Masala bonds: taking stock of developments so far

By Vallari Dubey (vallari@vindokothari.com)

Background

The Reserve Bank of India (RBI), on September 29, 2015, vide circular RBI/2015-16/193 had issued guidelines allowing Indian companies, Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) to issue rupee-denominated bond (masala bonds) overseas. Consequently, RBI, on April 13, 2016, vide circular RBI/2015-16/372 had reduced the tenure of such bonds to 3 years (previously 5 years) and allowed borrowing upto Rs. 50 billion (previously $ 750 million) under the automatic route. Now vide circular RBI/2016-17/316, RBI has again modified the tenure of these bonds. Interestingly, the tenure has now been segregated into 3 years and 5years respectively; while 3 years are for Masala Bonds raised upto USD 50 million equivalent in INR per financial year and 5 years for bonds raised above USD 50 million equivalent in INR per financial year.

Since its inception only Housing Development Finance Corporation Limited (HDFC) and National Thermal Power Corporation Limited (NTPC) have successfully listed its masala bonds on the London Stock Exchange worth INR 78 billion1 ($1.21 billion) and INR 20 billion ($300 million) respectively. Though HDFC’s masala Bonds are traded on London Stock Exchange (LSE), NTPC’s bonds are traded on both LSE and Singapore Stock Exchange (SGX).

Market Scenario

Masala bonds are in its early days, though, it has potential as, going forward, it can be a game changer for our economy. Not barred by Indian regulators, financial institutions like Inter-American Development Bank, International Finance Corp., and European Bank for Reconstruction and Development, have issued rupee bonds outside India for more than a decade. According to a report by LSE2, currently, about 38 offshore Indian rupee bonds have listed on its index, raising an approximate amount $4.26 billion. So far, the largest issuance has been made by HDFC Ltd. with an issue size of Rs. 33 billion ($ 510 million).The major Masala Bond issues till date are:

International Issuers

- Rs 10 billion ($150 million) issue in November 2014 by IFC to fund infrastructure projects in

- 18 billion ($ 270 million) issue in April 2015 by IFC to support private sector investment in India.

- Rs 3.15 billion ($47.25 million) issue in August 2015 by IFC to be used for private sector investments that address climate change in

- Rs 280 million ($4.34 million)

Other issuers of masala bonds include European Bank for Reconstruction and Development (EBRD), Inter-American Development Bank (IDB), The Province of British Columbia, etc.

Indian Issuers

- Rs 30 billion ($450 million) issue in July 2016 by HDFC — the first Indian company to issue Masala

- Rs 20 billion ($300 million) issue in August 2016 by NTPC — the first corporate Green Masala

- Rs 5 billion issued in September 2016 by HDFC – the whole amount being subscribed by The Province of British Columbia, also raised by issue of masala

- Rs 10 billion issued in September 2016 by

- 33 billion ($510 million) issue in March 2017 by HDFC —- the largest issuance by an Indian entity so far, with the purpose of funding the business of the Company

Other Countries

China has been ahead. Masala bonds were not the first local currency bonds issued internationally as similar bonds called as ‘Dim Sum Bonds’ denominated in the Chinese Renminbi (RMB), however issued outside China, were issued in 2007 by the China Development Bank. According to a Citibank July 2016 report3, at present there are a total of 110 Dim Sum Bond issues trading in the market with a par value of RMB 183.10 billion ($27.61 billion) and a market value of RMB 185.22 billion ($27.92 billion) — the average coupon is 4.10%, the Yield to Maturity (YTM) is 4.05% and the average life is 3.34 years, with over 75% bonds being of the investment grade. Since China has been showing rapid growth in its GDP for past years; Dim Sum Bonds have become very attractive and popular, with stock exchanges of Luxembourg, London and Hong Kong being the home of trade for these bonds.

Bond Market in India

Looking at the global trends, bank financing seems to be a less popular borrowing measure as compared to that of bond financing, but the current situation in India follows a totally contrary path.

Bonds are issued without creation of security interest, subject to certain compliances, so as to enable ease of raising of funds by the corporates, in many of the developed countries. Most corporates, do not have assets to create charge in favour of bond/debenture holders, as the assets are already charged in favour of banks. If the corporate had security to offer, it may be easier to access bank loans. It is when companies exhaust their security interests that they opt for bonds. Bonds are an incremental, additional source of funding, and not the first source of borrowing for most companies. India’s corporate bond market is smaller than 10% of the country’s gross domestic product. The corporate-bond markets in both China and Brazil are worth 40% or more of their respective GDPs.

Spate of action continues

Earlier, corporates, other than financial entities, were allowed to issue either secured bonds or bonds compulsorily convertible into equity within a period of 5 years from the date of issuance, anything apart from the said were treated as deposits. However, the Ministry of Corporate Affairs (‘MCA’) vide notification dated June 29, 2016 issued the Companies (Acceptance of Deposits) Amendment Rules, 2016 thereby providing relaxation with respect to issuance of corporate bonds by excluding listed unsecured NCDs from the definition of deposits.

In order to further streamline the process and to lay the oversight the of masala bonds in the regimen of Reserve Bank of India (RBI), MCA and Securities and Exchange Board of India (SEBI) clarified upon the prevailing ambiguities and simplified compliances by Indian issuers providing further ease of business to Indian entities.

