required to recognise a right-of-use asset representing its right to use the underlying leased asset and a lease liability representing its obligation to make lease payments.

To understand better, let us now take an illustration:

Illustration 1:

A is the legal owner of a car. B, a small businessman, intends to take the car on lease for a period of 3 years. Here, A becomes the Lessor, and B, steps into the shoes of a Lessee. Now that B has the right to use the car, he must identify this car as a right-to-use asset, more colloquially knows as RTU Asset.

Hence, the Lessee records the car along with other non-financial assets like property, plant and building, and the lease liabilities along with other liabilities. It is pertinent to note that the RTU asset must however, be recorded at its present value, arrived at by discounting at its Internal Rate of Return (IRR). As a result, the lessee also recognises depreciation of the RTU Asset and interest on the lease liability in its Statement of Profit and Loss.

Rationale behind IFRS-16:

By what can be called the “5 Rule Check”, IAS 17, distinguishes leases into two broad classesviz. Operational and Financial Leases. While the leased assets wererecorded in the books of the lessor, in case of both operational and financial leases; as per IAS 17, an operational lease in the books of a lessee was treated as an “off-balance sheet” item. Regards the objective with which the new standard was introduced, IASB Chairman, Mr. Hans Hoogervorst, said that “These new accounting requirements bring lease accounting into the 21st century, ending the guesswork involved when calculating a company’s often-substantial lease obligation. The new standard will provide much-needed transparency on companies’ lease assets and liabilities, meaning that off balance sheet lease financing is no longer lurking in the shadows. It will also improve comparability between companies that lease and those that borrow to buy.”

Hence, it is clearly a step towards IASB’s vision of transparency, accountability and efficiency.

Impact:

Put simply, IFRS 16 eliminates the distinction between operational and financial lease in the books of a lessee. We shall now analyse its impact in the real field and compare the outcome with the expectations.

Overall Impact:

On the surface, the accounting treatment will have a knock-off effect on financial elements; for instance, Earnings before Interest, Tax, Depreciation & Amortization (EBITDA) and Profit After Tax (PAT).

Let us understand this effect with the help of an illustration:

Illustration 2:

A Ltd., an aviation company, has taken on lease, aircrafts worth Rs. 1000 crore, having residual value (RV) 20%, for 36 months, @ 12% p.a., having revenue of Rs. 15,000 crore

