IBBI lays down procedure for Resolution Plans -Third set of amendment in IRP-CP Regulations

By Shreya Routh (resolution@vinodkothari.com)

“Tough times do not define you, they rather refine you”- is perhaps the quote which the Insolvency and Bankruptcy Code, 2016 seeks to achieve. The Insolvency and Bankruptcy Code, 2016 (“Code”) tries to refine the tough times which the corporate debtor goes though during the corporate insolvency resolution process. With an objective of bringing more clarity in the process of resolution, IBBI has come out with yet another amendment in the form of Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) (Third Amendment) Regulations, 2018, (“Amended Regulations”).

Following major amendments have been brought:

- Report certifying constitution of the committee of creditors

- Notice and voting at the meeting of the committee of creditors

- Invitation of Resolution Plan and Request for Resolution Plan

- Withdrawal of the CIRP Applications

- Regulations with respect to class of creditors

- Regulations with respect to authorised representatives of resl-estate buyers

This write up deals with the points 1 to 3.

To read about the other topics covered under the Amendment Regulations, please refer to the article,” CIRP Amendment lays focus on Class of Creditors” by my colleague Ms. Megha Mittal.

Applicability

The Amendment shall come into effect on the date of their publication in the Official Gazette and shall apply only to CIRP cases commencing on or after the date of said publication i.e on or after 3.7.2018.

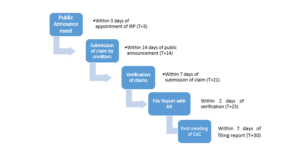

Shortening the timeline for submission of report certifying constitution of CoC and conducting of the first meeting thereof

Report and Meeting

Regulation 17 of the IRP-CP Regulations (“Regulations”) requires the IRP to submit a report certifying constitution of the committee of creditors (“CoC”) to the NCLT within 30 days of his appointment and the first meeting of the CoC to be held within 7 days of filing such report which effectively resulted to allowing the first CoC meeting to be held within 37 days of the commencement of the CIRP.

The Amended Regulations have shortened the above time period by allowing only 2 days from the verification for filing the report of constitution of the CoC and conducting the first meeting of COC within 30 days from the commencement of CIRP.

[“T” being the date of appointment of interim resolution profession]

Notice of Meeting

A minimum 7 days notice for the meeting of COC was required under regulation 19 which has now been reduced to 5 days.

Further, the Regulations allowed shorter notice of 24 hrs if approved by the CoC. This period of 24 hours should be read as 48 hours in case the CoC has any authorised representative.

Voting at the Meeting

The amendment has brought to rest one of the biggest difficulty and dichotomy of the erstwhile regulations – quorum within quorum.

The erstwhile regulations required presence of “ALL” CoC members for the voting to be done at the meeting. In case even one member of the CoC could not make at the meeting, the RP was required to allow facility to vote by electronic means through remote locations. This was adding on to the CIRP cost and also delaying the process.

The amended regulations seems to remove this concept of requirement of 100% attendance at the CoC for allowing vote on the same day without having to give the e-voting facility. However, the language of the amended text is not absolutely clear and the phrase “members who did not vote at the meeting” leaves a doubt as to (1) whether the members who came but did not vote at the meeting is only allowed second chance to vote or (2) members who were not present at the meeting is allowed to vote remotely.

Also, the members may now change their vote while the e-voting window is active.

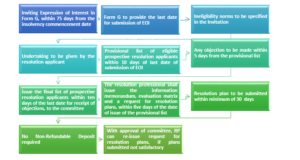

Introduction of methodology for Invitation EoI for submitting Resolution Plan

The Amended Regulations lists down the procedure to be followed for inviting the Expression of Interests (EoI) from prospective resolution applicants. Regulation 36A of the Amended Regulations puts forth the detailed methodology to be followed.

The major change brought into force vide this amendment is the fact that a proper procedure is now in place for inviting resolution plans. The procedure provides along with detailed timelines, a source of reference to the resolution professionals.

The major points to be noted in the methodology prescribed is –

- The announcement for inviting EoI is to be done within 75 days of the commencement of CIRP which is effectively around 1.5 months after the RP takes position

- A format for inviting EoI has been prescribed

- Long list of detailed undertaking is required from the prospective resolution applicant

- The RP is required to do due diligence of the undertaking shared by the applicant vis-à-vis the material on records

- No non-refundable deposit, generally known as NRF to be taken from the prospective resolution applicant

- A list of eligible prospective resolution applicant – both provisional and final has to be shared by the RP with the CoC and all such prospective resolution applicant

- While the EoI now seems to be one-time affair; the RP can keep re-inviting the resolution plans, if required

Regarding prohibiting of accepting any NRF while assessing eligibility of RAs:

The Amended Regulation puts an absolute prohibition on accepting any non-refundable deposit while submission of resolution plans. This provision seems to be a reactive amendment brought in light of many EoIs which were floated with an unreasonable and exorbitant amount of NRF.

It is to be noted that the statute should not be based on extremities of the pendulum; infact should strike a balance between law and practice.

To put it simple, complete doing away of an NRF at the stage of submission of resolution plan may flood the RP with frivolous plans and burden him with unnecessary communications and documentations in a water-tight timeline process.

Accordingly, to our minds, the appropriate way of balancing the situation would have been putting in a reasonable NRF, as approved by the CoC, so as to keep any such frivolous bidders at bay. This would help in the major filtering of the non-serious bidders.

Amendment with respect to submission of resolution plans

- The Amendment allows such rejected resolution applicants, who have contested the non-inclusion of their names in the provisional list of eligible RAs, to submit the resolution plan

- The resolution professional is required to submit a detailed compliance certificate in Form H, wherein he self attests the long comprehensive list of compliances undertaken during the CIRP, along with the resolution plan with the NCLT.

Snapshot of steps for submission of resolution plan

Therefore, after perusal of the two new insertions, one can sum up the process of resolution plan to be as follows:

Timelines involved in a resolution plan at a glance:

| SL No. | Particulars | Timeline |

| 1. | Inviting resolution plans in Form G | within 75 days of insolvency commencement date |

| 2. | Last date for submission of Expression of Interest | not be less than fifteen days from the date of issue of detailed invitation |

| 3. | Provisional list of eligible prospective resolution applicants | within ten days of the last date for submission of expression of interest |

| 4. | Any objection to inclusion or exclusion of a prospective resolution applicant in the provisional list | within five days from the date of issue of the provisional list |

| 5. | The final list of prospective resolution applicants | within ten days of the last date for receipt of objections |

| 6. | The resolution professional shall issue the information memorandum, evaluation matrix and a request for resolution plans | within five days of the date of issue of the provisional list |

| 7. | Submission of resolution plans | minimum of thirty days |

Leave a Reply

Want to join the discussion?Feel free to contribute!