The Ministry of Corporate Affairs, on August 3, 2016, clarified vide General Circular No: 09/2016 that Indian companies intending to issue masala bonds under the directives of RBI are exempt to comply with Chapter III of the Companies Act, 2013 and Rule 18 of Companies (Share Capital and Debentures) Rules, 2014. By this exemption, Indian issuer companies will not only be required to comply with the procedural norms relating to public issue and private placement disclosures but are also exempted to from complying with the provisions governing issue of debentures. Previously, MCA vide General Circular No. 43/2014 had clarified that provisions of Chapter III of the Companies Act, 2013 will not apply to issue of issue of a Foreign Currency Convertible Bonds (FCCBs) and Foreign Currency Bonds (FCBs) made exclusively to persons resident outside India in accordance with RBI directives. Similarly, MCA vide notification dated March 18, 2015 issued the Companies (Share Capital and Debentures) Amendment Rules, 2015 thereby clarifying the provisions relating to Rule 18 shall not apply to FCCBs and FCBs issued only to persons resident outside India in accordance with RBI directives.

Technically, masala bonds are not covered under the ambit of foreign currency bonds, as masala bonds are predominantly rupee denominated. However, many in the industry had the view that masala bond would get covered under the aforementioned relaxation under the Companies Act, 2013. Thus the clarification by MCA puts rest to these ambiguous stands prevailing in the market.

Securities Exchange Board of India (SEBI), vide circular on August 4, 2016, also clarified that such in masala bonds under the RBI directives will not be treated as investments by Foreign Portfolio Investors (FPIs) and will not come under the purview of the SEBI (Foreign Portfolio Investors) Regulations, 2014. Foreign investments in Masala Bonds will be reckoned against the existing corporate debt limit set for investment by FPIs, presently at INR 244,323 crore and will be available on tap to the foreign investor. The depositories are also requested to put in place necessary systems for receiving data on foreign investments in masala bonds from RBI on a periodic basis.

Boost for NBFCs

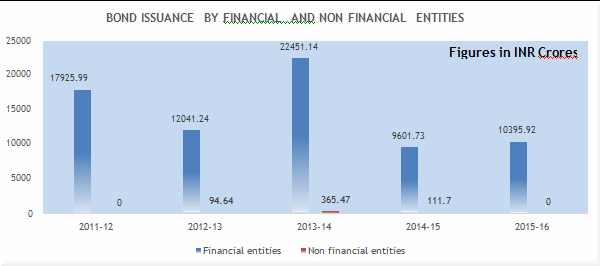

HDFC having already set the precedent for issue of masala bonds by a non-banking finance company, experts of the financial markets are of the view that big NBFCs are expected to issue masala bonds in good quantum over the next months. By enabling issuance of masala bonds, it has opened up new avenues for raising international finance for Indian corporates. The bond market in India is mainly dominated by NBFCs as issue of unsecured bonds by NBNFCs, until recently, were covered under the ambit of deposits. So, there were very few corporates left, who after securing assets with banks, had reasonable security to access the bond market. The same can be depicted by the chart below:

Source: Reserve Bank of India

Also, with the precedent being already set by HDFC, big NBFCs are expected to leverage out benefits of this mechanism. India, along with China and Brazil, is that rare fast-growing large economy, so investing in masala bonds is one of the rare ways for investors to take advantage of this.

Expectations not met

India’s attempt to diversify its debt market and take leverage by issue of masala bonds has not been what it was originally thought to be. A global pullback from emerging markets, volatility in the rupee currency among other backdrops has made them unattractive to both investors and issuers. Indian corporate giants are struggling as the amount they have to service their dollar and euro debt has substantially increased as the South Asian currency has depreciated over the past year(s). The volatility in Indian currency since then has been adding to investors’ concerns over investments in the currency.

Dewan Housing Finance Corporation Limited (DHFL) had conducted road shows in Singapore and Hong Kong to gauge investors’ mood has put its plans on hold “due to unfavourable market conditions.” Among others, Indian Railway Finance Corp. (IRFC), Shriram Transport Finance and Adani Transmission Ltd have all wanted to explore the masala bonds market with no success. Initially, HDFC and NTPC had also put their plans on rest, but later revisited these plans and successfully issued masala bond.

To attract the foreign investors, The Ministry of Finance has slashed the withholding tax on interest income of masala bonds from 20 per cent to 5 per cent, making it lucrative for investors. Also, capital gains from rupee appreciation are exempted from tax. However, the depreciation in currency is hampering India’s efforts to spread the use of the rupee as an international currency, diversify its source of funds and reduce its dollar liabilities.

Conclusion

The benefits of issuance of masala bonds are manifold as there can be acceleration in fixed income market. Further, once the masala bond entices investors in the offshore market, then it will also play a vital role in revitalizing the Indian currency. One such example is rising demand for Dim-Sum Bonds, which has led to significant appreciation of RMB as well as offered investment avenues for RMB holders based outside of China. But also, this has been the biggest reason for its downturn as so far as Indian companies has not been able to convince investors that masala bonds are a good bet.

Also, too much of reliance on external debt by way of raising funds through masala bonds along with issuances of traditional ECBs can have a negative impact on the global image of India, and thereby creating a problem of attracting investments to India.

Leave a Reply

Want to join the discussion?Feel free to contribute!