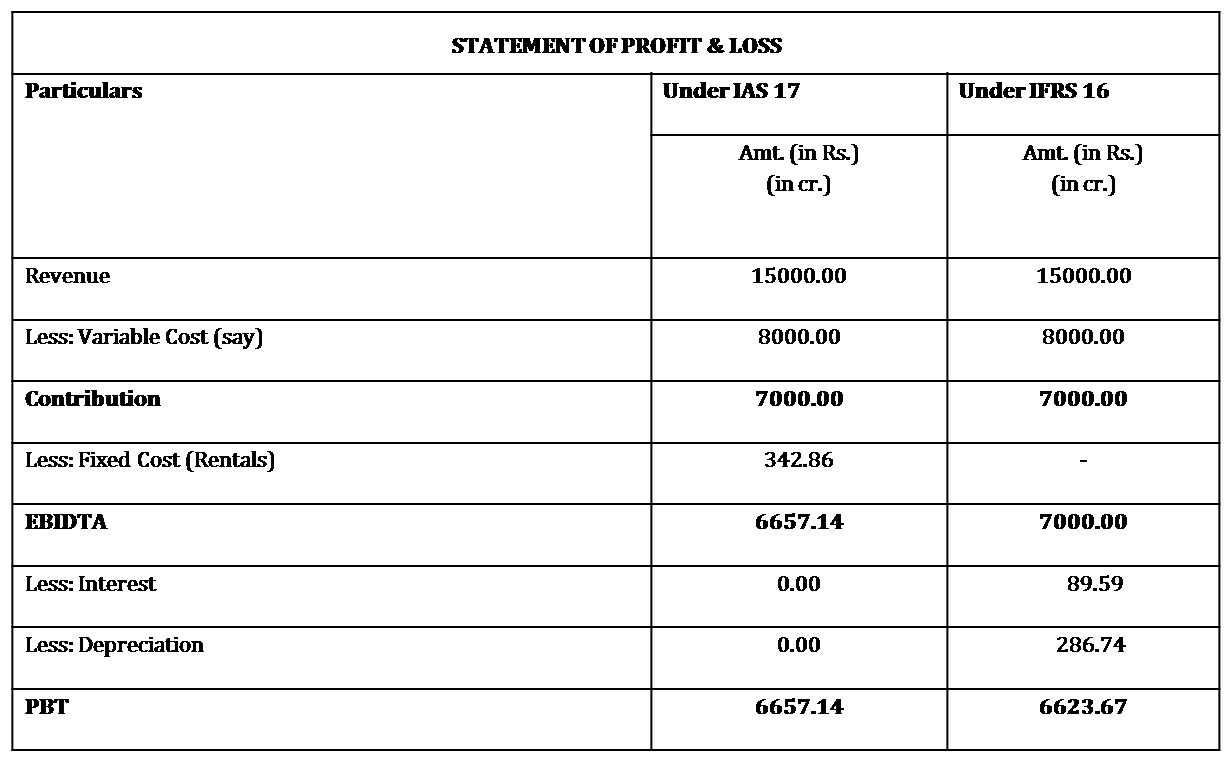

On the basis of the above information, we get the following:

- Lease Rental p.a. : Rs. 342.86 crores

- Right to Use Asset (RTU) : Rs. 860.22 crores

- Depreciation on RTU Asset (on SLM Basis) : Rs. 286.74 crores

- Annual Interest @ 12% p.a. : Rs. 89.59 crores

Now let us compare the impact of the accounting treatment under IAS 17 vs. IFRS 16:

Note: Unlike IFRS-16, under IAS 17, the entire operating lease transaction remains to be an off-balance sheet transaction. Under IFRS 16, the RTU less depreciation is recorded under the assets side vis-à-vis. Lease payables under the liabilities head.

Hence, as evident from the above illustration, sum towards rentals (fixed cost) under IAS 17, have now been substituted with Interest obligation under IFRS 16, and as such the EBIDTA is higher in the initial years. Further, recording the asset at RTU value also gives way for depreciation, and hence, as a result of depreciation along with interest, the PBT reduces in the initial years. From a bird’s eye view, both the assets and liabilities of the lessees adopting IFRS 16 will increase.

Re-negotiation of Loan Covenants:

Further, now that the lease assets are to be recorded, it will typically result in companies appearing to be more debt leveraged; however, since leases are most likely on the operating transaction side vis-à-vis loan transactions, this is not the true picture. This pseudo-presence of huge liabilities is also likely to take a toll on the lessee’s credit rating. Hence, formal communication with the lenders will become a matter of concern, and a sound two-way communication and transparency with the lenders will be the key to managing the transition from IAS 17 to IFRS 16, smooth and efficient.

Industry-wise Impact:

With the first quarter of F.Y. 2019-20 embarking the first quarter of implementation of IFRS 16, the author makes a humble attempt to study the impact, on the basis of financial results declared by several industry-majors.

BPM Industry-

According to a study by Cushman & Wakefield in June 2019, the Indian markets show a strong presence in office space leasing. It has also been observed that the IT-BPM sector, has a higher share in office lease activities, as compared to its contemporaries. Hence, it is evident that the “leasing” is an essential element in the BPM industry.

As the Mumbai-based BPM giant, WNS Global announced its first quarter results; we observe that while the operating profit increased as a result of IFRS 16, the profit for the quarter has decreased. This increase in the operating margins comes to picture as fixed costs reduce with interests of lease payments replace the rentals; the counter result of which is the increase in finance costs due to which the ultimate profit dips.

It is said that the three objectives of any business is Survival, Profit and then Growth. However, as may be seen from above, application of IFRS 16 has led to fall in the profit. It is apprehended that the fall in profit may hold back companies, in the BPM sector from continuing office-space leasing.

Aviation Industry-

Ever imagined that the airplanes we fly in, are most likely not even present on the company’s balance sheet? This non-appearance in the balance sheets was the outcome of accounting standards laid down under IAS 17. However, with IFRS 16 in the picture, the new financial year will be different from previous fiscals, especially for the aviation industry, as they now have to record all lease transactions in their books.

Adopting IAS 116, the Indian counterpart of IFRS 16, the airline industries now have to capitalise operating leases as RTU assets. While recording lease transactions and its by-products like interest, depreciation, the impact will majorly depend on factors like

- Proportion of operating lease in the overall asset pool;

- Duration of leases.

With leasing forming an indispensable element of airline companies, even though accounting should not be the key driver in commercial negotiations, market behaviour might change towards shorter lease tenures to minimize lease liabilities.

Owing to the fall in profits in the initial years, it is expected that there might be fall in operating leases, and sale & lease-back arrangements, which will prompt the airlines to purchase more aircrafts. Mr. Wui Jin Woon, Head of Aviation, Asia Pacific, Natixis CIB, also said that “Airline with sufficient access to liquidity may be more incline to purchase now that there is no difference from an accounting perspective between operating and finance leases.”

However, adopting IAS 116, the Indian counterpart of IFRS 16, the airline industry major, IndiGo stated that while there might be changes in the future reported profits, which may necessitate a change in current P/E based valuation methodology, it will not impact IndiGo’s cash profits, cash flows and growth strategy.

Hence, while there is broad consensus on how the standard will affect various financial metrics, there is considerably less agreement on how it might influence operating decisions and market sentiments.

Communication Industry:

Most Communications companies enter into lease agreements both as lessors and lessees, as such, leases in the industry are prevalent. The new standard is likely therefore to have a material impact for Communications companies.

Arrangements which may contain leases could include – customer contracts for using identified network or infrastructure equipment, equipment provided to customers through which the operator delivers communication services such as set top boxes and modems, and data centre services etc.

As a consequence of IFRS 16, the potential business impact could include renegotiation of network development and network sharing agreements. Further, companies already having large asset bases, may be prey to the impairment risk with the addition of further assets in the balance sheet.

Automobile Industry

(a) Corporate Car Leasing

Corporate Car Leasing is a very innovative employee benefit scheme that has cropped up off late. Under this scheme, big corporates provide its employees, car taken on operational lease, which the end of tenure is sold to the employee at a nominal value.Hence, while the car is essentially for the benefit of the employees, the company is the actual lessee. As this set up was in the nature of an operating lease, the lessee, as per IAS 17, was not required to record the car in its balance sheet.

However, will the roll in of IFRS 16, the corporates will be required to record these cars at their RTU as assets and a corresponding lease liability in their books; as a result of which, the balance sheet of the corporate shall increase manifold.

(b) Fleet Management

In the Fleet Management market, leasing, especially operating lease has proven to be a smart move to optimise its costs and maintain adequate ratios, as until now, it was not required to be recognized in the balance sheet of the lessee.

Murray Price, managing director of EQSTRA Fleet Management said, “These include the impact on the company’s financial report, key ratios, disclosures, the cost of implementation, the ability to access desired information, the impact of covenants and debt renegotiations and leasing strategies.

This magnification of balance sheet, by virtue of change in accounting policies is anticipated to be detrimental to this industry. It is expected that this will hold back corporates from entering into such arrangements.

Change in the Lessors’ Approach:

Like every action has a reaction, even though IFRS 16 does not essentially alter or modify accounting methodologies adopted by the lessors, the lessors may be impacted in their business models due to change in lessees’ behaviour. From the foregoing, a common thread that can be observed is that lessees having better liquidity, will now tend to incline towards purchasing the assets rather than leasing, as such, lessors may be required to revaluate the current portfolio of leases and prospective targets to identify lessees that may seek to alter their strategies as a result of IFRS-16.

Global Scenario:

Moving ahead from the industry wise acceptance, we shall now see how the new standard has been welcomed at the global level.While India has come up with IAS 116, drawn on the same lines and principles as IFRS 16, the United stated shall continue to follow ASC 842, dealing with the same subject.

Further, barring variances in implementation due to local regulatory requirements, IFRS 16 has been relatively consistently adopted in most of the Asia-Pacific markets. In Hong Kong, for example, most companies have a December financial year-end and submit financial statements to in around August in the following year. IFRS 16 impacts may become more apparent when listed companies release interim results in July 2019.

In Australia, most year-ends are in June, so some companies will not technically need to grapple with IFRS 16 until the second half of 2019.Similar patterns are evident in Singapore, Malaysia, India and the Philippines, where common accounting periods and reporting practices mean many companies won’t have to address IFRS 16 until later in the year.

The equivalent standards in Thailand and Indonesia are not effective until January 2020. In China, the Ministry of Finance only released the local version of the standard in December 2018, giving non-listed companies up to 2021 to adopt.

Conclusion:

Given the gravitas and indispensable presence of leases and the fact that it resides on such a large scale ground, to judge with certainty, the impact of IFRS 16 certainly requires more time. The dust around the same has not settled yet, hence one can say the picture is not yet vivid; however, it surely sets up the pace for what might unveil in days to come.

Link to our other publication on the above subject are provided below:

Leave a Reply

Want to join the discussion?Feel free to contribute!